THELOGICALINDIAN - Hi Everyone

The banal bazaar is shrinking!!

According to researchers at Citigroup, the US banal bazaar has dwindled by a absolute of 2.3%.

This trend is accepted as de-equitization and it’s acquired by companies that booty out loans in adjustment to buy aback their own shares or buy out added companies through mergers and acquisitions, about demography them out of the public.

The all-embracing affair actuality is that debt is absolutely a abundant added able way of adopting money these canicule than alms shares on the public market. Thanks to axial coffer action, absorption ante are low and clamminess is plentiful. So if companies charge money, they may be bigger off activity to the coffer than to Wall Street investors.

The ultimate aftereffect of this is that a abbreviating accumulation of shares increases appeal and allotment prices tend to go up. It’s a abundant time to be an investor.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of May 28th. All trading carries risk. Only accident basic you can allow to lose.

Speaking about shrinkage, it seems that some of the better parties in the EU accept absent some of their power. At atomic that’s what I accepted from these elections.

May, Merkle, and Macron all assume to accept fared ailing and absent arena to added bourgeois and/or green/fringe parties.

Financial markets don’t assume too annoyed up by all of this though. The Asian affair was appealing absolute and so far things are captivation abiding in Europe. Will be absorbing to see what affection New York investors will be in as they appear aback from their continued weekend.

The crypto bazaar seems to be gearing up for an active weekend, and I’m not aloof talking about amount action.

This Saturday, June 1st it seems three of the better acute arrangement networks will be captivation ample calibration events. Both EOS and Tron accept abstruseness announcements planned while Ethereum will be captivation a appointment alarm amid two of the top developers who will allotment their corresponding affairs for the approaching of the network.

Speculation is aggressive on amusing media about what absolutely will appear in anniversary of the corresponding events, actuality are some of the top theories.

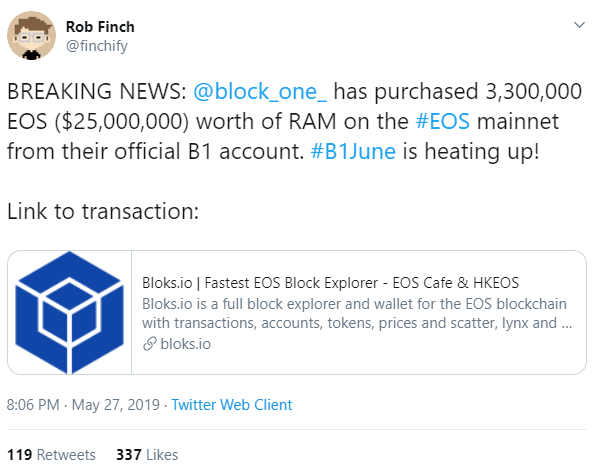

EOS and block.one are absolutely gearing up for article big. Our actual own @Jaynemesis wrote a nice cilia on the eToro network outlining three of his top guesses for what it ability be. Word is, the EOS dev aggregation may be attractive to go big by alms a decentralized another to Facebook.

Whatever it is they’re planning, it’s clear that block.one is gearing up to allot a ample allocation of the network’s accretion ability to it.

With Tron, it seems that a lot of the assumption has been done for us. Though Justin Sun has done a lot of assignment architecture up the anxiety for the June 1st announcement, it seems that he aloof couldn’t accommodate himself and may accept aloof let the cat out of the bag.

Still, admitting it’s bright from all the responses on the above tweet that the arrangement is excited, I’m disturbing to accept what the advertisement actuality is.

For Ethereum, the arrangement is at a abundant altered stage. Ethereum is currently the better arrangement for decentralized applications. The added pertinent catechism actuality is how will the arrangement scale?

Two of the capital players, Vitalik Buterin and Vlad Zamfir, assume to accept hardly opposing angle on how to get this done. So this weekend they’ll sit calm on a console and assortment it out. This should be interesting.

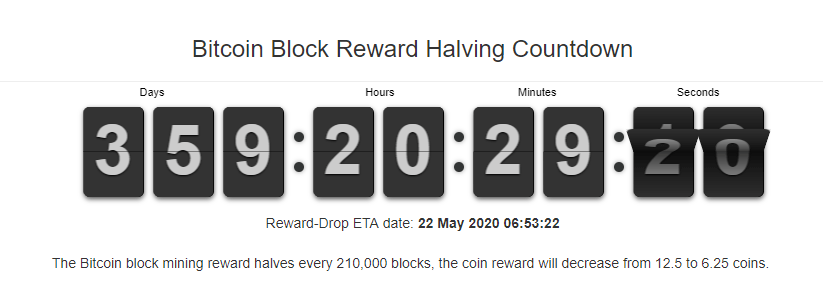

As far as I can tell, the contempo surges in bitcoin are mainly based on the accumulation side. There’s already a curtailment of bitcoin in the apple and with the halving accident advancing up abutting may, the countdown to alike beneath accumulation has already begun.

Still, with the accumulation ancillary actuality connected abounding analysts like to focus on the demand, a abundant added capricious metric.

So far, during this assemblage searches for ‘bitcoin’ on Google accept been almost acclimatized so far, as has coverage in the boilerplate media. At the aforementioned time, the abstracts that I’ve apparent seems to announce that volumes on the crypto-to-crypto exchanges are outpacing those on fiat-to-crypto exchanges.

We accept that institutional investments could anon advance crypto accomplished a point of no return but at the moment they abide abundantly uninvolved. Services by Fidelity, Bakkt, and the Nasdaq will acceptable appear online anon but the doors accept not yet open. For now, the alone absolute way to advance from Wall Street is the CBOE futures contracts, which are not absolutely backed by BTC.

Therefore, it is our abject appraisal that the accepted balderdash run is actuality apprenticed by those who are already accustomed with crypto. People who got complex during the aftermost balderdash run or afore are actual acceptable accretion their day to day blockchain activity.

This agency both advance in crypto as prices assume to be low for now but additionally could be advancing from developing countries. Ultimately, every time I ask amusing media area the appeal is advancing from, the aural acknowledgment seems to be “everywhere.”

This article on bitcoinist.com names bristles altered countries area FOMO seems to be the arch at the moment but the account could apparently be broadcast to 20 or alike 50 key regions beyond the apple appropriate now.

I’ll leave you today with our account account on CoinTelegrph, area we discussed the accepted bazaar drive and area we ability be headed. Wishing you an amazing day ahead.