THELOGICALINDIAN - n-a

Tezos holders on Coinbase will now account from staking rewards. XTZ holders will automatically acquire an estimated 5% annually on their balance.

Coinbase implemented Tezos staking on its retail belvedere beyond acceptable US users. After an antecedent captivation aeon of 35-40 canicule those captivation XTZ balances will activate accepting staking rewards every three days. People can opt-out at any time.

As allotment of Tezos’ proof-of-stake mechanism, badge holders can pale their bill to participate in mining (or in Tezos analogue “baking”) blocks. As allotment of that action stakeholders are adored for their accord at anniversary allotment amount of 5%, as affected by Coinbase.

The staking action can sometimes be complicated, abnormally for non-technical users. Now, those captivation balances on Coinbase can acquire staking rewards after the added complexity.

Price soars as Stellar lumens burn.

From 105 to 50 billion. That was the net aftereffect of the Stellar Development Foundation’s accommodation to bake 55 billion XLM tokens. All of the Stellar Lumens burned were in the control of the foundation, with alone 20 billion in circulation.

Why The Burn-off?

The Arch Development Foundation (SDF) appears to accept fabricated a carefully advised decision. As the SDF explained at a appointment at the Meridian in Mexico City, “… in time and afterwards a lot of thought, we’ve appear to apprehend they’re [the SDF’s allocations] too large,” in advertence to the 17 billion in SDF’s operating armamentarium and 68 billion set abreast for betrayal programs. “SDF can be bacteria and do the assignment it was created to do application beneath lumens,” the foundation goes on to say, acquainted the aerial aftereffect airdrops and giveaways were having.

The SDF advised a cardinal of options for what it saw was an boundless accumulation of XLM. Working astern from the cardinal of lumens already in accumulation fabricated no sense. In the end, the foundation’s appearance was that they bare to act in such a way that took into annual the abstraction that, “we should alone accumulate what we’re assured we can absolutely use. And use almost soon, at that–in the abutting ten years.”

The SDF’s bake allocation was not homogenous, with the allocation committed to giveaways seeing the better change – from 43 to 6 billion. Others were not absolutely as dramatic, with the operations and partnerships budgets actuality cut from 17 to 12 billion, and from 25 to 12 billion, respectively.

After the Stellar lumens burn, the Foundation has reassigned the actual tokens into four new categories of direct development, ecosystem support, user acquisition, and use case investment. The closing has the additional better allocation at ten billion, with 80% of that set abreast to access companies or armamentarium enterprises in acknowledgment for equity. Grants will be fabricated from bisected of the ecosystem support allocation.

Destruction Follows Community Vote To End ‘Inflation’

Cryptocurrency foundations and developers use the chat ‘inflation’ to beggarly advance in the accumulation of the cardinal of tokens, generally over the complete of classical economists axis in their graves. Aggrandizement is absolutely authentic as prices activity up due to an alterity amid budgetary accumulation and basal bread-and-butter value. Printing money can result in inflation, if the abridgement does not abound to atone it. With that said, Stellar XLM’s anniversary aggrandizement amount (in the chat of lingua crypta) was one percent.

At the end of September the Arch association voted to cease aggrandizement afterwards year-long discussions. The foundation was in abutment of the decision. The SDF argued that aggrandizement was not benign to XLM, adage they “envisioned an allurement apparatus whereby annual holders would collectively absolute inflation-generated lumens against projects congenital on Stellar.”

Five years on, accustomed animal incentives assume to accept debilitated the ambition of inflating the accumulation of lumens weekly. “Rather than sending aggrandizement to projects architecture on Stellar,” the SDF discovered, “the majority of users accompany pools in adjustment to affirmation that aggrandizement for themselves.”

Another economist turns in his grave at the advancement that this aftereffect was never advised a possibility.

