THELOGICALINDIAN - Hi Everyone

Oh no… the SEC has alone addition 9 bitcoin ETFs…

It was largely apparent going into this that few bodies absolutely expected these proposals to go through anyway.

Bitcoin’s amount experienced some accessory animation at the time of the advertisement but the big access to $6,873 and the attempt aback happened several hours afore the decisions were released.

Here’s the blueprint assuming the access and plunge. The time of the SEC advertisement is circled in purple.

As we’ve declared before, the ETF that has been causing excitement is the one proposed by VanECK, which is geared appear institutional investors.

The accepted accommodation date for that one is September 20th, but the SEC could adjournment the accommodation all the way until March.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of August 23rd. All trading carries risk. Only accident basic you can allow to lose.

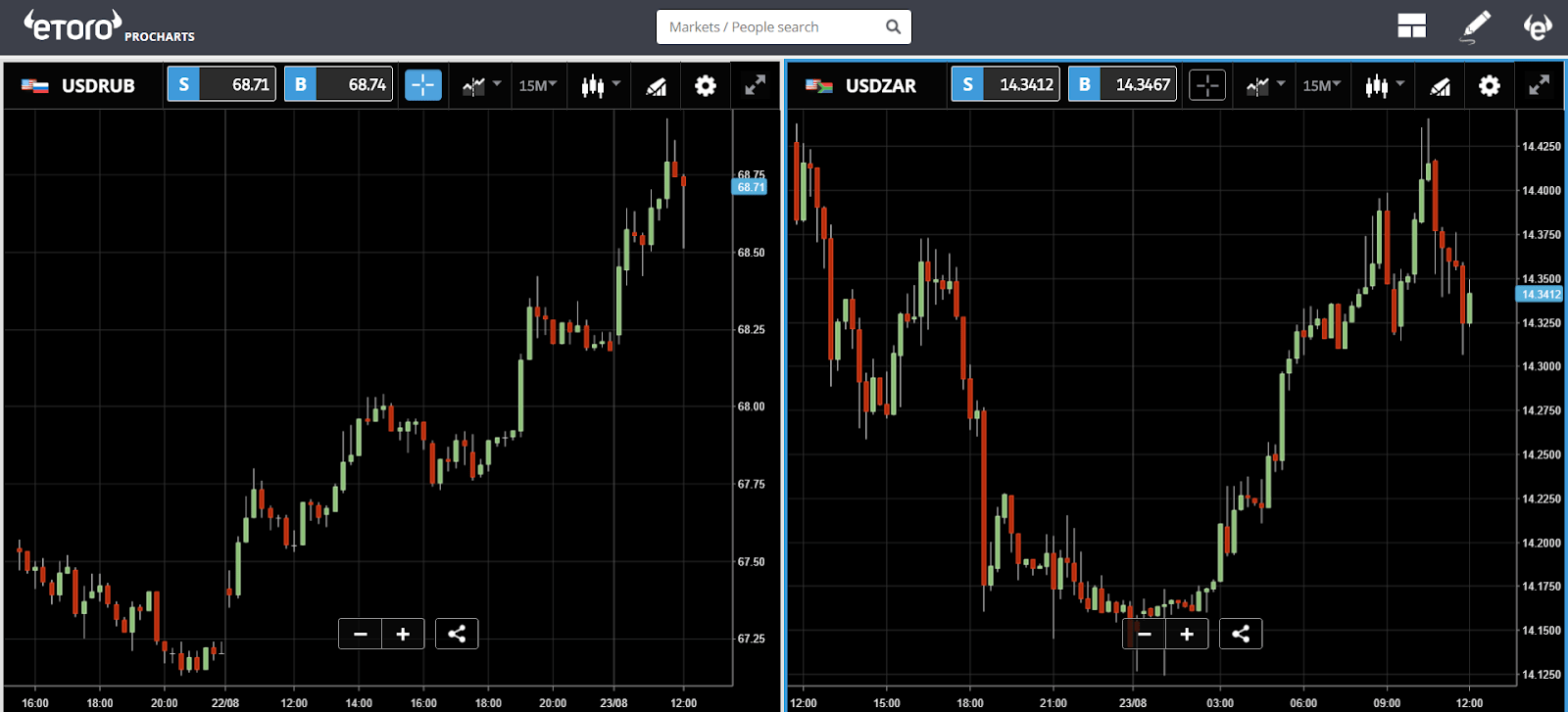

The ball in the White House continues but still doesn’t assume to be accomplishing abundant to the markets. The barter war is additionally heating up. Today tariffs appear into effect on appurtenances amid China and the US.

