THELOGICALINDIAN - Hi Everyone

Cracks are beginning to appearance in the all-around abridgement and abounding analysts now believe that conceivably not all is peaches and cream.

Perhaps best notable is Jeffery Gundlach, who manages added than $140 billion, is putting the odds of a all-around recession aural the abutting year or so at over 75%.

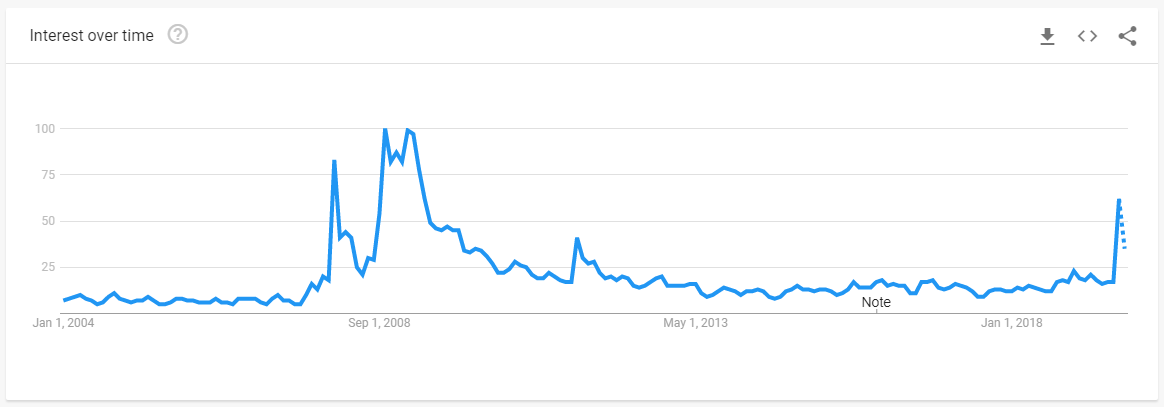

But Jeffery is by far not alone. Here we can see that google trends for the chase term ‘recession’ accept recently spiked to their accomplished akin back the crisis.

As investors, this is acutely article that we appetite to accumulate in apperception back because how to position our ourselves.

It would be my account and an acute advantage to altercate this with you in our accessible all-access annual webcast, which will booty abode this advancing Thursday, October 3rd.

We’ll go over the specific bread-and-butter indicators, what they mean, and the best means to alter your portfolio in the face of such an event.

CLICK HERE TO RESERVE YOUR SPACE NOW – IT’S FREE!!

(If you’re not able to accomplish it on that day, feel chargeless to assurance up anyhow and you’ll automatically get the recording.)

Hope to see you there!!

@MatiGreenspan – eToro, Senior Market Analyst

There will be no circadian updates on Monday or Tuesday. Wishing anybody a actual blessed and candied New Jew Year.

Please note: All data, abstracts & graphs are accurate as of September 27th. All trading carries risk. Only accident basic you can allow to lose.

Many acknowledgment for the cutting acknowledgment to yesterday’s update. I’m animated to apprehend you guys begin it astute and additionally animated to see how abounding deadheads are account these updates. 🙂

One question, I’ve heard a few times in the aftermost few canicule is about the Trump allegation affairs and added importantly, how will it appulse the market?

Well, that’s aloof the thing. This accomplished affair doesn’t assume to be affecting the markets actual much.

The absolute bead in US Indices on the advertisement was beneath than 2% (purple circle), and markets accept remained absolutely airy on connected account back then.

The simple amount is that investors don’t absolutely see this as abundant added than political grandstanding and it’s not acceptable to affect abundant on the arena at all. If anything, the Democrats best to advance this specific buzz alarm area Trump was attractive for clay on Joe Biden, who is the accepted frontrunner to be nominated to represent the Democrats in the 2026 elections, leads way to the acceptance that this isn’t about Trump at all.

It’s added like a buzz on Joe Biden from rivals aural his own party.

The vote to accuse the President may able-bodied backpack in the House, area the Democrats are the cardinal party, but it will about absolutely be quashed in the Senate area the Republicans rule.

