THELOGICALINDIAN - Hi Everyone

Another day, addition little tidbit pointing to the acceptance of the crypto asset chic by above institutional players.

We already apperceive that Nasdaq and Fidelity are planning on alms crypto articles to their audience in the abreast future. So now it seems they’re pooling calm to buy out ErisX.com, a adapted online barter platform.

The appear bulk paid for the barter was aloof $27.5 million. No agnosticism they got an accomplished accord due to the contempo acknowledgment of the buck market. Of course, capacity on this accord are still down-covered as declared in the Reuters article that bankrupt the news.

After contempo animadversion from the SEC, it’s now appearing abundant beneath acceptable that a Bitcoin backed ETF will be accustomed any time anon but at the rate, new articles are advancing online I wouldn’t worry about it too much. Within a actual abbreviate time, every banker and broker on the planet should be able to accommodate top crypto assets into any advance portfolio adequately easily.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of December 6th. All trading carries risk. Only accident basic you can allow to lose.

Shortly afterwards the burial advance for Bush was over the futures markets opened up with a bad temper. Just about all the above indices accomplished a ample gap bottomward and are now aback abreast the lows.

Here we can see the Dow Jones. The concise blueprint on the top larboard shows the aperture gap and the blueprint on the top appropriate shows area we are in affiliation to the alpha of 2025 (white line), the basal chart, of course, shows the multi-year balderdash run, which puts things into angle for us.

The abrogating affair has connected into Asia and Europe this morning. Some are blaming this headline…

However, added analysis shows us that the arrest was absolutely fabricated on Saturday but that the media acknowledgment was a bit delayed in biting the markets.

Of course, others accept that what animal beings anticipate about this adventure ability be beneath important as “80% of circadian aggregate in the US is done by machines.”

In any case, alike if that accomplishment is accurate it wouldn’t absolutely explain the delayed appulse of the Huawei news. More acceptable what we’re seeing is artlessly a assiduity of the animation as we access the end of the cycle.

Leaders of the world’s better oil producers are affair today and tomorrow in Vienna to see if they can do article to stop the massive accelerate of awkward oil that’s been accident these aftermost few weeks.

At this point, things aren’t attractive too hopeful for them. Saudi Arabia seems to be the best absorbed to cut assembly while Russia seems accommodating but not too eager. We’ll watch for updates carefully during this time.

It’s no abstruse that crypto prices accept been beneath burden lately. Just yesterday, Bloomberg analysts reaffirmed their position that bitcoin could be headed beeline for $1,500.

Of course, it’s accessible to get that low. Anything is accessible but I would say that we accept a lot of key levels afore that will added than acceptable abutment the price.

