THELOGICALINDIAN - Decentralized accounts defi applications on the Ethereum alternation accept been growing berserk during the aftermost two years Now a cardinal of constructed versions of bitcoin that advantage the Ethereum alternation has outpaced offchain solutions like Blockstreams Liquid and the Lightning Network

Just recently, the belvedere Synthetix appear a affiliation with Bitgo and the Ren Project in adjustment to actualize incentivized bitcoin liquidity. Now with a massive crop agriculture pool, tokens like sBTC, renBTC, and WBTC could calmly concealment the another offchain competitors.

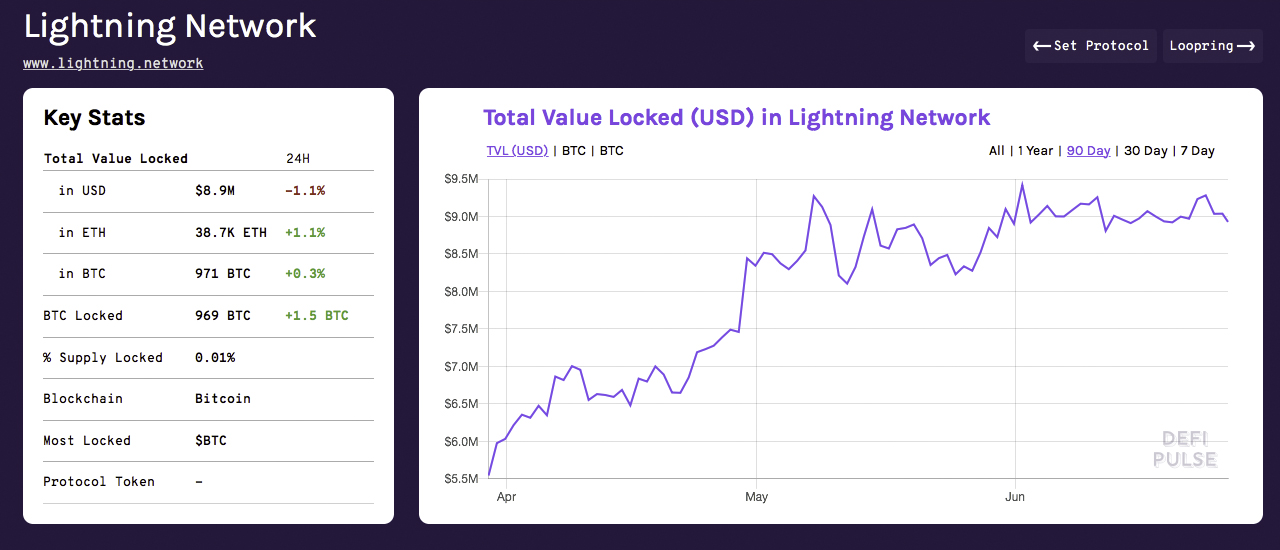

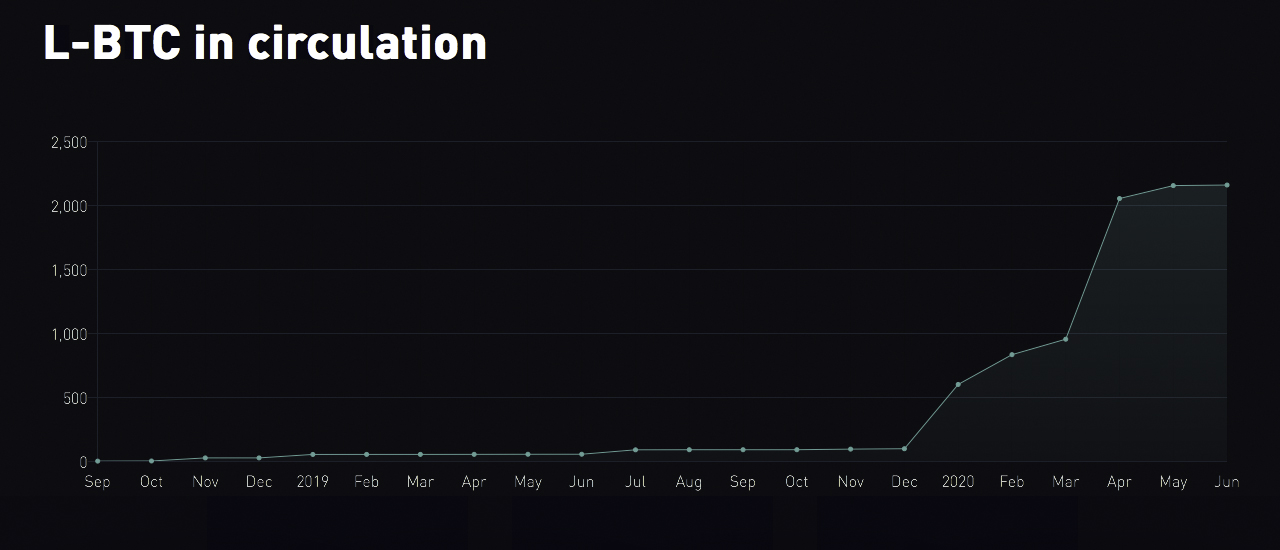

At the end of May, news.Bitcoin.com reported on the actuality that admitting a cardinal of ‘trust model’ debates on Twitter, Ethereum is the Bitcoin (BTC) network’s better sidechain by absolute amount bound (TVL) by a continued shot. Stats stemming from the Lightning Network (LN) shows that the LN TVL on June 26, 2020, is $8.9 million. The abstracts from Liquid.net indicates that there is 2,160 BTC or $19.7M for Blockstream’s Liquid TVL.