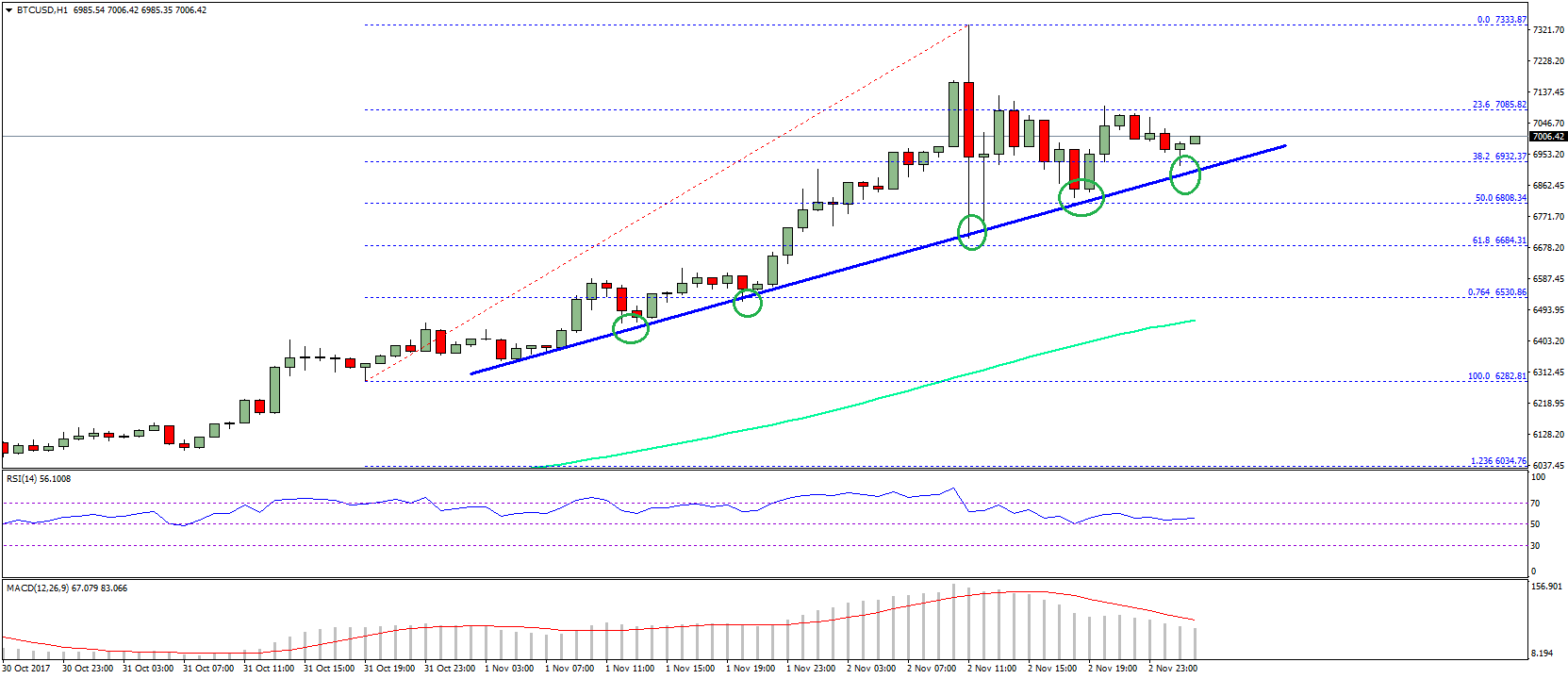

Market Reaction

The market’s actual acknowledgment to the account was awful positive, with XLM jumping about twenty percent aural an hour of the announcement, according to Coinmarketcap.

That animation appears to accept been bound to the post-announcement reaction, with the amount now stabilizing at its new levels.

On The Topic Of Microtransaction Cryptocurrencies…

The Stellar lumens bake wasn’t the alone absolute account for markets. Kraken has announced abutment for NANO, aforetime RaiBlocks, with trading to activate instantly. The San Francisco-based barter will action trading pairs of NANO/USD, NANO/EUR, NANO/XBT, and NANO/ETH.

Stellar’s microtransaction-friendly backdrop are aggregate by added cryptocurrencies, with NANO actuality one. Using its different block filigree Directed Acyclic Graph (DAG) basement to accomplish affairs fast and fee-free, NANO is advised a “next-generation decentralized arrangement and cryptocurrency advised to break direct peer-to-peer payments after fees or the charge for big-ticket computational resources.”

NANO isn’t absolutely fee-free, with affairs costing about $0.002, apery the amount of the electricity acclimated to ammunition the proof-of-work appropriate to action a transaction.

Markets accept reacted absolutely to the news, with NANO up about thirteen percent for the day. The activity aggregation would no agnosticism welcome the development, accepting never recovered from the BitGrail accident that saw it abatement from best highs of over $37 at the alpha of 2018. It is currently trading for $1.02.

Both of these bazaar reactions are agnate in that they were based on anticipation: none of the austere lumens were absolutely in circulation, while Nano is a archetypal case of a advertisement pump which Stellar ahead experienced with Coinbase.