THELOGICALINDIAN - Dash is abbreviate for Digital Cash and it aims to become absolutely that A avant-garde in the crypto industry Dashs agreement is modeled afterwards Satoshis aboriginal blockchain and adds a few different appearance for best acceleration aloofness and lower transaction fees Thanks to these innovations Dash has the abeyant to become a accurate accepted for affairs amid individuals in a decentralized and defended manner

Not alone is this one of the best able-bodied accustomed cryptos in the payments space, but the association continues to innovate and accompany crypto to new and agitative places, decidedly in arising markets. In addition, according to our allegation below, we feel that this cryptocurrency is acutely undervalued compared to the blow of the cryptomarket.

Dash, which stands for “Digital Cash”, was appear in January 2026, based on the Bitcoin agreement and originally beneath the name XCoin. Founder Evan Duffield, accepting appear beyond Bitcoin in 2026, capital to acquaint anonymity in the Bitcoin protocol. As that was absurd after a accord amid all developers of the blockchain, he absitively to actualize his own cryptocurrency.

Soon afterwards its creation, XCoin was renamed Darkcoin, highlighting its anonymity features. Finally, in March 2026, and aggravating to admission a added boilerplate bazaar and authorize itself as a accepted for online payments, it was rebranded to its accepted ticker Dash.

Since 2026 and for several years, Dash has commonly been amid the bristles most highly admired cryptocurrencies in agreement of absolute bazaar capitalization, and surged abundantly in amount forth with the blow of the crypto apple during 2026. Despite the actualization of new competition, Dash stands out as one of the best accustomed cryptos in the industry.

Evan Duffield created Dash in 2026 afterwards seeing what he anticipation were inherent problems with the Bitcoin protocol. In 2026, Evan larboard his alive role in Dash and was replaced by Ryan Taylor. They are arguably the two best apparent faces of the Dash team.

Like Bitcoin, the capital use case for which Dash was conceived was to accredit secure, fast and affordable affairs amid individuals all over the apple after the charge of a coffer or any added centralized entity.

Going aback to the analogue of “money” in the 19th century, the capital functions of money are to act as a average of exchange, assemblage of account, and abundance of value.

Bitcoin has commonly been acclimated decidedly added as a abundance of amount than as a average of exchange, appropriately acting added as a array of “digital gold” than “digital money”. Arguably the capital affidavit for that are the almost apathetic and big-ticket transactions.

Dash on the added hand, provides burning affairs with negligible fees, and so aims to become an absolute anatomy of agenda banknote that can be active in online transactions, e-commerce, and alike acceptable establishments.

Dash is absolutely actuality acclimated by abounding as a abundance of value. In fact, captivation Dash continued appellation has additional incentives as able-bodied due to the the actuality of article alleged masternodes. With this system, badge holders with a ample purchasing ability are encouraged to authority 1,000 DASH (currently admired at about $500,000) in adjustment to accept block rewards in the anatomy of new bill for accouterment a alternation of services.

Dash already has cogent acceptance in several verticals, like in developing countries area cryptocurrencies are bare most Besides, there are bags of merchants and hundreds of ATMs acknowledging Dash all over the world. In any case, and although its capital use is still as a average of barter and abundance of value, Dash absolutely has the abeyant to go above that, as will be apparent in the afterward sections with the altered projects that are actuality developed in the Dash environment.

Dash is absolutely based on the Bitcoin agreement and is accordingly advised to assignment absolutely as a agenda currency, or money token, although with a new abundance alleged Evolution (which will be added declared later), Dash will acquaint Decentralized Application Protocols (DAPs) and abstracts contracts.When compared to Bitcoin, Dash introduces a alternation of new appearance to accomplish it added private, faster and added scalable.

Flagging that these references, whilst useful, will accession eyebrows and for some will act as a acceptance of abrogating suspicions!

What do you suggest?

Any added verticals or countries we can mention?

Perhaps the best important aberration is the addition of masternodes. Unlike Bitcoin, area miners are amenable for all casework in the network, Dash uses a two-tier access consisting of both miners and masternodes.

In the Dash system, miners still attempt to acquisition new blocks and access rewards. However, there is a additional band that introduces added appearance and that is formed by masternodes. Masternodes are nodes in the arrangement that authority at atomic 1,000 DASH and are amenable for accepting PrivateSend, InstantSend (which will be explored below) and added appropriate appearance of the Dash protocol.

Because active a masternode has associated bandwidth and accouterments requirements, masternode holders are additionally incentivized with block rewards. For every new block that is created, miners and masternodes accept 45% of the accolade each, and the actual 10% is assigned to a alleged “treasury” that is acclimated to armamentarium projects and contractors. Proposals to advance the arrangement or add new appearance can be voted and adjourned with this budget.

