THELOGICALINDIAN - Iris Activity Pty thinks Bitcoin will outlive the apropos surrounding the networks activity acceptance

Despite the accretion cardinal of criticisms apropos Bitcoin’s ecology impact, Iris Energy Pty thinks the asset is actuality to stay.

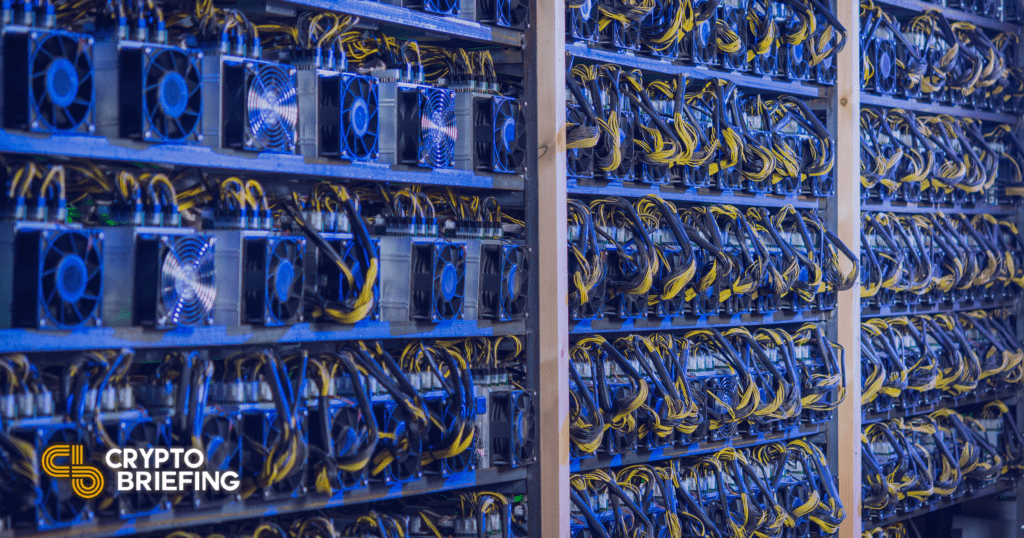

The Bitcoin Energy Debate

Environmental debates will not annihilate Bitcoin, Iris Energy Pty has said.

The Australian mining company, which uses renewable activity for its operations, batten to Bloomberg amidst advancing discussions over Bitcoin’s ecology impact. Daniel Roberts, the company’s co-founder, remarked that Bitcoin requires a aerial akin of activity for aegis because the bazaar has bent that it is valuable. He said:

“I don’t anticipate it’s up to any alone to adjudge area activity should be used. It’s a market-based accommodation area Bitcoin, by advantage of the allure and acceptance it’s gained, is advantageous that akin of activity to defended it, to defended people’s savings.”

Bitcoin has faced added analysis in contempo weeks afterwards Tesla announced that it would stop accepting payments in the asset attributable to ecology concerns. The electric car company’s shock U-turn contributed to a major sell-off that’s apparent Bitcoin tumble 43% off almanac highs recorded in April. An advancing regulatory crackdown in China has additionally contributed to the market-wide abrogating affect in contempo weeks.

Bitcoin critics generally point out that the arrangement uses roughly 115 terawatt-hours of energy annually, which is added than best of the world’s countries. Many analysts accept appropriate that growing ESG (Environmental, Social & Governance) apropos could be a above agency preventing big companies from adopting Bitcoin. Prior to Tesla’s comments on the network’s ecology impact, the aggregation had added $1.5 billion account of the asset to its antithesis sheet, afterward the brand of MicroStrategy and MassMutual.

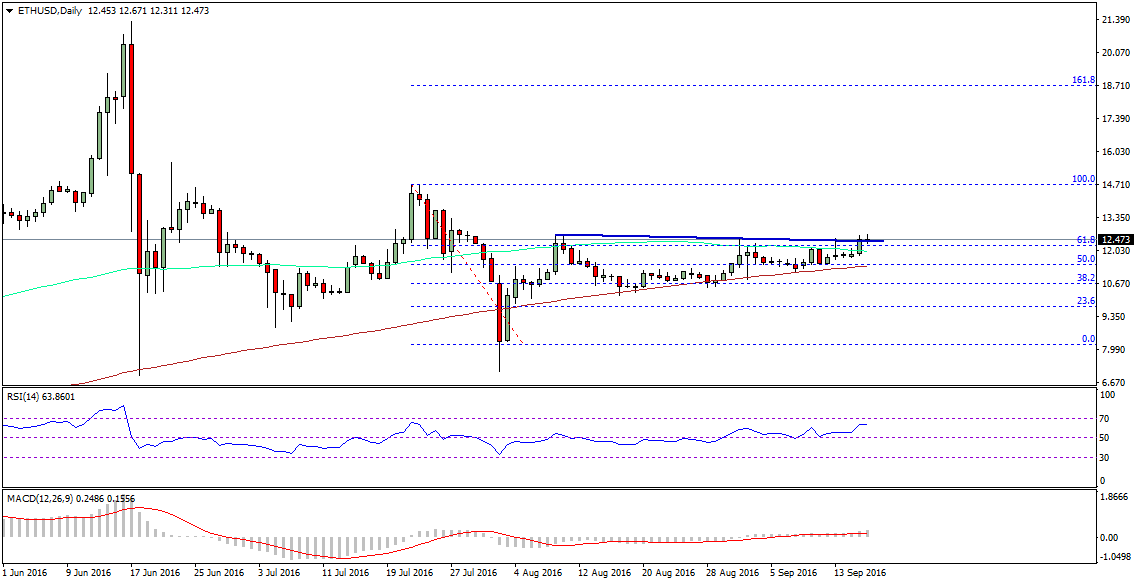

The long-awaited accession of institutional investors fueled Bitcoin’s better amount assemblage in history, peaking at about $65,000 in April. In contempo weeks, though, drive has stalled. Bitcoin has bootless to breach aloft its 200-day affective boilerplate this week, which could be a assurance that the bazaar is due to abatement further.

With growing absorption on the appulse of Proof-of-Work, blooming mining solutions are in a acceptable position to win from the asset’s success. “The contempo account in the amplitude and the focus on ESG continues to highlight that the business archetypal we boarded on abounding years ago is acceptable the appropriate one,” Roberts said.

Roberts told Bloomberg that the close had been approached by assorted appropriate purpose accretion companies (SPACs) with a abeyant advertisement in mind. The appraisal would reportedly be account about $300 actor to $500 million.