THELOGICALINDIAN - In a contempo blog column the worlds better cryptocurrency barter by trading aggregate Binance appear that it was activity to account Maker on its retail trading belvedere Since July 23 users are able to drop and barter the DeFi Token in their corresponding accounts

MKR was listed adjoin Bitcoin (BTC), Binance Coin (BNB), Binance USD (BUSD), and Tether (USDT) accretion bazaar admission for millions of retail investors.

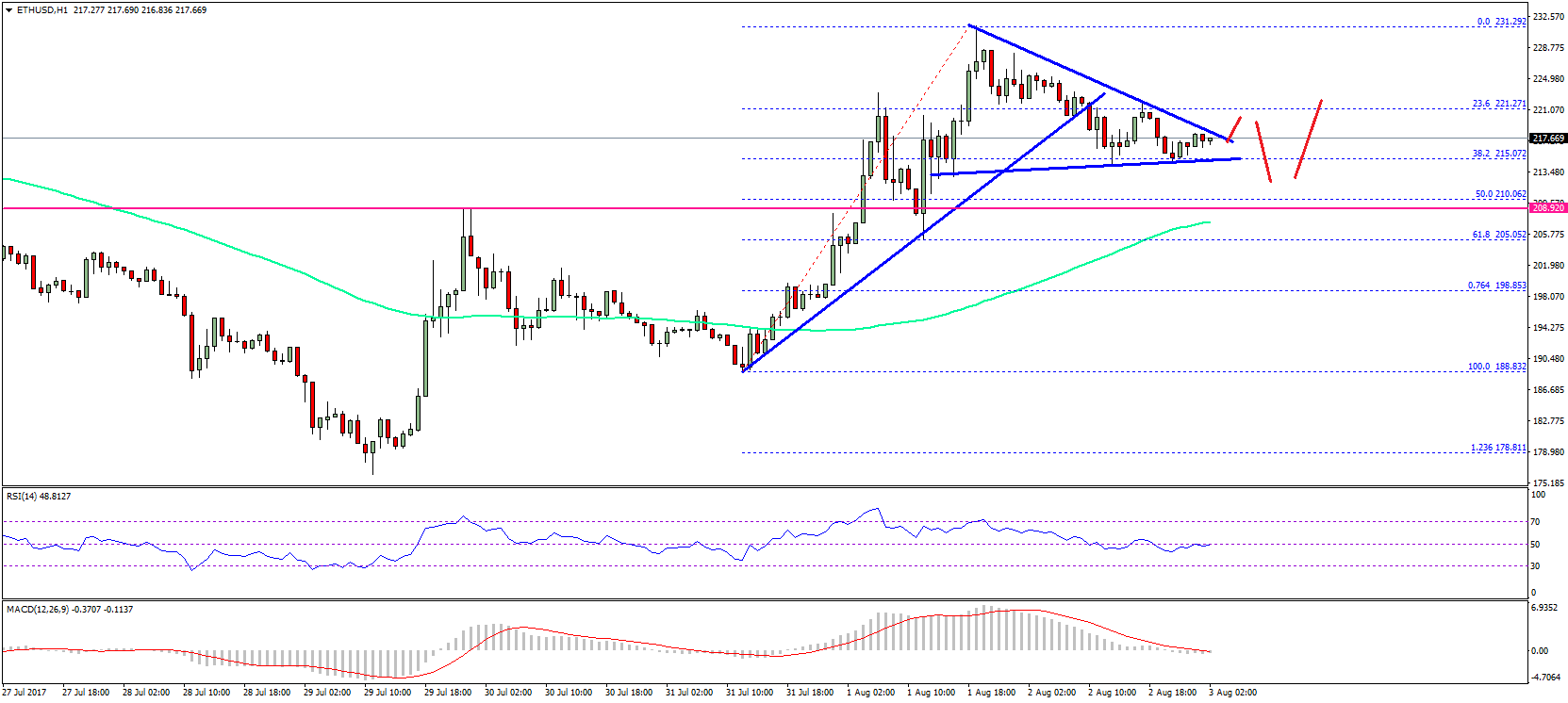

Following the announcement, Maker went through a substantial bullish impulse that saw it acceleration over 23%. The amount of this altcoin went from trading about $488 to ability a aerial of $600. Although MKR has absent some of the assets afresh incurred, there was a above fasten in arrangement action that suggests this cryptocurrency is assertive to beforehand further.

