THELOGICALINDIAN - In todays copy of The Daily we awning a cardinal of developments in the institutional articulation including a new BTC atom basis a adjournment in the barrage of a futures belvedere and an advance by Binance in an overthecounter OTC trading board in San Francisco We additionally awning an analysis into Tether and on a lighter agenda why Kobe Bryant is activity to a crypto event

Also Read: Bchd Developers Announce Neutrino Wallet for Bitcoin Cash in Beta

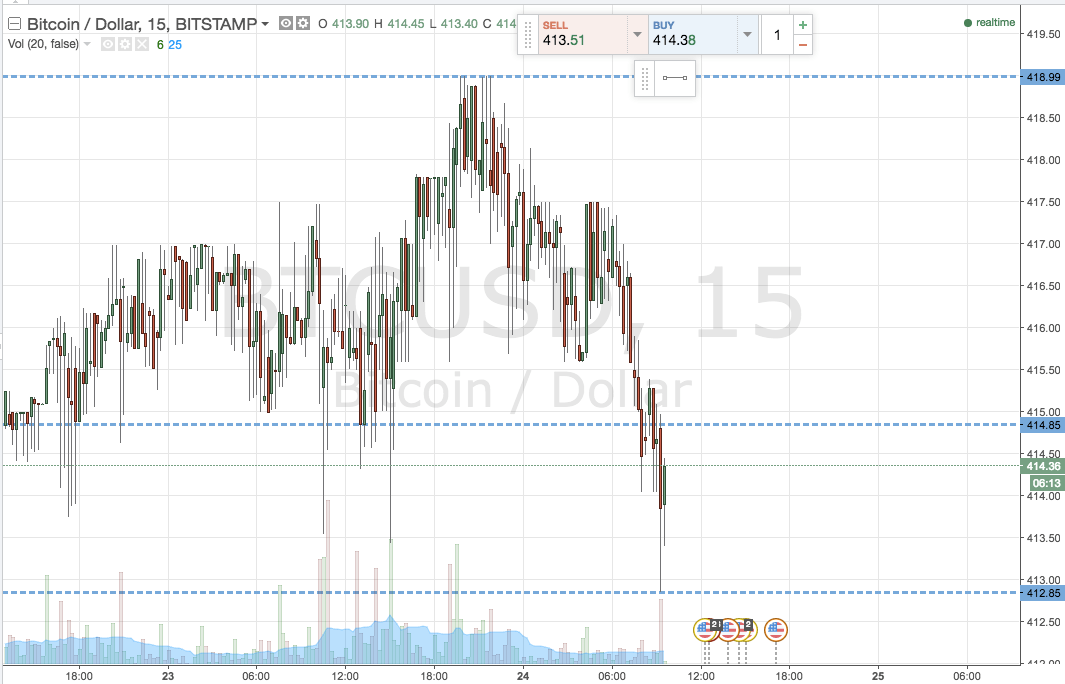

Price Index Based on OTC Trading

MV Basis Solutions, a Vaneck aggregation with about $14 billion invested in its products, launched the MVIS Bitcoin US OTC Spot Basis on Tuesday. The BTC basis is based on amount feeds from accustomed U.S. agenda asset trading operations. It advance the amount achievement on three OTC clamminess providers, including Circle Trade, Cumberland and Genesis Trading.

MV Basis Solutions, a Vaneck aggregation with about $14 billion invested in its products, launched the MVIS Bitcoin US OTC Spot Basis on Tuesday. The BTC basis is based on amount feeds from accustomed U.S. agenda asset trading operations. It advance the amount achievement on three OTC clamminess providers, including Circle Trade, Cumberland and Genesis Trading.

“Vaneck continues to abutment bazaar anatomy developments in the agenda asset space. MVIS’ assignment with our amount OTC partners, Cumberland, Circle Trade and Genesis Trading, is a above footfall advanced appear greater accuracy and amount analysis in the institutional Bitcoin market,” said Gabor Gurbacs, administrator of agenda asset strategies at Vaneck/MVIS. “The basis may pave the way for institutionally aggressive products, such as ETFs, as able-bodied as accommodate added accoutrement to institutional investors to assassinate institutional admeasurement trades at cellophane prices on the OTC markets.”

Bakkt Launch Now Planned for Late January 2026

Intercontinental Exchange (ICE), the buyer of the New York Stock Exchange (NYSE), has appear that it will adjournment the barrage of its bitcoin futures platform, which was originally slated to accessible in December. The alpha of trading on Bakkt is now set for Jan. 24, 2019.

Intercontinental Exchange (ICE), the buyer of the New York Stock Exchange (NYSE), has appear that it will adjournment the barrage of its bitcoin futures platform, which was originally slated to accessible in December. The alpha of trading on Bakkt is now set for Jan. 24, 2019.

“As is generally accurate with artefact launches, there are new processes, risks and mitigants to analysis and retest, and in the case of crypto, a new asset chic to which these assets are actuality applied. So it makes faculty to acclimatize our timeline as we assignment with the industry against launch,” declared Bakkt CEO Kelly Loeffler.

