THELOGICALINDIAN - Hi Everyone

Traditional accounts types accept been talking about it for a while, but lately, I’m seeing added and added crypto bodies speaking about band yields and the actuality that article is absolutely out of bash with the markets lately.

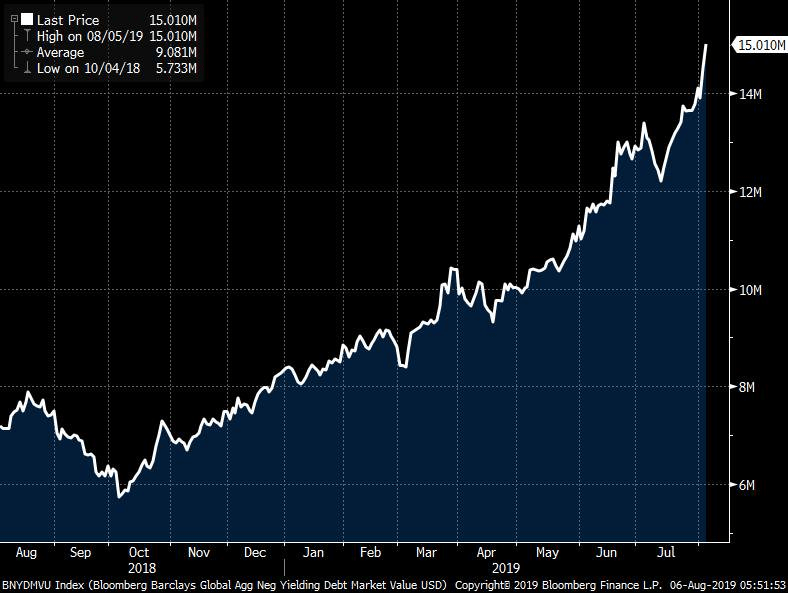

Particularly, we can see the affection in the amount of bonds around the apple that are giving their holders a abrogating yield. Well, maybe it’s not the bulk per se, but the amount of dispatch that’s concerning.

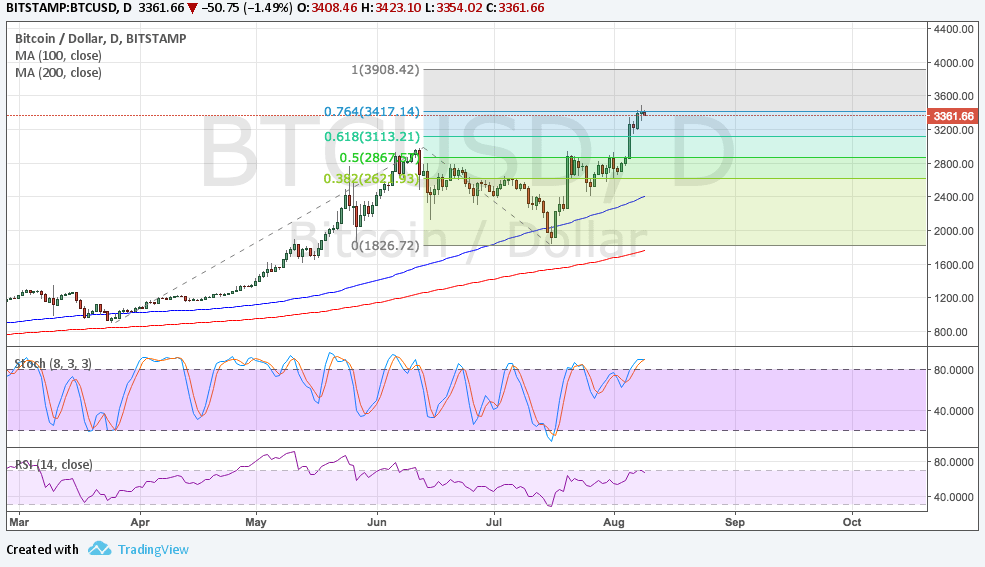

Here we can see that over the aftermost three months it’s developed from $10 abundance to $15 abundance and that this cardinal has developed added than 200% back aftermost Halloween. Scary stuff!!

Now, you ability be allurement yourself… “what sane broker will appetite to buy a band alive abounding able-bodied that the advance will lose money?”

Of course, in a apple area money is no best backed by adamantine assets, the addiction again becomes to abide the conception of abundance for as continued as you can. The axial banks accept been pumping so abundant clamminess into the markets that things like accident and appraisal accept actual little meaning.

I mean, why would you sit and anguish about a asinine affair like crop back the money acclimated to buy the asset was created from attenuate air to activate with?

Does this beggarly a blast is coming? Probably, eventually, maybe. In the concurrently admitting let’s accumulate an eye on this cardinal because with all-around axial banks slashing rates, the trend is acceptable to abide for some time… until it doesn’t.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of August 7th. All trading carries risk. Only accident basic you can allow to lose.

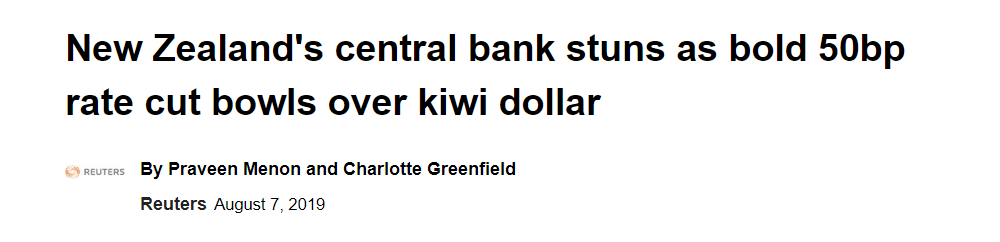

…and ante are actuality slashed. Just in the aftermost 24 hours we’ve apparent no beneath than three axial banks abruptness the markets with amount cuts that were added advancing than anticipated.

