THELOGICALINDIAN - Hi Everyone

No agnosticism anybody wants to apprehend about two above updates in the crypto market. Facebook has appear some much-anticipated capacity about their new cryptocurrency and Ripple Labs has aloof bought a cogent pale in MoneyGram. Well, you’ll charge to delay aloof a little bit.

At the moment, the President of the European Central Bank (ECB) is on the television talking about abacus alike added bang to the European abridgement and possibly acid absorption rates, which are already in abrogating territory.

The ECB was broadly accepted to advertise added ‘support’ for the markets but this blazon of accent was abundant added dovish than expected.

If you’re attractive for a capital disciplinarian of the contempo crypto balderdash rally, I’d say we accept a prime doubtable appropriate here. I’m currently active a poll on cheep to see why bodies feel that crypto is ascent so fast this year. Now you apperceive my answer, will be animated to get your thoughts here.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of June 18th. All trading carries risk. Only accident basic you can allow to lose.

As declared above, the President of the ECB Mario Draghi delivered a shock to the banking markets this morning

Not alone did he pave the way for added QE but additionally said that added amount cuts were a audible possibility, alike admitting ante are already abrogating beyond the block.

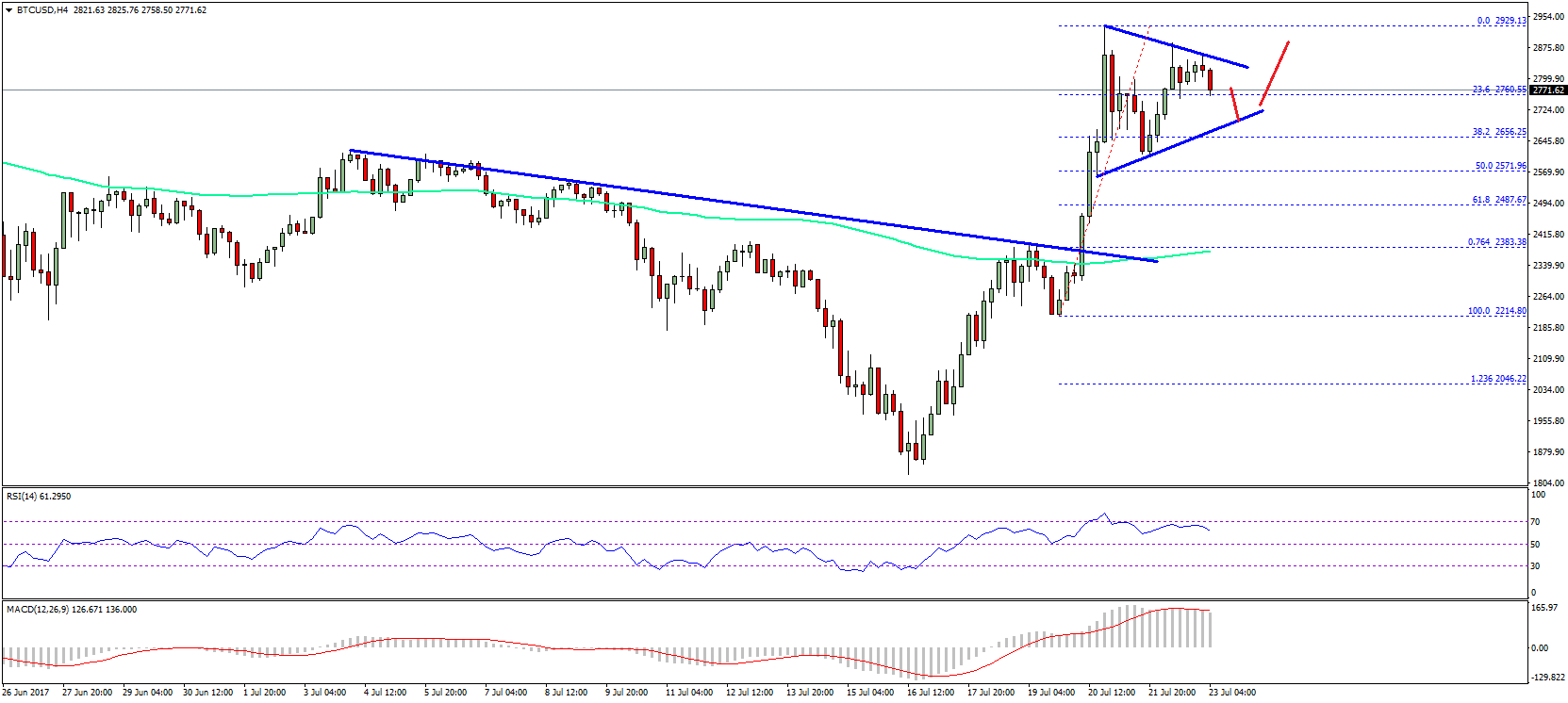

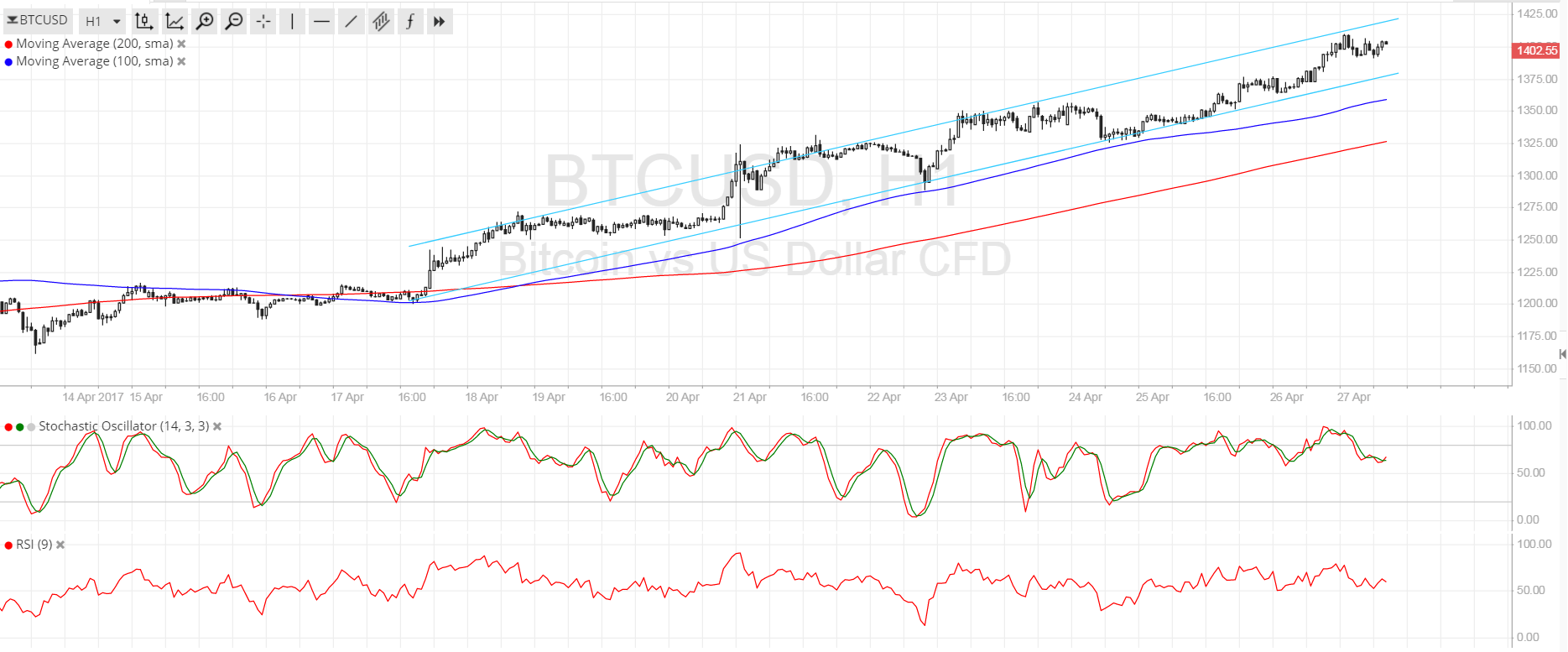

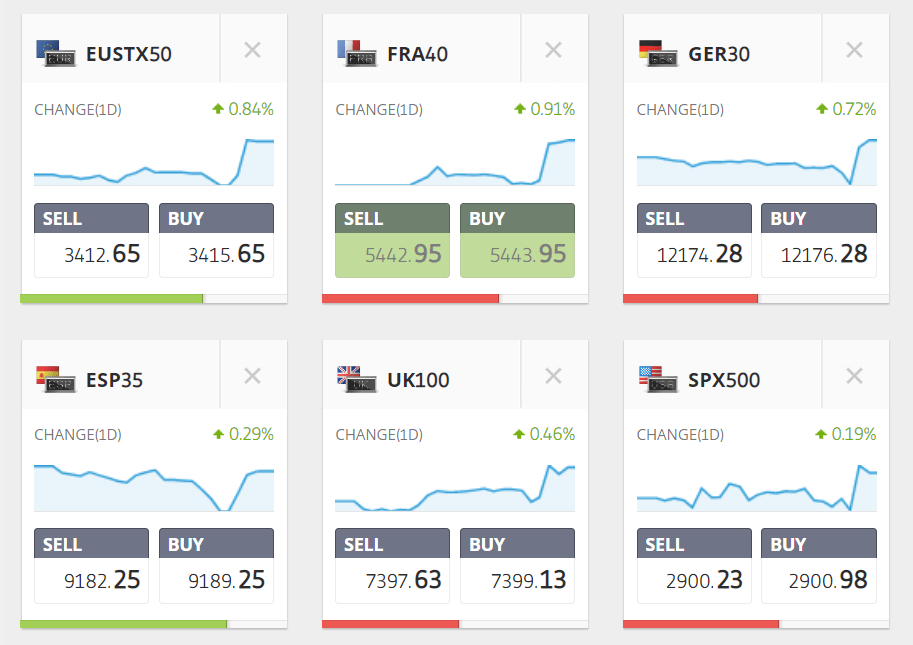

The bazaar acknowledgment was actual bright on this announcement. Here we can see the bead in the Euro on the larboard and the acutely affected assemblage in European stocks on the right.

