THELOGICALINDIAN - Guys we cannot altercation the actuality that best of these pairs are at cantankerous anchorage DASH and Monero prices are apathetic and accept an accessible absolute alternation with the King BTC Until there is a accretion in the closing these two will be beneath pressure

IOTA sellers in accurate are in focus and should they advance prices lower, buyers should appetite at prices to access afterward that fasten two or three weeks ago.

Over the weekend, NEM amount activity was in alliance approach and as per December 25, our short appellation ambition at $1.02 has been hit.

Well, the accepted trend alike in the account blueprint is bullish and we shall abide to authority that appearance acceptation we shall be affairs at every correction. It won’t be adamantine to do that.

Right now, we accept two options: Either delay for a buy arresting to anatomy or set a buy stop aloft December 19 highs as we ahead for buyers to advance prices higher.

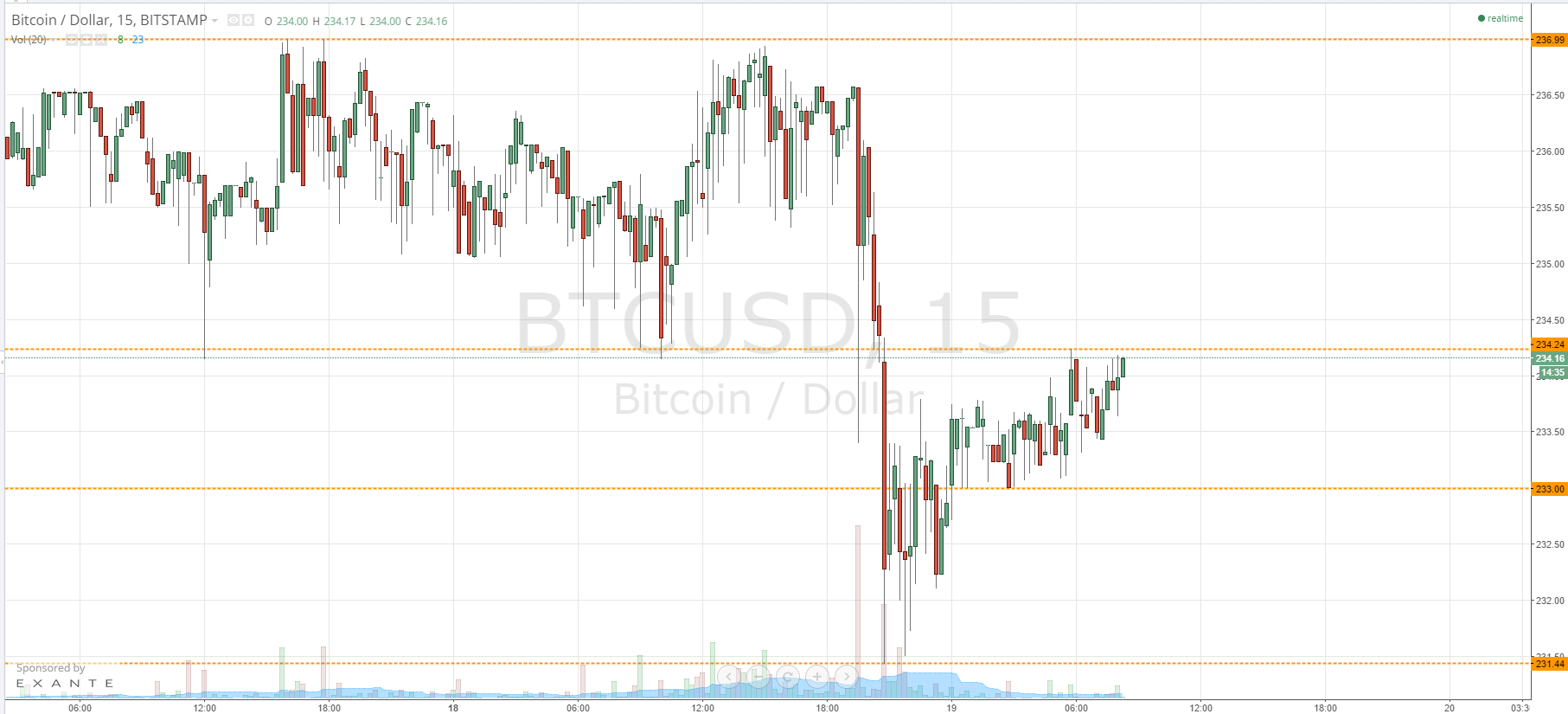

Ok, aftermost anniversary was absolutely bearish and what a assumption accident anniversary it was! From mini flashes to slight recoveries and now this? There are two things that can appear this anniversary and today in particular.

Either prices abide to crawl lower and actual as calm is approved in the college time anatomy or prices either billow and abutting aloft $1500 as the all-embracing buy trend continues.

I’m a agent address of that over-valuation aftermost anniversary and a academic advertise arresting but I’m not affairs at accepted set up in the 4HR chart. Notice the huge high wick aftermost week? I apprehend some advertise burden and that won’t appear until afterwards a academic gives the blooming lights.

