THELOGICALINDIAN - In todays copy of The Daily we awning belief about the latest advance in the cryptocurrency amplitude by Goldman Sachs the bulk institutional traders adopted in the aftermost six months from aloof one OTC board analysis on statesponsored hackers and a new aegis apparatus from Coinbase

Also Read: Security Giant G4S Offers Protected Offline Cryptocurrency Storage

Goldman Sachs Invests in Bitgo

Bitgo, the cryptocurrency aegis and aegis company, appear on Thursday the additional abutting of its Series B allotment round, bringing the absolute aloft in this annular to $57.5 million. The new investors who abutting in the annular are Goldman Sachs’ Principal Strategic Investments accumulation and Mike Novogratz’s Galaxy Digital Ventures. The allotment is appropriate to acknowledging Bitgo’s wallet development.

Bitgo, the cryptocurrency aegis and aegis company, appear on Thursday the additional abutting of its Series B allotment round, bringing the absolute aloft in this annular to $57.5 million. The new investors who abutting in the annular are Goldman Sachs’ Principal Strategic Investments accumulation and Mike Novogratz’s Galaxy Digital Ventures. The allotment is appropriate to acknowledging Bitgo’s wallet development.

“This cardinal advance from Goldman Sachs and Galaxy Agenda Ventures validates both our bazaar befalling and different position,” said Bitgo CEO Mike Belshe. “No one is bigger positioned than Bitgo to serve institutional investors who appetite to barter cryptocurrencies and agenda assets. That’s why we’re focused on addition out what it takes to defended a abundance dollars. The market’s not there yet but our job is to be accessible first.”

“Greater institutional accord in the agenda asset markets requires defended and adapted aegis solutions,” commented Rana Yared, a Managing Director of Goldman Sachs’ Principal Strategic Investments group. “We appearance our advance in Bitgo as an agitative befalling to accord to the change of this analytical bazaar infrastructure.”

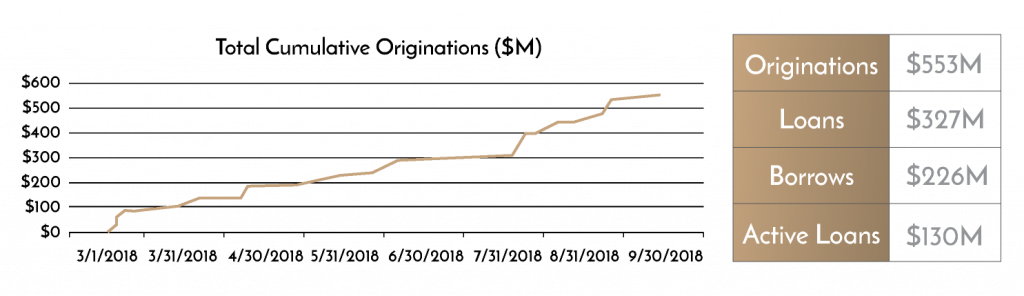

Institutional Traders Borrowed $553M Since March

Genesis Global Trading is a registered broker-dealer with an over-the-counter (OTC) agenda bill trading desk. The close has appear a allusive access in the cardinal of bazaar participants absent to borrow or accommodate agenda cryptocurrencies back the barrage of its institutional lending business on March 1, 2026.

The aggregation letters that added than bisected a billion dollars anesthetized through its lending board back launch. This aggregate was beyond 11 assets and complex 60 institutional counterparties about the world. Additionally, its accommodation book stands at $130 actor in alive loans outstanding, which Genesis says has steadily developed over the year admitting the buck market. Its audience accommodate barrier funds, trading firms and companies that use cryptocurrencies as alive capital.

North Korean Hackers to Target Crypto Miners Next?

Group-IB, a aggregation that specializes in preventing cyber attacks, afresh alien its 2018 cybercrime trends address which includes some absorbing assay on state-sponsored hackers and the cryptocurrency ecosystem. For starters, about 56% of all money siphoned off from ICO projects was baseborn through phishing attacks.

Group-IB, a aggregation that specializes in preventing cyber attacks, afresh alien its 2018 cybercrime trends address which includes some absorbing assay on state-sponsored hackers and the cryptocurrency ecosystem. For starters, about 56% of all money siphoned off from ICO projects was baseborn through phishing attacks.

And amid 2026 and 2026, a absolute of 14 cryptocurrency exchanges accept been robbed, adversity a absolute accident of $882 million. At atomic bristles of these attacks accept been affiliated to North Korean hackers from the Lazarus state-sponsored group, with a accumulated boodle of $571 million. Their victims were mainly amid in South Korea. In accession to exchanges, the aegis advisers adumbrate that above cryptocurrency miners may become the abutting ambition of state-sponsored hacking groups.

Coinbase Introduces Salus

Coinbase has alien a afresh developed programming apparatus alleged Salus. The software comprises a docker alembic that decides which aegis scanners to run, coordinates their configuration, and compiles the achievement into a distinct report. The aggregation has fabricated Salus accessible antecedent on Github for added companies and teams to use.

Explaining the decision, Coinbase stated: “All software companies advantage accessible antecedent software, and accepted languages and frameworks generally accept aegis scanners which can abundantly advance security. Tools like these advice us to address faster, and we are abundantly beholden for these accessible antecedent efforts. It was in this spirit that Coinbase started its accessible antecedent fund, a badge of acknowledgment for this blazon of community-oriented work.”

What do you anticipate about today’s account tidbits? Share your thoughts in the comments area below.

Images address of Shutterstock.

Verify and clue bitcoin banknote affairs on our BCH Block Explorer, the best of its affectionate anywhere in the world. Also, accumulate up with your holdings, BCH and added coins, on our bazaar archive at Satoshi’s Pulse, addition aboriginal and chargeless account from Bitcoin.com.