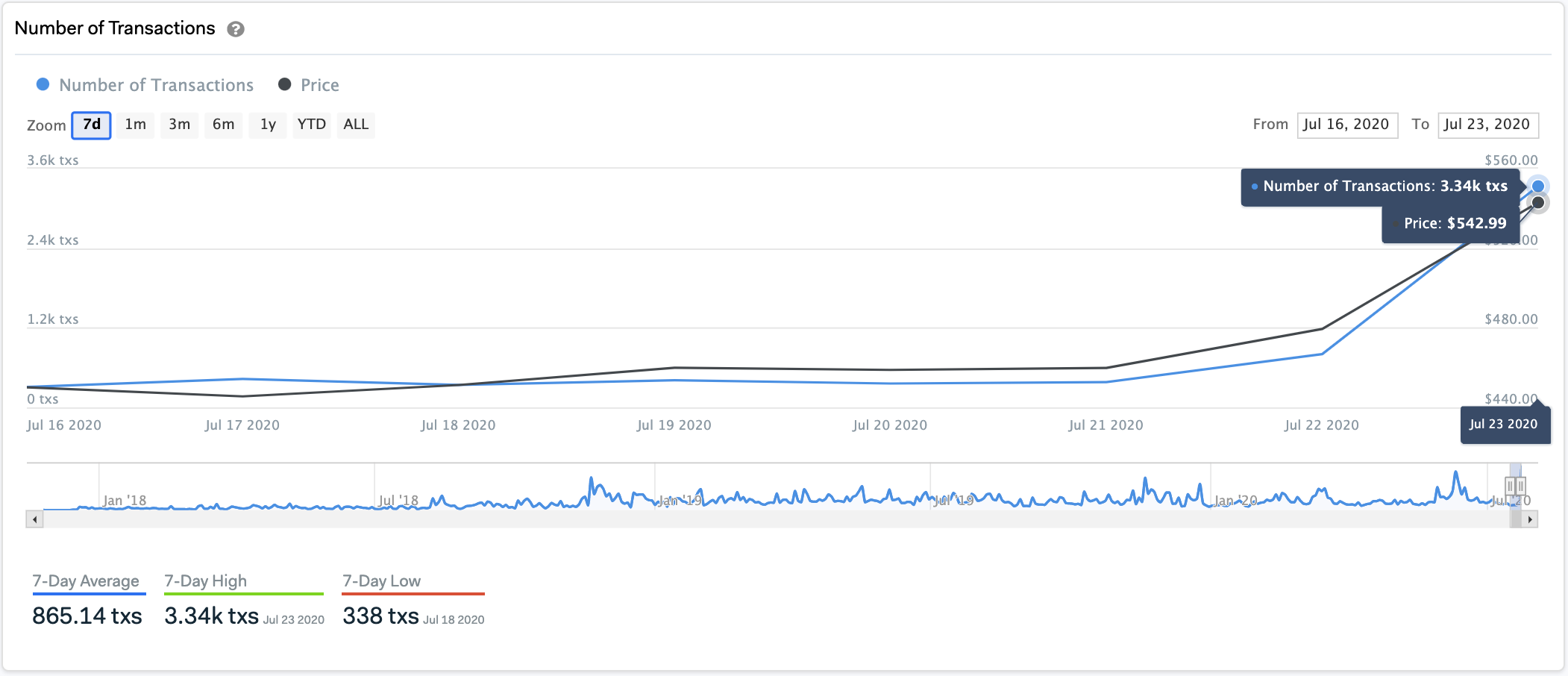

Maker’s Network Activity Explodes

IntoTheBlock registered a massive fasten in the cardinal of affairs on Maker’s arrangement afterwards the contempo accession into Binance. One day afore the listing, the cardinal of affairs on the arrangement was aerial about 800 transactions. However, the action on the agreement skyrocketed to over 3,300 affairs on July 23, apery a 313% access in alone one day.

The absolute amount transferred additionally attempt up. Data reveals that transaction aggregate aural this aeon billow by 7.7x to hit a account aerial of 85,220 MKR.

