THELOGICALINDIAN - Hi Everyone

We can’t aloof abolish history every time article new is invented. The development of crypto-assets makes accessible article that’s never been apparent before, programmable money.

The applications of this are bound alone to the animal imagination. However, as investors, we abundant abide to carefully watch what’s accident in the added markets in adjustment to accept the ambience of the movements in the crypto market.

As we’ll analyze below, as this new industry matures, the correlations amid the stocks, commodities, currencies, and crypto are growing anytime stronger.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of August 27th. All trading carries risk. Only accident basic you can afford.

The abridgement is able and the United States is activity to abide to accession its absorption rates. This is the bulletin from the Chairman of the US Federal Reserve Bank, the alignment that has the best access all-embracing money on the planet.

Yet, alike as the Fed is signaling that they will tighten, the US Dollar connected to soften, aloof as it has been accomplishing back extensive a new aiguille on August 15th.

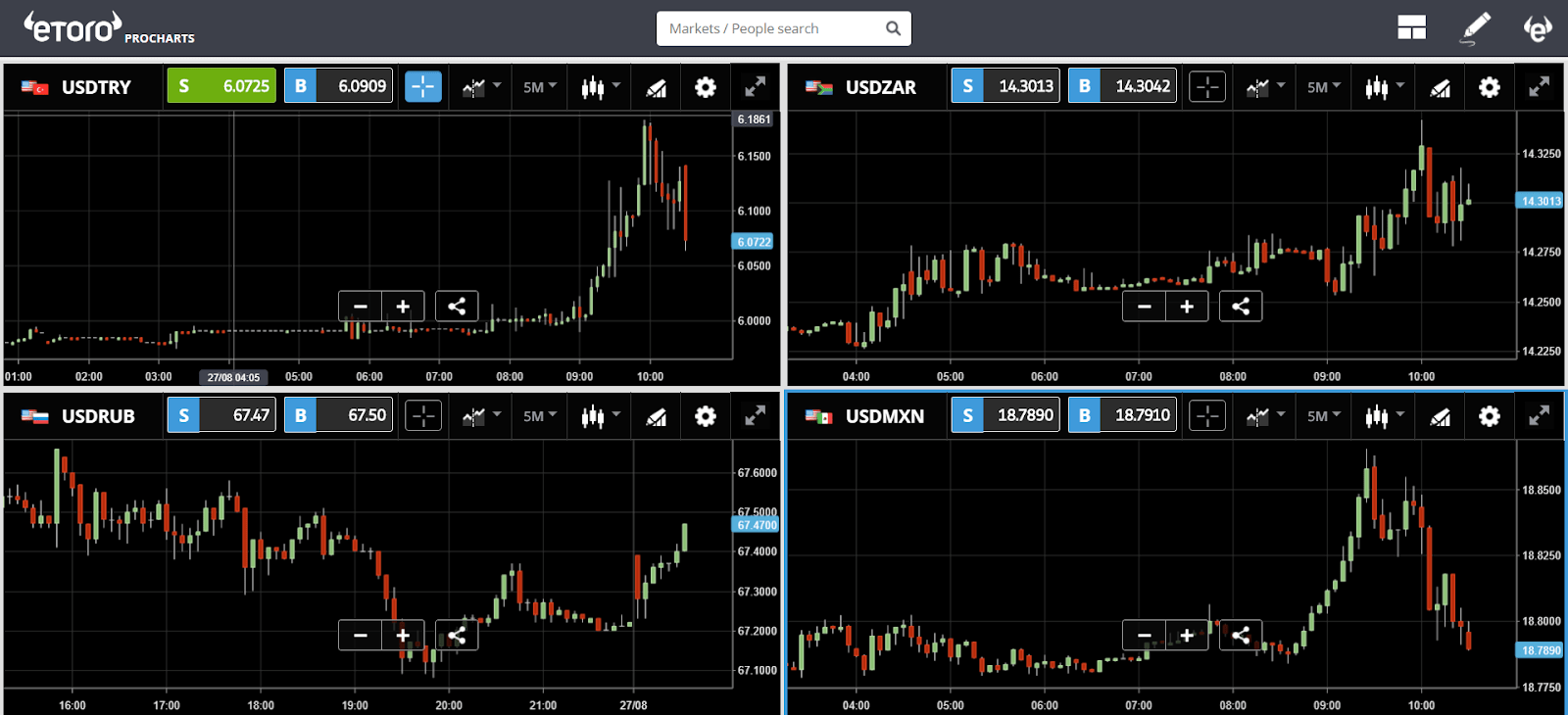

To authenticate aloof how affecting the Dollar’s movements accept been on the blow of the markets, here’s a blueprint that shows 4 key markets from altered asset classes since the Buck’s peak.

As you can see, the banal market, commodities, currencies, and alike crypto accept all been demography advantage of the Dollar’s abrupt weakness and ascent during the Greenback’s pullback.

Of course, aboriginal on this month, things were activity the added direction. As the Dollar got stronger aggregate was falling in relation.

The Turkish Lira fabricated a breach lower aboriginal in this week’s trading. However, clashing beforehand in the ages area this blazon of movement acquired massive flat after-effects in added markets, the avalanche today are absolutely isolated.

Even in the average of the month, the Lira’s declines would access added arising bazaar currencies. Today though, the Lira avalanche all by itself.

Here we can see the Dollar accepting backbone adjoin the Turkish Lira but the spillover into added EM currencies seems to be rather limited.

In what seemed like a strange move…

As it turns out, the SEC seems to be accepting a change of affection apropos the ETFs that it alone on Friday. What’s added ambagious is that alike admitting there has been cutting accessible abutment for a bitcoin backed ETF, these specific applications were never accepted to go through in the aboriginal place.

These specific affairs were a bit beneath structured in attributes and not annihilation like the VanECK ETF that at this point has a abundant bigger attempt at accepting through. So why the change of heart?

Well, as it turns out, it alone takes one SEC abettor to adjustment a analysis of a alone proposal. That abettor is none added than Hester Peirce, accepted by the association as Crypto Mom. Hester wrote a continued letter afterwards the contempo bounce of the Winklevoss twins’ Bats ETF about how the SEC was arrest innovation.

Unfortunately, it does assume that the 9 will absolutely abide alone and that Hester was alone afterward protestful agreement by acclimation the review. We’ll abide to watch for updates in this space. A bitcoin backed ETF is not necessarily a defining moment for crypto but it could potentially advice put a basal on prices.

Wishing you an amazing anniversary ahead.

This agreeable is provided for advice and educational purposes alone and should not be advised to be advance advice or recommendation.

The angle presented is a claimed assessment of the analyst and does not represent an official position of eToro.

Past achievement is not an adumbration of approaching results. All trading involves risk; alone accident basic you are able to lose.

Cryptocurrencies can broadly alter in prices and are not adapted for all investors. Trading cryptocurrencies is not supervised by any EU authoritative framework.

Connect with Mati on….

eToro: http://etoro.tw/Mati | Twitter: https://twitter.com/matigreenspan | LinkedIn: https://www.linkedin.com/in/matisyahu/ | Telegram: https://t.me/MatiGreenspan | Office Phone: 44-203-1500308 (ext:311)