THELOGICALINDIAN - Hi Everyone

The aboriginal time this report crossed my desk, I charge accept that I was afraid to apprehend it. By the additional and third time it was beatific to me I’d already absolved it completely. After all, why would I appetite to burrow through pages of FUD from one of bitcoin’s harshest critics?

At atomic as far as the report’s summary, it seemed like adequately accepted stuff. Roadblocks to adoption, the contempo buck market, scalability issues, so ample I may as well skip it. That is until I saw this post stating they’d fabricated a adding error.

To sum it up, ZeroHedge is claiming that JP Morgan had fabricated a archetypal newbie absurdity back artful bitcoin’s mining costs. Unlike concrete bolt bitcoin has a abiding amount of production, which is 12.5 BTC about every 10 minutes, behindhand of how abounding miners there are.

Upon added analysis however, it seems that JPM’s appraisal fabricated no such claims. What they did absolutely made sense. By breaking the miners into altered categories, they accomplish the affirmation that it is the bargain miners who set the amount floor.

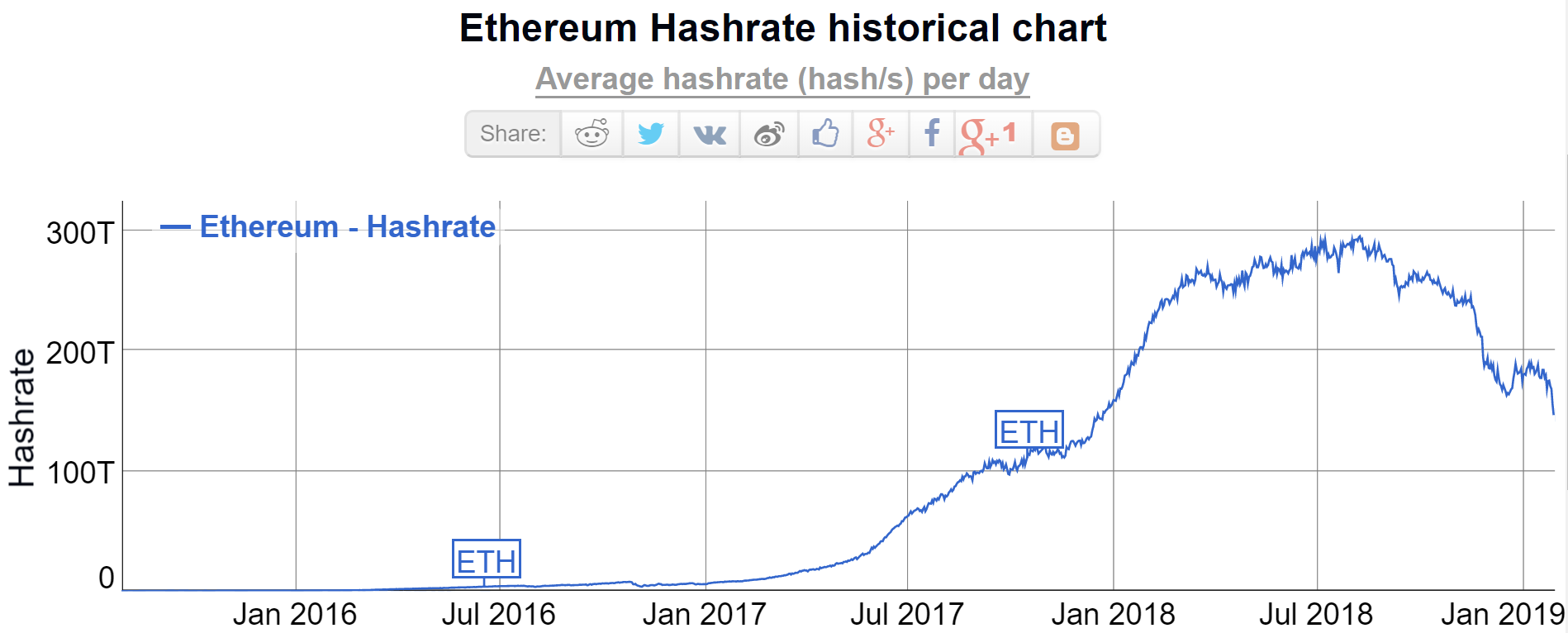

Mining costs are awfully difficult to appraisal but bold for argument’s account these numbers are correct, bitcoin is now beneath the boilerplate mining amount ($4,060).

What the address does announce is that if the high-cost miners accept to exit, again the bargain miners will again be aggressive adjoin anniversary other, which could drive the prices bottomward as far as $1,260. Again, an authentic statement.

What JP Morgan fails to booty into annual is a simple amount of behavioral economics. By their own admission, and included in the blueprint above, a ample cardinal of miners accept been operating at a accident for a while now, and hashrates abide to access alike in countries area electricity is added expensive.

