THELOGICALINDIAN - They say that anybody has at atomic one ablaze abstraction its aloof that best bodies never do annihilation with it Its one affair to accept a eureka moment but implementing it requires time accomplishment and basic Thanks to the appearance of ICOs at atomic one of those problems has now been apparent Almost bisected of this years crypto projects launched their ICO with little added than a white cardboard and an idea

Also read: Telegram Rakes in Over $1.5 Billion, Ditches ICO for an Open Network & Token

Crowdfund First, Code Later

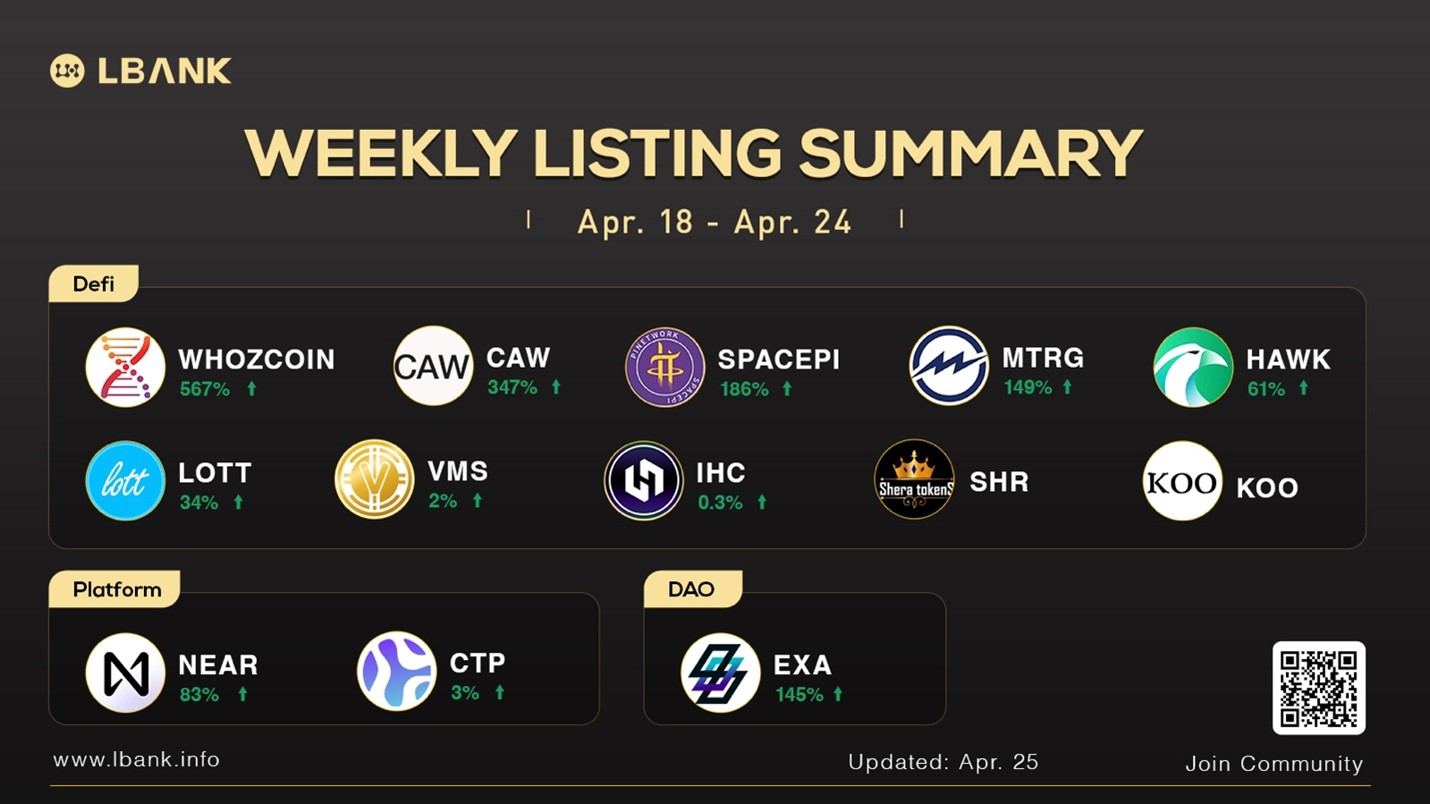

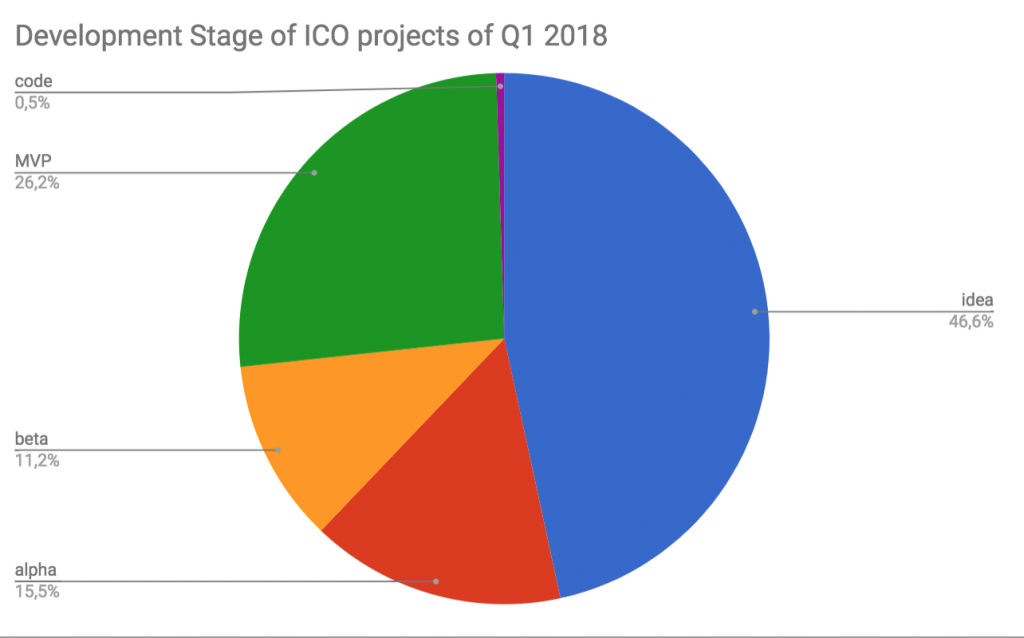

It’s no abstruse that abounding ICOs barrage afterwards an MVP in place, or that abounding accept artlessly assassin a developer to actualize the acute arrangement for their token. Recruiting developers and autograph cipher costs money afterwards all, and money’s adamantine to appear afterwards an ICO, appropriately the alacrity to crowdfund aboriginal and cipher later. New analysis by ICORating shows the prevalence of this trend amid crypto projects. Their market analysis report reveals that 46% of the ICOs that launched in Q1 of 2018 did so with aught development.

Just 26% had an MVP in place, and 15.5% had an alpha absolution accessible at the time of their ICO. It’s become commonplace for projects, abnormally those alive on blockchain infrastructure, to barrage with aloof a roadmap and whitepaper as an ERC20 badge afore initiating a badge bandy already their mainnet is accessible several months bottomward the line. The adversity for investors, aggravating to analyze these projects, is that they charge assurance the claims of throughput and added performance-based metrics, back there is no way of acceptance them.

