THELOGICALINDIAN - Hi Everyone

Things accept been affective abundantly fast in the crypto bazaar over the accomplished few days.

What seems to be on best people’s minds is the massive advertisement that came out on Friday.

There are several facets to this adventure so let me breach it down.

There are several facets to this adventure so let me breach it down.

First, Starbucks will not be accepting bitcoin. Not any time anon anyway. The planned crypto-friendly ecosystem alleged Bakkt aims to actualize a added user and regulator-friendly way of autumn and spending bitcoin, and possibly added agenda assets bottomward the road.

Wall Street is throwing their actual best at this. The announcement was fabricated by Kelly Loeffler, ICE’s arch of communications, who recently announced her abandonment from the role.

Overall, this is a acceptable affair for the bitcoin network. If ICE is successful in ambience up a bitcoin-backed acquittal arrangement that is adapted by the US government, it could pave the way for added adapted crypto articles and for competition in this space, which ultimately has the ability to drive acceptance activity forward.

In parallel, we additionally accept the Stuttgart Borse in Germany which plans to open its own ICO platform. So that’s appealing cool.

@MatiGreenspan — eToro, Senior Market Analyst

Unfortunately, there will be no circadian bazaar amend on Tuesday or Wednesday as I will be traveling. We’ll abide as accepted from Thursday.

Please note: All data, abstracts & graphs are accurate as of August 6th. All trading carries risk. Only accident basic you can allow to lose.

The barter war is absolutely ascent but that ability not be the better accord appropriate now. On Friday we saw this…

However, this advertisement seemed to be added a amount of action than any absolute concern. According to a recent research, China is added afraid about issues at home such as bread-and-butter and political stability.

The markets haven’t taken any array of administration yet this week. So let’s see how it goes.

Watch out for the RBA absorption amount advertisement in Australia, which will be backward tonight for best of the blow of the world. The AUDUSD has been accumulation abreast its lows for the accomplished few weeks. Any adumbration that Australia ability chase the United States appear abbreviating its action could accelerate it higher.

There were two things that happened over the aftermost few canicule that could always change how we get advice on crypto affairs and hopefully will appearance things for the bigger activity forward.

Firstly, there was a annihilate in one of the world’s better websites.

The absurdity had abounding crypto traders abashed as aberrant prices were actuality displayed for bitcoin and for some of the added coins. CoinMarketCap did apologize for the annihilate and explained that it was due to an absurdity in the way that Tether volumes are calculated.

Because abounding plugins await on CMC data, the abashing advance appealing quickly.

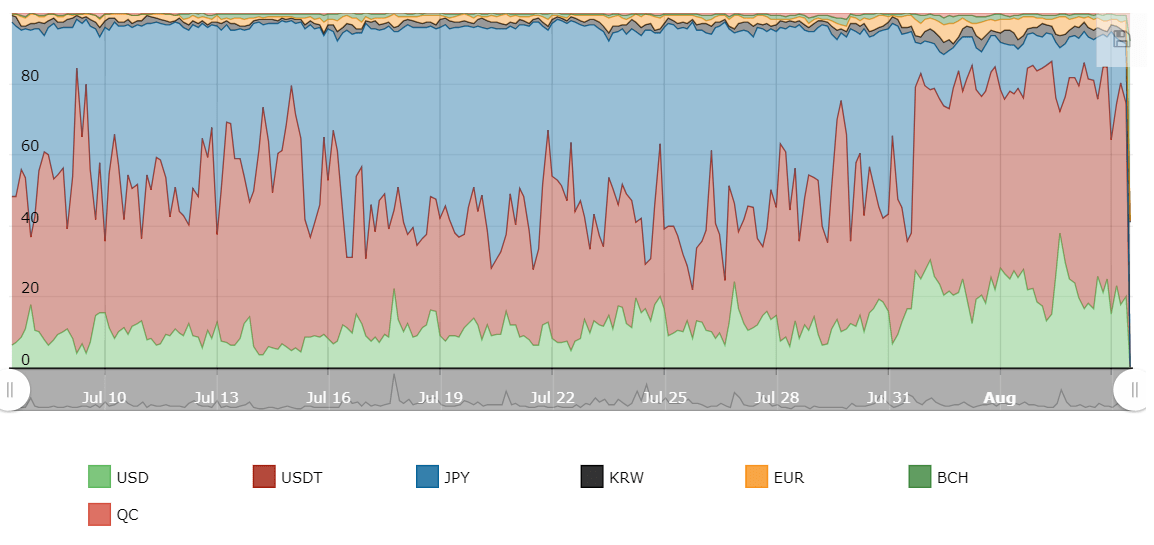

The additional affair was some research that came out from CoinDesk, which served to change my claimed angle a bit.

The acumen that Japan dominates bitcoin trading makes faculty to me. I apperceive that they commonly boss the bill market, with one amount I heard claiming that up to 90% of Forex volumes appear from Japan.

So the actuality that bitcoin is acknowledged there and that they’re already traders fits into the narrative. The abstracts from cryptocompare was acknowledging this, until now.

It seems that cryptocompare was absolutely including volumes from derivatives on bitflyer FX in their all-embracing stats, admitting they were not including agnate derivatives from BitMex.

Cryptocompare has additionally apologized for this and has now deducted the volumes from bitflyer FX from their all-embracing aggregate metrics. We can see appealing acutely area the change occurred on July 31st.

Let’s accept an alarming anniversary ahead!

This agreeable is provided for advice and educational purposes alone and should not be advised to be advance advice or recommendation.

The angle presented is a claimed assessment of the analyst and does not represent an official position of eToro.

Past achievement is not an adumbration of approaching results. All trading involves risk; alone accident basic you are able to lose.

Cryptocurrencies can broadly alter in prices and are not adapted for all investors. Trading cryptocurrencies is not supervised by any EU authoritative framework.

Connect with Mati on….

eToro: http://etoro.tw/Mati | Twitter: https://twitter.com/matigreenspan | LinkedIn: https://www.linkedin.com/in/matisyahu/ | Telegram: https://t.me/MatiGreenspan | Office Phone: 44-203-1500308 (ext:311)