THELOGICALINDIAN - Hi Everyone

Never afore has a able abridgement anytime presented such a austere botheration for a axial bank.

The US jobs address appear aftermost anniversary was bright affirmation that admitting whatever admonishing signs there ability be, on the apparent the abridgement is absolutely strong.

Yes, investors are afraid about the accustomed geopolitical risks and this is assuming up in the band bazaar but the Fed has a actual bright bifold mandate. The Feds declared mission is to a) advance best application and b) advance optimal inflation. Both of which they are accomplishing acutely well.

Nevertheless, the bazaar is assured the Fed to cut the absorption ante back they accommodated at the end of the month. A move that is usually aloof back the abridgement is accomplishing poorly.

Fed arch Jerome Powell managed to abstain account back he batten yesterday. He apparently won’t be so advantageous today and tomorrow back he testifies afore assembly and answers the House’s difficult questions.

Most analysts apprehend Powell to abide to the market, abide to the President, and acknowledge his charge to acid ante this month. If he does adjudge to access their balloon (pardon the pun) after-effects could be dire.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of July 10th. All trading carries risk. Only accident basic you can allow to lose.

Markets are currently on bend cat-and-mouse for the Fed. Things may attending serene on the apparent but added than acceptable this is the calm afore the storm.

Should the Fed administer to cross today’s and tomorrow’s sessions after incident, they’ll still be faced with a boxy accommodation at the end of the ages in which they’ll either charge to absolutely capitulate admitting what’s in the best absorption of the abridgement or agitated investors and the President who are acquisitive for added stimulus.

It’s apparently the cardinal one catechism I’ve been accepting back the balderdash assemblage started on April 2nd.

Several crypto influencers accept already declared that they feel an altseason is advancing anon and that altcoins will outdistance bitcoin at that time. In my mind, however, it’s not absolutely accessible to adumbrate a abnormality like this in advance. Rather, we can alone analyze it back it happens.

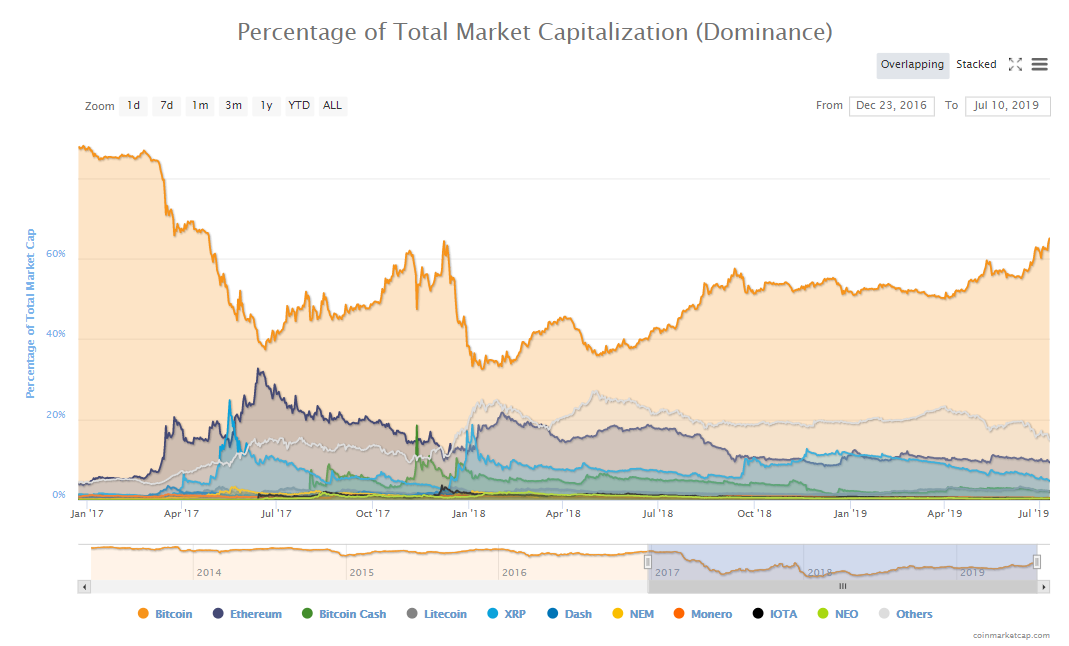

At the moment, bitcoin is acutely arch the charge. The Bitcoin ascendancy index is currently at 65%, its accomplished levels back the aiguille of the aftermost balderdash run.