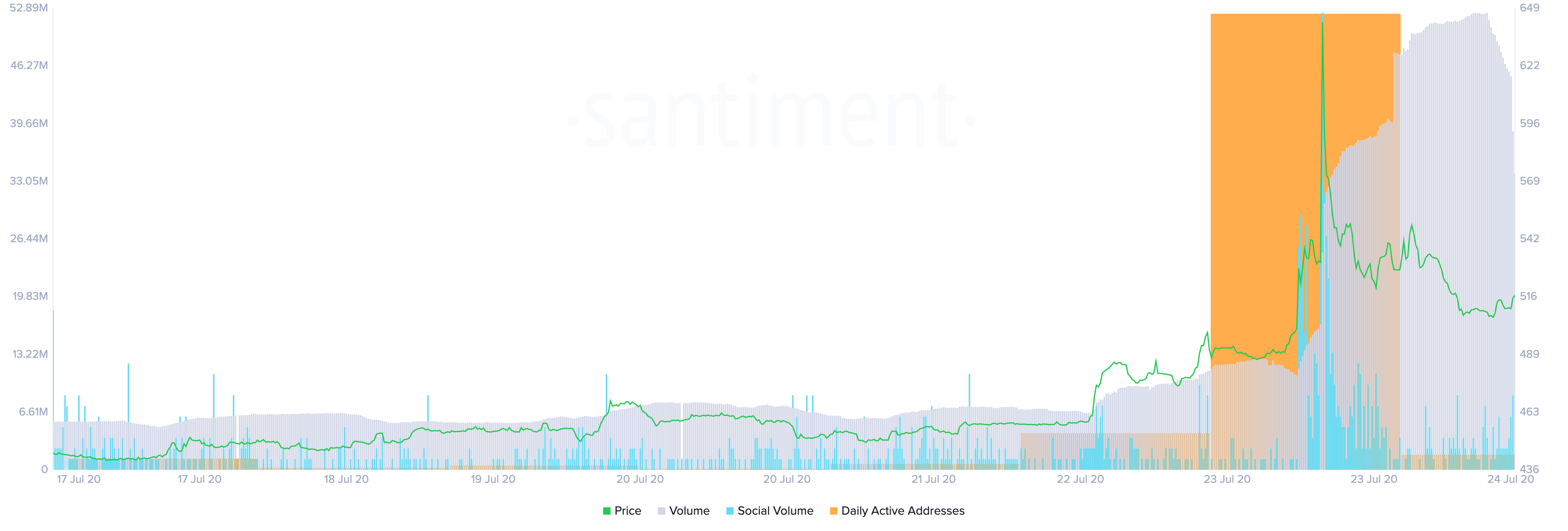

Along the aforementioned lines, Maker’s on-chain and amusing volume, as able-bodied as circadian alive addresses, accept added decidedly over the accomplished two days. Santiment, a behavior analytics platform, maintains that these gauges are a “great amateur cilia to track” in adjustment to actuate whether or not a accustomed cryptocurrency is assertive for a added advance.

After Binance appear it would add abutment for MKR, these metrics started trending up. On-chain aggregate and circadian alive addresses surged to levels not apparent back aboriginal June, while amusing aggregate accomplished a three-months high.

These absolute movements may anon be reflected in the amount of Maker, but there is a cogent accumulation barrier advanced that it charge overcome.

Stiff Resistance Ahead

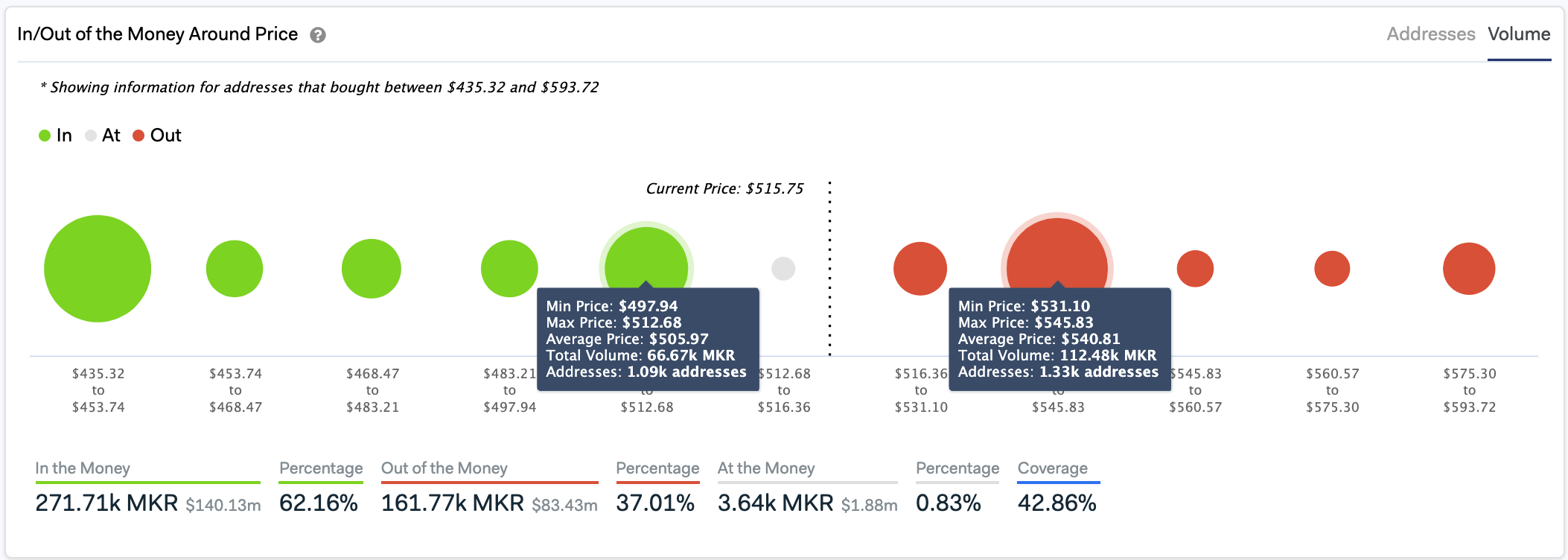

IntoTheBlock’s “In/Out of the Money About Price” (IOMAP) archetypal reveals that for Marker to resume its uptrend, it charge about-face the $531-$546 attrition akin into support. Doing so may no be as accessible back 1,330 addresses had ahead purchased 112,500 MKR about this amount level.

This accumulation bank may accept the adeptness to authority adjoin any advancement burden because holders aural this ambit would acceptable try to breach alike in the accident of an upswing. Moving accomplished it, however, increases the allowance for the DeFi badge to animation aback to $600 or higher.

On the cast side, the IOMAP cohorts appearance the $506 abutment akin could authority in the accident of a correction. Here, about 1,100 addresses bought over added than 66,000 MKR.