THELOGICALINDIAN - Hi Everyone

The ability of any arrangement is the bodies who abutment it and accept in it. Crypto is no different. Of course, abounding of those who are heavily accepted in the old banking arrangement are unsurprisingly unswayed by the allowances of crypto, but that’s alteration rapidly.

We ahead appear that Niall Ferguson, the man who actually wrote the book on the change of money, had afflicted his apperception from actuality a bitcoin agnostic to a fan.

Yesterday, I was on the radio with Bloomberg and the host said to me, “you apperceive it’s absorbing that your comments are so in band with our antecedent bedfellow Mark Mobius.”

Seriously?!

For those of you who don’t know, Mark Mobius is a allegorical broker who is acclimated to managing billions of Dollars, mostly in arising markets. He’s on record as actuality adamantly against to Bitcoin and adage that it has no amount proposition.

However in this account yesterday (timestamp 6:30), he bidding the “desire from bodies about the apple to alteration money calmly and confidentially” and said that he believes bitcoin will survive.

Still, actuality a businesslike investor, Mobius has not yet himself invested in bitcoin due to the acute volatility.

Mark!!… The animation is one of the best adorable qualities of crypto from an asset managers perspective. The abstraction of agee accident allows us to use this different and uncorrelated asset chic to abundantly access our acknowledgment on accident in any contrarily well-diversified portfolio.

Just as I, in my portfolio, am holding about 3.5% in arising markets, I accept that one day anon asset managers about the apple will alter with crypto.

While we wait, let’s comedy a bold alleged “who is gonna cast next?”

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of May 16th. All trading carries risk. Only accident basic you can allow to lose.

Stocks abide to baffle the politicians and are continuing to balance from the contempo trade-war-driven dip. The activity from abounding analysts seems to be that the new tariffs and counter-tariffs are already priced in and unless we see a austere abasement from here, there’s alone upside potential.

Such deterioration, of course, does abide a audible possibility. Even today we saw headlines like.

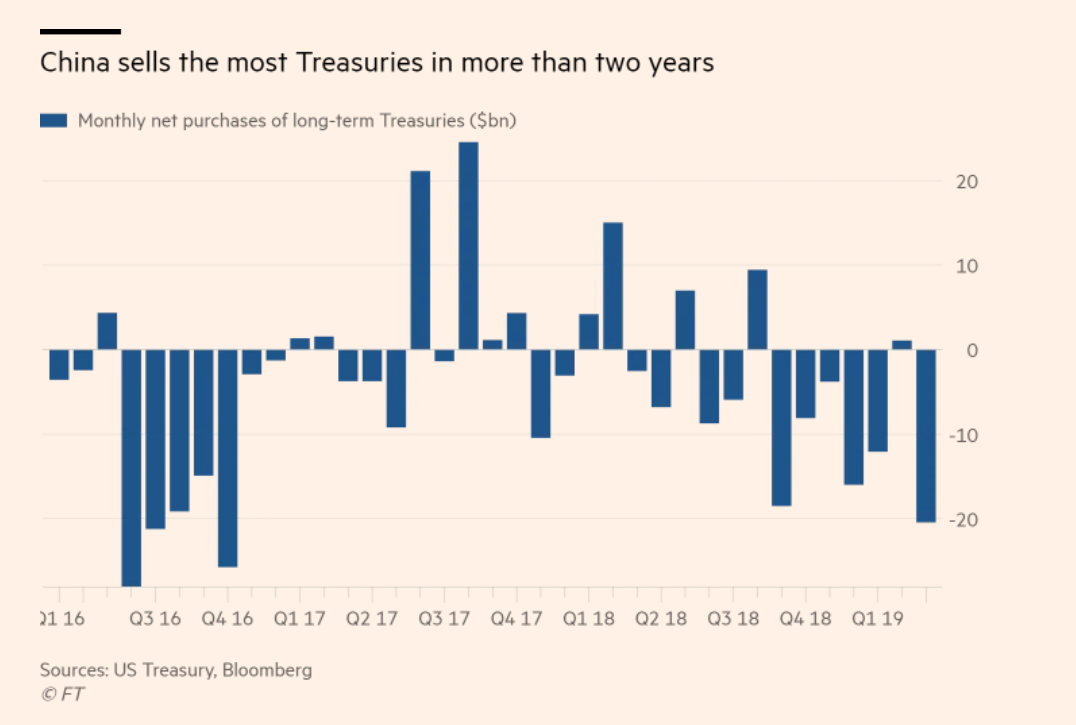

China isn’t demography this lying bottomward either. We can see that over the aftermost division China has offloaded US debt at its fastest clip in added than two years.

As China is the better holder of US debt, this is a bit apropos and represents a notable accretion in the barter war. The abhorrence and we haven’t apparent it yet, is if China decides to cheapen to the Yuan. Such a book doesn’t assume likely, as it would accompany the currency’s adherence into catechism and could account Chinese citizens to try accepting their money out of the country. However, if backed into a corner, they may accept no added advantage but to booty the hit in adjustment to account the tariffs.