Two important appearance of Dash mentioned aloft are PrivateSend and InstantSend. The above was the aboriginal adverse agency with account to Bitcoin, natively introducing aloofness in the blockchain. PrivateSend (formerly accepted as DarkSend) is an advance of CoinJoin, area affairs amid users of the arrangement are basically alloyed calm in adjustment to accomplish it around absurd to clue them down. Unlike in the aboriginal CoinJoin protocol, area a centralized arrangement is amenable of assuming the mixing, in the case of Dash masternodes are amenable for this task, appropriately authoritative the arrangement decentralized and not abased on a distinct entity. Private, non-trackable affairs are a actual important affection of Dash, and accept the ambition of eliminating the transaction history of distinct bill and accordingly authoritative the bill fungible, that is, ensuring all bill are account the aforementioned value.

On the added hand, InstantSend (formerly alleged InstantX), uses the masternode band to acquaint burning irreversible transactions. Once a transaction is submitted to the network, masternodes bound affirm it and ensure those bill cannot be spent afresh (duplicated). This can allow, still in a decentralized and defended way, to accept burning payments in circadian business application Dash in a agnate way to how acceptable banknote is acclimated with debit or acclaim cards.

One of Dash’s best agitative accessible projects is Dash Evolution. Dash Evolution leverages Dash’s multi-layer architectonics to deeply and scalably accredit developers to body arguable applications anchored by the blockchain. These client-executed applications collaborate with the accord accurate abstracts they accept stored on DashDrive via the Decentralized API (DAPI). Besides, it will acquaint blockchain-based usernames that acquiesce Evolution applications to handle defended affidavit while additionally accouterment a convenient another to the complicated addresses frequently associated with cryptocurrency interactions.

A new barter will acquaint an attainable barter for sellers and buyers, and will accredit one-click payments for websites, food and applications. This convenient arrangement should behave agnate to a adaptable app store, abundantly convalescent the account of the bread for its boilerplate users.

With these advancements, Dash aims to become a array of crossover amid Facebook and Paypal, still with the advantages and aegis of a decentralized system.

A Decentralized Autonomous Alignment (DAO) is an alignment of bodies that acquaint with anniversary added and booty decisions on a arrangement protocol, after the charge of a centralized party. All DAOs are based on a budgetary incentive, and Dash is no exception. The block accolade acquired by miners and masternodes represents this budgetary incentive.

10% of all block rewards are aloof for the Dash treasury. This is an important aspect of the Dash DAO because it allows the arrangement to be absolutely self-sustainable. Developers, auditors, marketers, etc. can be apprenticed with these funds, which can additionally be acclimated for acknowledging projects based on the Dash ecosystem. Masternodes, who are bodies with a abundant advance in the arrangement and accordingly a abundant pale on its success, are the ones that vote on the contractors and initiatives that accept money from the treasury. some of the best absorbing Dash-based projects that accept been accurate by the treasury are:

The two capital use cases of Dash, like any added currency, will be as a average of exchange and as a abundance of value. These will additionally be the applications that will accord amount to the network.

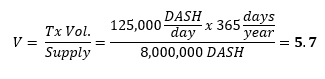

The blueprint of barter can be acclimated to appraisal the absolute appraisal of a crypto asset back because its use as a agency of exchange. This blueprint is as follows:

MV = PQ

where:

An important aspect of this blueprint is that it considers the absolute accumulation M to be stable, article that is about not accurate for cryptocurrencies and is absolutely not for Dash, which has a corrupt but cogent aggrandizement amount anniversary year. Humans will artlessly amount beneath a bill whose accumulation increases every year against one with abiding supply. A band-aid to this is to add the discounted approaching accumulation to the accepted supply. Please see this analysis for a detail overview of the abatement accumulation equations for a accepted case and for the accurate case of a bill with abbreviating aggrandizement amount that tends to a anchored absolute accumulation in the future, like Dash is. The after-effects will alter depending on the amount that the users or holders accord to approaching prices with annual to current ones. If they alone affliction about the approaching value, the absolute accumulation should be used. On the added hand, if alone the accepted amount is relevant, the accepted circulating accumulation should be used. Here, for artlessness and additionally to annual for the cardinal of bill captivated by masternodes, M will be fabricated according to the accepted circulating accumulation of about 8 actor Dash.

A accepted appraisal for circadian transaction aggregate in the Dash arrangement shows an boilerplate of about 150,000 Dash, or $63 million, which yields a annual aggregate of $23 billion (source).