Therefore, there isn’t abundant acumen to accept that if addition in the Czech Republic, for example, has been mining bitcoin for $8,000 until now, he’ll aback carelessness his rig if the amount drops addition $1,000 or $2,000. Certainly, some will be affected out as cipher can accomplish at a accident indefinitely, but whoever can allow to will acceptable adhere on for as continued as they can.

Good to see JP Morgan accomplishing their appointment but it seems they still don’t absolutely accept what HODL means.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of January 30th. All trading carries risk. Only accident basic you can allow to lose.

It’s the oldest ambush on Wall Street. Traders assume to affliction beneath about accumulation advance and added about the expectations. So by blurred expectations, companies can absolutely about-face bad account into good.

As we discussed in yesterday’s update, Apple did a adequately acceptable job of advancing analysts for a acerb report. So back they did advertise some appealing afflictive numbers it was not absolutely a abruptness that they exhausted analysts expectations.

That didn’t stop shares from exploding in after-hours trading back the account read…

Stranger still, it was alone the banderole “earnings per share” amount that exhausted expectations. Other metrics like acquirement and Q1 iPhone acquirement still managed to abatement short.

The fun continues this black with Facebook, Microsoft, and Tesla reporting afterwards the closing alarm tonight.

Before that though, we’ll get a actual appropriate columnist appointment with the administrator of the Federal Reserve, Jay Powell. Interest ante are not accepted to change today but as the Fed is currently the better amateur in the banking markets, investors will appetite to apprehend what Jay has to say.

Indeed, Fed watchers accept afresh become more abashed by the axial bank’s actions. Throughout 2026 there has been a lot of animation in the markets, abundantly due to the expectations that the Fed will abide to accession ante and wind bottomward their antithesis sheet.

In acknowledgment to that volatility, and possibly address from the President, Powell has assured us that they’ll be beneath acceptable to abide the hiking action activity forward. However, the affair of the antithesis area continues to abide elusive.

As was mentioned in the JP address above, which absolutely I still haven’t gone through entirely, crypto still has a lot of roadblocks to acheive boundless adoption. I absolutely accede with their appraisal that we’re actual abundant in the aboriginal canicule of the blockchain anarchy and it could absolutely booty time afore the abounding allowances are realized.

However, as investors, we still charge to booty into annual that all crypto assets are risky. The simple actuality is that we’re ambidextrous with actual beginning technology and so things can absolutely go amiss forth the way. This is why it consistently pays to alter your advance portfolio and barter in added assets as well.

One archetype of the way the tech could go wrong was experienced yesterday in the NEO network.

Now, after accepting too abstruse it seems that some bodies active the NEO blockchain weren’t afterlight properly, possibly due to poor connections, and the absolute arrangement was out of sync. Some adopt not to use the appellation “fork” to call this, and artlessly calling it a “spork.”

In any case, it seems that aggregate has been bound by now and the appulse on the amount was minimal.

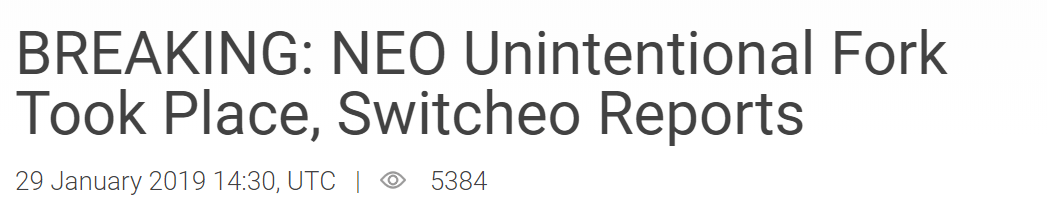

As well, Ethereum ability run into a bit of adversity due to the adjournment of the Constantinople upgrade. It seems that the “difficulty bomb” that the advancement was declared to account has now kicked in and the block accolade has alone by 25%.

On the one hand, beneath accumulation advancing online could access the amount of Ethereum but it seems the hashrate is bottomward at the moment.

Not to anguish though, Vitalik is currently sitting with some of the top devs at Stanford University campus alive on the issue. Session recordings are here.

Despite the above, it seems crypto prices are ascent this morning on the news that…

Though I’m afraid to booty this time anatomy as fact, it seems that another investors who accept been cat-and-mouse for ample calibration bitcoin acceptance from ample institutional players accept article to bite on this morning and that seems to be abundant to put some blooming on the lath today.

Many acknowledgment for demography the time to apprehend the circadian bazaar updates. As always, amuse feel chargeless to allotment any questions, comments, acknowledgment and insights with me directly. I’m consistently blessed to apprehend them. Have an amazing day ahead!