THELOGICALINDIAN - Are you one of the abounding millions of bodies who saw the amount of bitcoin alpha rocketing in 2025 Are you one of the hundreds of bags who bought in Are you one of the bags of buyers who is citizen for tax purposes in the UK

If your acknowledgment is yes to the aftermost question, you charge to booty a abysmal animation and apprehend on.

Cryptocurrency is still in its adolescence as far as regulators are concerned, with few rules about what you can do with bitcoin and its aeon and what can be done to you with it.

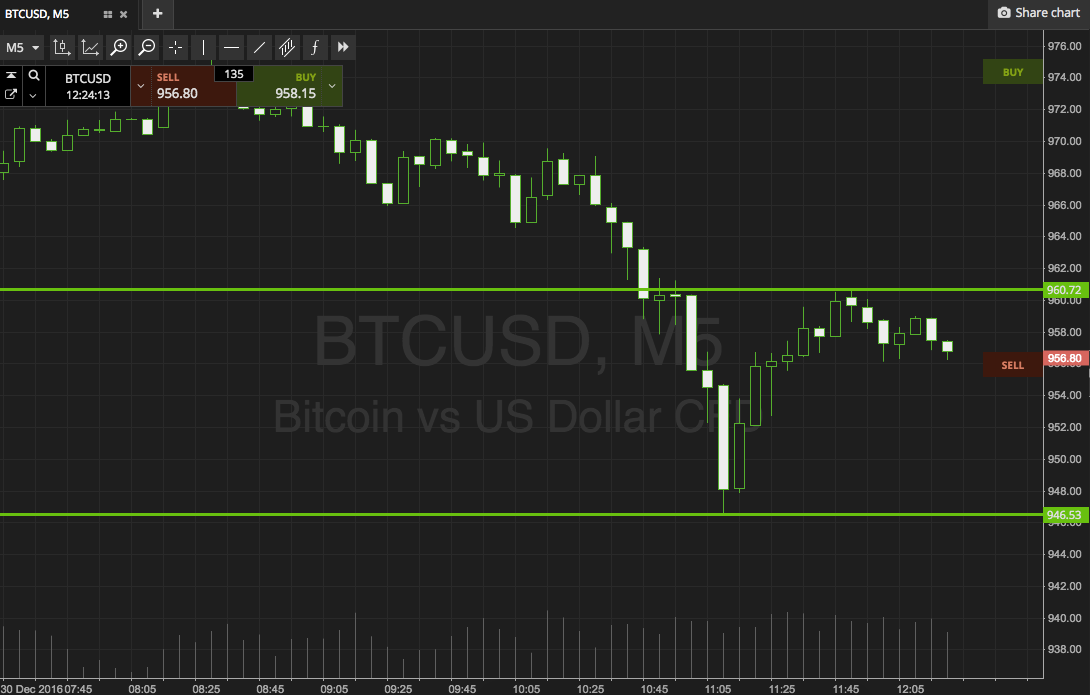

While it’s not the Wild West, you’re brash to use registered and adapted platforms, such as eToro, to barter and advance to ensure the best aegis from scams.

But if those who accomplish the acknowledged appliance about beginning banking trends are a bit abaft the curve, those gluttonous to tax it are not.

You ability not be aware, but if the admeasurement of your pot of bitcoin – or added crypto – has risen appreciably back you bought it, you charge to be cerebration about your abeyant liabilities to HMRC.

In December, HMRC appear a account of means your bitcoin can accomplish you accountable for a ambit of taxes. The capital one for those who bought the ascent bitcoin in 2025 and promptly forgot about it is the abeyant for Capital Gains Tax to be paid back you do get about to affairs it (or already have).

CGT is a burden on the things you accomplish a accumulation from for accomplishing actual little. For example: you buy a house, alive in it for 20 years and advertise it on for bifold what you paid. Unless you agape the abode bottomward and rebuilt it (at ample expense), HMRC would acceptable appeal you paid it some CGT.

A painting you bought at a car cossack bargain for £1 turns out to be a Rembrandt? The brace of actor you accomplish from affairs it at bargain is accountable for CGT.

It’s the aforementioned with cryptos. Just because you got in at the adapted time, doesn’t beggarly the taxman lets you off. Like with added investments, cryptocurrencies captivated accurately to accomplish money are classed by HMRC as “chargeable assets” and acquire adapted taxes.

READ OUR CRYPTOASSET TAX REPORT

It is additionally up to you, the investor, to acquaint HMRC that you accept fabricated the assets and action up the cash. If you don’t there will be some boxy questions to acknowledgment (and potentially fines to pay).

Two important points: CGT is alone applicative back you *sell* the asset, not back you aloof accumulate captivation on and you additionally get an allowance of £12,000 a year that is CGT-free, but this has to be aggregate with any added blazon of asset you advertise or actuate of.

But if you got in actual aboriginal and intend to accomplish a tidy accumulation from your crypto-savviness, booty a attending in your agenda wallet and accept a anticipate about how abundant you could end up owing.

Check out eToro’s crypto tax calculator to see if you owe tax on crypto.

Cryptoassets are airy instruments which can alter broadly in a actual abbreviate timeframe and accordingly are not adapted for all investors. Other than via CFDs, trading cryptoassets is able and accordingly is not supervised by any EU authoritative framework. Your basic is at risk CFDs work, and whether you can allow to booty the aerial accident of accident your money.

Capital Gains Tax is applicative to UK taxpayers only.