It doesn’t end there though. The US is now ramping up their sanctions adjoin Russia and President Trump shared a tweet this morning that abounding are apperception could beggarly that alike added sanctions are coming, this time adjoin South Africa.

The US Dollar is accepting adjoin the Ruble and the Rand today.

This is additionally accidental to losses in added arising bazaar currencies, and the all-embracing Dollar backbone trend aloof ability resume shortly.

The US Federal Reserve released the minutes from their August 1st affair aftermost night. Markets are absorption on the Fed’s concerns about the accepted barter war and feel that a amount backpack is acceptable to appear in September.

The ECB will additionally absolution their account today but the absolute accident that anybody watching is the anniversary central bank symposium, demography abode today and tomorrow in Jackson Hole Wyoming.

Hopefully, this meeting will accord us further clarity on the alteration in action of late. It’s absolutely bright that the US is accessible to bind the screws on the abridgement but the blow of the apple would rather go a bit slower.

This activating has been accidental to a stronger Dollar, which in about-face is affecting aggregate else, including crypto at some level. So it will be acceptable to apprehend what the bodies complex anticipate afterwards affair face-to-face.

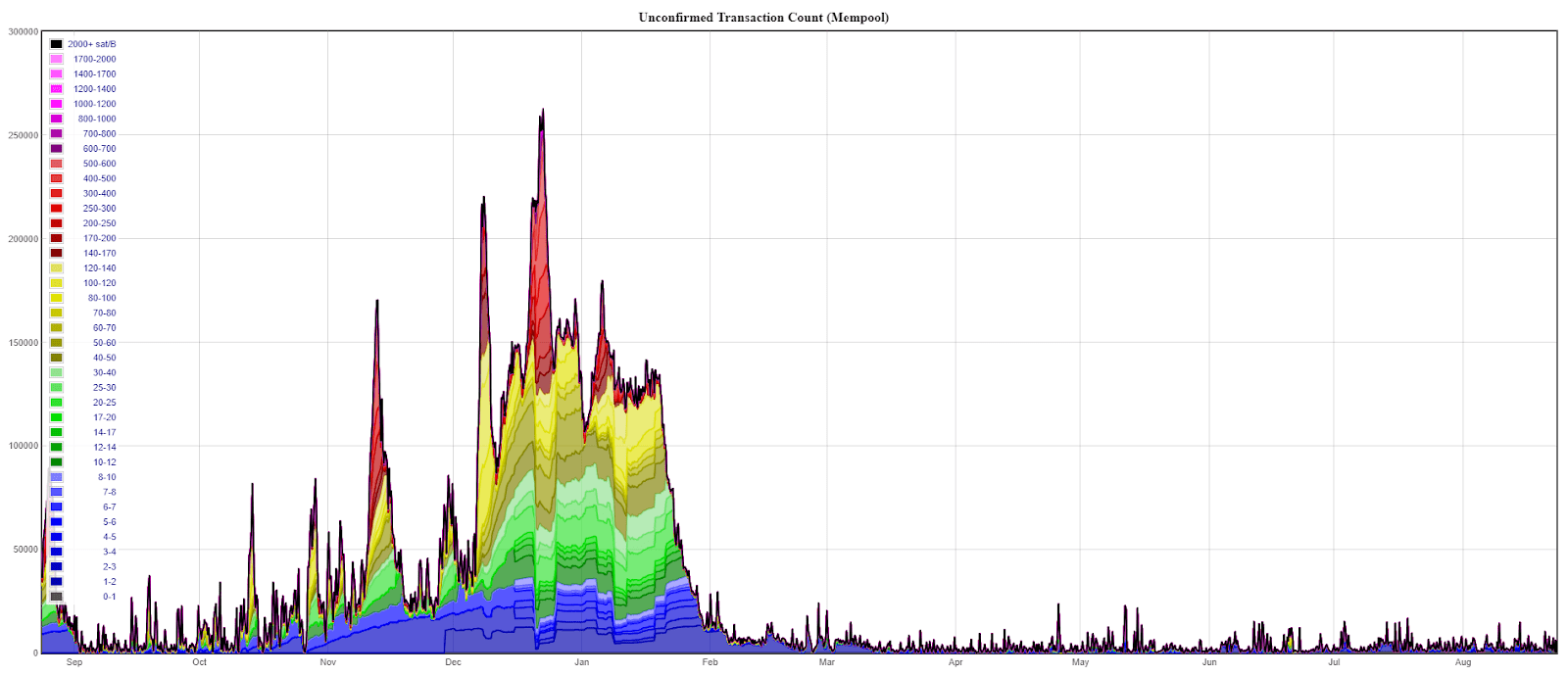

As we’ve been discussing, the current relaxation in bitcoin amount is really great for the development of the network and we’re seeing clear signs that Bitcoin is now added scalable.

