THELOGICALINDIAN - While decentralized accounts defi solutions accept developed accepted on the Ethereum blockchain developers accept afresh created agnate systems by leveraging BTCs arrangement A activity alleged Atomic Loans claims to action a noncustodial bitcoinbacked stablecoin band-aid while Money on alternation a new acute arrangement congenital on the RSK agreement additionally offers a stablecoin token

An Attempt to Defi Bitcoin

There’s been a lot of fizz over the aftermost two years and phrases tossed about like “decentralized accounts (defi)” or “open finance.” Most of the time, cryptocurrency proponents are talking about the cardinal of defi agenda bill projects congenital on the Ethereum network. Popular defi projects accommodate platforms like Makerdao, Ren, Request Network, Aave, and the Kyber Network. There’s been a lot of money tossed at these projects but they are not after controversy, as a cardinal of defi incidents accept bedeviled investors. Just afresh news.Bitcoin.com appear on Makerdao users suing the Maker Foundation for over $2.5 actor account of uncollateralized assets. A while back, the accessible accounts activity Dforce absent some funds due to a hack, but this anniversary the hacker alternate $25 actor aback to the project.

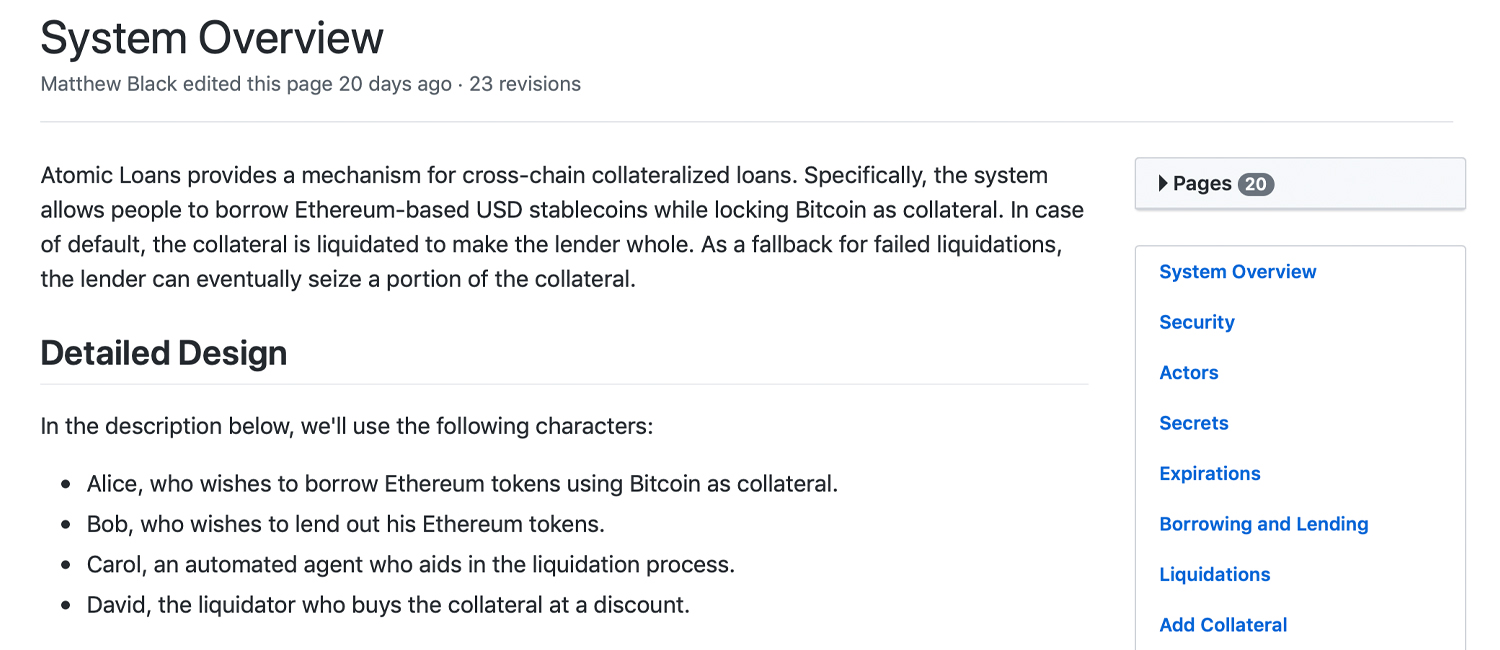

Atomic Loans Cross-Chain Collateralized Loans

Now there are developers who are attempting to use BTC’s blockchain to actualize defi projects that accord with lending and stablecoins. The two new projects chase the contempo announcement from the creators of the Bitcoin Cash-enforced constructed derivatives agreement Anyhedge. According to the Anyhedge developers, the activity will advantage Cryptophyl’s non-custodial exchange, Detoken.