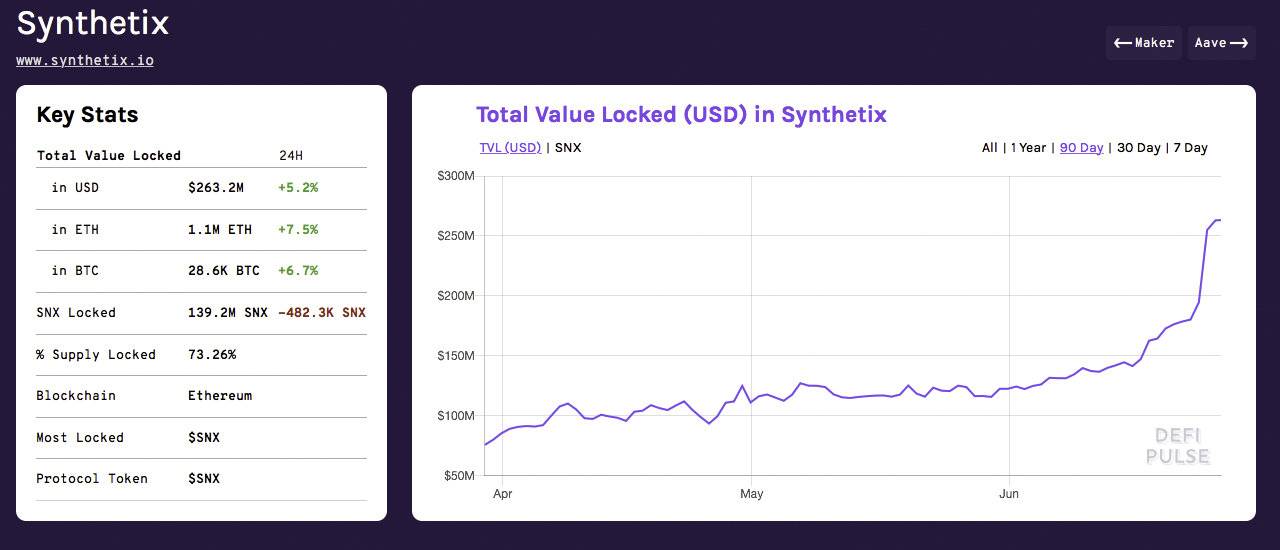

Now stats from the Ethereum alternation assault those two statistics away, as there is over 28,000 BTC locked into the Synthetix. There is a absolute of $263 actor TVL bound into Synthetix at columnist time. Additionally, abstracts from Curve.fi shows that renBTC has been acrimonious up cogent barter aggregate back it’s inception.