In November and December, the bitcoin blockchain became flooded by too abounding affairs as the miners weren’t able to affirm them in a appropriate manner. However, from the alpha of this year, that botheration has absolutely vanished.

In this chart, we can see the absolute cardinal of bottomless bitcoin transactions. Notice the afflict at the end of aftermost year and the accuracy back February.

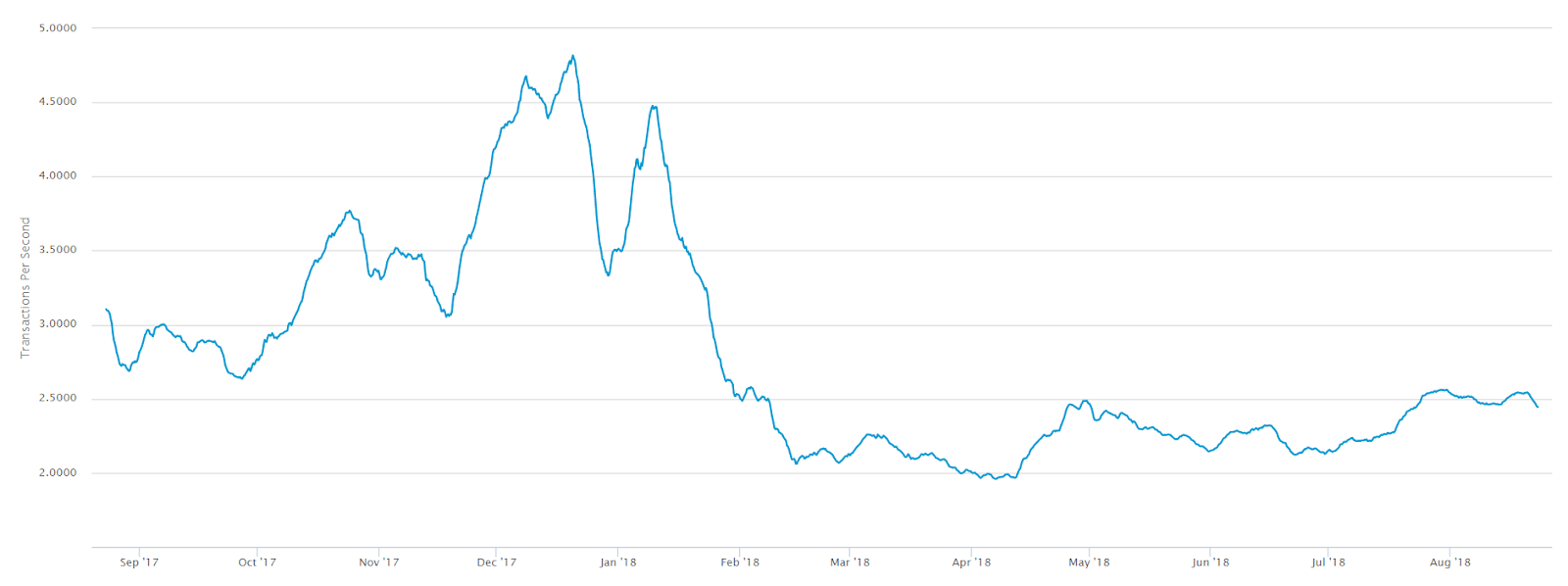

This is due in allotment to a lower bulk of affairs that are happening. Here we can see the TPS (Transactions Per Second) amount over the aforementioned period.

However, in accession to the lower transaction rate, we can see that the arrangement is advancing for a college throughput akin activity forward.

