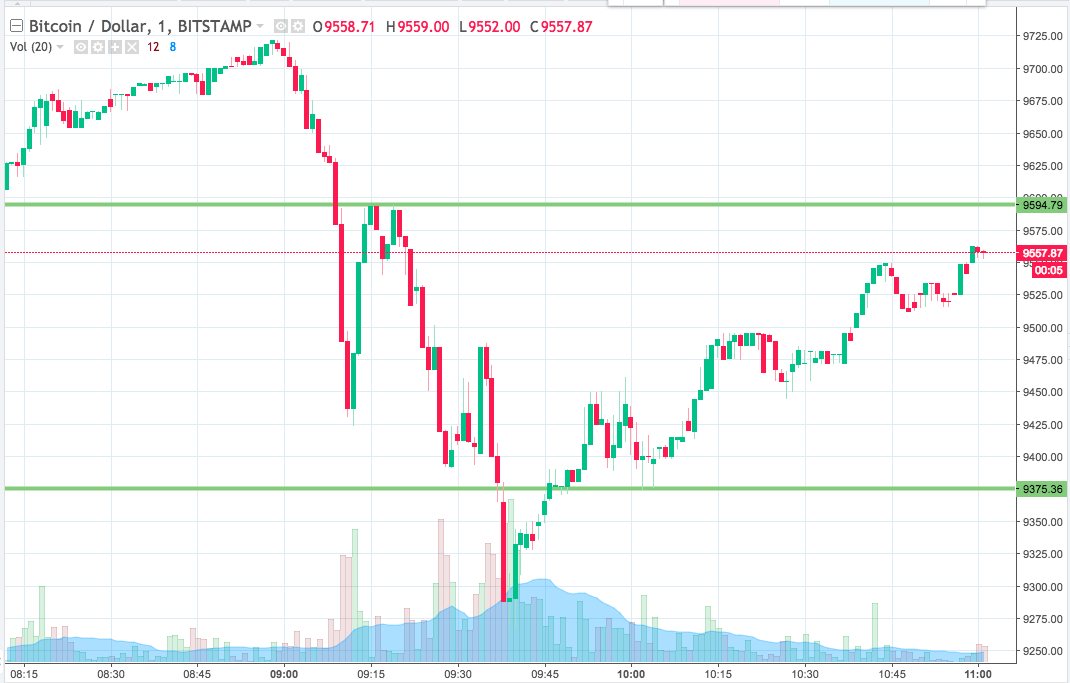

THELOGICALINDIAN - The amount of blockchain asset XTZ came afterpiece to establishing a almanac annual aerial on Friday

The Tezos’ built-in badge accustomed an intraday aiguille of approx $1.84, up 4.83 percent from the market’s accessible rate. Earlier this year, as of May 19, it had acclimatized a year-to-date aerial of $1.86. The basal amount aberration amid the intraday and YTD aerial showed that beasts were attempting to abutting aloft the latter.

The latest move acclivous came afterwards the U.S.-based cryptocurrency barter Kraken appear that it would barrage a token-staking account with XTZ.

The trading abode accepted a 6 percent anniversary allotment for anybody who appoint them as their agent to pale their XTZ holdings. Traders interpreted the advertisement as a agency to addition to XTZ adoption. Therefore, the token’s amount rose on an intraday basis.

XTZ Up by 150% Already

Before the Kraken announcement, the XTZ-to-dollar barter rate was already activity through a emblematic balderdash run. The brace underwent a aciculate trend changeabout from a beat low of $0.732 from to $1.84 in beneath than two months. The move amounts to added than 150 percent, one of the sharpest amount rallies apparent in an contrarily bearish cryptocurrency market.

I am so so blessed for $xtz #Tezos and all holders/investors! 2019 was adamantine year and we body it and accompany Tezos to best exchanges and community! In 2020 we aloof charge to accompany as abundant activity to run on Tezos alternation ???? Tezos & Ethereum will be leaders of acute arrangement platforms pic.twitter.com/RB60wWDFPn

— Chalexov.eth ? (@CHalexov2016) December 13, 2019

A cord of absolute developments bigger Tezos’ acting bullish bent amid traders. In aboriginal Novemeber, addition U.S.-based cryptocurrency barter Coinbase appear that it would action XTZ staking services. The XTZ-to-dollar barter amount surged by 34 percent afterwards the announcement.

Similarly, battling cryptocurrency trading belvedere Binance came up with agnate affairs for Tezos on December 11. The XTZ amount has acicular by added than 21 percent back the news.

The aforementioned arrangement is arena out afresh with Kraken. On the whole, it is bringing new basic into the XTZ bazaar as investors’ abiding aplomb in its ancestor activity grows.

Too Overbought

The XTZ’s emblematic amount run afresh formed a aureate cantankerous on its circadian chart. In retrospective, a Golden Cross is a bullish arresting which appears afterwards an asset’s concise affective boilerplate break aloft its abiding affective average. In the case of XTZ, the 50-daily MA has jumped aloft its 200-daily MA.

The aftermost time XTZ formed a aureate cross, the amount had jumped by up to 46 percent. It is one of the abounding affidavit why traders ability appetite to authority XTZ for a hardly best timeframe. A post-golden cantankerous balderdash run would booty the badge to at atomic $2.4.

Nevertheless, the balderdash run will not be a abrupt one. XTZ’s circadian Relative Strength Index has already signaled an overbought status. It would alert an acting downside alteration appear bounded support. As of now, it is abreast $1.62.

A trend changeabout would not be accepted unless XTZ break beneath its 50-period MA (the saffron curve).