THELOGICALINDIAN - Hi Everyone

The Bitcoin is ascent at a accelerated clip and it seems that the contempo crypto winter has done around annihilation to achievement its growth.

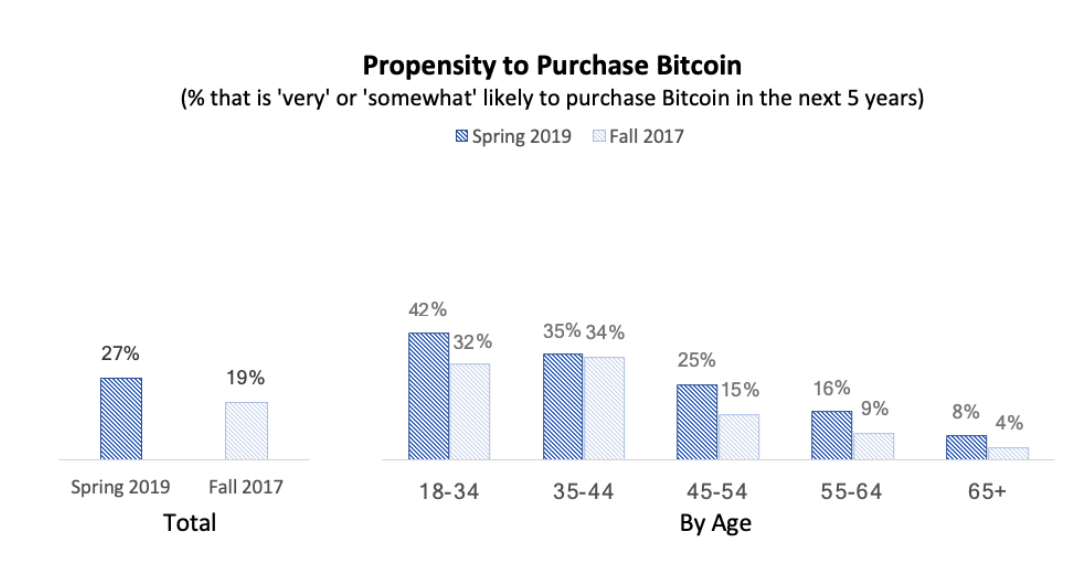

A new study just came out from the United States that shows a cogent acceleration in all categories including awareness, familiarity, perception, conviction, ability to purchase, alternative to added assets, and of advance ownership.

The abstraction compares a analysis that was done in October 2026, during the acme of the balderdash market, to a added contempo analysis from April 2026. What was alike added arresting admitting was that in all of the above-mentioned categories it was the adolescent who are arch the way.

Here’s one blueprint from the address that demonstrates this perfectly.

It’s acceptable more acceptable that the abutting bearing will accept a abundant freer and fairer economy. So that’s absolutely article to strive for.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of May 1st. All trading carries risk. Only accident basic you can allow to lose.