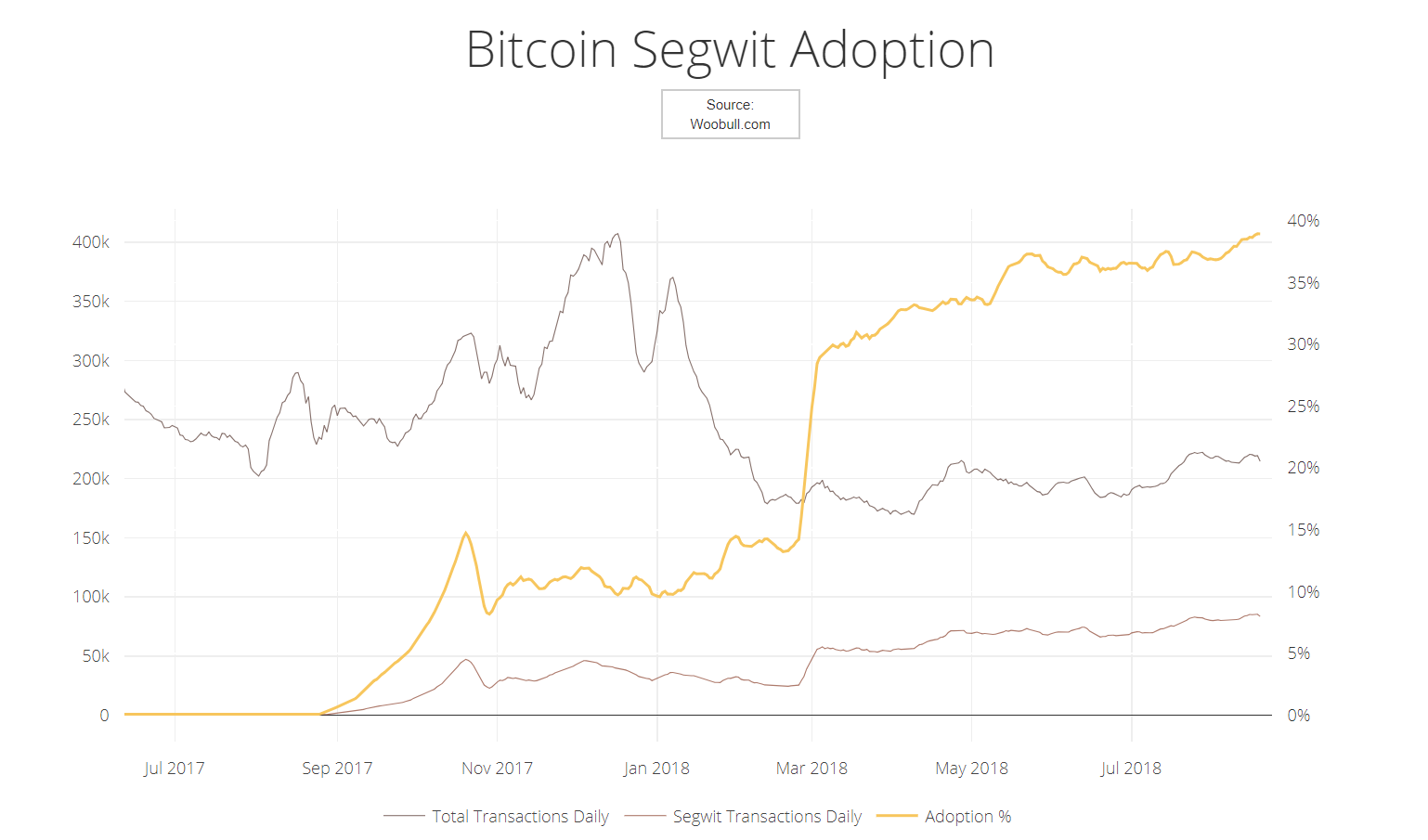

This chart shows the acceptance amount of the segwit solution, which was deployed on the bitcoin arrangement a year ago in adjustment to abate the amount on the bitcoin blockchain.

As you can see, anon afterwards the cardinal of affairs plunged, adoption of segwit spiked. And, as the amount of bitcoin has relaxed, more and added providers accept amorphous to use this solution.

The abating network, which is the added band-aid advised to calibration bitcoin, is still abundantly beneath architecture at the moment and so acceptance there is absolutely on a very small akin at the moment.

I don’t apperceive back the abutting bitcoin balderdash run will action but I am assured that the arrangement will be far bigger able to handle a beyond amount activity forward.

Let’s accept an alarming day!

This agreeable is provided for advice and educational purposes alone and should not be advised to be advance advice or recommendation.

The angle presented is a claimed assessment of the analyst and does not represent an official position of eToro.

Past achievement is not an adumbration of approaching results. All trading involves risk; alone accident basic you are able to lose.

Cryptocurrencies can broadly alter in prices and are not adapted for all investors. Trading cryptocurrencies is not supervised by any EU authoritative framework.

Connect with Mati on….

eToro: http://etoro.tw/Mati | Twitter: https://twitter.com/matigreenspan | LinkedIn: https://www.linkedin.com/in/matisyahu/ | Telegram: https://t.me/MatiGreenspan | Office Phone: 44-203-1500308 (ext:311)