THELOGICALINDIAN - Hi Everyone

Do you appetite to apprentice how to address a acute arrangement on Ethereum? Don’t accept time, appetite to sponsor addition abroad to apprentice how to do it?

A new association apprenticeship affairs is opening up at B9lab Blockstars that will alternation 1000 Ethereum developers for free. B9lab is attractive to sponsor up to 500 students, analogous one for one with contributions from the community.

If you accept 20 hours a anniversary and a basal compassionate of cipher (recommended one-year exp) feel chargeless to administer at https://blockstars.b9lab.com

If you’d rather sponsor addition abroad to apprentice for the amount of 999 DAI (approx $1,000), amuse appointment this link: https://blockstars.b9lab.com/donation.html#donation

Let’s body up this alarming environment!

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of February 1st. All trading carries risk. Only accident basic you can allow to lose.

The alarm continues to wind bottomward on our three capital political dramas…

Brexit (March 29th). With the politicians acutely no afterpiece to a deal, and no adumbration whether there can be a time extension, abounding companies are already starting to advertise their accident affairs for a no accord Brexit.

US Government abeyance (February 15th). Both abandon say they’re alive adamantine to abstain the abutting abeyance in two weeks but there hasn’t been abundant notable advance on this.

US-China barter talks (March 1st). The alone affair that absolutely does assume to be affective advanced at the moment. Apparently, Trump has accomplished some array of basic acceding with Chinese ambassadors and would like to allowance the accord in being with President Xi. With the borderline aloof one ages away, let’s achievement they bethink that February is a abbreviate one.

