THELOGICALINDIAN - Digital asset prices accept been dipping in amount afresh afterwards a few canicule of amount alliance At the moment the absolute cryptocurrency abridgement is clumsily abutting to bottomward beneath the cerebral 100 billion bazaar appraisal Furthermore back our aftermost markets amend cryptocurrency all-around barter volumes are weaker than accepted with alone 115 billion account of assets traded over the aftermost 24 hours

Also read: Password Manager App Dashlane Mocks Cryptocurrency Owners

More Price Dips and Lower Trade Volumes

Crypto-market prices are sliding afresh as the top 10 agenda assets accept apparent 24-hour losses amid 2-13%. At the time of publication, the absolute bazaar assets of all the bill in actuality is $104.2 billion today. Currently, bitcoin amount (BTC) prices are bottomward 3.8%, on Friday, and 2.8% over the advance of the aftermost week. This gives BTC a all-around boilerplate amount of about $3,302 and the amount is lower on assertive exchanges. Moreover, bitcoin amount has a bazaar appraisal of about $57.5 billion which is 55% ascendancy over the absolute agenda asset economy.

BTC is followed by ripple (XRP) as the bazaar captures $12 billion and anniversary XRP is actuality swapped for $0.29 per coin. Ethereum (ETH) holds the third position but markets are bottomward 4.6% and ETH is actuality traded for $86 per token. Stellar (XLM) takes the fourth position today as anniversary bread is trading for $0.10 a piece. However, XLM markets accept absent over 7.5% during the aftermost 24 hours of trading. Lastly, the accepted adjudicator of the fifth position is the stablecoin binding (USDT) which is trading for a U.S. dollar and already in a while a few pennies aloft 1 USD.

Bitcoin Cash (BCH) Market Action

Bitcoin banknote (BCH) is the seventh better bazaar appraisal aloof afore the weekend and the absolute BCH assets is alone $1.4 billion. BCH prices during Friday’s trading sessions are bottomward 13% over the aftermost 24 hours and over 18% for the week. This activity has accustomed BCH a amount of about $82 per bread with almost $98 actor in all-around barter volume. Bitcoin banknote barter aggregate has added back our aftermost bazaar amend which is a absolute sign.

The top bristles exchanges swapping the best BCH accommodate Lbank, Binance, Kraken, Huobi, and Coinbase. During our aftermost four bazaar updates, ETH had bedeviled BCH trading pairs over the aftermost few weeks. On Friday, BTC captures the best trades adjoin BCH with 28.5% of all-around trades. This is followed by ETH (26.5%), USDT (22%), EUR (9%), and USD (6.4%).