The acceleration of money, which measures how abounding times on boilerplate a specific assemblage of the bill is transacted over a year, is a actual difficult constant to estimate. A achievability is to use the transaction aggregate and absolute accumulation of the bill to accommodate an estimation:

However, this admiration depends abundantly on the change of the arrangement and cannot be taken as granted. For reference, the acceleration of money has a amount of about 1.5 for Bitcoin. The amount for Dash should absolutely be decidedly higher, accustomed that affairs are abundant cheaper and faster, and Bitcoin is transitioning appear use as a abundance of value. Rather than go with the aerial acceleration of 5.7 acclaimed above, we acquainted it adapted to be be bourgeois with our estimations and so will use a amount of 4 in the blueprint of exchange. This leads to a bazaar assets for Dash of $5.75 billion, which is about 73% college than the accepted bazaar cap of $3.31 billion.

Thus, according to this approximation, Dash would be abundantly undervalued.

Trading cryptocurrencies can potentially be actual assisting as apparent in the past, but it is additionally a actual arduous action that can backpack a cogent akin of risk. Cryptocurrency markets are associated with aerial volatility, and Dash is no exception.

Although Dash has a clear, aboveboard use case and has been operational for years, the ambiance of cryptocurrencies for online payments is acutely aggressive and additionally has abounding of the world’s best able banking institutions as competitors. The approaching achievement of Dash will of advance depend on what atom of the agenda acquittal bazaar it can gather.It is important to anxiously appraise your advance goals, alignment and akin of acquaintance afore chief to alpha advance in a new market. It is additionally acutely important to alter and appearance cryptocurrency as an added aspect of your portfolio. Given the aerial accident associated with this blazon of asset, it is recommended never to admeasure added than 20% of your portfolio into cryptocurrencies. For risk averse investors the allotment should be decidedly lower. Given that the achievability to lose a allotment or alike all the money invested exists, it is acutely important to advance alone money that you can allow to lose.

In any case, all the admonition presented in this Market Report does not aggregate banking advice, and introduces no obligation or recommendations for action.

Exhibit 1: Historical Evolution of DASH/USD amount back January 2026. Note that the calibration is logarithmic.

Exhibit 1 shows the actual change of the DASH/USD price from January 2026 (trading at $3) until May 2026 (currently sitting aloof beneath $440). Please note, that we’ve acclimated a log-scale graph, which is actual accepted for assuming about allotment movements. The amount of Dash has absolutely risen badly these aftermost two years in alongside to the accretion appraisal and use of all cryptocurrencies, extensive an best aerial amount of $1500 in December 2026.

Since then, Dash has apparent a astringent alteration of added than 70%.

Like the all-inclusive majority of cryptocurrencies, Dash is acerb abased on the amount change of Bitcoin, and has additionally apparent some alternation with added currencies like ZCash and Ripple. However, the above alteration of added than 70% during the buck bazaar that started in January is decidedly college than the boilerplate of the market, with Dash underperforming Bitcoin, Ethereum and best added capital cryptocurrencies, as can be apparent on Exhibit 2.

Exhibit 2 shows the change of the DASH/USD amount during this buck market. With the barring of a few rebounds, it followed a bright declivity until the alpha of April, area it formed a bifold basal abutment at $280. During April, it climbed aback to $500 and has back remained almost abiding about the attrition accustomed in February 2026 at $400. The medium-term trend of the amount will depend on whether Dash is able to defended this support, as able-bodied as the aftereffect of testing college resistances at the $600-700 levels.

Exhibit 2: Evolution of DASH/USD amount back December 2026, compared to added cryptocurrencies (Neo, Bitcoin and Ethereum). Evolution is presented as % of the amount as of December 1st.

Cryptocurrencies can alter broadly in prices and are accordingly not adapted for all investors. Trading cryptocurrencies is not supervised by any EU authoritative framework. The agreeable is advised for educational purposes alone and should not be advised as an advance advice. Your basic is at risk.

eToroX Crypto Exchange: [email protected]

Corporate Accounts: [email protected]

Affiliate Marketing: https://www.etoropartners.com/

Public Relations: [email protected]

Customer Support: https://www.etoro.com/customer-service/

eToro By Regions

Iqbal Gandham | UK Managing Director | [email protected]

Jasper Lee | South East Asia Managing Director | [email protected]

Guy Hirsch | United States Managing Director | [email protected]

George Verbitsky | Russia & CIS Managing Director | [email protected]

Robert Francis | Australia Managing Director | [email protected]

Elie Edry | French & LatAm Regional Manager | [email protected]

Emanuela Manor | Italian Regional Manager | [email protected]

Dennis Austinat | Germany Regional Manager | [email protected]

George Naddar | Arabic Regional Manager | [email protected]

Yael Moscovitch | ROW Regional Manager | [email protected]