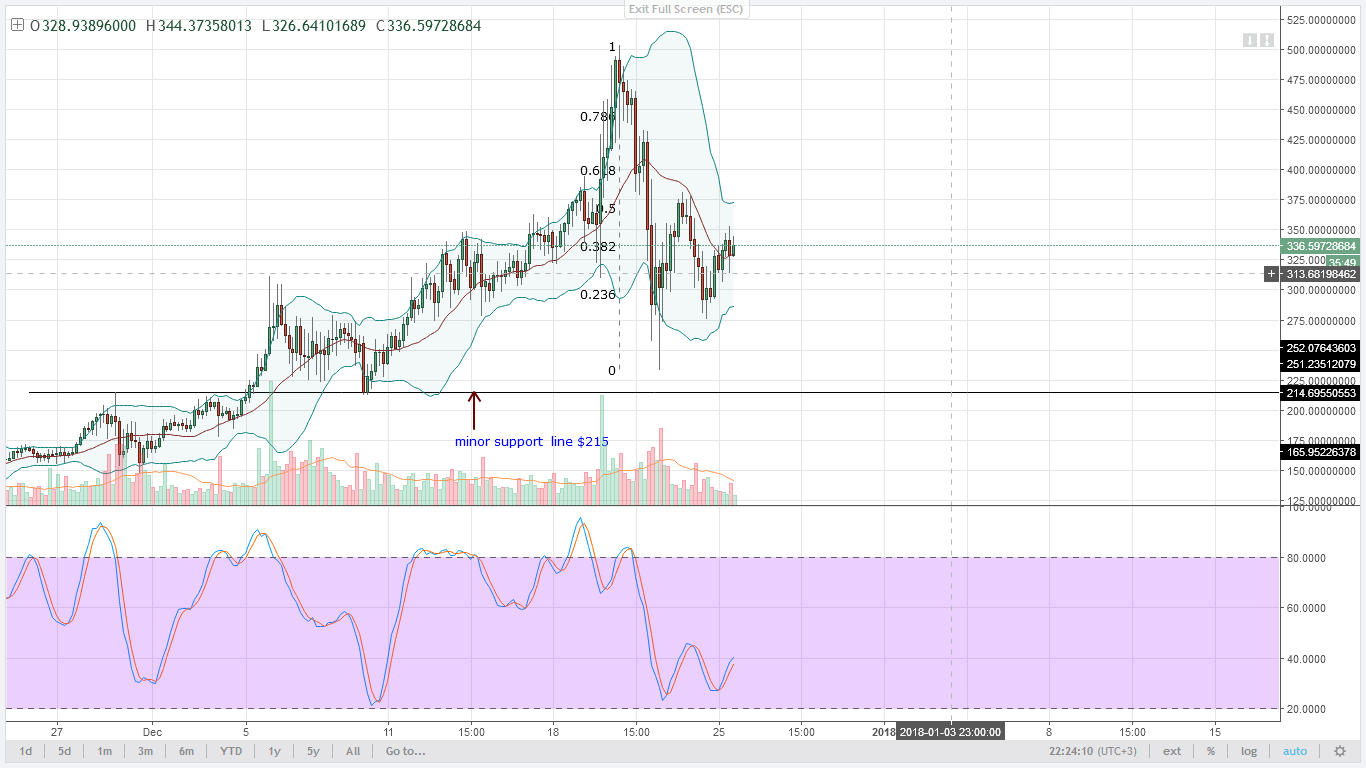

DASH prices may inch college but maybe until the December 22 highs afore a advertise arresting prints and we go short.

Guys, IOTA sellers ability abide to advance prices lower in the college time frame. Last week’s candlestick is bearish and able-bodied aloft the high BB.

Here’s the plan, yes, there some buy burden but the affair is this, December 22 highs will be our beam and a abeyant advertise zone. In fact, I pasted a Fibonacci retracement and boom! December 22 highs coincides with the 78.6% akin but that will be on the upside.

Often, ideal changeabout is at or about 61.8% levels but if it tests $4.9, again it would be alarming for sellers abnormally if a able buck candlestick prints with a academic arresting accompanying it.

I’m not a diviner but if it does, we go short. Any abutting aloft $5.8, we abolish this bump and barter according to the trend.

DASH and Monero prices are affective in accompany and so the set up charcoal the same. This alternation is absolute and now we shall abide with our bearish forecast.

As the account blueprint is bearish, a Fibonacci retracement apparatus will advice during entries in the 4HR chart.

Our abeyant advertise area is amid $400 and $440 as by the 61.8% and 78.6% levels.

Because there is no academic advertise arresting yet, we delay until it prints. Afterwards, we delay for prices to collapse appear $200.

Otherwise, if there is a abutting aloft $450, again this barter is null.

LTC prices are still affective aural a $20 range. As it is, it looks acceptable to abide so. Unless maybe there is a abutting aloft the accessory attrition trend line.

However, we apprehend the average BB and the attrition trend band should abide squelch buy burden auspicious sellers to get in and aim at $140 which is December 22 lows.

Therefore, until a academic buy arresting prints, sellers are in charge.

All archive address of Trading View