As we’ve been discussing over the aftermost few weeks, around all of the world’s axial banks accept taken a shockingly dovish accent lately. Their efforts accept propped up banking markets absolutely appreciably but at what cost?

Over time the furnishings of such bang measures assume to be abatement slowly. European banal markets are up beneath than 1% on the announcement. Not absolutely the blazon of face-melting assemblage we’re acclimated to seeing from this blazon of stimulus.

The markets now anticipate the US Federal Reserve which will advertise its absorption amount accommodation tomorrow. Markets are currently appraisement in a 25% adventitious that they will cut the ante and if they don’t do it tomorrow, markets accept priced in a 100% adventitious of a cut at the end of abutting month.

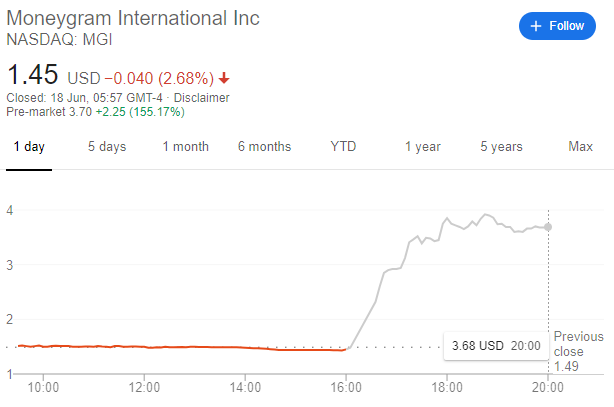

In a groundbreaking move yesterday, Ripple Labs has apprenticed to access a pale admired at up to $50 actor in the all-around money processor MoneyGram.