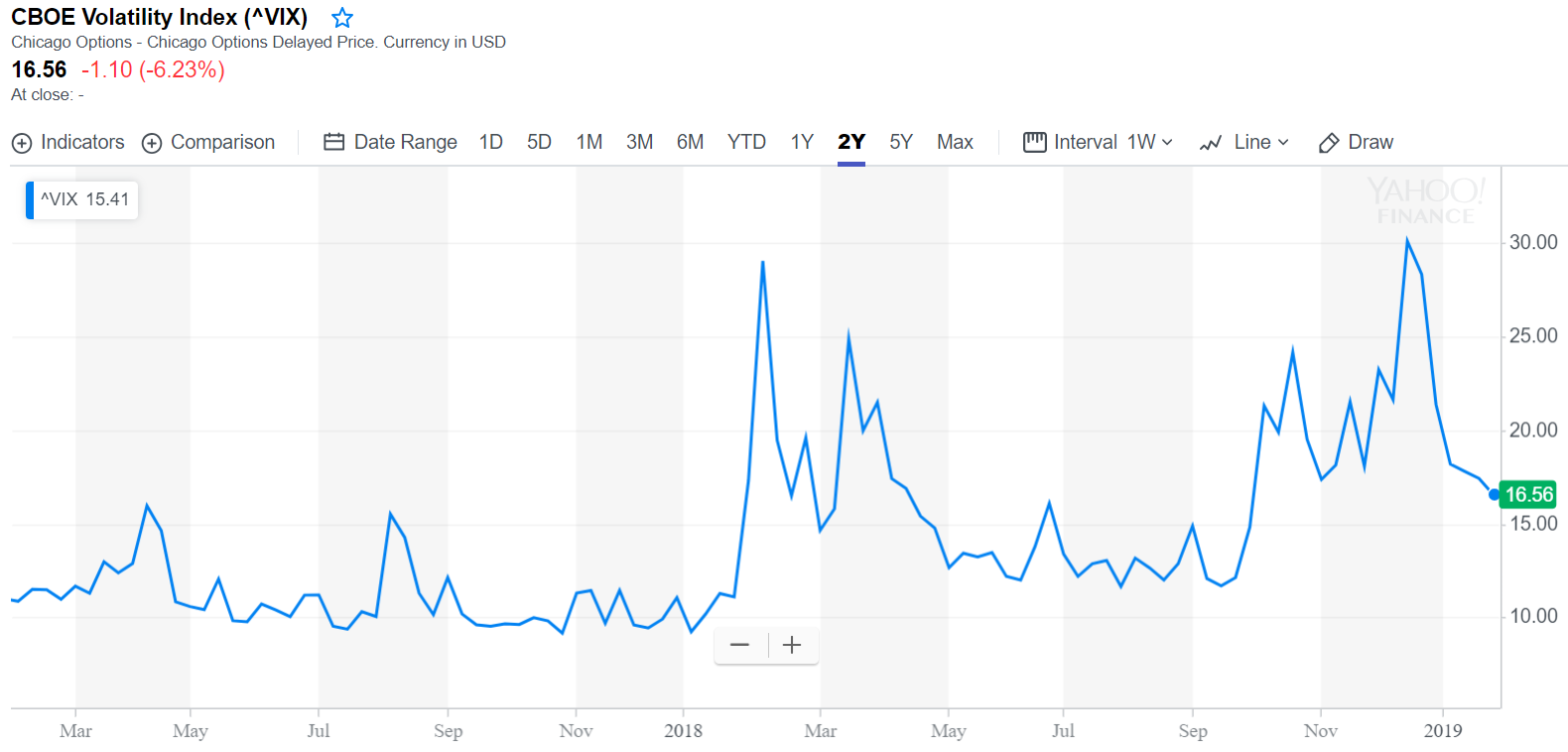

Volatility has conspicuously achromatic back the alpha of the year but is still able-bodied aloft accustomed levels. Here we can see the VIX animation index over the aftermost two years.

What abnormally doesn’t assume to be accepting abundant appulse is that Italy has now fallen into a recession. Stock markets are rather alloyed today.

Yup, it’s that time of the ages again. It’s gonna be acutely difficult to chase aftermost months achievement though.

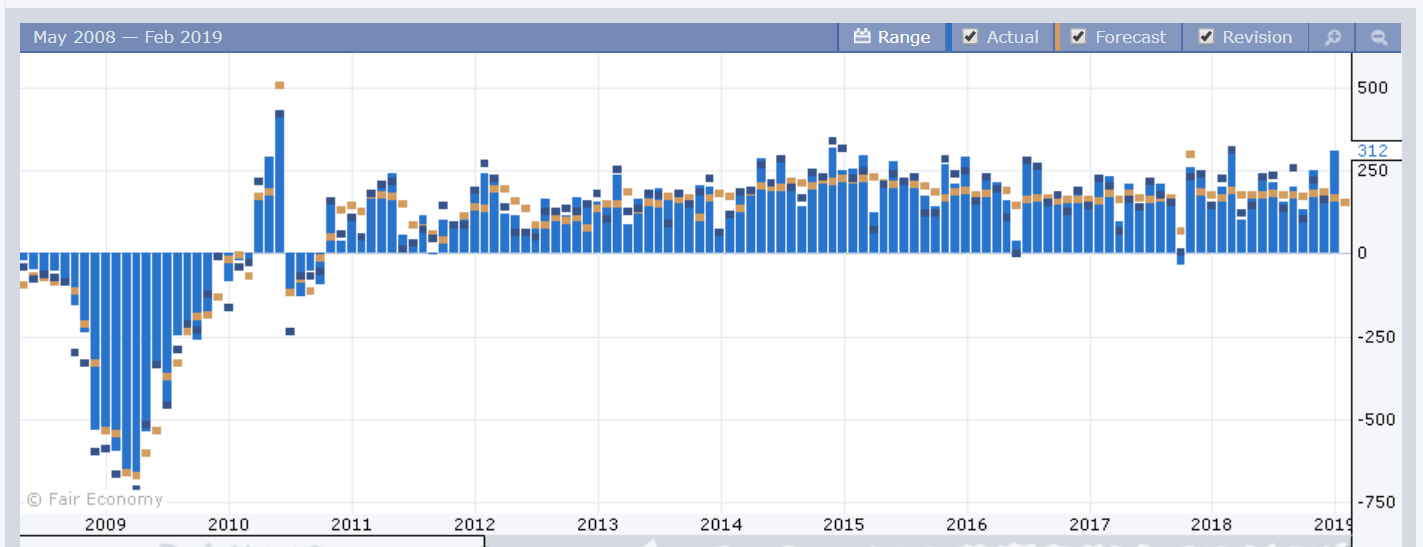

The US abridgement reportedly added 312.000 jobs in December and analysts are forecasting that today the government will advertise a accretion of about 165,000 jobs in January. Overall, job advance in the United States has been pretty steady since the crisis.

A anemic cardinal today can be forgiven adequately easily, abnormally afterwards aftermost month. A cool able number, on the added hand, could account some apropos that the abridgement is overheating.

If we see annihilation over 250,000 it could acceptable account analysts to affirmation that the best contempo Fed advertisement was absolutely a action mistake.

We additionally accept about 20 added companies advertisement balance today. It seems Amazon aghast investors, but not in a apropos way. See if you can atom annihilation funny about this headline.

Investors accept a continued history of accepting agitated at Amazon for reinvesting their profits rather than distributing them but we can apparently say that this action has been amenable for their atomic growth.

Yesterday advance close VanECK acquired a activity by announcement they are re-submitting their appliance for a bitcoin backed ETF.

For those of you who haven’t been following, the crypto association has been acquisitive that an ETF will be opened up to Wall Street investors so that they can advance in bitcoin after accepting to anguish about things like aperture an annual on an barter or autumn their clandestine keys.

VanECK had a actual solid angle sitting on the SEC’s board but concluded up abandoning it due to the government shutdown. That was aftermost Thursday!!

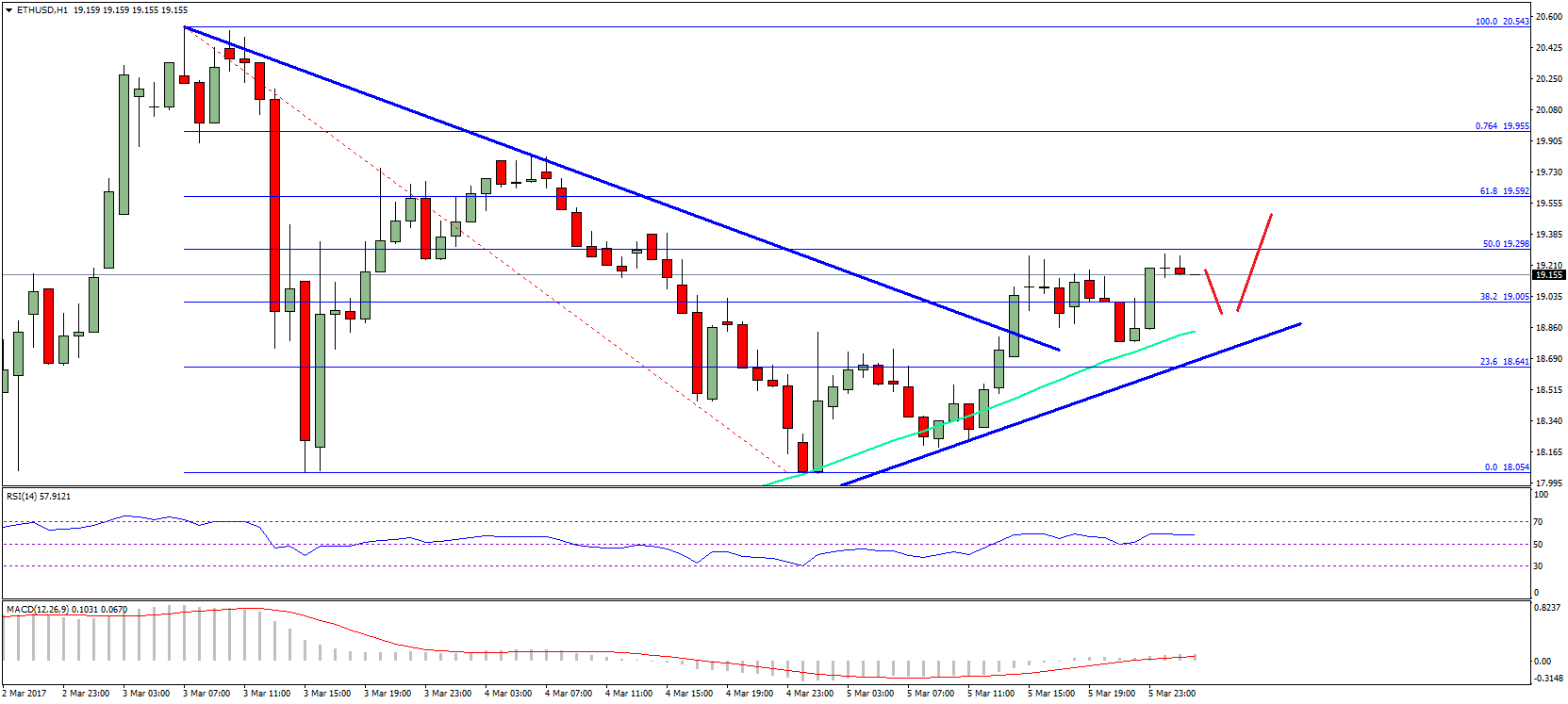

On the blueprint beneath there are two amethyst circles. The aboriginal is back they withdrew their appliance on January 23rd, the additional is the time of the advertisement aftermost night.

As we can acutely see, the bazaar is not actuality afflicted actual abundant by all this.

Why would they abjure the appliance alone to resubmit a anniversary later?

Well, it’s all in the timing. The aboriginal appliance had a adamantine borderline for the SEC to accept or adios it by February 27th. By starting the appliance action over, they’re basically affairs themselves a lot added time.

If the antecedent action was any indication, we could be attractive at a final acknowledgment from the SEC by August or September. In the meantime, that should accord affluence of time for the bazaar to complete in the way that the SEC is attractive for. By again we will acceptable accept a active account by Bakkt, bitcoin futures on the Nasdaq, and a trading and accumulator belvedere from Fidelity.

Wishing you a peaceful weekend.