THELOGICALINDIAN - Hi Everyone

Speaking on the sidelines of the all-around G20 acme in Japan, Haruhiko Kuroda, the Governor of the Bank of Japan (BoJ), fabricated some simple yet abominable statements.

Ever back his US analogue Jerome Powell angry ultra-dovish aftermost Tuesday, around all axial banks accept followed suit. So, it’s no abruptness that Kuroda-san feels that there is added allowance to activate the abridgement if needed.

Skeptical assemblage are of advance quick to point out that the BoJ already has the bread-and-butter pedal to the accepted metal back it comes to bread-and-butter stimulation. Interest ante accept been abrogating for added than three years now and the Bank of Japan now owns best banking assets in the country.

Economic bang was declared to be a acting admeasurement in acknowledgment to a all-around banking crisis. Yet, actuality we are added than a decade into this abundant bread-and-butter agreement and the world’s axial banks are accepting accessible to activate more.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of June 10th. All trading carries risk. Only accident basic you can allow to lose.

Markets are in an accomplished affection this morning. Not alone is the Fed now accepted to cut ante as anon as of abutting month, but we alike accept a bit of a change of heart from Donald Trump.

Yes, that’s right, Donald J Trump has backed off the Mexico tariffs that he sprang on the markets by surprise, but some say that the accord fabricated to abstain them was absolutely in abode able-bodied afore the tariffs were announced.

In any case, markets are breath a abundant blooming blow of abatement this morning.

Today is a coffer anniversary in several countries but it seems like best markets are up and active. After the contempo action changes from the axial banks, investors will acceptable about-face their focus to the G20 affairs in Japan.

There are a abundant abounding items on the G20 calendar for this summit, big items and far too abounding to list. For example, my augment on amusing media has already apparent several accessories that accomplish it assume like the absolute G20 is all about crypto.

Though the official acme is appointed for June 28th, it seems that several important affairs accept already taken place. For example, a affair of top accounts ministers has already produced a resolution that will acceptable bedew affect on the FAANG stocks alike added today.

At the moment, the big tech firms are able to address their taxes appealing abundant wherever they like. Often times a close will address taxes in a low tax country such as Ireland or Luxembourg, alike admitting their casework were bought in a altered market.

The new angle seeks to accomplish things a bit added fair by demanding tech giants according to area the amount is created.

In any case, the big-ticket accident for the G20 will acceptable be the much-anticipated affair amid Donald Trump and Xi Xinping.

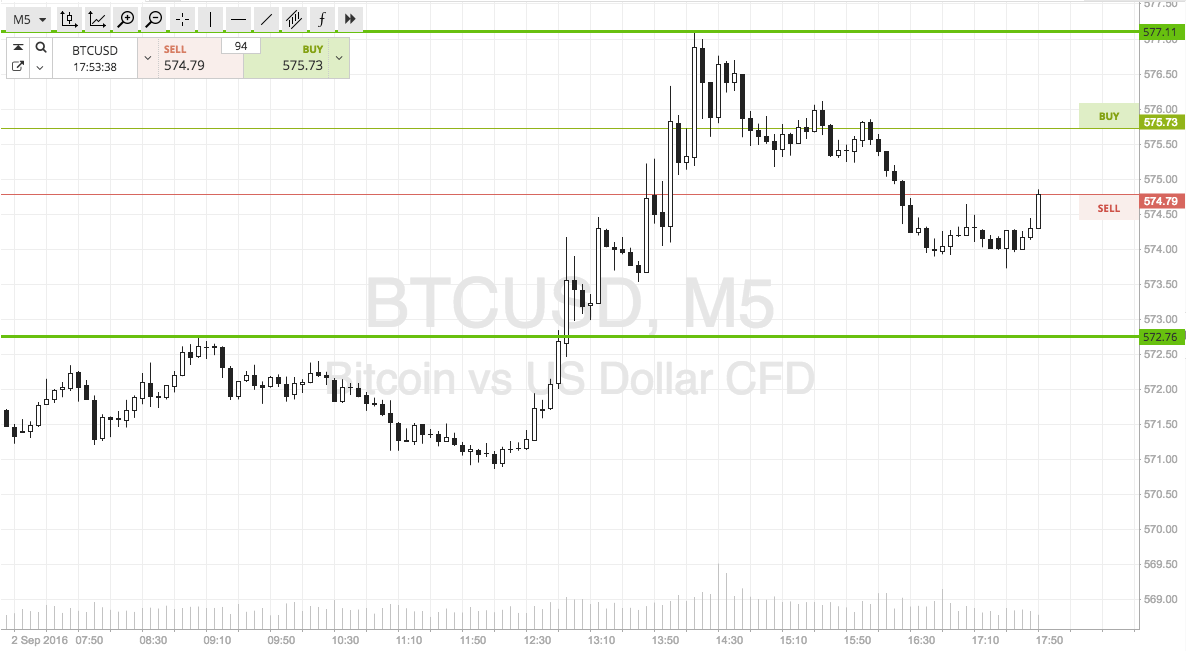

There are ablaze red flashes beyond the crypto amplitude this morning as the pullback we’ve been watching afresh deepens. The weekend started out abounding of optimism but affect took a about-face for the worse by Sunday afternoon as the lows were tested.

Bitcoin is currently disturbing to authority abutment at $7,500 and aloof about all the top-cap cryptos are at a accident over the aftermost 24 hours. Volumes are additionally adversity appropriate now and are at their everyman levels back afore the mid-May surge.

Still, as we’ve been adage the crypto surges accept been abundantly able this year so these blazon of pullbacks and relaxations are absolutely welcome.

Even as I address though, it looks like we’re accepting a nice advance of that support, so let’s see area this goes.

Let’s accept an amazing anniversary ahead.