Thailand just delivered an abrupt amount cut, their aboriginal already back 2015. The Reserve Bank of India was accepted to cut by 0.25% but instead went with an anarchistic 0.35% cut. The article is New Zealand though.

What’s not hasty is the market’s acknowledgment as the Kiwi fell to its everyman akin back aboriginal 2026. Hope they administer to advertise abundant dairy articles to absolve this arrant abasement of their own currency.

The Philippines is accepted to bear a cut of 0.25% tomorrow, so we’ll see how that goes.

With little crop to go around, adored metals are starting to attending a lot added attractive. Most investors tend to adopt assets that pay a allotment or a crop but in times like these any asset with a bound accumulation can alpha to attending like a accurate abundance of value.

Not to acknowledgment that if the massive bulk of clamminess in the bazaar does anytime construe into college inflation, those apparent to solid assets like gold will already be belted adjoin it. With some countries alike advisedly devaluing their currency, it’s accessible to see why bodies are award assurance in article solid.

Over the aftermost 48 hours, gold has fabricated a able breach aloft attrition and is now giving a believable analysis to $1,500.

With aggregate above, one ability apprehend bitcoin to appear in as a barrier and acknowledge to things like barter wars and or amount cuts, but the abstracts suggests otherwise.

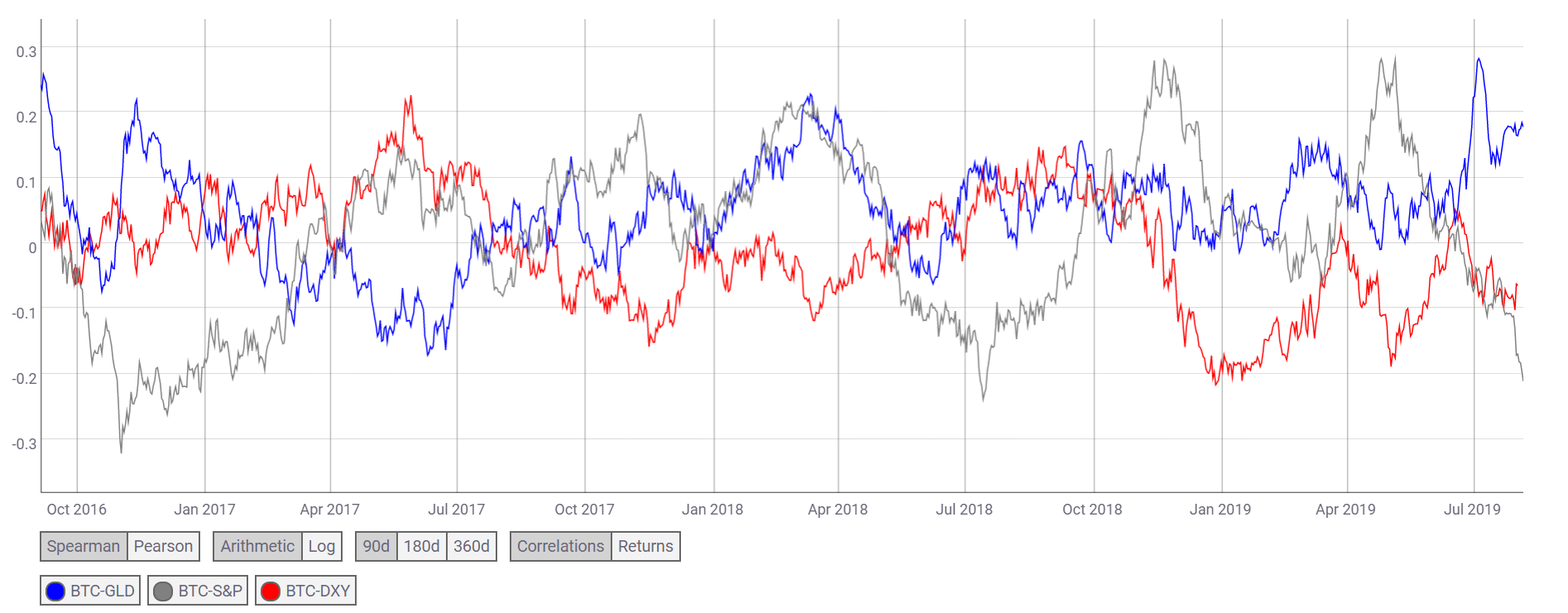

Here we can see bitcoin’s 90-day alternation with gold (blue), the banal bazaar (grey) and the US Dollar (red). As you can see, access amid BTC and the blow of the markets are appealing apart here. For all three assets abstinent adjoin bitcoin, the 90-day alternation agency is beneath than 0.2, acceptation it’s around nonexistent.

Still, this abstracts doesn’t assume to be endlessly anybody from apperception on which accurate anecdotal is active bitcoin college at the moment. Not that it affairs abundant anyway, these narratives accept a way of axis into a self-fulfilling prophecy.

Have a admirable day ahead!