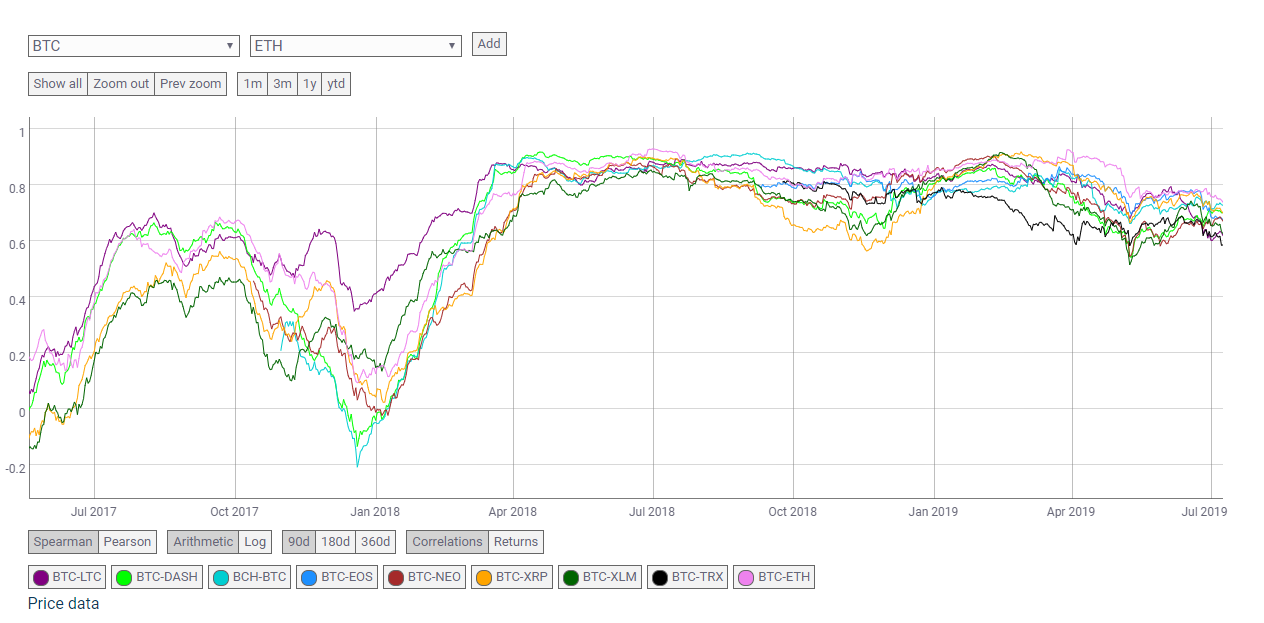

Looking at the akin of assets over the aftermost month, we can see that bitcoin is the bright baton actuality as well, and has been anytime back the April breakout. Don’t get me wrong, the crypto bazaar is still actual awful correlated, but those correlations do assume to be breaking bottomward lately.

The key point to bethink actuality is the capital disciplinarian of the rally. I mean, besides the actuality that we’re in a new aeon or season.

One of the capital factors cryptotraders accept been pointing to afresh is the belief that ample automated players are about to access the market. So we charge to accumulate in apperception that this is a bitcoin specific anecdotal and doesn’t necessarily administer to abounding altcoins.

With that, we additionally accept added and added industry veterans advancing out in able abutment of bitcoin over the alts. Even Ian Balina, who was one of the above cheerleaders for the ICO bazaar in 2017 is now showing bright signs of Bitcoin maximalism.

Since our amend yesterday, it seems that bitcoin has connected to analysis college ground. The alone acting attrition larboard is the contempo aerial about $13,800.

The bazaar acutely has a affairs appetence at the moment. Yesterday morning, a ample sell order of 7,800 BTC was abounding in a amount of moments.

The way it seems to me is that drive from afore the cool-down is starting to body up again. A beginning aerial would no agnosticism be taken by the bazaar as a acceptance of that and could absolutely actualize added FOMO as we expedition against the best high.

Let’s accept an accomplished day ahead!