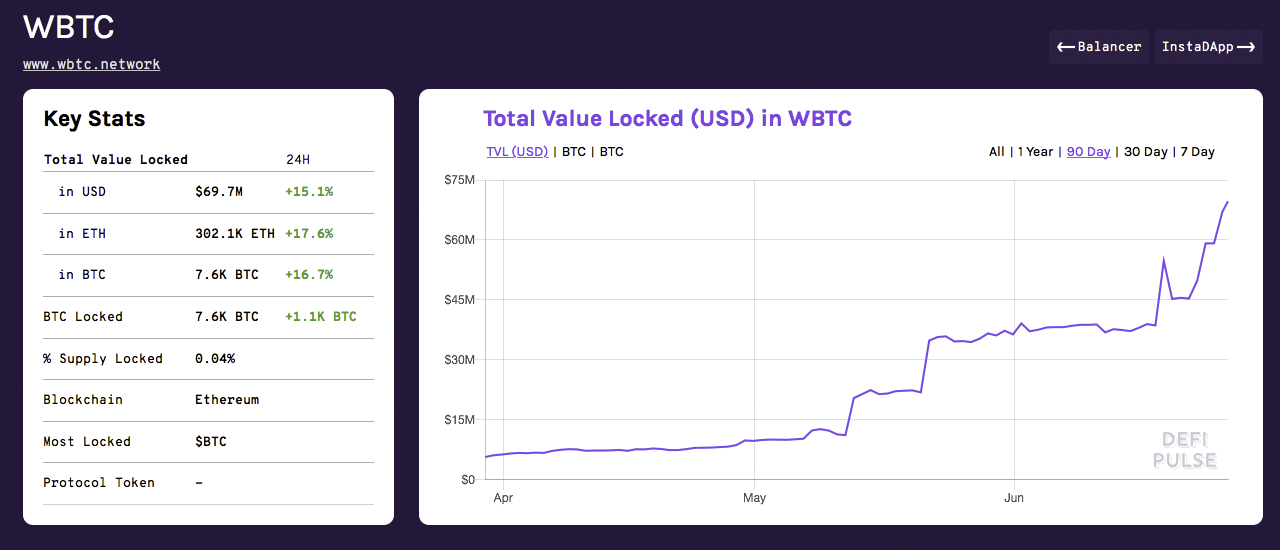

The activity WBTC, backed by Bitgo has a massive $66.9 actor TVL, with 7,600 BTC bound into the defi project’s contract. Statistics from sBTC markets additionally appearance exponential advance over time. Then on June 18, 2020, the Ren Project’s Taiyang Zhang appear the crop agriculture basin partnership.

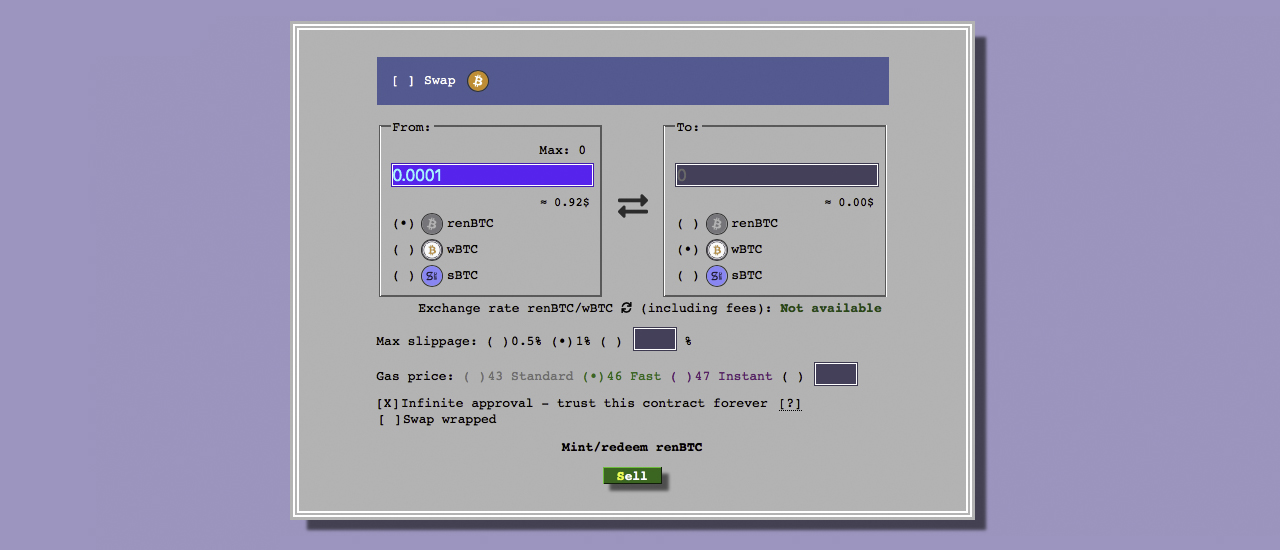

“This basin consists of three BTC ERC20 variants; renBTC, WBTC, sBTC. Our ambition is to actualize the best aqueous Ethereum based BTC basin accessible to action traders admission to the everyman slippage for trades amid sBTC, renBTC, and WBTC,” Zhang wrote. The Ren Project adumbrative additionally stated:

Zhang additionally said that abaft the scenes, “Synthetix and Ren accept created a Balancer pool for SNX and REN area LP Rewards are broadcast in the anatomy of BPT (wrapped SNX and REN).” The Ren Project rep said that the aggregation is “thrilled” with the latest affiliation and the aggregation “looks advanced to partaking in the aboriginal stages of defi crop agriculture with Curve and Synthetix.”

Despite the massive about-face to the Ethereum alternation with three actual accepted constructed BTC tokens, both networks accept been adversity from college arrangement fees. Not alone are defi projects that action constructed BTC tokens actuality acclimated far added often, but stablecoins on Ethereum are accepting a ample allotment of use as well.

News.Bitcoin.com aloof reported on Ehereum fees ascent aloft BTC fees for a abbreviate aeon and with the accumulated contempo use of defi and stablecoin tokens, ETH fees accept surged to a two-year high. According to Billfodl fee stats, the BTC “fee to accept your transaction mined on the abutting block (10 minutes)” is $0.78 at columnist time. Data from Bitinfocharts.com indicates that ETH fees on June 25, 2020, were $0.66 per transaction.

If the crop agriculture basin alms from Synthetix, Bitgo, and the Ren Project grows accepted it will affect arrangement fees activity forward. But additionally affectation a blackmail to BTC offchain competitors.

What do you anticipate about the basin actuality offered by Synthetix, Bitgo, and the Ren Project? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, De Fi Pulse, Liquid.net, Curve.fi