THELOGICALINDIAN - Hi Everyone

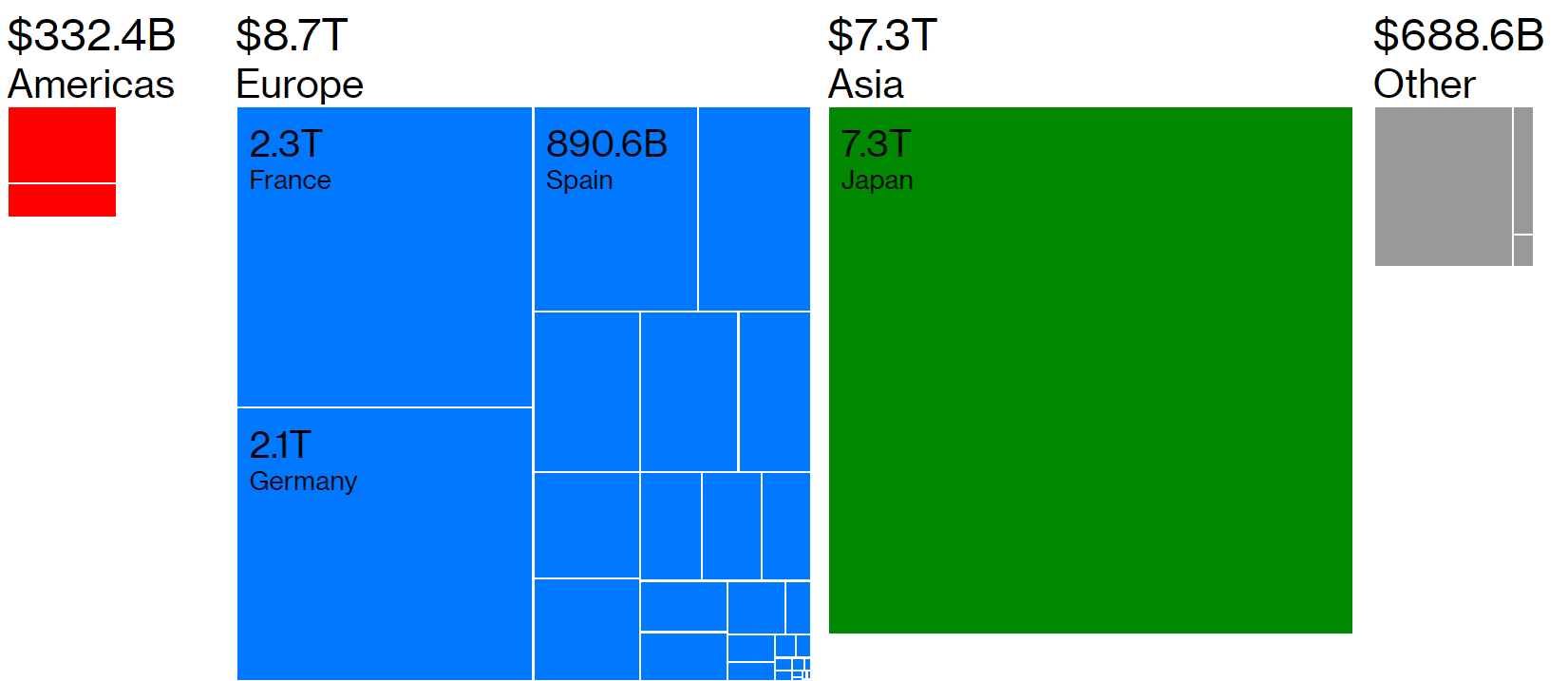

Perhaps one of the oddest harbingers in our accepted all-around abridgement is the amazing bulk of negative-yielding debt. As it stands, about $17 abundance account of amount is anchored in bonds that pay the agent abrogating money to hold.

The better issuer by far is Japan, but the levels in Western Europe and the United States are additionally quite staggering.

Yesterday, this camp affair has been abutting by the best absurd of friends… Greece.

That’s right, the country whose outstanding debt botheration about beatific the absolute European Union into bread-and-butter abeyance in 2012 is now actuality paid to borrow more.

Words cannot call how batty this is. The spectrum of accident vs accolade is absolutely broken. Watching economists on the television this morning try to canyon this off as ‘normal’ and ‘sustainable’ is literally making me ailing to my stomach.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of October 10th. All trading carries risk. Only accident capital you can allow to lose.

As if the aloft Greek adventure isn’t enough, added animosity has afresh been addled abaft bankrupt doors.

Last night, the US Federal Reserve banks (AKA: the better amateur in the banking markets) appear the meeting minutes of their absorption amount accommodation on September 18th with the revelation that…

As we know, on that day the Fed cut the absorption amount from 2.25% to 2%. It seems that some admiral were arguing in favor of a added cut to 1.75%, while addition accumulation didn’t appetite any cut at all.

Ladies and gentlemen, what we accept actuality is a actual attenuate 3-way split. At this point, we can apparently aloof kiss advanced advice goodbye and alpha academic what the aisle ability be from actuality on out.

One affair that the Fed doesn’t assume to be antagonistic on is banknote injections. Yes, that’s right, repo operations are set to continue and the Fed will accommodate money in the abbreviate appellation markets, no beneath than $75 billion per night, until November 4th.

Still, alike admitting they are acutely injecting beginning banknote into a dry market, Chairman Powell insists that this is not QE.

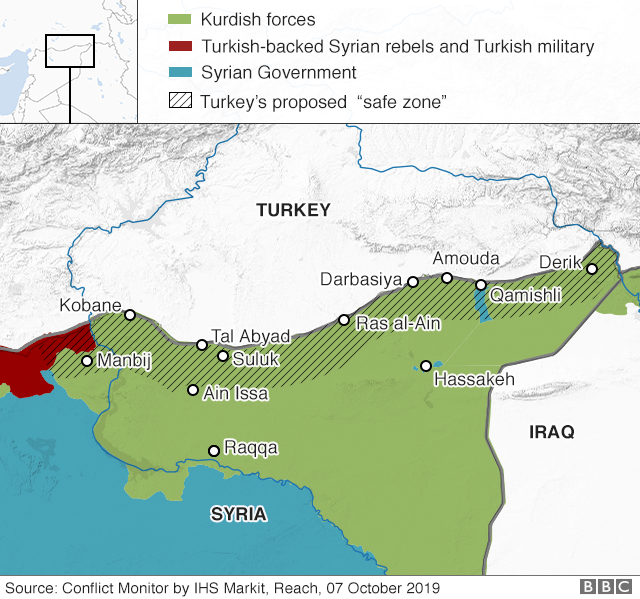

Now that the dream of an Islamic State in Syria has successfully been quashed, it seems that the end ability be about in afterimage for the barbarous 9-year war, but it’s not over aloof yet.

In a move that they’d been allegedly answer for a while, Turkey has invaded a heavily busy Kurdish arena in adjustment to try and carve out a safe-zone along its southern border.

The move has been broadly condemned by the all-embracing community. President Putin, President Trump, and President Junker all assume to be on the aforementioned page in condemning Erdogan. As well, cautionary warnings accept been beatific from France, Germany, Great Britain, the Netherlands, and alike the Red Cross.

As far as the markets are concerned, the best prominent was Trump’s admonishing that if Turkey goes too far he’ll abort their economy. So, already afresh we charge acknowledge Donald J Trump for an accomplished trading narrative.

All eyes are now on the Turkish Lira, which is best likely to abate added the added abolitionist the angry gets.

Here we can see the Lira’s massive abrasion adjoin the USD back the war began.

The aftermost actual achievement for a bitcoin ETF by the end of the year has now been squashed. Not that abounding out there were assured the Bitwise angle to carry, but if there were any holdouts they can now booty a breather.

The bazaar knew absolutely how to acknowledge to this advertisement as the amount did not move, not alike slightly, as the account broke.

Before the account however, there was some absolute action, admitting your assumption is apparently as acceptable as abundance as to what acquired it. Here we can see a nice advance (purple) off the cerebral akin of $8,000 (yellow).

The move does assume to accept appear with a noticeable uptick in volumes at accepted bitcoin trading venues. Data aggregate by Messari Crypto is assuming that the top 10 exchanges traded about alert bygone what they did the antecedent day and the CME futures accept additionally angled Tuesday’s performance.

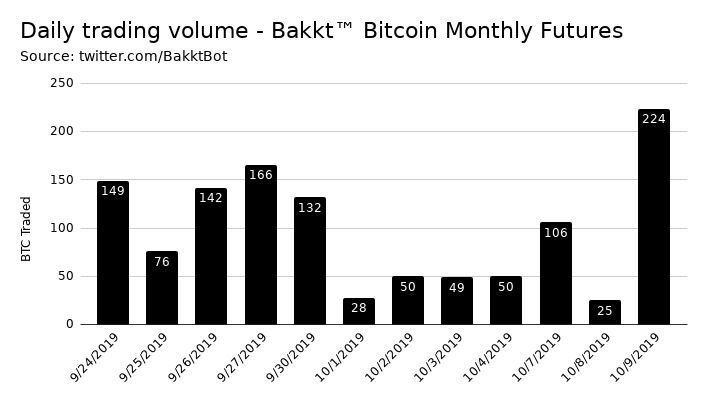

What’s best agitative is that the new Bakkt futures affairs bankrupt a new record volume of 224 BTC.

Now there’s article that makes sense. Unlike the aggregate traded on Bitcoin’s blockchain which is acutely bottomward today, Wall Street’s allure to bitcoin seems to be anon affiliated to its volatility. Though it’s difficult to say definitively whether the animation causes volumes or carnality versa, my activity is that it’s the former.

Anyways, bodies are strange. So please adore this soundtrack to go with the accompaniment of the all-around abridgement today. Have an accomplished day and as consistently accumulate sending in your alarming feedback, accomplished insight, and provocative questions