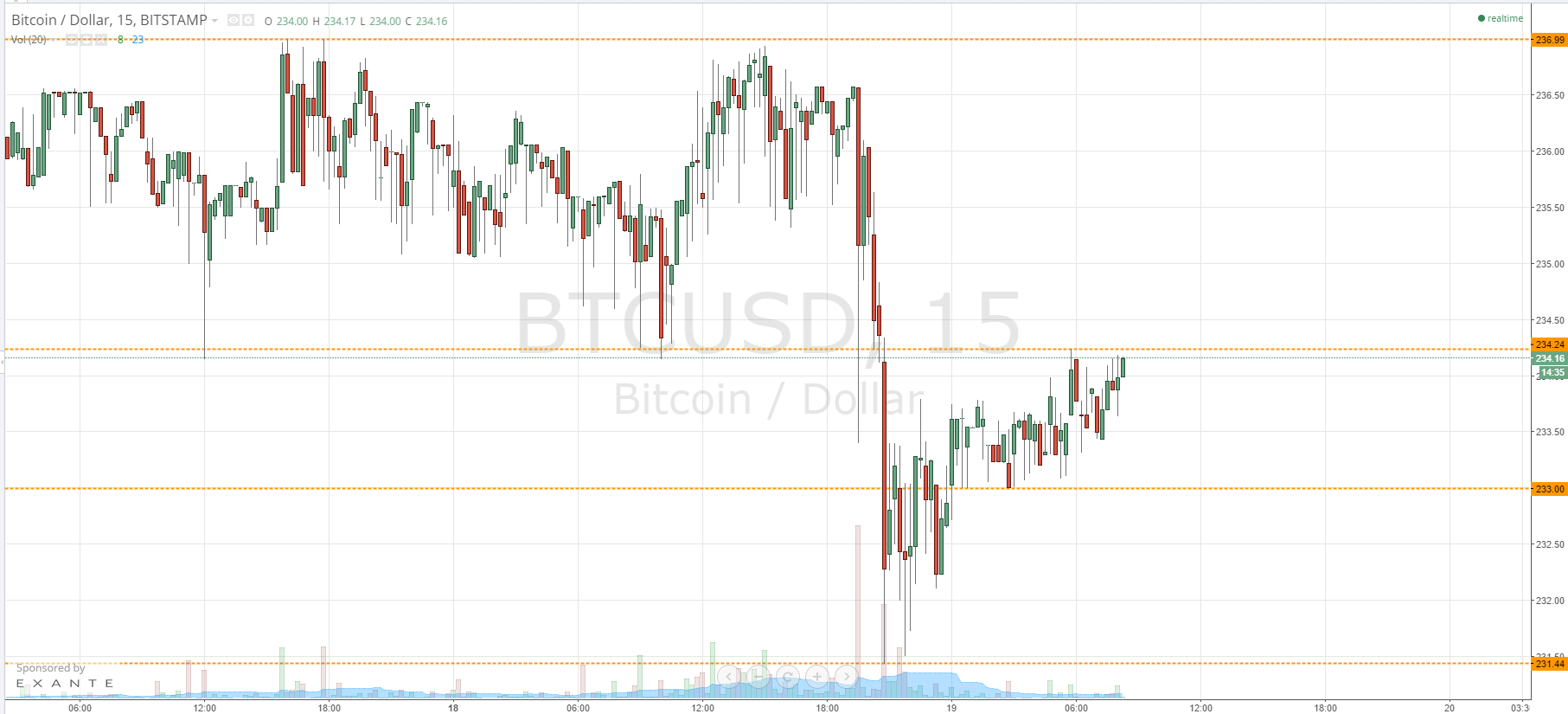

THELOGICALINDIAN - Following the abandoning of Segwit 2X the pump has been aloof and as a aftereffect alt bill are aback to their antecedent trading ranges Coincidentally these reversals happened at key Fibonacci retracement levels fatigued amid AugustSeptemberOctober HiLos Lets see what happened yesterday

Based on our altitude yesterday, NEM amount activity bootless to abutting aloft $0.22 capital attrition line.

There was a able backlash from that akin and USD beasts carve losses convalescent $0.04 and closing at November 9 lows. Note that this re-bounce was at the 68.2% Fibonacci level. As such, our bold plan today is if alt bread NEM will abutting beneath the capital abutment akin at $0.20 today.

It is likely, analysis the continued high wick this morning which announce USD balderdash burden and a apparent discharge over from yesterday’s buck run.

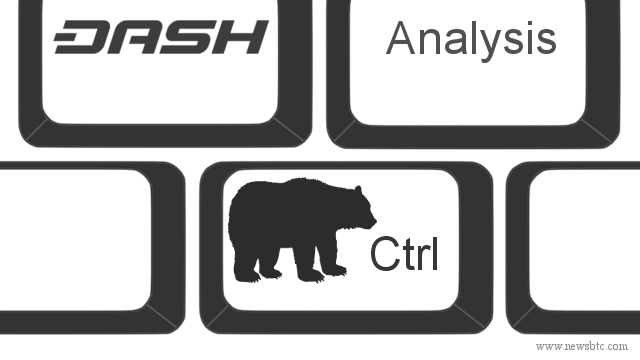

Yesterday’s alt bread DASH amount activity concluded up as a doji candlestick closing aloft the high BB. Concurrently, alt bread DASH highs antipodal in our advertise area amid $335 and $370 afterward segwit 2x cancellation.

November 10 and 11 candlestick characteristics announce advertise burden body up. After all, $327 November 10 abutting is aloft the high BB acceptation DASH is expensive, not at calm with crumbling balderdash drive as stochastics shows.

According to our plan, should advertise burden access as it is accident now, again we initiate abbreviate positions anywhere amid 38.2% and 23.6% Fibonacci levels fatigued from August-September Hi-Los. Fine tune your access and access abbreviate in the 4HR time frame.

After testing highs of $0.60 attrition line, alt bread IOTA adapted lower and is now trading at $0.50 afterwards account of segwit 2x cancellation.

That agency aural two days, alt bread IOTA has afford $0.10. Then again, it is abandoning from the 61.8% Fibonacci akin as fatigued from August-October Hi-Los. That’s not all. Between November 9 and 10, alt bread IOTA amount activity concluded up closing aloft the high BB at $0.53 and $0.50 respectively.

This alteration lower should abide now that balderdash drive is cutting out as stochastics show. More importantly, if USD beasts administer to abutting beneath $0.48 abutment level, again the buck burden should abide aback to $0.38 capital abutment line.

Now that alt bread Monero beasts are at breach even, it is bigger to avenue this barter with some profit. Obviously, the pump is over and basic is abounding aback to BTC afterwards Segwit 2x adamantine angle cancellation.

After all, alt bread Monero is topping as amount activity hints. That able bearish engulfing candlestick abandoning from 23.6% Fibonacci retracement levels agency Monero prices ability abatement aback to $80. In the beggarly time, let’s not balloon that there is a stochastics advertise signal, apocalyptic of advertise pressure.

Additionally, November 9 candlestick is aloft the high BB and a abutting lower to adverse this in-equilibrium was necessary.

Alt bread NEO didn’t breach aloft the $40 mark and afterwards registering highs of $38.5, USD beasts took over.Furthermore, there is a 3-bar changeabout candlestick with bearish drive blame in afterwards November 10 buck candlestick.

Unless there is added NEO balderdash burden and amount abutting aloft $33, we advance a bearish outlook. In ablaze of this, the breach out action is still in play.

All archive address of Trading View