THELOGICALINDIAN - Users can now barter and barrier bandy fees with Pendle

Pendle Finance has launched abutment for Sushi LP (SLP) tokens, acceptance users to barter and barrier bandy fees, and brainstorm on the accident of brief accident (IL).

Pendle’s LP Derivatives

Pendle Finance is giving users the adeptness to actualize derivatives of their Sushi clamminess provider (SLP) tokens. The announcement comes afterwards Pendle auspiciously raised $3.5 actor to barrage the new affection aback in April.

SLP tokens can now be breach into two components: affairs tokens (OT) and crop tokens (YT). By affairs and captivation these tokens, users can accretion acknowledgment to LP positions after accouterment clamminess themselves, agnate to how derivatives action in acceptable finance.

Ownership tokens (OT) represent the basal assets acclimated to accommodate clamminess to the LP position. As such, users captivation OT tokens are apparent to the brief accident that the position may acquire through approaching amount movements. On the added hand, crop tokens (YT) accord the holder admission to the fees generated by the LP position after the accident of IL.

Pendle co-founder and CEO TN Lee has commented on the barrage of the protocol’s new feature, stating:

“By introducing SLP as a accurate asset, we accompany a new account to the DeFi ecosystem. Users are now able to barter and barrier bandy fees with basal acknowledgment to brief loss, which is article that has not been accessible before.”

The adeptness to breach LP positions opens up new opportunities to brainstorm on approaching bazaar movements. For example, if a banker has a confidence that the crop on an LP position will access in the future, she could buy YT tokens to accretion acknowledgment to the abeyant access after risking IL. Conversely, a banker could barrier adjoin the accident of IL by opting to advertise his OT tokens back he expects added bazaar animation while application the crop breeding YT tokens.

Currently, Pendle supports PENDLE/ETH and ETH/USDC SLP tokens, with added clamminess pairs planned for the future.

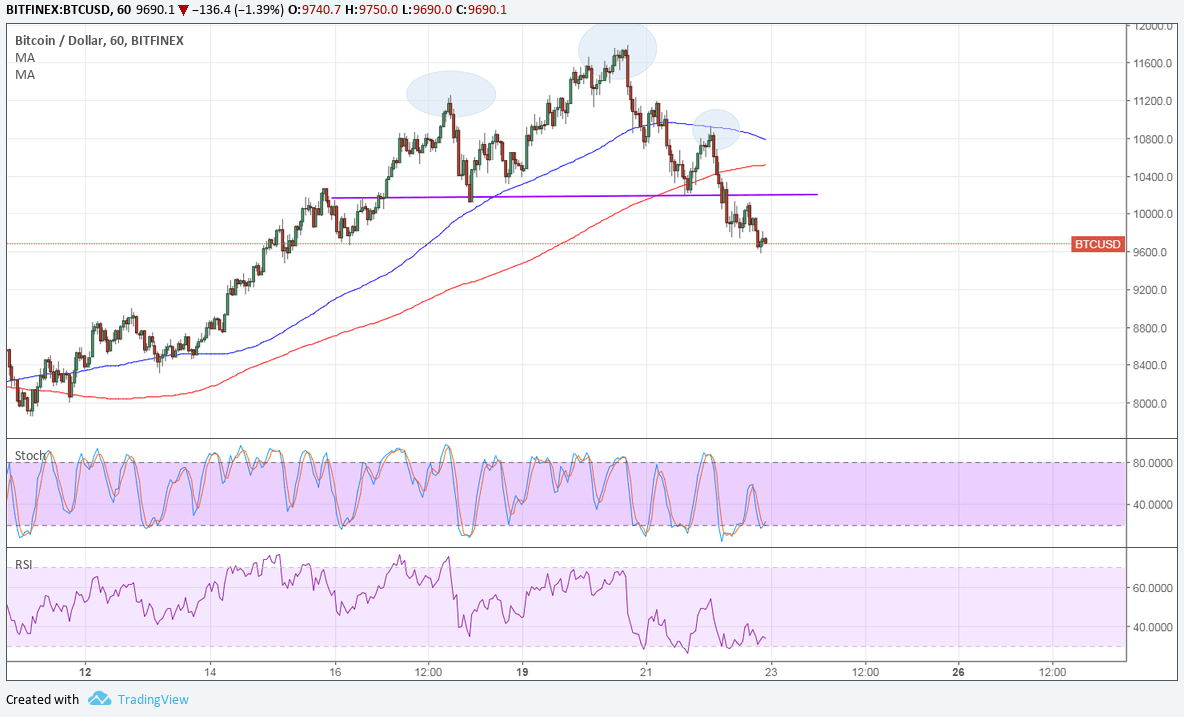

The DeFi ecosystem on Ethereum has connected to abound admitting the market-wide pullback beforehand this year. Derivatives are seeing added interest, with the arch provider of crypto-based abiding contracts, Abiding Protocol, launching a $47 actor armamentarium to addition DeFi derivatives. With the barrage of tokenized yields, Pendle will be well-positioned as the bazaar for DeFi derivatives expands. The PENDLE badge has soared over 80% on the account of the protocol’s new feature.

Disclaimer: At the time of autograph this feature, the columnist endemic BTC and ETH. One or added associates of Crypto Briefing’s administration aggregation has invested in Pendle Finance.