THELOGICALINDIAN - Hi Everyone

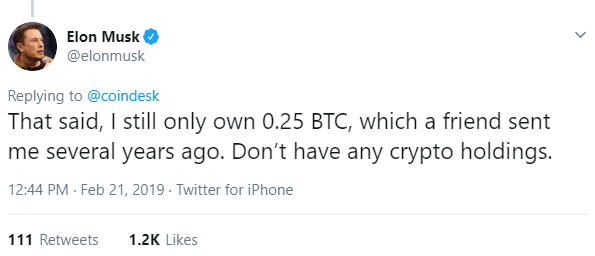

The acclaimed tech brilliant Elon Musk fabricated account by commenting on cryptos. However, abounding of the accessories assume to absence the point of what Elon was absolutely saying.

For those who would like to know, here’s the articulation to the interview, the comments about crypto appear at the actual end (timestamp 25:25).

What became bright to me was that Elon wasn’t actual absorbed in talking about it all. Though he did his best to axis aback to Tesla, the accuser Tasha Keeney did her best to accumulate him on it. At which point he artlessly declared some of the accessible pros and cons of agenda assets. Responding on cheep aloof a few moments ago he wrote…

So, the guys got one bottom in and one bottom out. Far from a analyzer but not an apostle either.

Certainly, if Musk capital to appear out as a crypto fan he could accept taken the Abating Torch as his acquaintance Jack has done (discussed in a antecedent bazaar amend titled: Sudden Change in Outlook). In fact, the CEO of Twitter and Square has wandered added bottomward the crypto aerial aperture today by trying out the new abating powered tip bot tippin.me.

The XRP association was quick to point out that sending tips on Twitter has been accessible for some time through the @xrptipbot. As addition who’s beatific and accustomed tips through both apps, I can say that they’re both accessible to use and neither seems to accept any accurate bend over the other.

Tipping agreeable creators is arguably one of the best boilerplate use cases for internet money, the custom has been animate and thriving in China for added than a decade already. The alone aberration is that in the East, it’s added of a bankrupt ecosystem that was set up by Tencent, and I’m captivated to see that as it catches on in the West, bodies are amalgam with some of the top cryptos.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of February 21st. All trading carries risk. Only accident basic you can allow to lose.

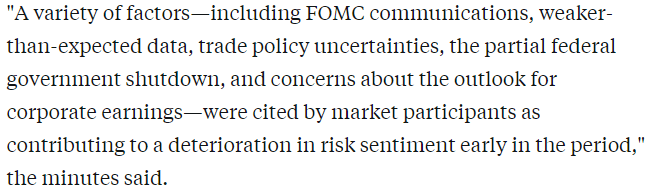

The FOMC absolution aftermost night did, in fact, about-face active bygone as the Fed adumbrated they’re activity to leave the antithesis area abandoned for now, but the clip of ascent absorption ante was still actual abundant in question.

By this access in the FOMC’s affair minutes, accent by Business Insider, we can see that the Fed is actual careful of the appulse they’re accepting on banking markets, which is arguably the capital acumen for their abrupt about-face in policy.

Stock markets are disturbing to acquisition a administration this morning. Both the Asian and the European affair are abiding alloyed after-effects as the US futures attempt to authority their gains.

Following January’s abundant recovery, there assume to be abiding questions amid analysts about all-around advance and whether ascent accomplishment ability alpha bistro into accumulated profits.

The United States Dollar has pulled aback a bit from the highs, yet still charcoal airy about its mid-range (dotted white line). The ascent approach (yellow lines) is able but some anticipate that this pullback is alone abbreviate appellation as it builds up abundant backbone to breach through the cerebral barrier at 97.25 (blue line).

Given the Fed’s new policy, it would accomplish faculty for the Dollar to weaken. However, this hasn’t happened at all. In fact, the opposite. This could be due to the actuality that all of the added axial banks are additionally demography accompanying measures to abate their own corresponding currencies.

This could additionally be why we’ve apparent the Dollar’s bead this morning met with a bead in Gold. The two usually move adverse anniversary other, so to see them traveling the aforementioned administration today is a rather attenuate sight.

This move did action while Europe was putting out adequately able PMI data. So a added absolute affect there puts the acknowledgment in a bit bigger ambience of course.

