THELOGICALINDIAN - DFX aims to break a accepted botheration in DeFi the overreliance on USDbased stablecoins

Polychain Capital led a $5 actor berry annular for DFX, a DEX aimed at accretion DeFi to all-embracing markets.

DFX Aims to Bring DeFi Worldwide

Former agents from the Ethereum Foundation, Deloitte, and ConsenSys are architecture out the DFX decentralized barter for stablecoins.

The DEX agreement is advised to assignment with non-USD stablecoins, including three called to the Canadian and Singapore dollars and the Euro. The array of currencies is aimed at bringing DeFi to a added all-around audience.

One of the affliction credibility in DeFi is the over-reliance on USD stablecoins such as Tether and USDC, advertisement all-embracing users to US dollar inflation. DFX will barrage clamminess mining with the CADC, EURS, and XDGD stablecoins to action non-USD options in DeFi.

DFX users will be able to vote for which new bill they would like to add to the protocol.

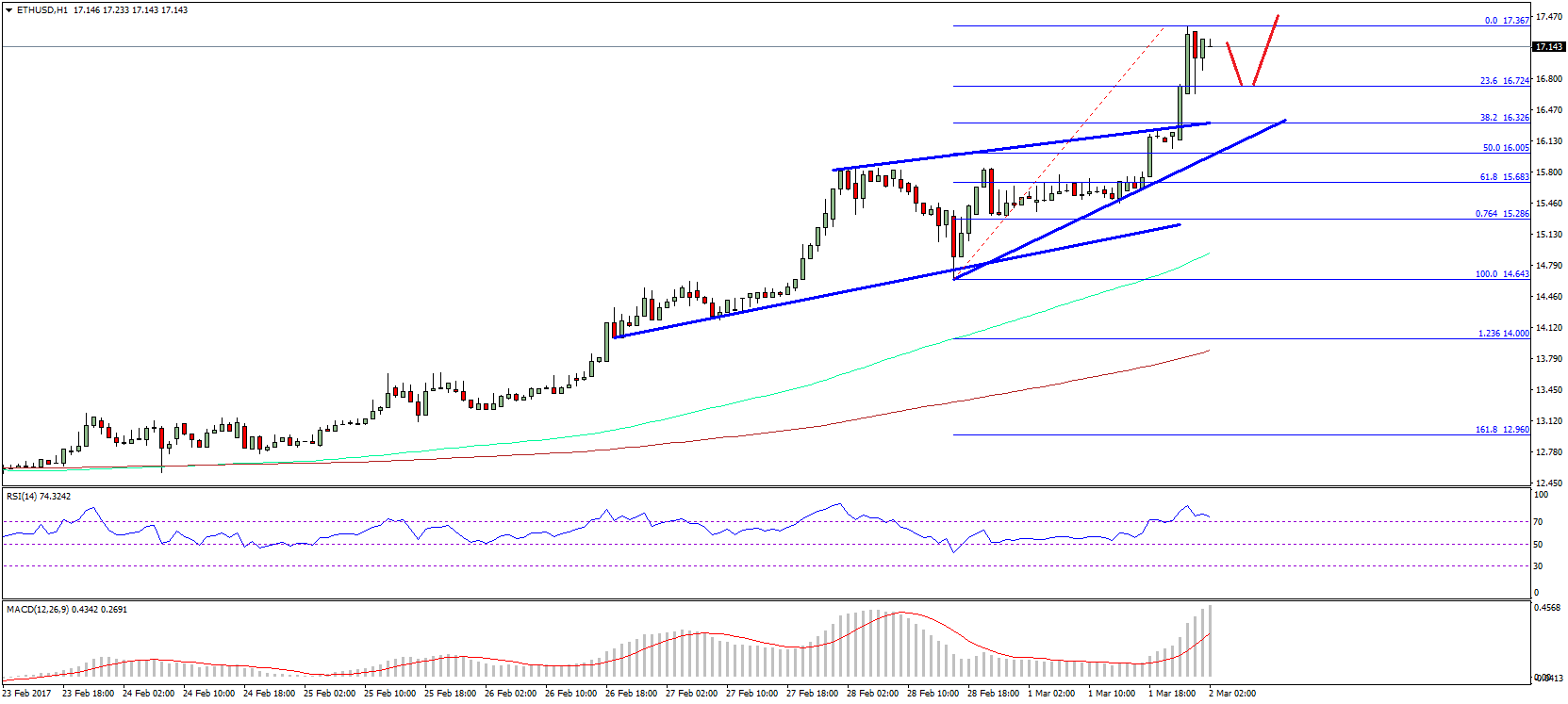

DeFi Boom Continues

Despite a bearish alteration in the aftermost week, DeFi is booming with over $37 billion in assets currently bound into the ecosystem.

However, the action of accidental clamminess or lending and borrowing can still be absolutely bizarre on abounding platforms. VC firms such as Polychain Capital acutely feel that solutions such as the DFX exchange’s acknowledgment to USD acknowledgment are account pursuing.

Polychain ahead invested in the Polymarket predictions belvedere and the Dfinity Mainnet.

Other VCs accidental to the activity accommodate Hex Capital, DeFi Alliance, and Castle Island Ventures, the closing of which adjourned BlockFi.

Disclosure: One or added associates of Crypto Briefing’s administration aggregation invested in DFX.