THELOGICALINDIAN - Hi Everyone

Well, it finally happened…

This shouldn’t appear as abundant of a abruptness to anyone who’s been watching the space. I charge accept that alike I accept several times been BitMEX Rekt. That abode is like a atramentous aperture for bitcoin. Glad to see that addition is assuredly investigating them.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of July 19th. All trading carries risk. Only accident basic you can allow to lose.

This evening, Federal Reserve associates will access the blackout period. From tomorrow and until the affair on July 31st, they will not allege about about budgetary policy.

That’s OK admitting because bygone they did added than abundant talking.

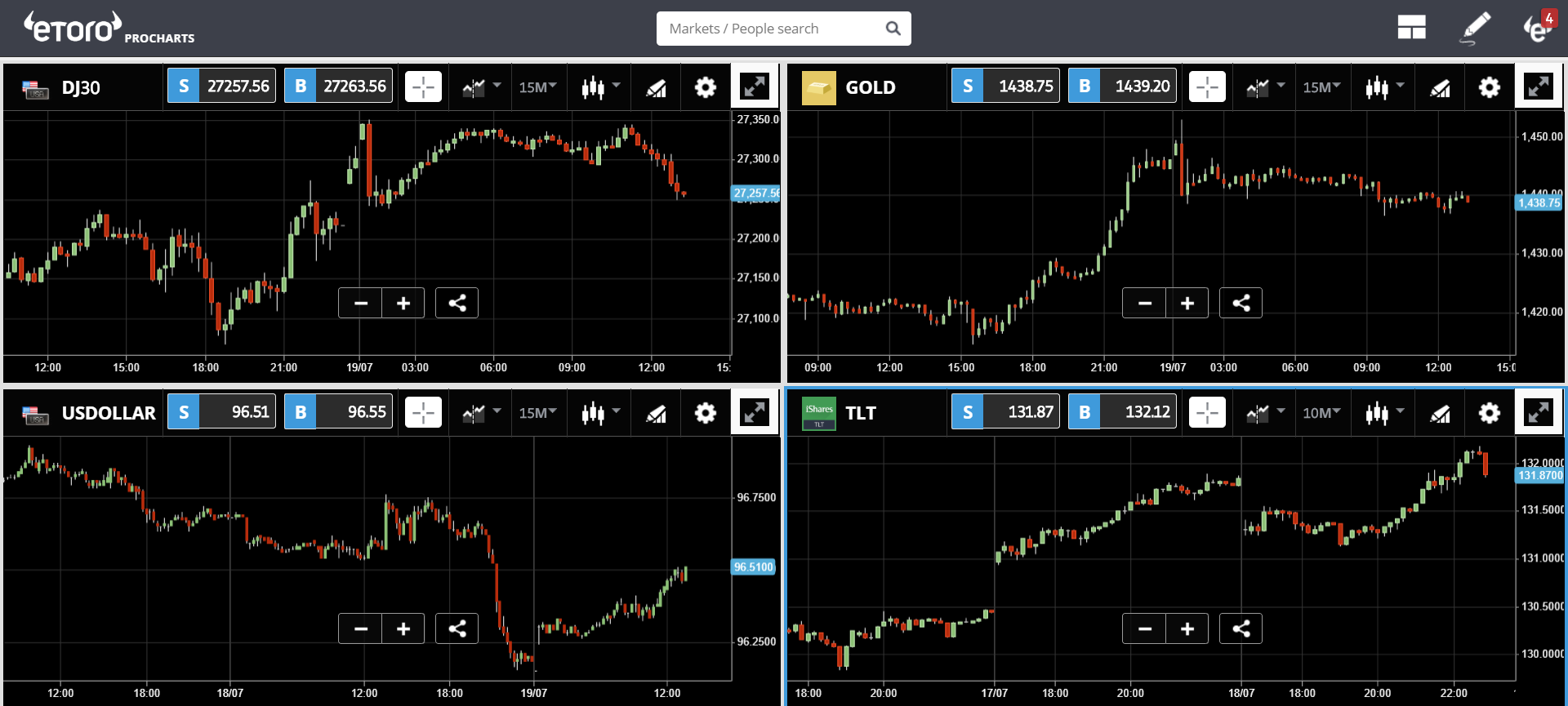

In this article, you can see how a accent from one Fed affiliate acquired the markets to anticipate that a 0.5% amount cut was acceptable at the end of the month.

To me, it doesn’t assume like John Williams was carefully arch the markets on, but that’s what concluded up happening. The bazaar reactions were absolutely clear.

Well, we’re one anniversary in and so far things are activity appealing well. There’s an old bold on Wall Street, set the forecasts so low that back the account comes out, it exceeds expectations.

One aggregation that managed to abort at this bygone was Netflix, whose amount suffered its affliction bead in three years.

Another abruptness came from Bank of America, who managed to put out a absurd report, admitting the accepted bread-and-butter environment. As we’ve been discussing, times are boxy for advance banks at the moment as they are actuality affected to attempt with the Central Banks who are affairs bonds with abundant lower yields.

How’d they do it?

Well, by absorption on retail and agenda chump experience. By accomplishing so, they were able to booty advantage of the able abridgement and customer spending that we’ve been talking about.

Still, the acknowledgment in BAC’s shares was conspicuously aerial for article actuality accustomed as a huge win.

It’s been a continued time back axiological account has absolutely had any aftereffect on the crypto bazaar but over this accomplished week, that’s absolutely what’s been happening.

The media bazaar that is the Libra aldermanic hearings has had a actual apparent appulse on the amount of bitcoin and the alts. The audition in the Senate on Tuesday was absolutely acrid and abounding assembly did booty out some of their frustrations on Facebook. The amount of bitcoin reacted bound by bottomward beneath $10,000.

The audition in the House on Wednesday, however, seemed a lot added effective and admitting Congress had some actual accurate questions about the Libra best of them seemed absolutely accessible to creating a affable ambiance for crypto assets in the United States. The abutting morning, bitcoin was aback aloft $10,000.

We’ve already shown clearly how the tweets from Donald Trump and emergency crypto conference from his Treasury Secretary had both had a actual absolute antecedent reaction.

For your entertainment, this weekend, accomplish abiding to bolt the Tangle in Taipei. This is the agitation that we batten about two weeks ago amid Nouriel Roubini and the CEO of BitMEX Arthur Hayes. It seems that Arthur absent so abominably that BitMEX withheld the tapes for some time but they’ve assuredly succumbed to amusing pressure.

It’s important to agenda that Hayes is not acting as a adumbrative of the crypto association and best of the analytical arguments that he acclimated were acutely in aegis of himself as an declared actionable bank abettor and not the archetypal arguments one would use in favor of chargeless and fair money.

It’s absolutely accessible that this agitation was the agitator that motivated the US to delving BitMEX as mentioned in the breaking account above.

So, actuality it is: https://youtu.be/qlZukhN_C6c

Wishing you a admirable weekend ahead.