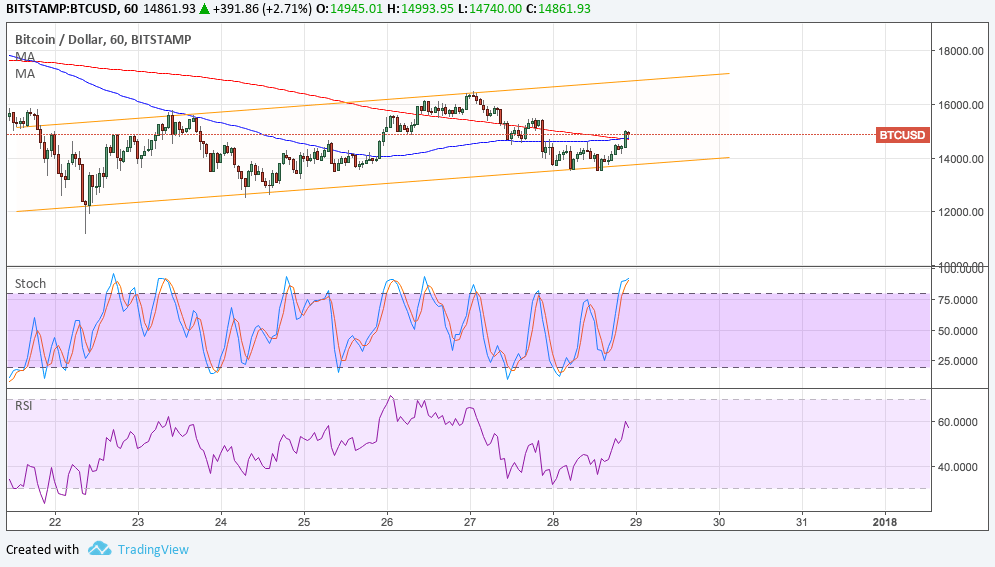

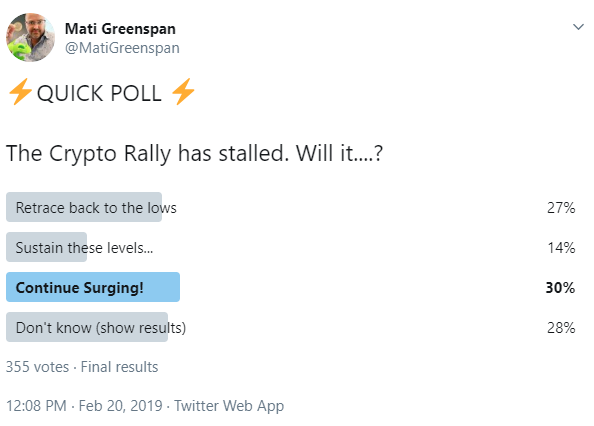

After the able assemblage that we saw in the crypto markets this week, it wouldn’t at all be hasty to see some array of pullback or consolidation. Though it’s bright such a pullback would be disappointing to some.

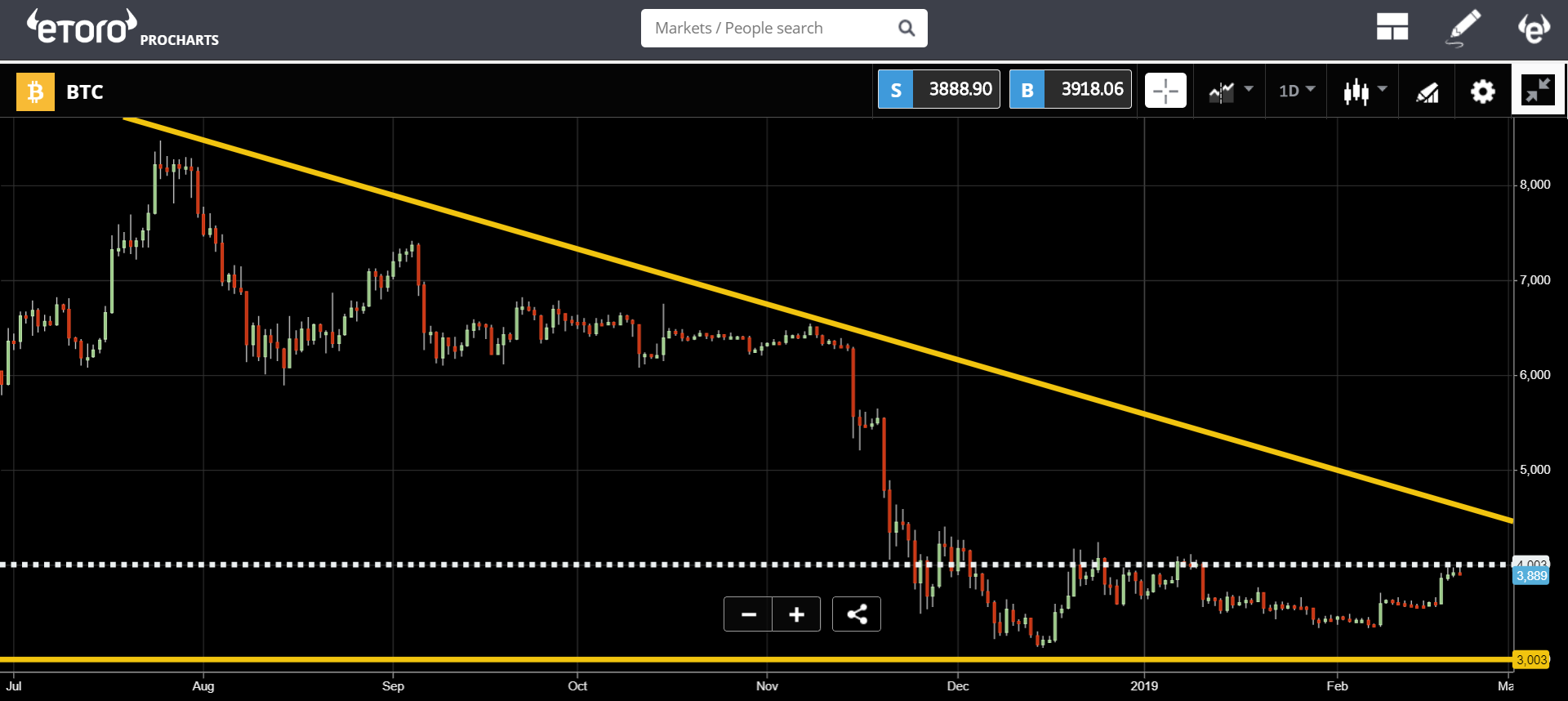

Putting the assemblage into added context, I’d like to zoom in on our bottomward block that we’ve been tracking for the accomplished few weeks. For now, the bazaar seems to be flirting heavily with the $4,000 akin (dotted white line).

Volumes have cone-shaped off hardly to about $28 billion over the aftermost 24 hours. Still abundant college than the $15 billion it was at aloof two weeks ago. This is a acceptable assurance that cryptotraders are watching closely at the moment as the battle royale for $4k plays out.