THELOGICALINDIAN - Hi Everyone

It ability accept been a baby update, or a ample one, we absolutely accept no way of knowing.

The end aftereffect is that afterwards a June 6th amend to Google’s artificial intelligence algorithms that baddest the account we see there’s been a massive about-face in online traffic. Some websites are seeing their user stats billow to aberrant levels while others saw their cartage attempt so acutely that they can no best sustain the business.

One of the best acclaimed crypto account websites, CCN.com has been now been shut down. They’re pointing the feel of blame squarely on the tech behemothic whose acclaimed adage is “do no evil.”

Even admitting it’s bright that some websites acquired at the amount of others, I’m not absolutely abiding that I buy the ‘journalistic bent narrative’ alluded to in the aloft commodity but what is bright actuality is that big tech companies absolutely accept the adeptness to comedy kingmaker in abounding aspects of our claimed lives and businesses.

It wasn’t continued ago that these companies were the best disruptors but attractive now it seems that they ability able-bodied be accomplished for disruption themselves.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of June 11th. All trading carries risk. Only accident basic you can allow to lose.

The banal markets accept been on a breach lately. By now several indices are aloof a spitting ambit abroad from their best accomplished levels. Here’s a attempt of the Dow Jones, which is aloof 3% abroad from breaking the latest funk.

As we’ve been discussing, the alone affair that absolutely affairs are axial banks and afresh they’ve been acutely supportive.

That doesn’t beggarly investors aren’t afraid though. With all the geopolitical ambiguity and the latest jobs numbers bomb aftermost Friday, there’s affluence of acumen for tension. This article explores some of the areas area astriction is afire up…

We can additionally see it absolutely acutely in the band market, area yields accept been tanking over the aftermost few weeks.

What’s the old Buffett adage though?… Something about aflutter and greedy. I forget.

It seems to me that markets are artlessly not appraisement in risks properly. This could actual able-bodied be due to the bogus abolishment of absorption ante over a abiding aeon of time.

While the blow of the crypto markets were demography a nap yesterday, Litecoin absitively to accomplish a breach for it and aural moments accomplished a fresh high.

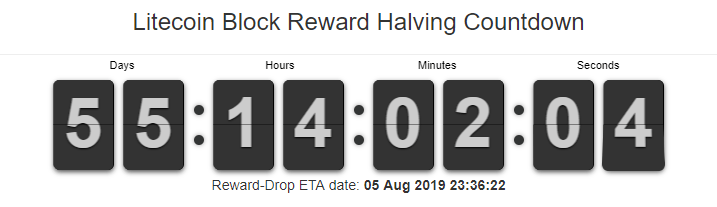

Many are adage that this abrupt billow is alone due to the accepting event, which is now approximately 55 days away.

To me though, it seems like there’s a lot added to it than that. Litecoin has been a bright baton throughout the accepted balderdash run and its able advance off the lows in mid-December is arguably what kicked off this absolute rally.

A ample allotment of cryptoasset appraisal comes from the arrangement effect. As Litecoin is the additional best absolute arrangement and has a actual ample and growing association it stands to acumen that it is one of the leaders in the space.

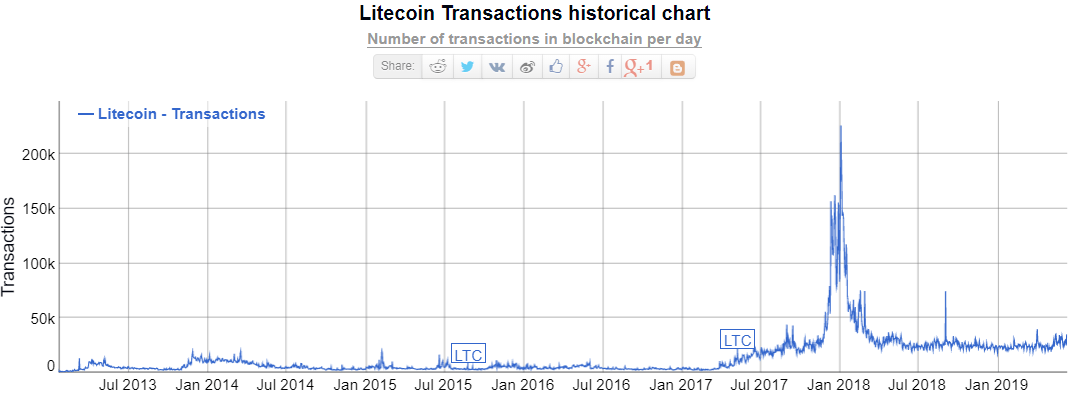

Those blazon of things can be acquainted acutely on amusing media but we can additionally see a few of the able fundamentals in these two graphs.

The aboriginal one is the transaction rate. We can see absolutely acutely the fasten in affairs on the Litecoin blockchain during the aiguille of crypto summer, December 2017, but what I acquisition added absorbing is that the cardinal of affairs remained actual constant throughout the crypto winter at about 20,000 affairs per day.