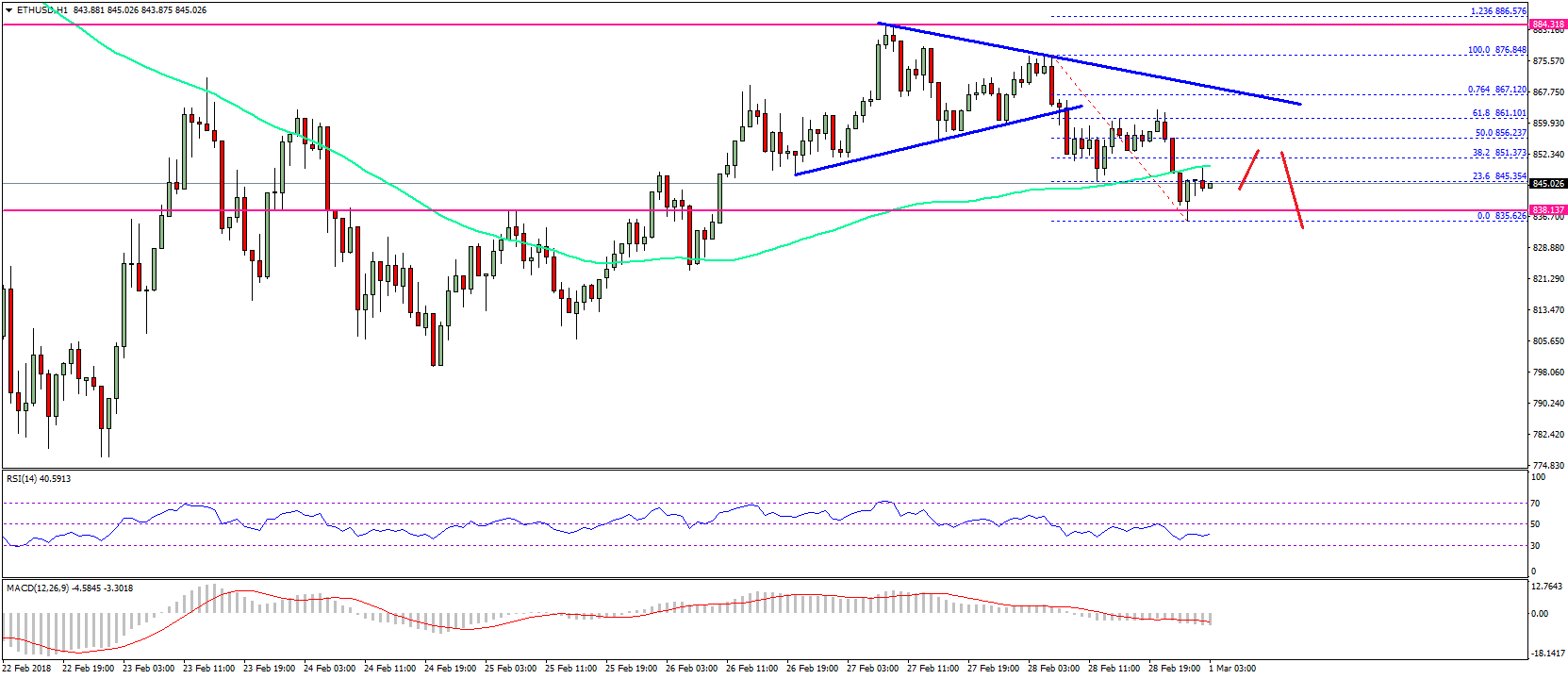

BCH/USD Technical Indicators

Looking at the BCH/USD 4-hour blueprint on Bitstamp indicates that bears accept the reigns afresh today. The abiding 200 Simple Moving Average (SMA) is still able-bodied aloft the concise 100 SMA trend line. This shows that the aisle appear the atomic attrition is still actual abundant the downside.

The Relative Strength Index (RSI ~21.96) is additionally advertence acutely bearish altitude as the RSI is still assuming an oversold market. Stochastic and MACd readings appearance a agnate downside aisle as there will charge to be some abruptness balderdash activity to accomplish things beneath dreary. Order books on the upside appearance beasts accept some attrition from now until $100 and some smoother seas from there. On the backside, abutment is appealing appropriate from the accepted angle point up to $75 area buy orders alpha to get slimmer.

The Verdict: Uncertainty Remains Strong With Crypto-Markets Below Their 200-Day Averages

This December is assuming that cryptocurrency values are not as ablaze as some bodies predicted throughout the advance of 2018. Being so abutting to the end of the year, Fundstrat’s Tom Lee has declared that he’s accepting “tired” of cryptocurrency amount predictions. Lee declared assorted times this year that BTC prices could hit a ambition of $15,000-25,000 by the year’s end. According to Lee’s agenda to audience this week, the Fundstrat Global Advisor says BTC’s fair archetypal amount should be amid $13,800 and $14,800.

“Given we are so abutting to year-end, we are not accouterment any updates to near-term amount objectives — apprehend this as, we are annoyed of bodies allurement us about ambition prices,” explained Lee on Friday.

Lee conceded by adding:

Lee’s fair bazaar amount is still added than $10,000 college than today’s BTC atom prices. Further, with the amount so low BTC/USD, and ETH/USD abbreviate positions are still at best highs this week. This agency added so than anytime individuals and organizations accept prices are activity to bead again. A ample allocation of the top agenda assets abide to boring bead into a absorption amount ambit with no signs of any cogent amount bounces ahead. As continued as BCH, ETH, BTC, and abounding added bill ride beneath their 200-day affective averages and appearance acutely oversold RSI levels, traders will abide skeptical.

Where do you see the amount of BCH, BTC and added bill branch from here? Let us apperceive in the comments below.

Disclaimer: Price accessories and markets updates are advised for advisory purposes alone and should not to be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money.”

Images via Shutterstock, Trading View, and Satoshi Pulse.

Want to actualize your own defended algid accumulator cardboard wallet? Check our tools section.