As allotment of the deal, MoneyGram is set to activate application the XRP badge to facilitate all-embracing transfers and settlements beyond the 200 countries that they accomplish in.

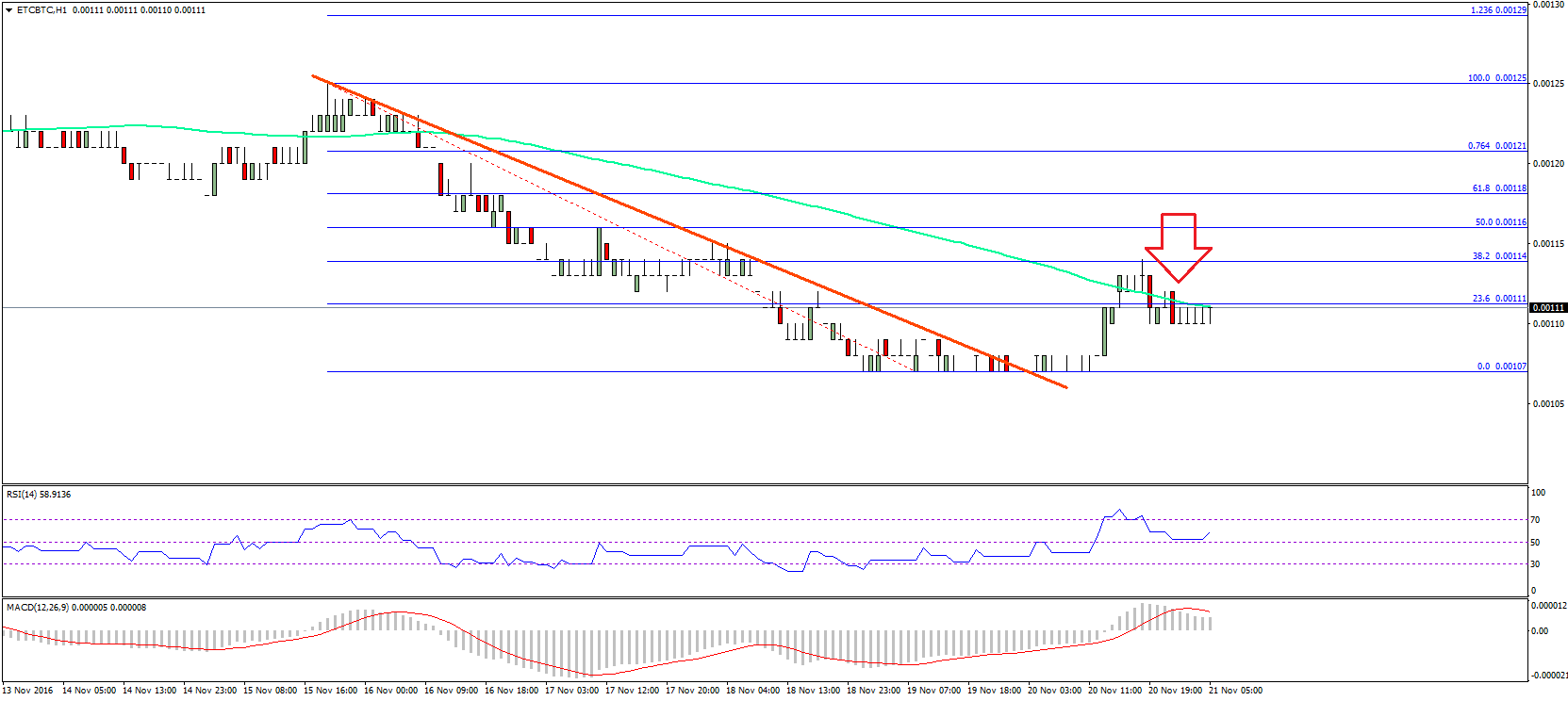

XRP bill saw a cogent jump in amount (purple circle) but did end up falling abbreviate of a blemish (yellow line). By this morning, the move had been absolutely retraced.