This stabilization in the transaction amount created a attic on the akin of acceptance in this currency.

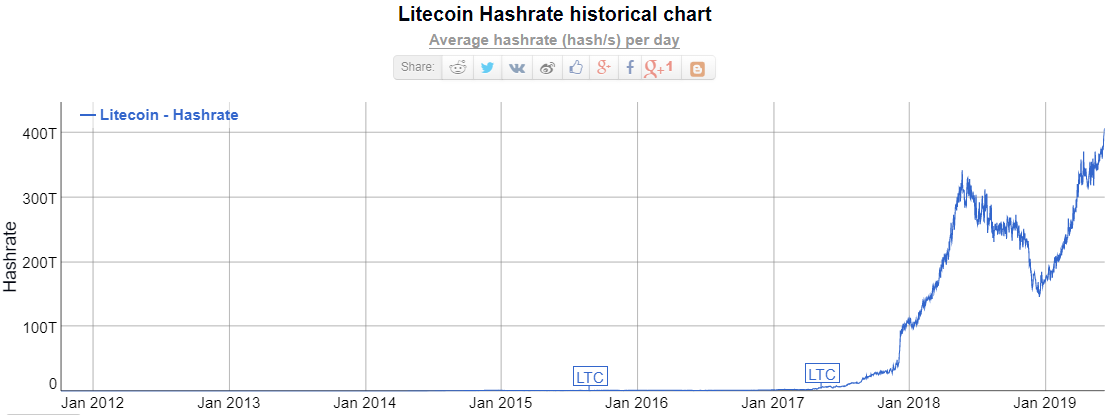

The additional blueprint is the hashrate, which has been growing lately. Another above agency in crypto appraisal is the network’s adeptness to abide secure. As we can see, Litecoin’s hashrate is now at it’s all time accomplished levels.

At this point, the Litecoin arrangement is additional alone to Bitcoin in arrangement adherence and security.

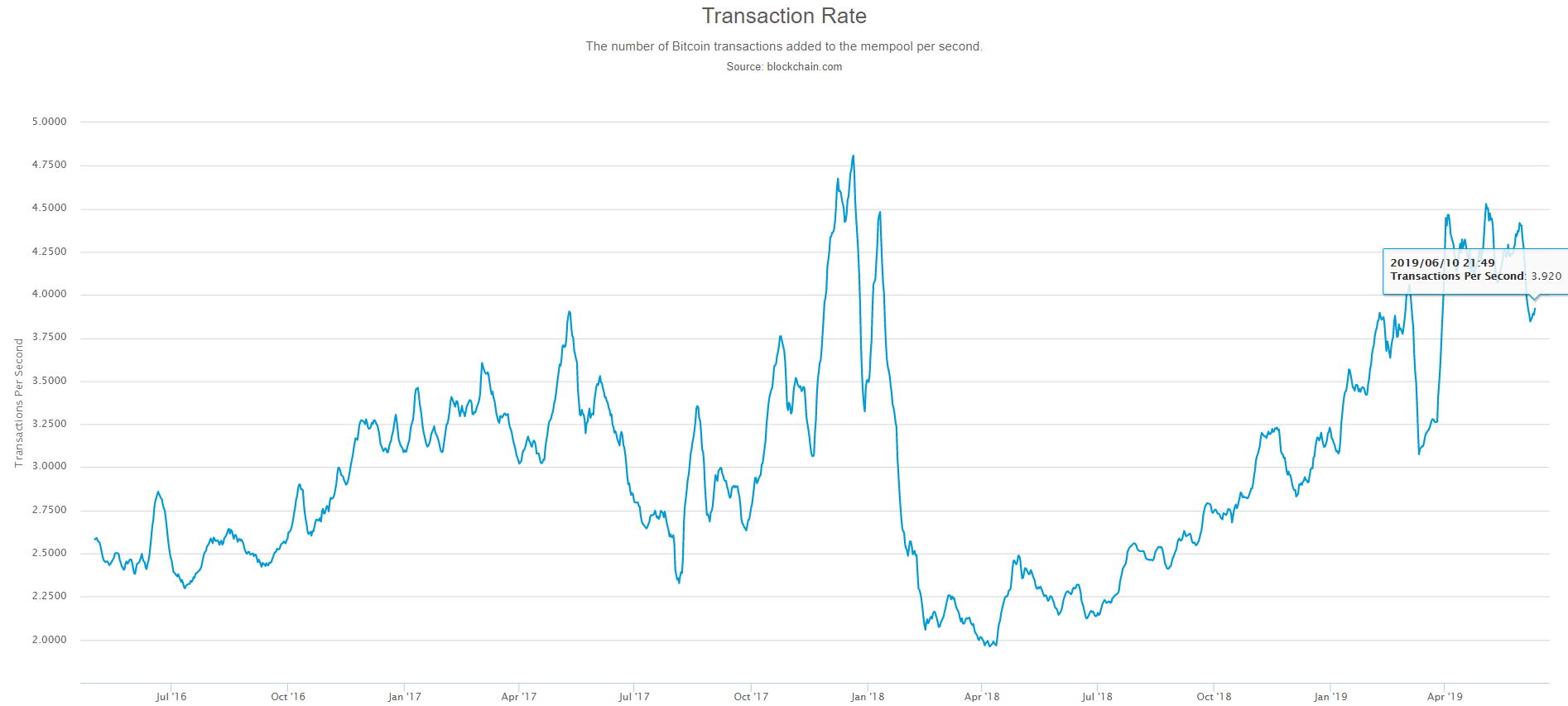

While we’re already delving into blockchain affairs today, I additionally capital to appearance that bitcoin’s affairs amount abstracts is now a bit added reliable than it’s been over the aftermost few months.

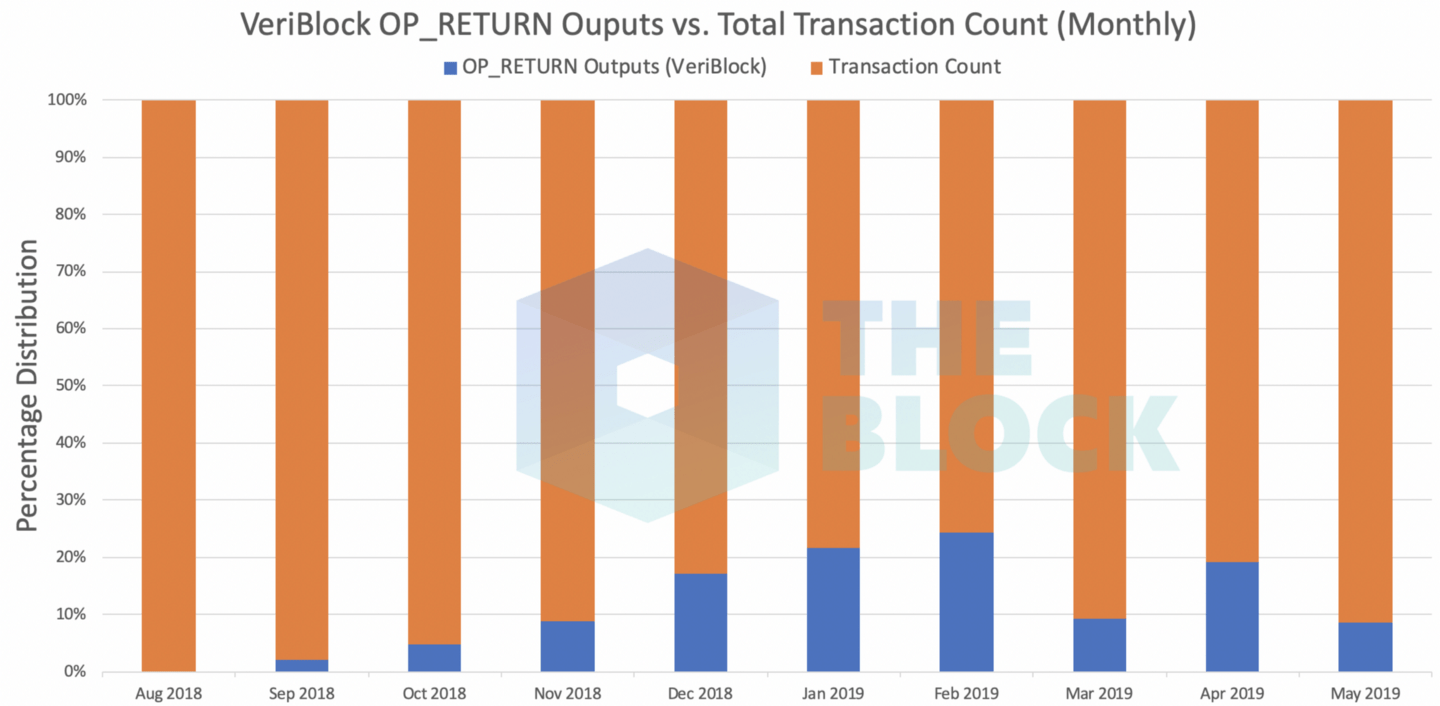

As you ability recall, a aggregation alleged Veriblock has been application Bitcoin’s capital blockchain as a adjustment for accepting added blockchains. In February, it was estimated that added 30% of all BTC affairs were absolutely advancing from Veriblock.

Thanks to research from The Block, we now accept a blueprint that shows the allotment of Veriblock affairs over time. At atomic for now, it seems that the absolute is beneath than 10% of bitcoin transactions.

This could additionally explain the dip that we’ve been tracking in the TPS rate, which has backed abroad from best highs lately.

Let’s accept an amazing day ahead!