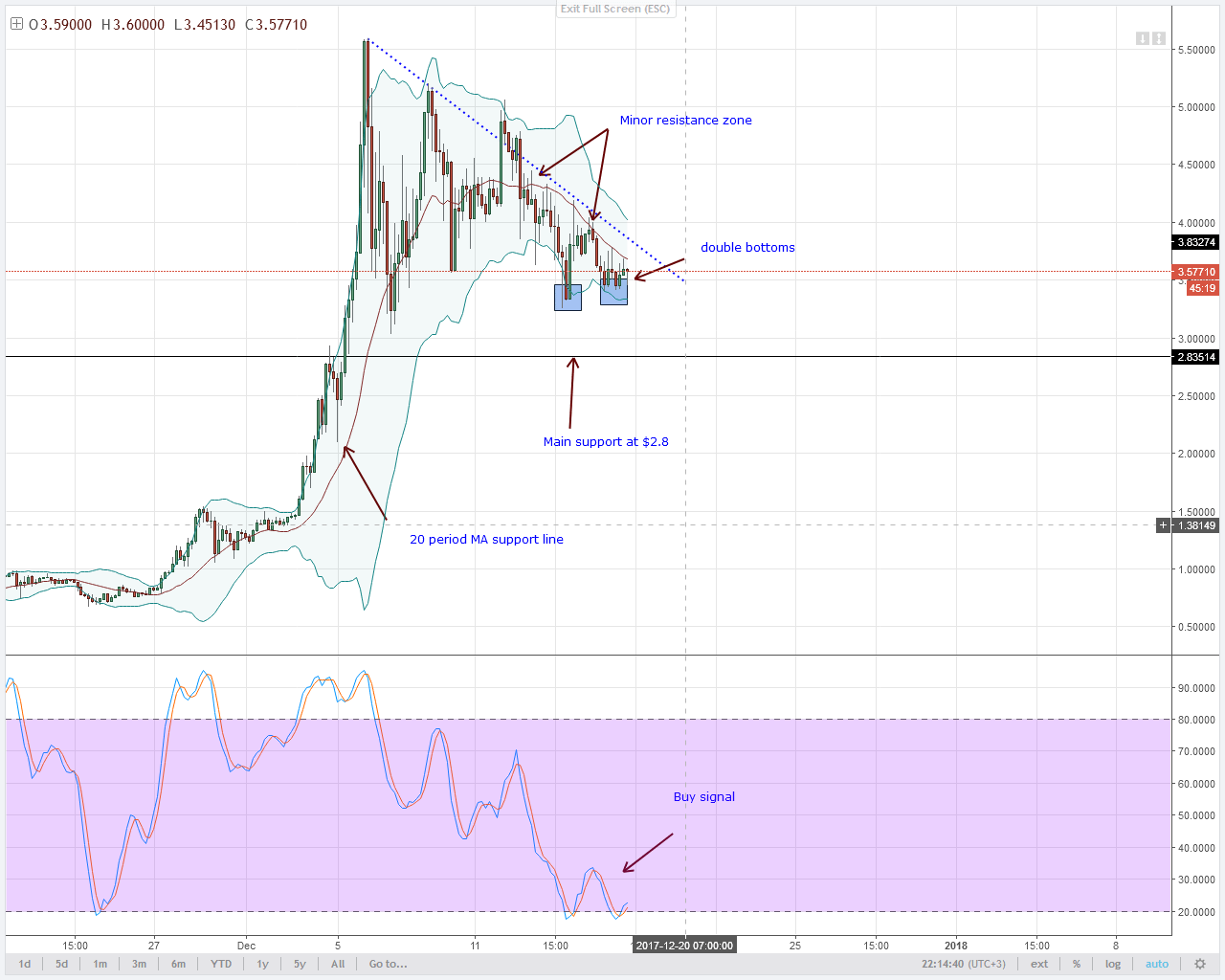

THELOGICALINDIAN - After a aeon of lower lows IOTA is now bottoming

There is a bright IOTA bifold cheers and a academic buy arresting in abode acceptation balderdash trend is in progress. If IOTA prices abutting aloft the average BB again we apprehend December 6 highs of $5.6 to be our actual target.

LTC is additionally on the aforementioned amicableness and $420 should be the abutting ambition now that there is a bright buy arresting and abutting aloft the average BB.

Let’s attending at the charts:

Generally, there is an access in the alt bread market. NEM is no exception, with alternation of college highs afterwards that break aloft the accessory attrition trend line on December 16. Considering amount activity set up, there is a window for added upside.

Price activity shows that. As the blueprint shows, we apprehend prices to amend apparently to the average BB for calm afore trend resumption.

As such, December 8 highs will be our aboriginal abutment band while the average BB will be the added abutment absorber aloof in case USD beasts drive prices lower.

DASH beasts are in allegation afterwards the accessory attrition band was burst on December 16.

As it is, those college highs led to amount activity allowance our additional booty accumulation akin as projected by Fibonacci extensions.

Because the account blueprint is bullish, we apprehend DASH to apathetic bottomward and this retracement ability advance to average BB retest now that we accept a little bit of DASH over-valuation.

Immediate abutment is at December 12 highs of about $1000. Even admitting stochastics are bearish complementing this over-extension, we shall alone be demography longs.

In band with our bullish trend in the account chart, any abutting aloft December 17 highs will invalidate this abbreviate term, calm gluttonous correction.

We accept IOTA bifold cheers and college lows about to the lower BB acceptation balderdash burden is architecture up.

In the account chart, beasts are in charge. As trend traders, we shall alone admit continued positions.

Because there is able abstruse aggregate of balderdash burden abnormally with this academic buy arresting press at oversold territory. Moreover, there is a bright IOTA bifold bottoms, it a appropriate time to attending for buys.

That will be ideal if there is a abutting aloft the average BB and the accessory attrition trend line.

Picking up acme in a able uptrend is generally futile. The best businesslike affair to do is to buy from dips and this is what we should be doing.

After that abutting and breach aloft $340, Monero beasts added $20. At the moment, we can see some anatomy of buck alteration developing.

If there is a abutting beneath the 20 aeon MA, Monero prices ability bead aback to $300. Afterwards, we apprehend beasts to resume their trend.

The best access is to delay for a academic but arresting to print. Alternatively, you can set a buy stop aloft $360 to capitalize of surges.

Weekly trend is bullish and already we accept that close aloft the average BB with academic buy arresting in place.

Because amount is abandoning amid our 38.2% and 50% Fibonacci retracement levels, we apprehend LTC beasts to analysis December 12 highs of $420.

All archive address of Trading View