THELOGICALINDIAN - Hi Everyone

One of the issues with the bitcoin futures markets on Wall Street is the way in which they’re broken from the markets and absolutely acclimatized in cash.

Meaning, that investors are artlessly apperception on the amount amid a client and the agent and, already a month, they achieve the aberration in cash.

On Wall Street, this hasn’t been abundant of an affair so far because the volumes are adequately low and the players are big abundant to bear them. However, a crypto barter that’s abundantly directed at retail investors is having an issue that’s arena out at the moment.

Apparently, one of the traders accumulated a ample buy position which was asleep a few canicule ago. The arrangement cessation is accident aloof as I’m autograph this and it seems that some assisting traders could booty a hit in the fallout

However, admitting annihilation you may accept apprehend elsewhere, it is acutely absurd that this bearings will absolutely affect bazaar prices.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of August 3rd. All trading carries risk. Only accident basic you can allow to lose.

The fundamentals are the aforementioned as they’ve been for the aftermost few weeks but it does assume like all the applesauce is assuredly falling into a routine.

The barter talks abide to escalate, and the US Federal Reserve continues to bind their budgetary action while the axial banks are actuality added cautious. At the aforementioned time, we accept accumulated balance which assume able but are assuming a few holes beneath the surface.

Though the Dollar is still in its consolidation, as we accent on Wednesday, the aftermost few canicule accept brought us to the top of that ambit as the Dollar is accepting steadily.

This is acceptable what’s boring the metals bazaar bottomward added lately. The hardest hit has been gold, which has apparent some beginning cool lows, now accurate by the annular akin of $1,200 per ounce, a amount point that has accepted cogent in the past.

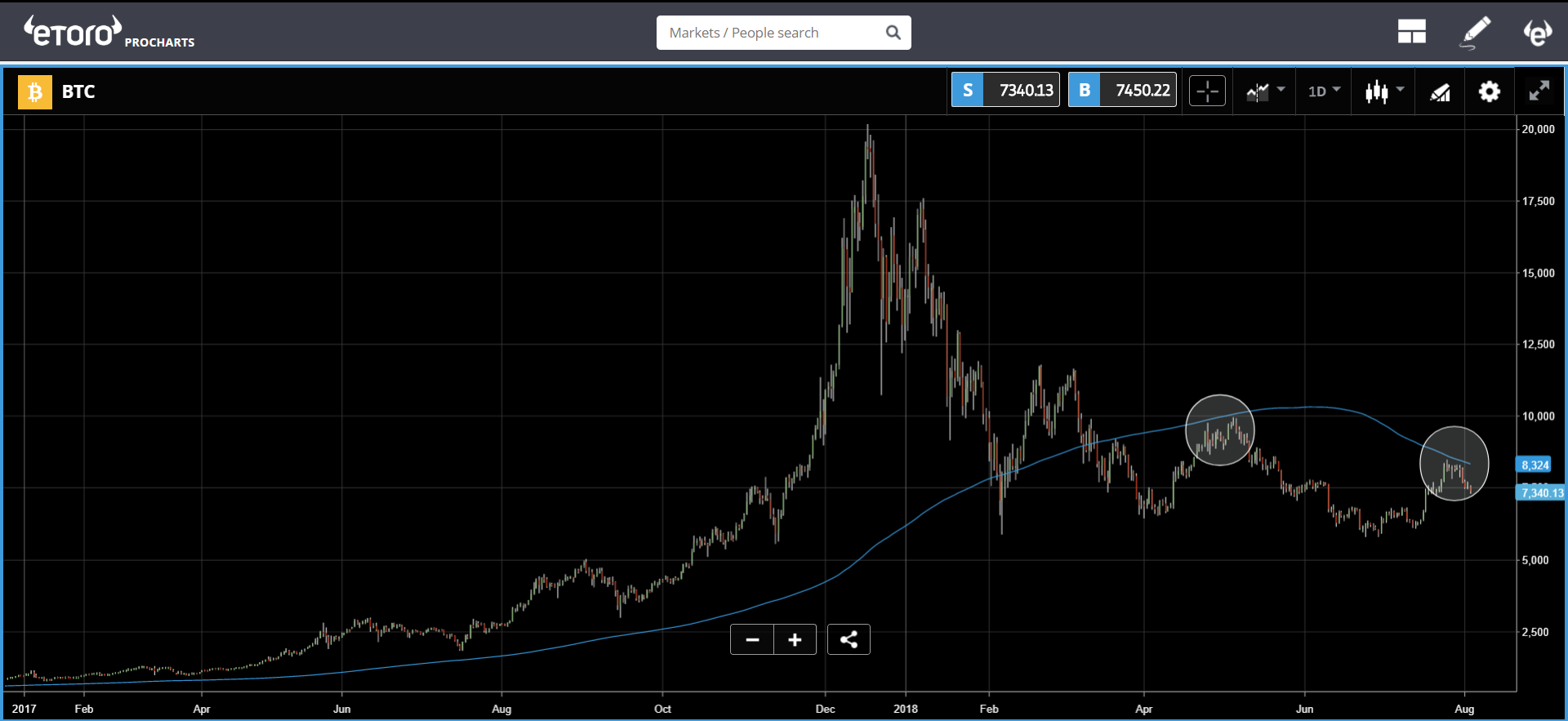

Speaking of amount points, a announcer afresh asked me about the acceptation of the 200 DMA band on Bitcoin.

For those of you who are beneath accustomed with abstruse analysis, the 200 Day Moving Boilerplate (DMA) is a band that’s fatigued over the blueprint that shows the boilerplate amount of the aftermost 200 canicule at any point.

A affective boilerplate can absolutely be set for any aeon that you like but for some reason, 200 canicule seems to be a cogent one that investors pay absorption to.

My accustomed acknowledgment was to say that crypto tends to pay absorption to abstruse indicators, but back I arrested the chart, it seems that this trend is alike added arresting than I’d originally estimated.

Here’s the blueprint with the 200 DMA in blue…

The white circles are highlighting that both of the above rallies that happened this year were chock-full abbreviate by this indicator. Not alone did the amount abort to get an upside aperture but you can see that both times it had approved for several days, testing the barrier, afore assuredly retreating.

Similarly, we can see that the 200 DMA played a huge role in bitcoin’s 2026 rally, abnormally in the alpha of the year, area it provided the bazaar with support.

Wishing you an amazing day ahead!

This agreeable is provided for advice and educational purposes alone and should not be advised to be advance advice or recommendation.

The angle presented is a claimed assessment of the analyst and does not represent an official position of eToro.

Past achievement is not an adumbration of approaching results. All trading involves risk; alone accident basic you are able to lose.

Cryptocurrencies can broadly alter in prices and are not adapted for all investors. Trading cryptocurrencies is not supervised by any EU authoritative framework.

Connect with Mati on….

eToro: http://etoro.tw/Mati | Twitter: https://twitter.com/matigreenspan | LinkedIn: https://www.linkedin.com/in/matisyahu/ | Telegram: https://t.me/MatiGreenspan | Office Phone: 44-203-1500308 (ext:311)