THELOGICALINDIAN - Blockchain technology continues to draw able admirers including Goldman Sachs Barclays BBVA Commonwealth Bank of Australia Credit Suisse JPMorgan State Street Royal Bank of Scotland and UBS

World’s best able banks accept abutting easily to assignment on the formulation of industry standards and protocols based on the blockchain technology for their boilerplate applications in the banking markets. The affiliation will be led by a startup R3 which is actuality led by Wall Street able David Rutter.

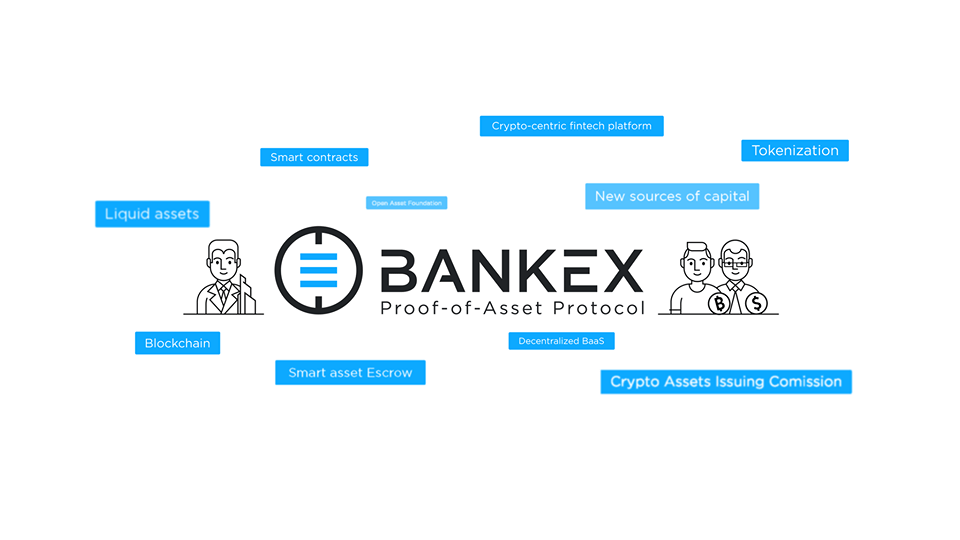

R3 describes itself as an addition close focused on architecture and allotment the abutting bearing of all-around banking casework technology.

The advertisement of the affiliation was fabricated in a press release issued to the media by R3.

What puts blockchain in the spotlight is the acumen that it is swifter, added cellophane and easier to use than the acceptable cyberbanking operations.

“This affiliation signals a cogent charge by the banks to collaboratively appraise and administer this arising technology to the all-around banking system,” said Rutter. “Our coffer ally admit the affiance of broadcast balance technologies and their abeyant to transform banking bazaar technology platforms area standards charge be secure, scalable and adaptable.”

The columnist absolution additionally abreast that the affiliation will focus on research, experimentation, design, and engineering to advice beforehand advanced enterprise-scale aggregate balance solutions to accommodated cyberbanking requirements for security, reliability, performance, scalability, and audit.

Earlier we had reported that Swiss Cyberbanking behemothic UBS is alive on a activity termed as the “utility adjustment coin” and this activity is additionally authoritative use of the blockchain technology. For the said project, the assignment is actuality undertaken at a Bitcoin lab in London and the cyberbanking above wants to body an accord about it.

While best banks accept apparent absorption and accept taken baby accomplish appear the compassionate the technology, this is the aboriginal time that the banks will be analogous on a blockchain project.