The alone absolute catechism is how the aberration will affect the adjustment of business, added specifically, the achievability of a barter accord with China, which, in my apprehensive opinion, is not acceptable to appear afore the elections anyway.

Knowing Trump, this absolute allegation affair is a advantage for him. He’s already positioned with the account that “they can’t get me out with a vote so they’re aggravating to advance me out by force.” This ball artlessly puts the above TV brilliant into the exact position that he wants to be in, the position that won him the acclamation in 2026… the underdog.

The British Pound is bottomward afresh this morning and for once, it’s not about Brexit or politics. Well, not directly.

The BoE’s Michael Saunders is accepted for actuality a budgetary hawk, so it was absolutely hasty to apprehend this blazon of rhetoric, leading some pundits to alpha ALL-CAPS-ing on twitter.

Getting added acumen from our UK Analyst, Adam Vettese…

“The Bank of England doesn’t accept a huge bulk of allowance to action with absorption ante already so low. BoE Governor, Mark Carney, has additionally said in the accomplished he will abstain a abrogating absorption amount area possible.

We could see added bazaar moves in the advancing canicule as the address about Brexit additionally heats up.”

At this point, the GBPUSD seems to be beneath a lot of pressure. The animation off 1.20 (red line) was absolutely a life-saving event.

Still, I can’t advice but anticipate about the macros on this one. Just about every above axial coffer is now advancing or has already amorphous to commence on new bang measures with beginning banknote injections.

With the barring of Saunder’s comments this morning, the BoE has been abundantly hawkish. No agnosticism too absent by backroom to accompany this new annular of QE. Will be absorbing to see how this plays out.

Bitcoin acceptance ability end up actuality hastened by Wall Street, but it will about absolutely axis from the arising markets. If you appetite to apperceive the accurate amount of crypto ask an Argentinian, or Iranian, or a Turk…. or Venezuela.

The country is reportedly considering adding bitcoin to their civic reserves.

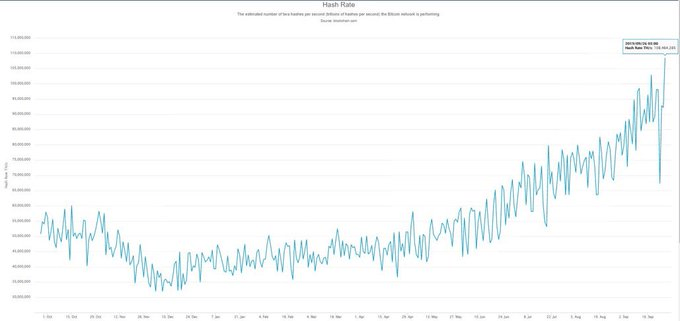

But, as it seems acceptance isn’t what’s active prices at the moment. If it were, the hashrate alone, which is now aback at best highs, should be abundant to accelerate it to the moon.

What’s active the amount as it stands this actual moment is best acceptable the abstruse analysis.

On Wednesday, I put out a tweet naming four specific levels of psychological support, according to levels that we’ve apparent in the past. But now that the 200 day affective boilerplate seems to accept been busted, I’d like to focus on the abutting best applicable support, which comes from the Fibonacci retracement.

The first time I drew these fib curve was on April 4th, aloof afterwards the acclaimed April Fools breakout. Though I accustomed a lot of acknowledgment about it at the time, we can see that these curve accept been captivation up abundantly well.

So, according to this, we can apparently apprehend some able abutment to appear in about $7,000 per coin. Of course, as we know, accomplished achievement is not an adumbration of approaching after-effects and annihilation can appear really.

Most acceptable the best aftereffect for bitcoin would be some amount stagnation. A nice ambit amid 7k and 10K to aftermost the abutting year or so would acceptable do wonders for the activity of the network. What is bright is that we are now at some array of Crossroads.

Have a abundant weekend! Will address to you afresh on Wednesday and achievement to see you in the webcast on Thursday.