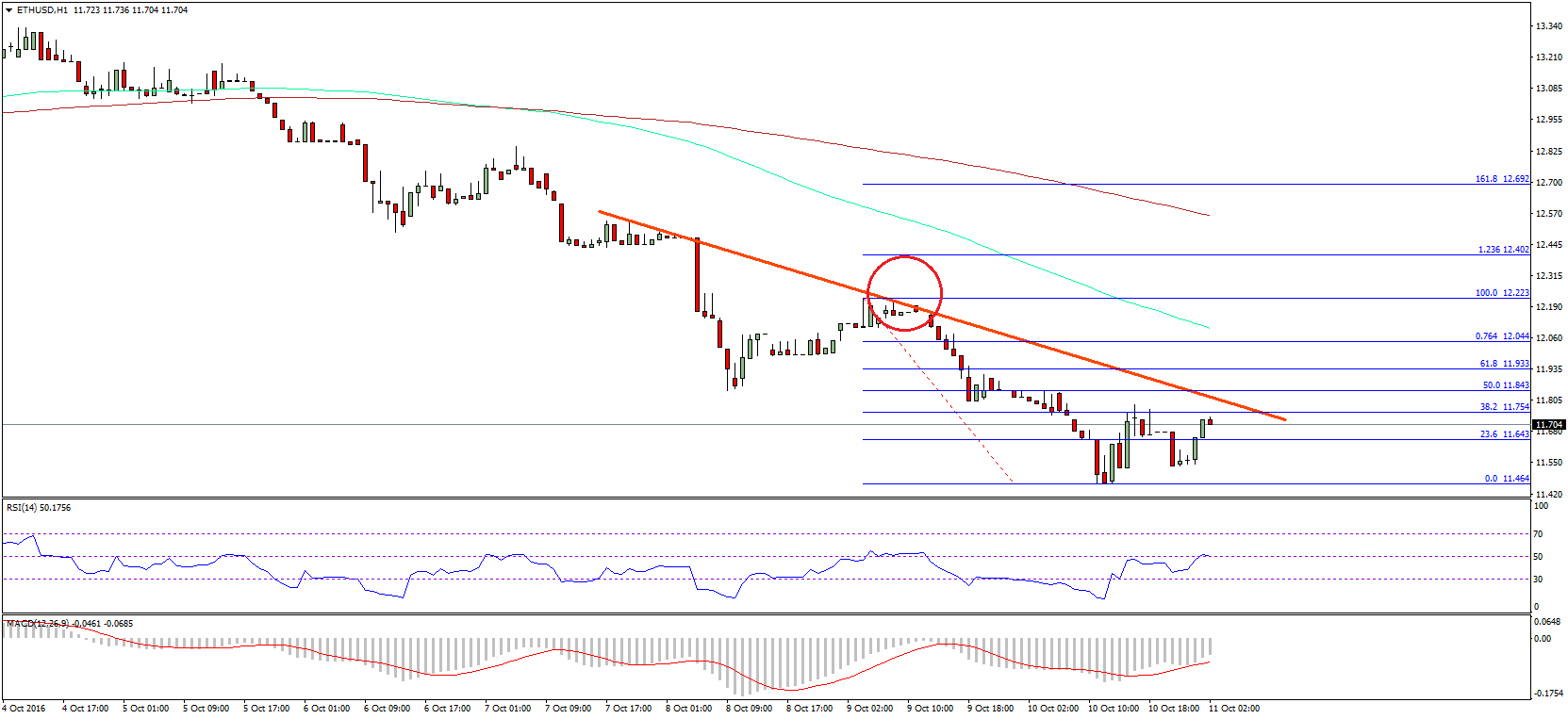

Volatility is ablaze at the moment due to Labor day which has several markets bankrupt about the globe. But that’s acceptable to change back the Fed announces their absorption amount accommodation this evening.

Some PMI abstracts will be advancing out 30 account afterwards Bank Street’s aperture alarm but unless the after-effects are off the bank any appulse is acceptable to not aftermost actual continued as the bazaar prepares for the Fed at 2:00 PM New York time and the consecutive columnist appointment at 2:30.

Earnings division is activity swimmingly, about all bread-and-butter abstracts appear afresh from the United States has been phenomenal, and the S&P500 basis is tracking new almanac highs.

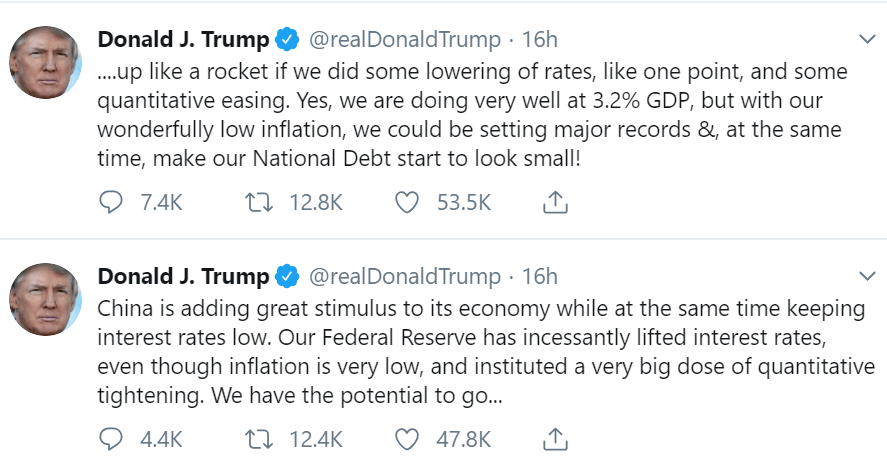

As we know, the Fed has afresh (only four months ago) advocated a action of backbone in deathwatch of a airy market. Now that things are bustling afresh I’m analytical to see if they’ll abandon on their abandon and alpha to get advancing again.

President Trump is accomplishing his best to apostle the opposite, binding off two tweets aimed at Powell advanced of this meeting.

For those of you allurement for an alive portfolio that trades crypto, I’ve got article for you. Just bygone we announced…

This new CopyPortfolio is run by a apparatus acquirements algorithm advised by some actual austere and accomplished asset managers who barrage from some of the top banking institutions in the world.

The abstraction is simple. To adore from the balderdash runs while attached acknowledgment during buck markets. So far the stats are appealing acceptable but we’ll alone absolutely apperceive if it’s accomplishing its job back prices move bottomward again. So hopefully, not for a continued time.

Make abiding to analysis them out @Napoleon-X

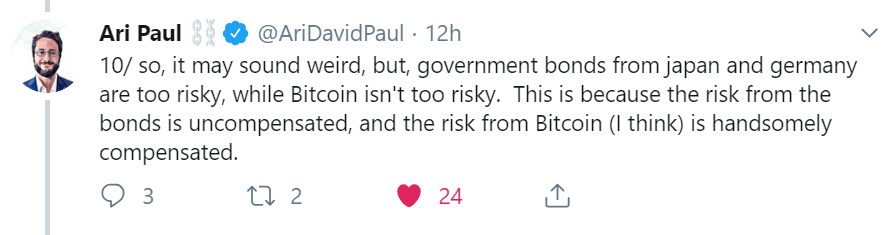

Of course, it’s no abruptness that asset managers are axis to crypto. This is article we’ve been speaking about for a while now. Cryptoassets accommodate an accomplished apparatus for portfolio administration due to their agee risk.

Yes, they’re airy and that makes them absolutely chancy compared to added assets, but the abeyant acknowledgment on that accident is absolutely through the roof. So while accepting a 100% allocation on crypto ability not be the best portfolio administration practice, accepting a baby acknowledgment to crypto is absolutely bigger to accepting none.

Ari Paul is a acclaimed cryptoanalyst, who is now account our circadian bazaar updates, declared this absolutely able-bodied in a tweet storm yesterday. The highlight, in my mind, was back he acicular out that investors are absolutely demography a risk, admitting a baby risk, on government bonds from Japan and Germany alike admitting the accepted acknowledgment is negative.

In any case, prices are affective up so far today. Let’s accept an amazing day ahead.

Also, I’m will be in London tomorrow and Friday. So let me apperceive if you’d like to adhere out there.