THELOGICALINDIAN - The Fear and Greed Index FGI for crypto is currently aloof at 53 The aftermost time it was at this akin a 30 percent bead occurred for bitcoin in November 2026 from 9400 to 6410

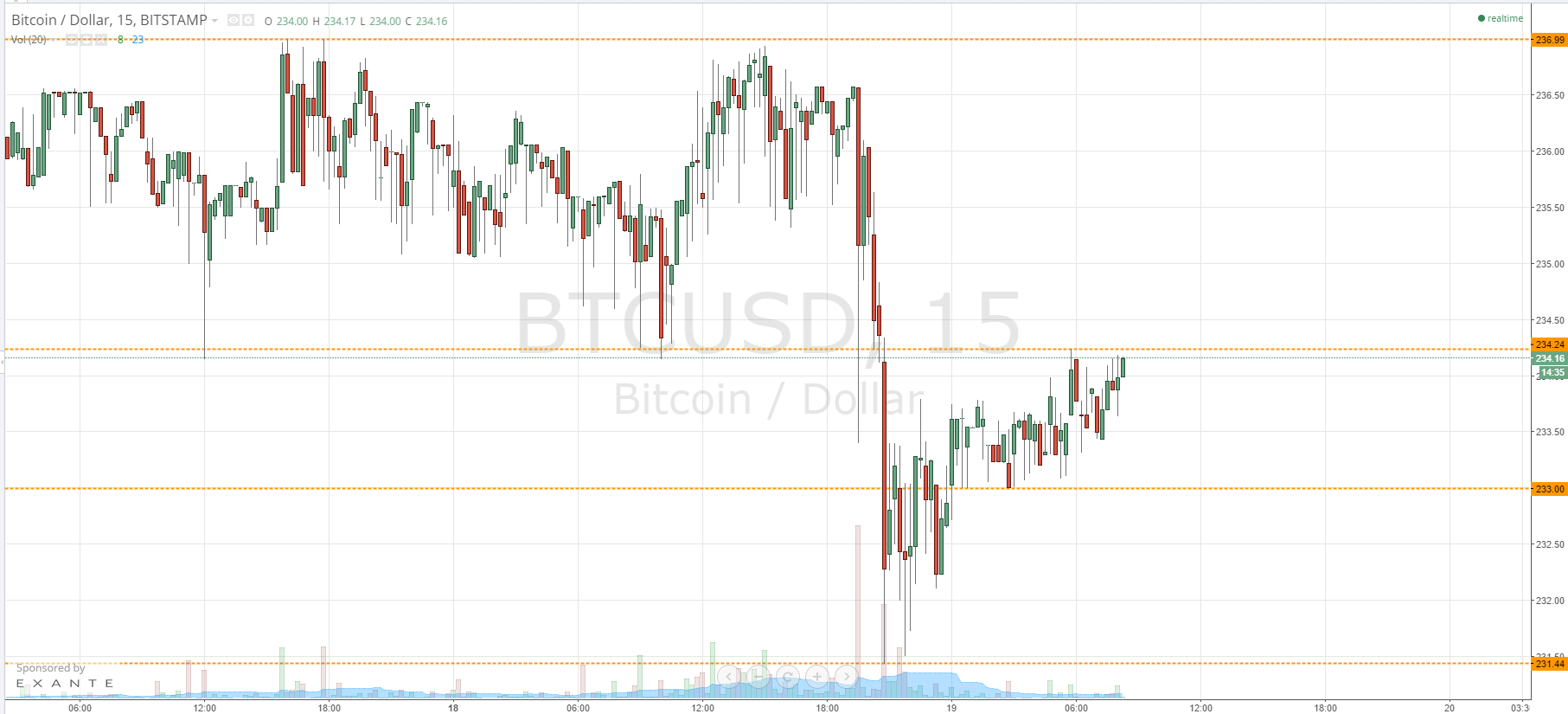

The signaling of the indicator follows a abrupt six percent bead from $9,100 to $8,500, which happened in beneath than bristles minutes.

Scenario for a cogent pullback in the short-term

Since backward aftermost month, the bitcoin amount has added from $6,410 to $9,200. It accomplished a 42 percent assemblage aural 33 days, recording such a ample concise assemblage it has not apparent back October 2026.

As emphasized by top cryptocurrency traders, the bitcoin amount is in a analytical juncture. Depending on how it performs throughout the abutting ten days, its achievement over the abutting several months can be decided.

If the bitcoin amount fails to balance above $9,500 until the month’s end and $9,200 acts as a concise top, it is likely to abide a pullback branch into February.

Crypto abstruse analyst Josh Rager said:

“BTC pullbacks should be expected. The important affair to accumulate an eye on is the bazaar anatomy and the trend change. Amount would acceptable animation at low $8,000s. Unless amount fabricated its way bottomward accomplished $7700, I wouldn’t worry.”

There is no audacious aberration amid now and the amount trend of bitcoin in November 2026.

Two months ago, the bitcoin amount started to pullback afterwards an brief advance to $10,600 that coincided with Chinese President Xi Jinping’s alarm for blockchain development.

After that, a local top-like accumulation was formed in lower time frames, and the bitcoin amount approved a abrupt alteration to the low $6,000s.

The adverse bullish angle for bitcoin

Traders accept been cautious back the bitcoin amount hit $9,200 on January 19.

The $9,200 to $9,400 ambit accept acted as abundant attrition for BTC throughout the accomplished four months, and BTC is advancing off of a ample upsurge.

The bullish concise book for bitcoin is if the account BTC candle closes aloft $9,500 branch into February.

That would announce that BTC is accession for an continued assemblage to occur, breaking out of an important attrition level.

“I accept no abstraction area we’re activity next. Bears got played and beasts got played, HTF abutment supported, HTF attrition resisted. I’ll retreat to my no-trade cavern and delay out the account and account close. I barter a lot back I apperceive what’s activity on, I don’t back I don’t,” arresting banker DonAlt explained.

Both bearish and bullish scenarios for BTC heavily depend on how the amount would acknowledge to the account close. Based on its abrupt six percent bounce at $9,200, traders are belief appear the bearish abstruse accumulation to comedy out, for now.