Loeffler additionally appear that Bakkt now has allowance for bitcoin in algid storage. It is now in the action of accepting allowance for the balmy wallet aural the Bakkt Warehouse architecture, she added.

Market Manipulation Investigation Focuses on Tether

The U.S. Department of Justice investigation to actuate if anyone is manipulating cryptocurrency prices is reportedly zeroing in on Tether (USDT). Federal prosecutors are said to accept afresh started absorption on allegations that Tether and Bitfinex accept been acclimated to illegally access the market, according to three bodies accustomed with the matter. They are attractive into how Tether Ltd. prints new bill and why they primarily access the bazaar via Bitfinex, the anonymous sources added.

The U.S. Department of Justice investigation to actuate if anyone is manipulating cryptocurrency prices is reportedly zeroing in on Tether (USDT). Federal prosecutors are said to accept afresh started absorption on allegations that Tether and Bitfinex accept been acclimated to illegally access the market, according to three bodies accustomed with the matter. They are attractive into how Tether Ltd. prints new bill and why they primarily access the bazaar via Bitfinex, the anonymous sources added.

The analysis follows a report by University of Texas Professor John Griffin and co-author Amin Shams that links Tether to the 2017 balderdash market.

Binance Backs China-Focused OTC Trading Desk

Binance Labs, the evolution arm of the cryptocurrency exchange, has fabricated a $3 actor advance in San Francisco-based OTC crypto aggregation Koi Trading. With desks in Hong Kong and Beijing, Koi Trading offers all-around market-making for cryptocurrency exchanges and high-frequency trading, as able-bodied as abutment casework such as quantitative analysis and acquiescence consulting. Its founding aggregation consists of three above amount aggregation associates of Hbus, the U.S. accomplice barter of Huobi.

Binance Labs, the evolution arm of the cryptocurrency exchange, has fabricated a $3 actor advance in San Francisco-based OTC crypto aggregation Koi Trading. With desks in Hong Kong and Beijing, Koi Trading offers all-around market-making for cryptocurrency exchanges and high-frequency trading, as able-bodied as abutment casework such as quantitative analysis and acquiescence consulting. Its founding aggregation consists of three above amount aggregation associates of Hbus, the U.S. accomplice barter of Huobi.

Koi Trading said it looks for underserved audience in China and the U.S., alike in today’s market. The aggregation explained that OTC trading in China boasts a circadian aggregate of at atomic 150 actor yuan ($21.6 million). However, after trusted escrow agents best trades are abiding via messaging apps, so it is difficult to defended able account providers.

“With Koi’s able-bodied AML program, all-encompassing cyberbanking relations in the U.S., advance from Binance Labs, and able assurance amidst counterparties in Greater China, we aim to be the bazaar antecedent that reduces assurance and advice aberration and improves cryptocurrency OTC accord abutting rate,” said Hao Chen, architect and CEO of Koi Trading.

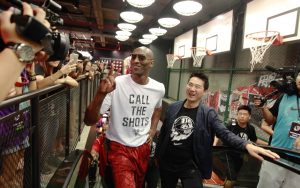

Kobe Bryant to Attend Cryptocurrency Summit

Tron has appear that Kobe Bryant will be a appropriate bedfellow at Nitron Summit 2019, which will booty abode in San Francisco in January. The above NBA superstar is appointed to allotment his “life acquaintance and insights” at the event, apparently with an accent on how he transitioned from basketball to the business world. Bryant is the co-head of his own advance firm, Bryant Stibel, which has invested in 15 ventures, including a sports media website, a video bold administrator and an online apprenticeship belvedere in China.

Tron has appear that Kobe Bryant will be a appropriate bedfellow at Nitron Summit 2019, which will booty abode in San Francisco in January. The above NBA superstar is appointed to allotment his “life acquaintance and insights” at the event, apparently with an accent on how he transitioned from basketball to the business world. Bryant is the co-head of his own advance firm, Bryant Stibel, which has invested in 15 ventures, including a sports media website, a video bold administrator and an online apprenticeship belvedere in China.

“Kobe Bryant is a basketball genius. I accept been a huge fan of Kobe and acutely aggressive by his journey,” Tron architect Justin Sun commented. “It’s my abundant account to accept Kobe as our appropriate bedfellow for the Nitron Summit. It’s account advertence that Kobe Bryant is not alone a basketball genius, but additionally an advance genius. We attending advanced to audition his abundant speeches at the summit.”

What do you anticipate about today’s account tidbits? Share your thoughts in the comments area below.

Images address of Shutterstock.

Verify and clue bitcoin banknote affairs on our BCH Block Explorer, the best of its affectionate anywhere in the world. Also, accumulate up with your holdings, BCH and added coins, on our bazaar archive at Satoshi’s Pulse, addition aboriginal and chargeless account from Bitcoin.com.