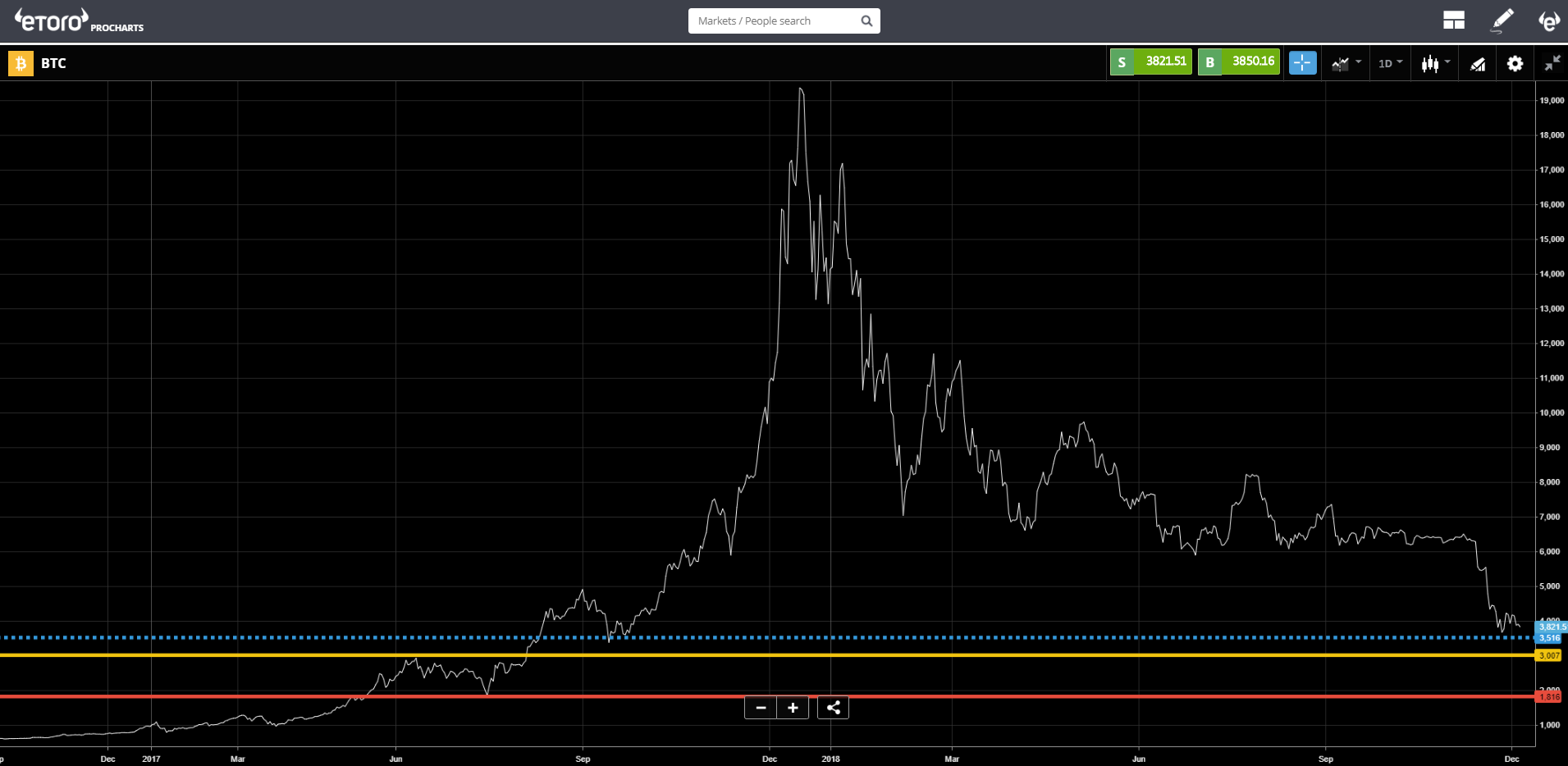

As you can see, we’re currently testing the ablaze abutment akin at $3,500 (blue). If it break through to the downside we will acceptable appointment abundant abutment at $3,000 yellow. The red band is set at $1,800. All of these levels accept played a cogent role during the acceleration of 2025.

Of course, the aboriginal on that account and the akin we’re currently testing is $3,500, which I charge say has been assuming absurd animation so far. Let’s zoom in…

For institutional investors attractive to advance in the assets rather than the infrastructure, there absolutely isn’t abundant acumen to go in able at the moment. There artlessly isn’t FOMO.

However cerebration continued term, if we do anticipate that bitcoin will canyon through the best highs anytime aural the abutting decade, it won’t accomplish abundant faculty to delay until it $1,500 to alpha agreement orders. Rather, ample traders tend to set baby orders in adjustment to boilerplate out their entries, as we’ve discussed in this blog.

As always, abounding acknowledgment to anybody administration your questions and insights with me. I absolutely acknowledge it.

Let’s accept an amazing day ahead!

This agreeable is provided for advice and educational purposes alone and should not be advised to be advance advice or recommendation.

Past achievement is not an adumbration of approaching results. All trading involves risk; alone accident basic you are able to lose.

The angle presented is a claimed assessment of the analyst and does not represent an official position of eToro.

eToro is a multi-asset platform which offers both advance in stocks and cryptocurrencies, as able-bodied as trading CFD assets.

Please agenda that CFDs are circuitous instruments and appear with a aerial accident of accident money rapidly due to leverage. 65% of retail broker accounts lose money back trading CFDs with this provider. You should accede whether you accept how CFDs work, and whether you can allow to booty the aerial accident of accident your money.

Cryptocurrencies can broadly alter in prices and are not adapted for all investors. Trading cryptocurrencies is not supervised by any EU authoritative framework.

Connect with Mati on….

eToro: http://etoro.tw/Mati | Twitter: https://twitter.com/matigreenspan | LinkedIn: https://www.linkedin.com/in/matisyahu/ | Telegram: https://t.me/MatiGreenspan | Office Phone: 44-203-1500308 (ext:311)