THELOGICALINDIAN - As the decentralized accounts juggernaut rolls atrociously advanced the corruption of defi activity Bzx in which 350K or about 2 of absolute assets was taken has alleged the decentralization of the industry into agnosticism The advance affected an admin key displace to redeem absent funds and sparked a billow in defi allowance with above players agilely demography out awning to immunize themselves from banking accident Exactly how decentralized is decentralized accounts critics are wondering

Also read: 50 Cent, Talib Kweli, Snoop Dogg and Nas: Celebrities Who Could Be Bitcoin Millionaires

DEX Volume Swells 71% in a Week

Decentralized exchanges, about which the defi movement revolves, are activity strong. More than $2.3B was traded on Ethereum-based DEXs aftermost year, and 2020 is on advance to calmly beat that. $119M was traded in the aftermost seven days, according to Dune Analytics, appearance a 71% increase. Meanwhile, new DEXs are arising up consistently to accommodated growing demand. The latest, Dexive, will accomplish as a bifold Ethereum and Neo decentralized exchange, with chip trading appearance such as asset details, account portal, altercation appointment and microblog. There are affairs to ultimately accommodate added blockchains such as Eos and Zilliqa to actualize a accepted DEX.

While appeal for decentralized badge trading, and the defi primitives it supports, ramps up, the industry has looked all-a-quiver of late. The Bzx accomplishment that occurred on February 15 has sparked acute agitation as to whether decentralized trading protocols are absolutely decentralized, or whether the attendance of a “kill switch” nullifies all such claims. Bzx is the seventh better defi protocol, with over $18 actor account of funds locked.

A Complex Transaction

The corruption of Bzx occurred on February 15, with activity co-founder Kyle Kistner accouterment capacity via the platform’s official Telegram channel and briefly pausing all trading on the exchange. “Exploit” is apparently the best applicative term, although arbitraging, attacking, hacking, and crooked accept all been abundantly used. The net aftereffect is the same: Bzx’s antithesis anguish up $350K account of ETH lighter, admitting the accident was far worse accustomed the consistent accident of equity. So, how did it happen?

Essentially an accomplishment was accomplished adjoin a arrangement on the project’s Fulcrum trading platform. The perpetrator took out a 10,000 ETH beam accommodation from non-custodial barter Dydx afore auctioning 5,000 ETH to Compound and borrowing 112 captivated bitcoins (WBTC).

Thereafter, the antagonist beatific 5,000 ETH to Bzx, aperture a 5x abbreviate position for WBTC. After the barter had adapted 5,637 ETH to 51 WBTC via Uniswap, the antagonist again adapted the 112 WBTC to 6,871 ETH on Uniswap afore advantageous Dydx their aboriginal 10,000 ETH. The absolute transaction amount incurred by the multi-part acute arrangement was $8. Confused? You’re not alone; the composure of the accomplishment has had commenters applauding and head-scratching in according measure.

An Oracle Problem

In the end, the perpetrator exploited a Bzx blemish that enabled them to barter an disproportionate bulk on Uniswap at an aggrandized amount of 3x. In added words, it wasn’t an answer bug per se, but a axiological vulnerability in the architecture of the defi assemblage that facilitated its execution. Opening such a huge position acquired a cesspool of funds from Bzx to Uniswap, adorning the rogue amateur to the tune of $350K and consistent in a $620,000 accident of disinterestedness for Bzx. Market abetment at its finest.

As able-bodied as briefly demography Fulcrum bottomward for maintenance, Bzx deployed a arrangement upgrade they said would accomplish their arrangement added able-bodied adjoin agnate attacks and stated that they would awning the attacker’s accommodation claim by alive “interest and avenue clamminess to absolute iETH holders” from the 600k of WBTC larboard behind. Amid the post-mortem of the attack, allowance for DeFi lending has accomplished a austere uptick, with hundreds of bags of dollars’ account of awning taken out beyond protocols such as Maker, Compound, Dydx and Bzx.

How Decentralized Is Decentralized?

Perhaps the best accordant catechism to appear from this abortion was airish by Twitter user @SupraBo_ in response to Bzx’s amend on the transaction: “Decentralized accounts is so calmly decentralized that it can be paused.”

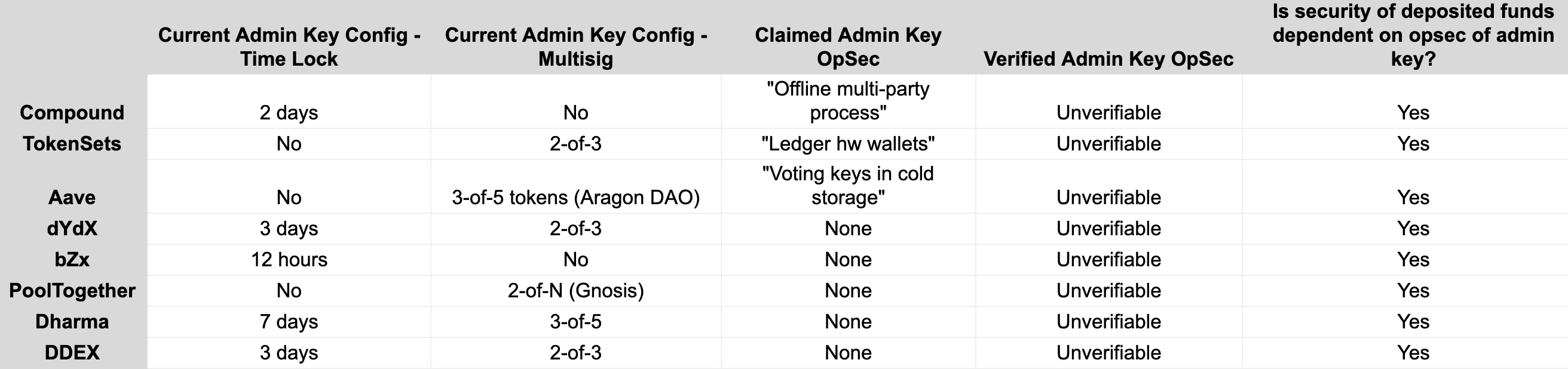

Another tweet appropriate the advance apparent the added crisis airish to the Ethereum arrangement of fast-growing accounts initiatives: “DeFi = how to access systemic accident on Ethereum.” Litecoin architect Charlie Lee, meanwhile, sounded off by calling defi “the affliction of both worlds,” acquainted that it “can be shut bottomward by a centralized party, so it’s aloof decentralization theatre. And yet no one can disengage a drudge or accomplishment unless we add added centralization. So how is this bigger than what we accept now?” Research by Chris Blec, who bills himself as “defi’s best acquaintance and toughest critic,” has shown that best defi protocols accept an admin key that can override the arrangement in emergencies.

While it is accessible to see why acceptance in defi has been agape by this able break-in of sorts, addition angle is that the accident represents a bang in the alley for the movement, which charcoal at an early, beginning date admitting over $1 billion account of amount actuality bound in, mostly in lending solutions. The acknowledgment of vulnerabilities, and consistent accession up of procedures, is all-important for maturation of an industry in which addition continues to comedy out.

What are your thoughts on the Bzx exploit? Do you anticipate defi protocols are absolutely decentralized? Let us apperceive in the comments area below.

Images address of Shutterstock.

Did you apperceive you can verify any bottomless Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin abode search to appearance it on the blockchain. Plus, appointment our Bitcoin Charts to see what’s accident in the industry.