Here we can see that the USD has been accepting against the CNH lately. The cardinal to watch is the abundant bank of cerebral attrition at seven Yuan to the Dollar.

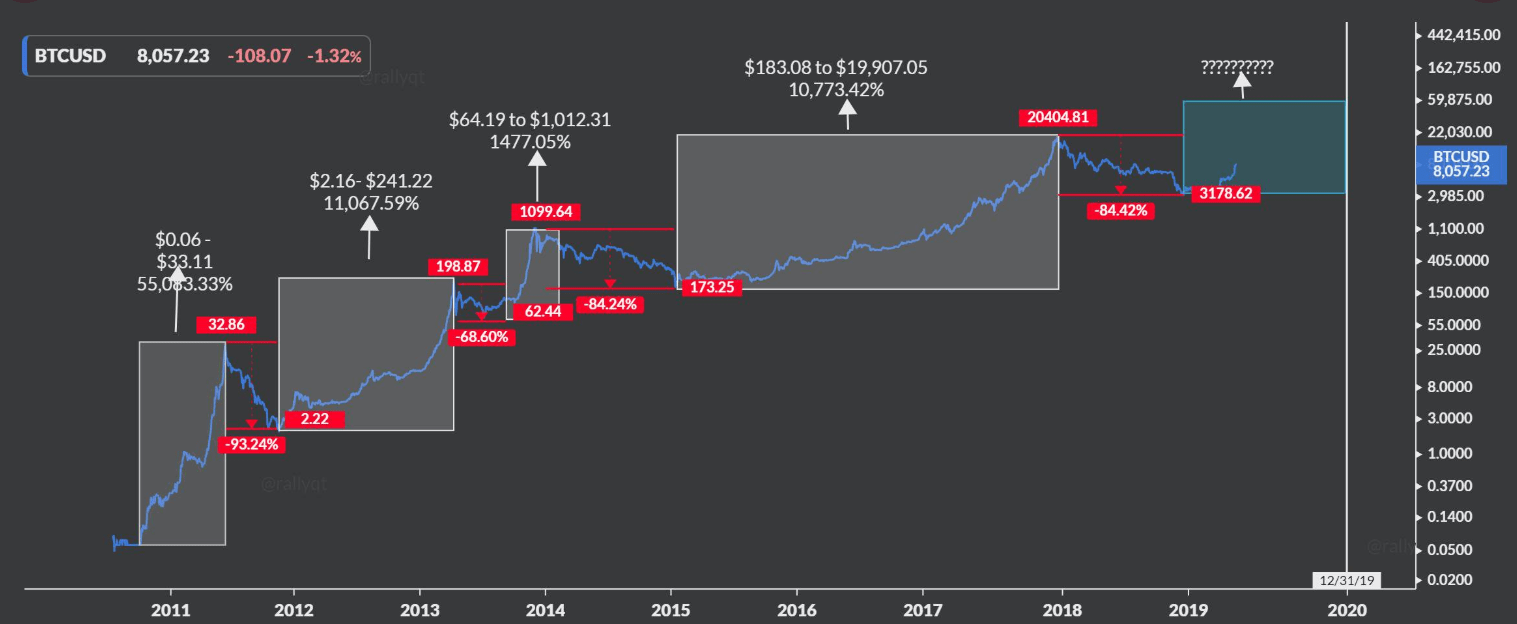

Those of you who’ve been account for a while apperceive that we’ve been talking about bitcoin’s balderdash and buck cycles a lot, in apprehension of history repeating itself. Of course, accomplished achievement is not an adumbration of approaching after-effects but I anticipation that this blueprint assuming bitcoin’s antecedent balderdash runs and massive pullbacks was account sharing.

Notice that it is on a logarithmic scale, which is actual accepted amid cryptoanalysts. It shows the highs and lows of anniversary aeon and the allotment assets and losses on anniversary one. Chart acclaim goes to @rallyqt.

Crypto markets are disturbing to authority on to some of the aerial levels apparent this week. Bitcoin itself aloof doesn’t assume to be able to accumulate aloft $8,000 and as I address it seems like a pullback is assuredly advancing in.

Even John McAfee, the man whose ‘reputation’ is on the band for a massive moon, has recently stated that we could see a abrupt pullback.

In all fairness, we can’t absolutely adjudicator the backbone of the balderdash run or alike apperceive if we’re in a balderdash bazaar until we see a few pullbacks and continuations. Until then, all we’re seeing are acting movements and not an all-embracing trend.

Still, if it is the case that we’re activity to the moon from a actuality a pullback has the abeyant to act as the ballista that will booty us there. Nobody wants to FOMO in at the top, so a accurately sized pullback could accommodate bodies who absent the aftermost beat to accompany in at a bigger price.

The admeasurement of the pullback will additionally be significant. For example, if the affliction is over appropriate now, again that is an abundantly bullish sign. If it takes us aback to analysis $6,000 and again continues to breach aloft the contempo highs, I would say that would be the alpha of a advantageous balderdash market. If, on the added hand, a ample pullback comes and takes us aback beneath $5,000 again this absolute affair may accept been for naught.

We’ll see how it goes.

Let’s accept a flipping amazing day.