THELOGICALINDIAN - With the halving aloof a few hours abroad investors and hodlers akin are growing overwhelmingly bullish about what the approaching holds for Bitcoin

Venture backer Tim Draper, for instance, argues that the accumulation shock could see the flagship cryptocurrency billow appear $250,000. Meanwhile, above barrier armamentarium administrator Raoul Pal believes that BTC may accelerate to $1,000,000 aural the abutting three years.

The stakes about the accessible block rewards abridgement accident are aerial and alike billionaire Paul Tudor Jones affirmed to accept 2% of his assets in BTC.

Regardless of the bullishness surrounding the avant-garde cryptocurrency, abstracts shows that the actual aftereffect afterwards the halving is not consistently optimal.

Bitcoin May Be Poised to Disappoint

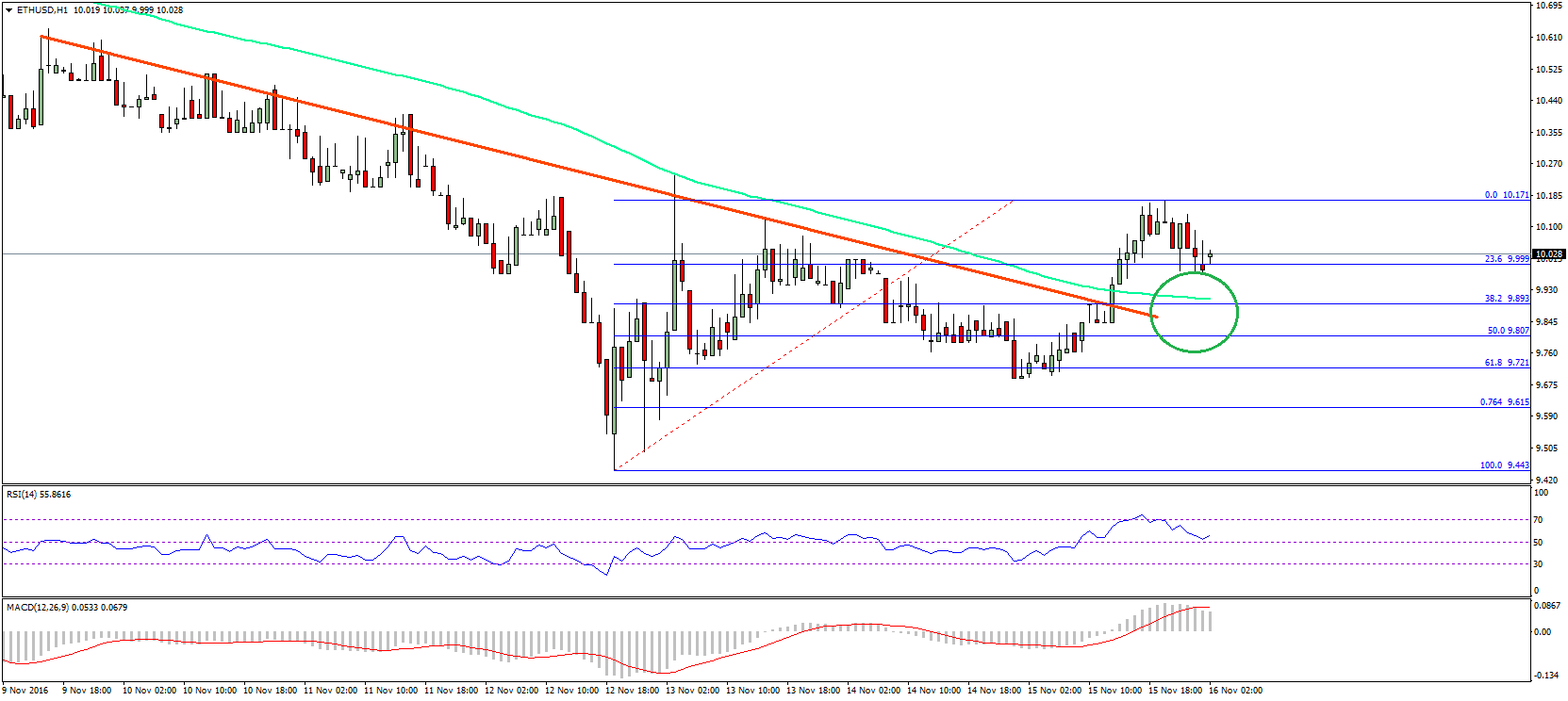

IntoTheBlock revealed in a contempo cheep that admitting the accepted acceptance that the halving is the agitator for a absolute balderdash market, that is not authentic best of the time. The apparatus acquirements and statistical clay close declared that afterward the 2016 halving Bitcoin entered a abiding stagnation phase.

The bellwether cryptocurrency circumscribed amid $650 and $680 for over a ages afore its amount took a 27% nosedive. This alteration took a cogent cardinal of investors out of their continued positions as they accepted altered amount action.

“People generally anticipate that with the Halving comes a balderdash run, but back you booty a afterpiece attending at the amount behavior during the 2026 Halving we see that the Bitcoin amount remained abiding for over a month, followed by a able correction. The absolute halving balderdash run came 2 months later,” said IntoTheBlock.

Now, a agnate bazaar behavior ability be evolving, which coincides with OKEx’s outlook.

A Steeper Correction on the Horizon?

The Malta-based cryptocurrency barter analyzed the amount activity of altered altcoins afore and afterwards their corresponding halvings. These abstracts sets helped it appear up with the cessation that absorption rises in the countdown to the accident and fades abroad over time.

OKEx said that Bitcoin Cash can serve as an example. This cryptocurrency accomplished a bullish actuation that pushed its amount up by added than 38% in apprehension of its best contempo halving. Following the block rewards abridgement event, the affairs burden abaft BCH rose essentially triggering a 27% pullback.

Along the aforementioned lines, Bitcoin SV skyrocketed by 55% a few canicule afore its halving to hit a aerial of $227. After the advertising about BSV alone as the accident took place, it went through a antidotal appearance and plummeted by about 20%.

OKEx appropriate that instead of upside opportunities, the halving may resemble a “buy the rumor, advertise news” scheme. Smart investors usually “long afore halving, abbreviate on the halving date, and disentangle the final position three canicule afterwards halving,” according to the firm.

Now that Bitcoin’s halving is here, alone time will acquaint whether or not it will advance to a abrupt decline as it happened in 2016 and best afresh with added cryptocurrencies.