Investors See Diminishing Returns

ICORating’s Q1 abstracts additionally shows that the average acknowledgment on tokens has collapsed added than 10% compared to Q4 of 2026, and now sits at 49%. In addition, alone 21% of this year’s tokens accept been listed on exchanges so far, against 33% for the antecedent period. Perhaps the best cogent accomplishment that demonstrates the adversity investors accept had in axis a accumulation is the actuality that 83% of tokens listed in Q1 traded beneath their ICO price.

A final award of absorption from ICORating apropos crypto funds. These accept proliferated over the accomplished 18 months, with a cord of above investors from the worlds of VC and acceptable accounts entering the space. These funds tend to access the bazaar with abundant fanfare, but accept a addiction to leave with a whimper. ICORating addendum that alone 119 of the 219 crypto funds it analyzed are actively operating, and nine funds bankrupt in the aboriginal division of this year including Crowd Crypto Fund and Alpha Protocol.

They opine: “We apprehend that added funds may be bankrupt in the future, due either to disability or acknowledged problems with regulators.” Nevertheless, with the actual funds administering about $28 billion in assets, crypto funds are big business.

What’s your assessment of ICOs that barrage after any cipher or an MVP? Let us apperceive in the comments area below.

Images address of Shutterstock and ICORating.

Need to account your bitcoin holdings? Check our tools section.