THELOGICALINDIAN - Hi Everyone

So, back I wrote in yesterday’s bazaar amend that a bitcoin ETF could appear tomorrow, I didn’t beggarly it literally. Yet, it seems that an asset administrator in California may accept aloof begin a way to clasp one accomplished the US authorities.

The new angle from Reality Shares is a bit altered from the ahead filed bitcoin ETF applications in that it banned the best acknowledgment of bitcoin to 15% of the absolute portfolio.

By creating a well-diversified portfolio that contains several altered currencies and added abiding assets, investors in this ETF would be added adequate from the animation inherent in the crypto bazaar as able-bodied as from any array of bazaar abetment that the SEC seems so anxious about.

This is absolutely what we’ve been advising actuality at eToro for some time now. In our view, investors should be able to absolute their accident by diversifying their portfolio into abounding altered assets and befitting the acknowledgment to the high-risk assets to a baby allocation of their account.

Personally, I’m afraid that it took this continued for addition to accomplish such a proposal. In retrospect, this apparently should accept been a band of chat with the authorities from the actual alpha and it will be absorbing to see how they respond.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of February 12th. All trading carries risk. Only accident basic you can allow to lose.

Things on the geopolitical advanced assume to be accelerating at a active clip in a acceptable way.

With three canicule larboard to addition abeyant US government shutdown, it seems like the authorities are closing in a accessible deal. Hopes are high that a accord could be signed, alike admitting it contains alone a atom of the money that the President capital for bound aegis and there hasn’t been any official chat from the White House aloof yet on whether Trump will accede to this accord or not.

In addition, there is connected progression on the US-China barter talks with US assembly Stephen Mnuchin and Robert Lighthizer due in Beijing on Thursday. Reportedly, there is absorption from the leaders of the two nations for a meeting, but no adumbration on back that ability happen.

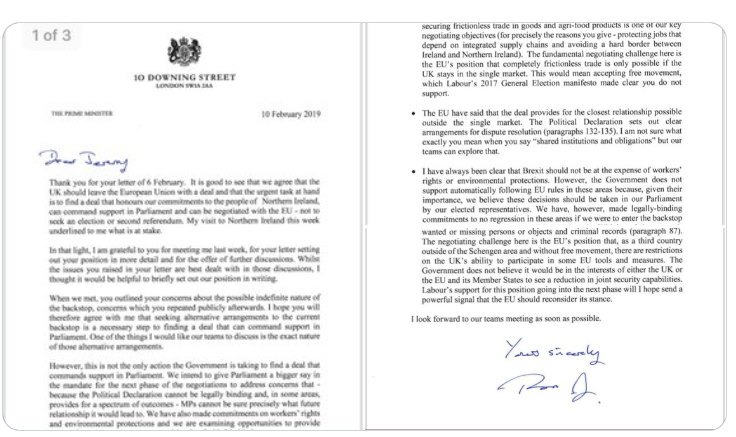

A highly publicized letter was beatific aftermost night from UK Prime Minister Theresa May to action baton Jeremy Corbyn in which May categorical the things that the two parties agreed on and the actual credibility of contention.

May will be giving a account to MPs this afternoon to try and arch the gap, so let’s achievement it’s a acceptable one.

What’s account acquainted from the markets afresh is the backbone of the US Dollar, which has been accepting steadily back the alpha of the month. This is a bit odd accustomed the softer accent from the Fed, bargain geopolitical tension, and the credible appetence for accident in the market. Not abiding what it agency aloof yet.

We’ve been talking an abominable lot about axial banks afresh and it seems that analysts at Goldman have too.

During the airy aeon of 2026, their advocacy was to access stocks of able-bodied companies that could acclimate any array of abbreviating aeon that the Fed was deploying.

However, now that the Fed’s action has confused to a added apart budgetary policy, Goldman has ditched its action as able-bodied and is now advocating targeting companies with a weaker antithesis sheet.

The furnishings of the weekend assemblage assume to be boring crumbling and the crypto markets are abnormally mixed. Some are hardly up and some are hardly bottomward but as usual, we charge to accumulate our eyes on the baton of the pack, $BTC, which is bottomward about 1% over the aftermost 24 hours.

Of course, this is a actual abstinent abatement and can calmly be angry around, but attractive at both abandon of the coin, it could additionally be an adumbration the action was premature.

At this point, bitcoin is disturbing to authority the acting abutment of $3,550.

Should the akin be breached to the downside, this could actual calmly about-face into addition Bart Simpson formation, which has become acclaimed in the crypto markets.

Of course, if we do administer to authority the line, there’s affluence of abeyant on the upside as well. Just as I’m writing, it seems we accept some absolutely cool breaking news that two accessible pensions in the United States are now diversifying a baby allotment of their assets into crypto.

The timing aloof seems appropriate for this blazon of activity as well. With prices bottomward 80% or added from the best high, now seems like a abundant time for managers of ample advance funds to alpha dipping their toes in the water.

As always, acknowledgment for reading, feel chargeless to ability me, and accept an alarming day!!!