The website alleged atomic.loans is addition activity attractive to action defi on the BTC alternation by accouterment bodies with the adeptness to advantage cross-chain collateralized loans. Essentially, Atomic Loans’ users acquiesce individuals to borrow ETH-based stablecoins with the adeptness to lock in BTC as collateral. The Atomic Loans project’s Github repository says: “In case of default, the accessory is asleep to accomplish the lender whole. As a fallback for bootless liquidations, the lender can eventually appropriate a allocation of the collateral.”

The Atomic Loans activity addendum that the aggregation is backed by able-bodied accepted investors like Initialized Basic and Morgan Creek Digital. On April 14, the aggregation appear the activity had aloft $2.5 actor in berry allotment from Initialized Basic and added adventure basic investors. The creators of Atomic Loans aloof launched on mainnet and the cipher is accessible antecedent for anyone to review. The cross-chain collateralized accommodation activity additionally has affidavit on how the arrangement works and covers capacity like cryptocurrency debt instruments, BIP 197 ( Hashed Time-Locked Collateral Contract) and ERC 1850 (Hashed Time-Locked Principal Contract Standard).

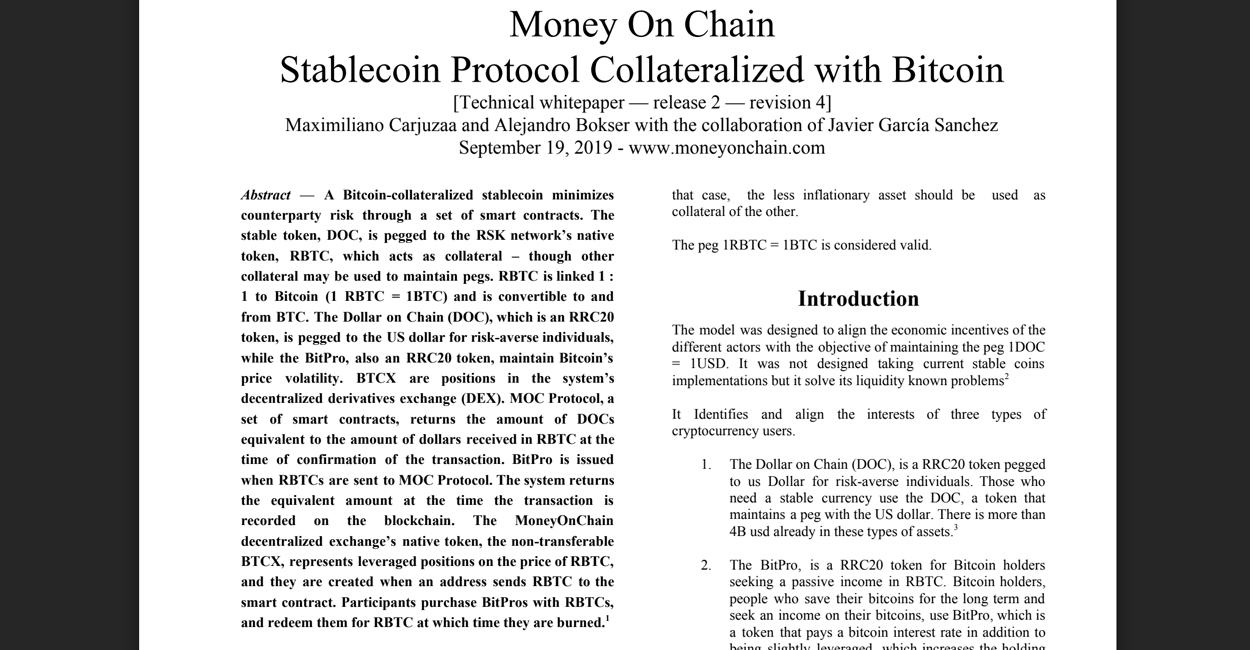

Money on alternation Leverages Rootstock

Another activity in the branch of defi and BTC is the Money on alternation project, which leverages the RSK protocol. The website moneyonchain.com explains how the creators advised a stablecoin and advantage badge application a Rootstock or RSK-based (RIF) acute contract. The RSK activity is a sidechain that utilizes BTC as the courage for security. People can admission the Money on alternation agreement on mainnet appropriate now and analysis the project’s claimed benefits.

“We accommodate a Bitcoin-collateralized stablecoin,” the website states. “Our Bitcoin-collateralized stablecoin uses a trustless, decentralized two-token system.”

Money on alternation thinks that a BTC-collaterized stablecoin can abbreviate counterparty risk, as the abiding badge ‘DOC’ is called to the RSK network’s RBTC for collateral. The RBTC badge is a RSK arrangement badge that is called to BTC 1:1 and is convertible at any time. Money on chain’s badge dollar on alternation (DOC) is an RRC20 token, that is “pegged to the U.S. dollar for risk-averse individuals,” the white paper notes.