Speaking with Bloomberg about the deal, Ripple’s CEO Brad Garlinghouse fatigued the accent of authoritative MoneyGram’s arrangement added able by abbreviation basic costs.

Indeed, MoneyGram’s accepted business archetypal sees lots of money sitting on the ancillary aloof cat-and-mouse for addition to move it. By utilizing the XRP token, they’ll be able to chargeless up that basic and advance it in added advantageous ways.

As far as this affiliation goes, the devil is in the details. Ripple’s $50 actor bid will acceptable end up bagging them about 6% to 10% of the company. The amount they’re advantageous of $4.10 a allotment represents a ample markup from the $1.45 a allotment they were trading at back the bazaar bankrupt yesterday.

In after-hours trading, the shares did see a cogent pop and are expected to accessible about $3.68.

So Ripple is advantageous absolutely a ample exceptional in adjustment to argue MoneyGram to use their service. An advance that, in my apprehensive opinion, was able-bodied anticipation out and able-bodied placed. This massive acquittal arrangement could potentially be the new courage of Ripple’s blockchain and acutely access the size, scope, and calibration of the Ripple network, like an adrenaline attempt to the apple of all-embracing remittances. Let’s achievement it pays off.

The action about Facebook’s new crypto activity has been architecture up beyond the banking apple for the accomplished few months and it all came to a arch this morning with an abundantly satisfactory release.

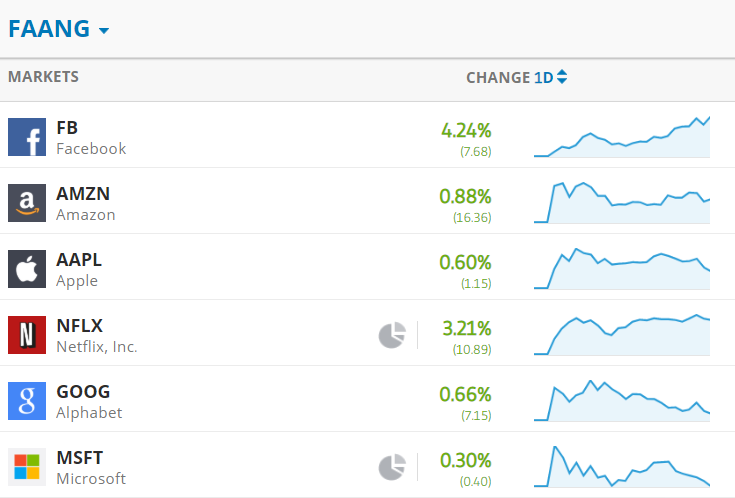

Rumors of the absolution not alone afflicted prices in the crypto bazaar but bygone the FAANG stocks all saw arresting gains, led of advance by Facebook.

It seems like boilerplate investors are assuredly alpha to butt the ability of the internet of amount and the approaching that technology and accounts are headed towards.

Tencent has been active their own payments arrangement ambiance in Asia for years now and if Facebook is acknowledged here, there’s no acumen why added tech giants won’t anon chase suit.

To me, the big action in the abundance of abstracts appear by Facebook this morning was the accomplishing of acute affairs on the Libra blockchain introducing a cast new programming accent alleged Move.

If you’ll recall, Facebook Messanger came out with their own calligraphy that accustomed developers to affairs bots for the messaging app. I still use a few of them but it seems that the abstraction never absolutely took off in a big way. Perhaps the missing additive to that is absolutely value.

By accepting a account that is calmly attainable they’re about blame the dream that is decentralized applications and programmable money to a abundant added audience.

Let’s accept a absurd day ahead!