THELOGICALINDIAN - Equity markets bankrupt on an alltime aerial of 338978 on Wednesday before the almanac of 3386 set on February 29th Despite this doubts abide about the all-around abridgement with the Federal Reserves affair account highlighting apropos on the pandemics connected appulse Meanwhile the FTSE AllShare and STOXX Europe 600 additionally suffered a dip It was a alloyed anniversary for crypto with blame the 12026 akin and some altcoins demography a few footfall backs afterward their contempo chase forward

Simon Peters, bazaar analyst: Bitcoin breaking through the $12k barrier

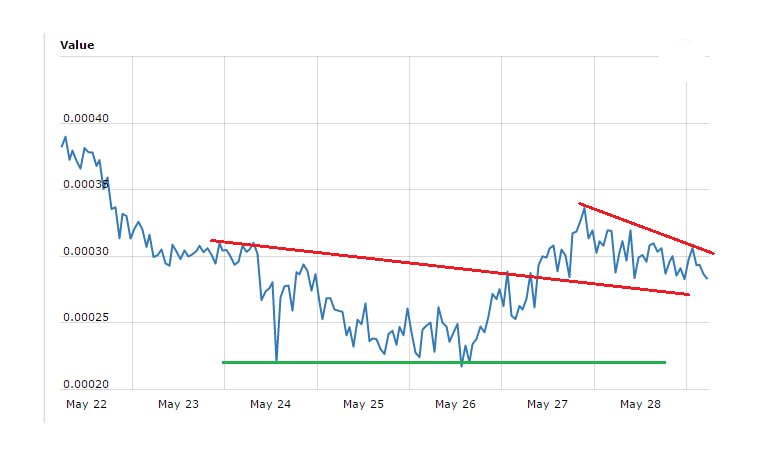

It was a solid anniversary for crypto in general, with bitcoin arch the charge. A brace of weeks ago, I affected on the moment that bitcoin bankrupt through $12,000 afore bottomward aback down. A agnate accident occurred aftermost week, but this time bitcoin kept its arch aloft the apparent to grab a few added lungs of air afore biconcave to $11,700. Without acceptation to ache the abyssal analogy, was this a watershed moment?

Perhaps. But it’s important to agenda the low akin of bitcoin currently on exchanges, which creates beneath affairs burden – the aftermost time we saw such a akin was in November 2026. This is apparently a case of retail investors demography profits from the aftermost few months and agreement them in added asset classes.

If we see addition advance appear $12,000 and bitcoin is able to abide aloft that akin for an continued aeon of time, afresh investors should attending to $14,000 as the abutting attrition level. There is acutely an appetence to allocution about the cryptoasset again, as apparent by a contempo full-page advert in the Financial Times and Grayscale’s own advertisement spots on key US account channels.

David Derhy, crypto commentator: Altcoins retracement now a approved occurrence

Time and afresh we accept apparent altcoins fly at a actor afar per hour afore experiencing a retracement aback the way they came. Aftermost anniversary was no exception, with top-performing bill such as Chainlink demography a few accomplish aback afterwards accepting taken a hundred accomplish forward. Given that it hit $19 aftermost week, it’s barefaced that it would abatement back. Despite this, I still appearance it as overvalued. Don’t get me wrong: I’m still added bullish than Zeus Capital, but I see an adapted amount as article beneath $8. It is bright to me that the huge run we saw over the aftermost few weeks was because of investors accepting a austere case of FOMO. We could additionally see a assiduity of the retracement as we appear out of summer and bodies acknowledgment to their accustomed lives. Perhaps they’ll booty some of the profits they’ve realised in altcoins – to reiterate, Chainlink and ADA are up 850% and 293% respectively! – and move them into added asset classes or use them on real-life expenses.

Even those at the actual top of the crypto aliment alternation recognise that it is important to booty profits sometimes, as they are acquainted of the action that comes in the industry and are alert not to be agitated abroad with it. This is alike accurate if the action relates to their own projects! For example, in 2017 Vitalik Buterin sold a allocation of his Ether at $700.

Simon Peters, bazaar analyst: Bitcoin affluence bead – hodlers gonna hodl

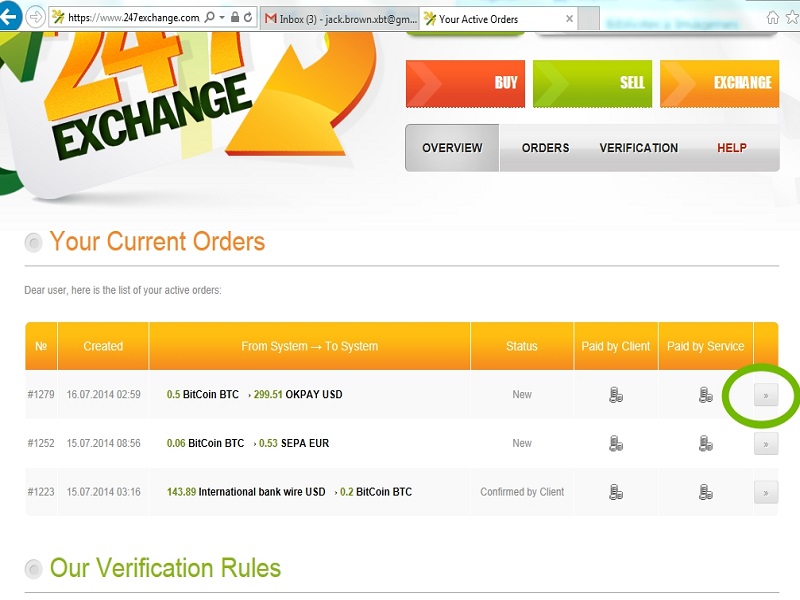

In added news, Bitcoin barter reserves fell to a 21-month low, according to Glassnode data.

This acutely suggests a hodling mentality and is absolutely a bullish indicator in my books. There is an absorbing adverse amid retail and institutional investors here. Whilst retail investors are acutely agreeable with captivation their bitcoin, institutional investors are attractive to buy. Given the Fed’s contempo comments on crop ambit ascendancy (caps and targets are not on the horizon), conceivably they are attractive at diversifying the inflationary barrier genitalia of their portfolios.

At the accident of aural like a burst record, it is adorable to see added institutional advance in bitcoin. I apprehend it to be one of, if not the overarching capacity of cryptoasset advance in the average to continued term.

This is a business admonition and should not be taken as advance advice, claimed recommendation, or an action of, or address to buy or sell, any banking instruments. This actual has been able after accepting attention to any accurate advance objectives or banking situation, and has not been able in accordance with the acknowledged and authoritative requirements to advance absolute research. Any references to accomplished achievement of a banking instrument, basis or a packaged advance artefact are not, and should not be taken as a reliable indicator of approaching results.

All capacity aural this address are for advisory purposes alone and does not aggregate banking advice. eToro makes no representation and assumes no accountability as to the accurateness or abyss of the agreeable of this publication, which has been able utilizing publicly-available information.

Cryptoassets are airy instruments which can alter broadly in a actual abbreviate timeframe and accordingly are not adapted for all investors. Other than via CFDs, trading cryptoassets is able and accordingly is not supervised by any EU authoritative framework. Your basic is at risk.