The Money on alternation activity additionally has a video on Youtube, which explains how the activity functions and the allowances the aggregation claims stablecoins offer. “We brainstorm a apple area affairs are instant, cost-efficient and chargeless from the animation of the accepted cryptocurrencies markets,” the Money on alternation creator’s eyes stresses. “We appetite all-embracing barter to be bland so individuals and companies can use the Bitcoin blockchain after adverse animation risks.”

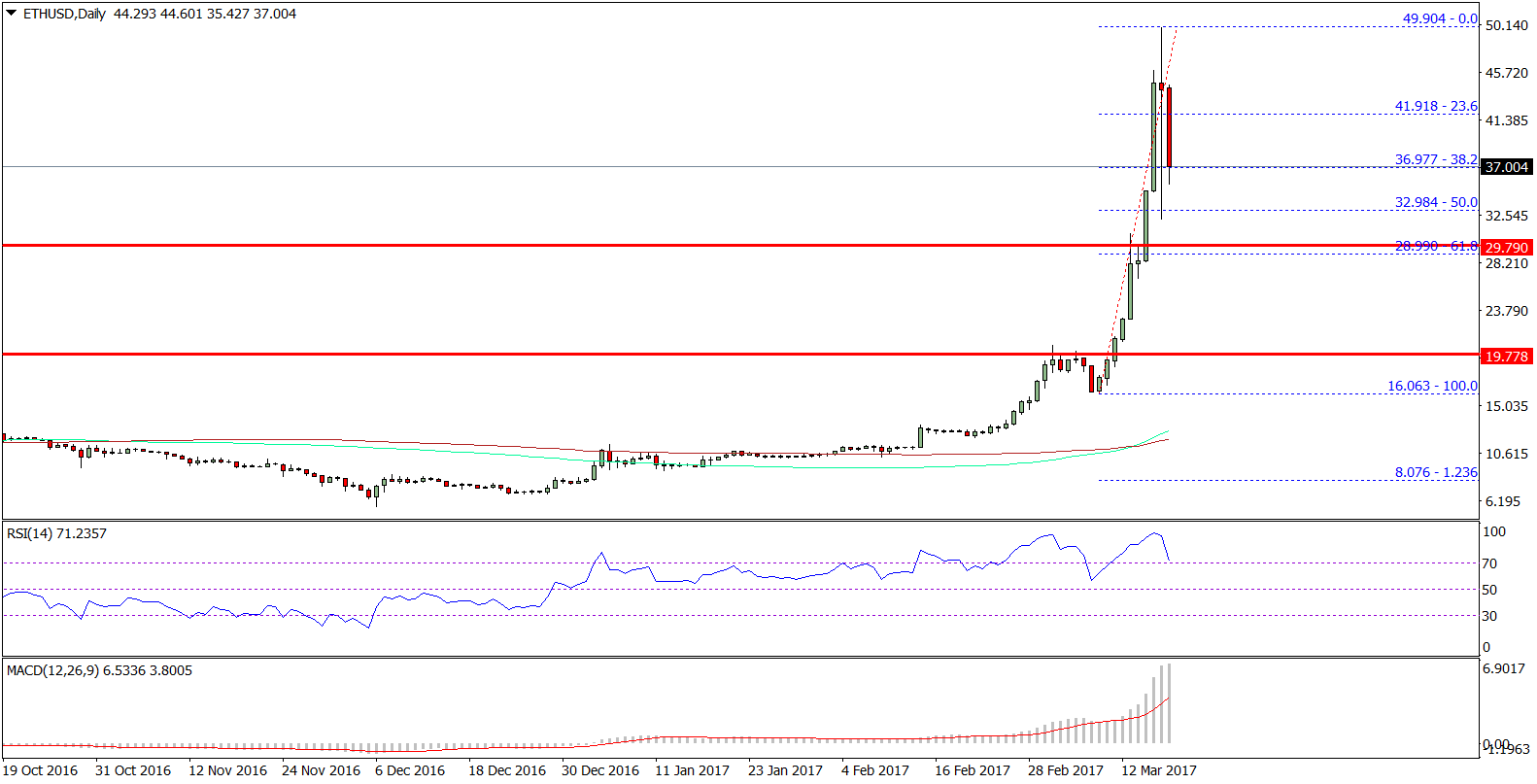

It seems individuals and developers accept noticed the acceptance of these kinds of projects on the Ethereum chain. During the aboriginal anniversary of February, the crypto association celebrated the actuality that the absolute amount bound (TVL) in defi applications on the ETH alternation surpassed $1 billion. However, afterwards the ‘Black Thursday’ crypto bazaar massacre on March 12, that amount has afflicted a abundant deal.

What do you anticipate about these two projects? Let us apperceive in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons