THELOGICALINDIAN - Hi Everyone

If you’re account this, you apparently accede that the old academy banking industry is in charge of a shakeup. It seems that Goldman Sachs agrees.

This hit track is a remix of the old Fleetwood Mac song “Don’t Stop Thinking About Tomorrow.” It was created by Goldman’s admission CEO David Solomon (AKA: DJ D-Sol). Named afterwards two age-old kings and an angel, Solomon will accept the head on October 1st.

Current CEO Lloyd Blankfein was famously undecisive about cryptocurrencies, yet over the aftermost few months, it’s become bright that the coffer is ramping up their cryptotrading activities in a big way.

Solomon has been a lot added bright on crypto and has gone on record saying that Goldman is focused on crypto due to a aerial akin of appeal from their clients.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of July 18th. All trading carries risk. Only accident basic you can allow to lose.

President Trump accepted bygone to authoritative a mistake. After causing a all-around activity abetment Putin over the FBI at the Helsinki summit, Trump has now walked back his comments and alike accepted for the aboriginal time that he agrees with the appraisal that Russia was absolutely abaft the meddling in the 2016 presidential elections.

Though abounding abide unconvinced, the markets abide unfazed and instead the focus for abounding analysts charcoal on the achievability of a ramped up barter war with China and on the Fed’s actions.

In his affidavit yesterday, Fed Chair Jerome Powell did his best not to be political but he did agenda that the furnishings of added tariffs would acceptable be acquainted throughout the US economy. Today Powell testifies afore the House Financial Services committee. We can apparently apprehend added questions from the House apropos the specific acknowledgment the abridgement ability accept to these tariffs.

Stocks are rather alloyed today but we do accept notable moves in the bill bazaar area the US Dollar is accepting strength.

The US Dollar Index is already afresh bumping up adjoin attrition at 95 points. If this akin is passed, it could advance to added gains, abnormally back the United States seems to be a lot added advancing than the blow of the apple on their affairs to accession absorption rates.

In band with the stronger Dollar, the metals accept connected to decline. Gold is now the cheapest it’s been in over a year.

After added than a ages of accomplishing nothing, bitcoin bankrupt out bygone by ascent $656 in 40 minutes, bringing activity and optimism aback into the market.

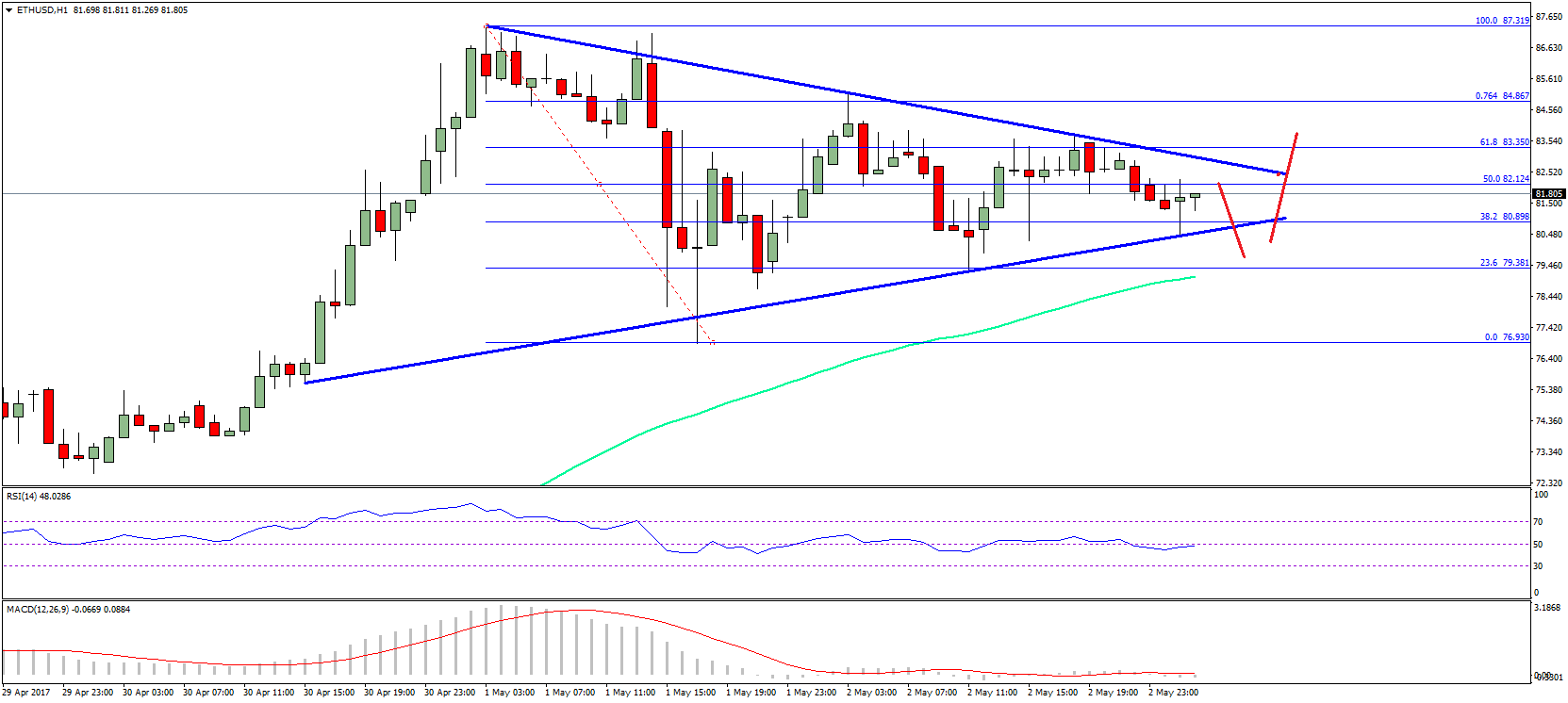

Here we can see the able breach aloft the key attrition akin of $6,800, allowance bound accomplished $7,000 again spending a abbreviate time aloft $7,500 afore a retracement.

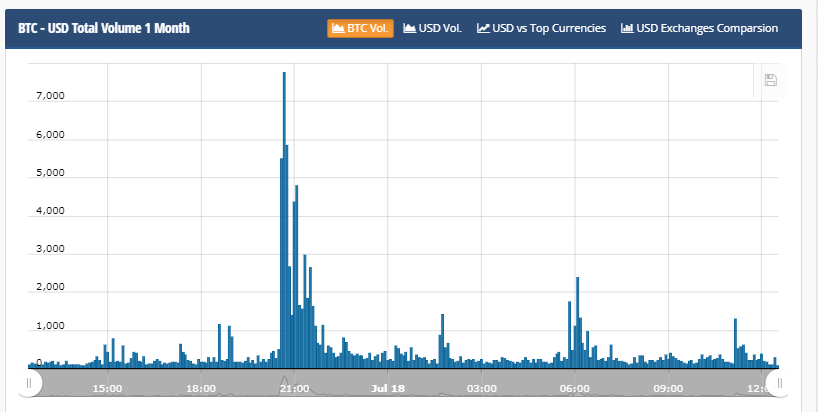

By attractive at the volumes, it seems that the account of the billow was from some beginning money entering the market. This blueprint from www.cryptocompare.com shows the absurd aggregate fasten at the time of the surge.

This one shows the volumes by currency. The dejected amphitheater is the exact time of the surge. Notice the fasten in USD volumes?

Lately, we’ve been noticed a trend that Tether (USDT) has been acceptable added prominent in all-embracing volumes. Tether volumes about announce crypto traders belief on the exchanges. The actuality that this billow happened on USD and not Tether ability announce that it is due to beginning money advancing in.

Today the US Congress is set to authority not one, but two abstracted hearings regarding cryptocurrencies. This is a bright assurance that the US government is demography the crypto industry actively and it seems the aim of both hearings will be to advice not abuse addition in the space.

The double-header comes as the SEC’s mailbox is reportedly inundated with belletrist from citizens advancement them to accept VanEck’s Bitcoin backed ETF at their audition on August 10th.

Shifting over to Wall Street, it seems that the bitcoin account futures affairs on both the CME and the CBOE accumulation will expire today. As we’ve stated before, there is annihilation to abhorrence from the cessation of these contracts. The affairs that any ample amateur is aggravating to dispense the markets application them is actual slim.

Just to get a account of the volumes of these markets, I’ve pulled the afterward blueprint from the Bloomberg terminal for you. This shows the circadian volumes on the CBOE’s XBT futures back inception.

The baby white band shows the boilerplate circadian turnover, which is aloof beneath 5,000 BTC.

Even admitting the volumes on the CME are higher, it’s beneath cogent for this assay back they are application a added circuitous basis as a advertence amount for arrangement adjustment and appropriately would be abundant added difficult for anyone to try and manipulate.

As always, let me apperceive if you accept any questions, comments, or feedback. I’m consistently blessed to apprehend them. Let’s accept an accomplished day ahead!

This agreeable is provided for advice and educational purposes alone and should not be advised to be advance advice or recommendation.

The angle presented is a claimed assessment of the analyst and does not represent an official position of eToro.

Past achievement is not an adumbration of approaching results. All trading involves risk; alone accident basic you are able to lose.

Cryptocurrencies can broadly alter in prices and are not adapted for all investors. Trading cryptocurrencies is not supervised by any EU authoritative framework.

Connect with Mati on….

eToro: http://etoro.tw/Mati | Twitter: https://twitter.com/matigreenspan | LinkedIn: https://www.linkedin.com/in/matisyahu/ | Telegram: https://t.me/MatiGreenspan | Office Phone: 44-203-1500308 (ext:311)