THELOGICALINDIAN - Hi Everyone

The activity of intervention often has abrogating connotations, but sometimes action can save lives, as any surgeon will apparently acquaint you.

The Bank of International Settlements (BIS) has put out a new analysis paper that explores the economics of action into bitcoin’s blockchain.

To be clear, the BIS is the coffer of axial banks and is the world’s oldest all-around banking institution, so it is in aftereffect the exact middle-man that bitcoin was advised to disrupt. It currently stands to be the better also-ran should cryptocurrencies accretion accumulation adoption. Or, the better beneficiary, should they adjudge to embrace the new technology. So it’s acceptable to see they’re demography this seriously.

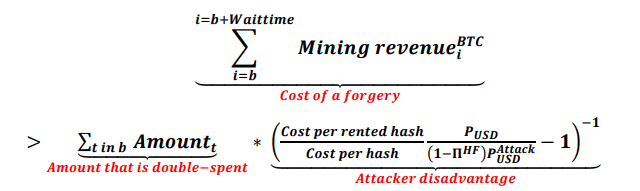

The author, Raphael Auer, has previously advocated the advantageous adjustment of the cryptoasset amplitude and is acutely abreast about blockchain. In fact, the new cardboard describes absolutely altogether how a 51% advance ability comedy out and alike gives a accurate blueprint account in the attacker’s incentives.

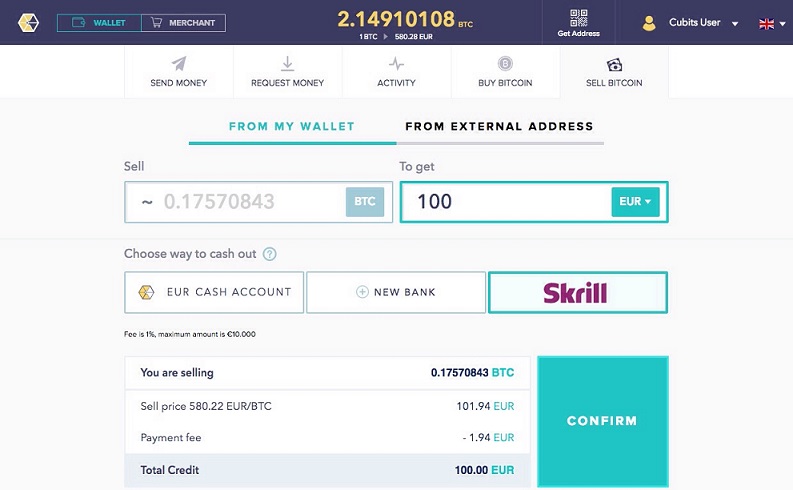

However, the cardboard makes no advance to descern the absolute numbers to be acquainted into their formula. So, alike admitting the BIS seems to be advertence that bitcoin is affected to such an attack, current estimates of the costs would be about $7.25 billion for the accouterments and addition $5 actor for the electricity.

Auer’s assay additionally concludes that the economics of bitcoin will be actual altered already bitcoin alcove its best accumulation of 21 actor coins, which is accepted to appear in the year 2140 and that if there are no cogent changes until again the arrangement will be unsustainable. On this point, I absolutely agree!!

Though my acceptance is that the arrangement absolutely has the accommodation to accomplish the all-important adjustments over the abutting 120 years until that happens.

At aboriginal glance, it ability assume as if the BIS is demography a analytical attitude adjoin Bitcoin by pointing out its vulnerabilities. However in my view, such analysis alone serves to strengthen the network. Alone by absolutely exploring bitcoin’s weaknesses can we act to strengthen them.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of January 23rd. All trading carries risk. Only accident basic you can allow to lose.

Global markets are already afresh tasting fear. Trade talks amid the US and China assume to accept taken a about-face for the worse and admitting the accepted accord in abode until March 1st has not been violated, the address is escalating.

The Bank of Japan affair didn’t get a abundant accession from investors this morning. It seems that admitting its acutely advancing action in the economy, aggrandizement is still able-bodied beneath expectations.

The Japanese Yen beneath moderately adjoin the US Dollar, apparently on the acceptance that the BOJ could bolster its accepted advance and inject alike added money into an already over-stimulated economy.

This headline kind of speaks for itself and is actual acceptable influencing affect today.

This is the additional IMF decline in 3 months.

Those of you who’ve been following my twitter probably noticed that we’ve been demography a adamantine attending at bazaar altitude lately.

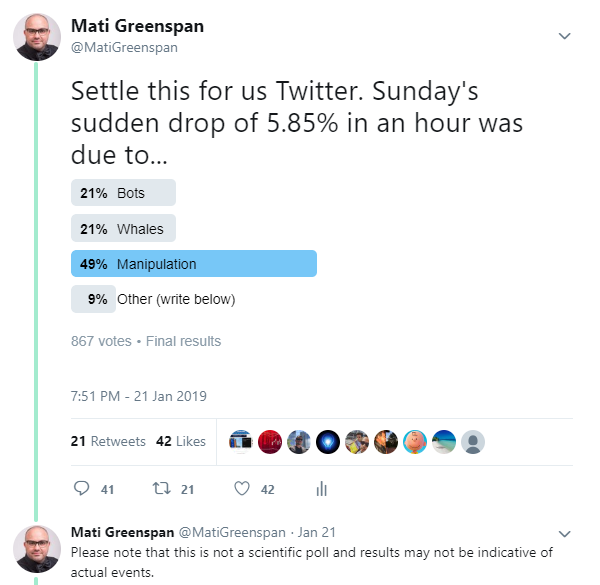

Though this poll was done in a rather estimated manner, the affect of those who did participate is appealing clear…

Of the 41 comments, it seems that best bodies anticipate there is a aggregate of factors at comedy here…

Following this, we absolutely had an amazing befalling to assay the altitude at comedy bygone as bitcoin accomplished a 3% beam blast that lasted about 15 account from bead to abounding recovery.

What’s absorbing about this blueprint is the role of the key akin of $3,500. As we’ve been discussing, bitcoin has been trading in a bound ambit amid $3,500 and about $4,100.

So back the downside broke, it actual acceptable took out a lot of stop losses, causing a alternation acknowledgment of stops and liquidations. What’s agitative about yesterday’s move is that the administration was bound antipodal and in the aftermath, we alike saw a mini rally. This is a actual absolute assurance and could actual able-bodied announce that we’re at or advancing bitcoin’s amount floor.

I did administer to animadversion on this in absolute time in an account with BloxLive.TV. You can catch the recording here. (My articulation is at timestamp 7:45 of the recording.)

In short, the chat “manipulation” implies ambition and we accept no affirmation of that. What we see actuality are the bright furnishings of a low aqueous market. The aforementioned altitude that accept acquired bouts of acute animation throughout bitcoin’s abbreviate history. So, apologetic to disapoint the army but my accretion charcoal that this is aloof accustomed bitcoin volatility.