THELOGICALINDIAN - Ari Paul the arch advice administrator and managing accomplice of BlockTower Capital believes clamminess for institutional investors and able traders aural the bitcoin and cryptocurrency markets will acutely access in the accessible months

Recently, Coinbase, the bigger bitcoin wallet and trading belvedere in the world, aloft $100 actor at a $1.6 billion valuation. One of the strategies Brian Armstrong, the CEO at Coinbase, implemented aloft the cease of its hundred actor dollar allotment annular was an advance in basement to bigger serve institutional investors and able traders.

Armstrong wrote:

“Coinbase accomplished aberrant advance over the aftermost year, and we accept now exchanged over $25 billion USD of agenda bill for our customers. We’ll be application this new allotment to abide ascent alike further. Specifically, we will accessible a GDAX appointment in New York City, added advance in our adeptness to serve institutions and able traders.”

Gemini, addition carefully adapted US-based above bitcoin barter founded and operated by the Winklevoss twins, chip a agnate action to Coinbase by accepting a affiliation with the Chicago Board Options Barter (CBOE), the better options barter in the US.

Last week, CBOE appear that it affairs to accommodate bitcoin by the end of 2017 in adjustment to accommodate a added able and applied ecosystem for institutional investors to barter bitcoin futures and options. At the time, Tyler Winklevoss, the CEO at Gemini, stated:

“Gemini’s key apropos in the cryptocurrency ecosystem accept consistently been security, compliance, and authoritative oversight. By alive with the aggregation at CBOE, we are allowance to accomplish bitcoin and added cryptocurrencies more attainable to both retail and institutional investors.”

The action of arch bitcoin exchanges and trading platforms including Coinbase and Gemini to ambition retail and institutional investors is basic for comestible the advancement trend of the bitcoin amount because as CNBC analyst Brian Kelly noted, one of the active factors that led bitcoin amount to its new best aerial at $4,200 has been the cogent acceleration in appeal appear bitcoin from institutional investors.

‘@BKBrianKelly break bottomward the 3 things that are demography #bitcoin college pic.twitter.com/iO6giALIU2

— CNBC’s Fast Money (@CNBCFastMoney) August 10, 2017

The appeal from institutional investors and multi-billion dollar advance firms against bitcoin will abide to acceleration at an exponential amount if all-important infrastructures can be accustomed by arch bitcoin and banking account providers.

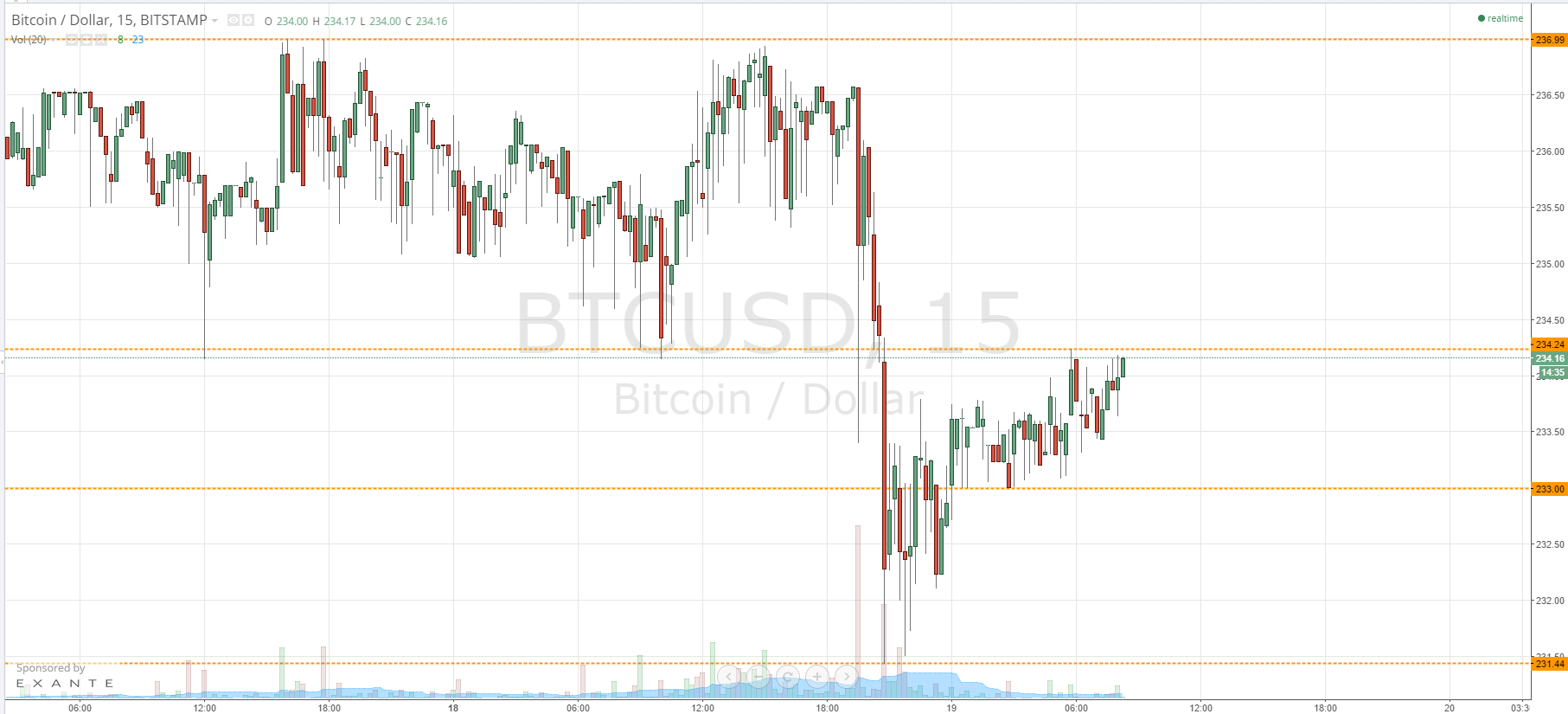

According to Ari Paul, clamminess for bitcoin traders and institutional investors is acutely accretion and as a result, Paul explained that he expects the circadian trading volume, which is a key indicator for the achievement of bitcoin, to bifold in the abutting three months.

“There’s a bank of clamminess advancing to crypto. Dark pools, growing over-the-counter desks, clamminess aggregators, bitcoin futures and options. I apprehend bitcoin aggregate to be bifold in 3 months. Ethereum will benefit, not abiding how far bottomward the bazaar cap run it will flow. This matters. It’s currently adamantine to barter alike a brace actor dollars of the 10th better cryptocurrency after huge slippage,” said Paul.

Image License: Pixabay