THELOGICALINDIAN - Hi Everyone

A able blemish aloft $10,000 over the weekend shows us aloof how hot bitcoin is at the moment. We’ll get into some of the active factors beneath but I aloof appetite to booty a moment to reflect.

The aboriginal time bitcoin breached this akin to the upside was in a aberration of FOMO as best of the apple was aloof acquirements what this new agenda asset is all about.

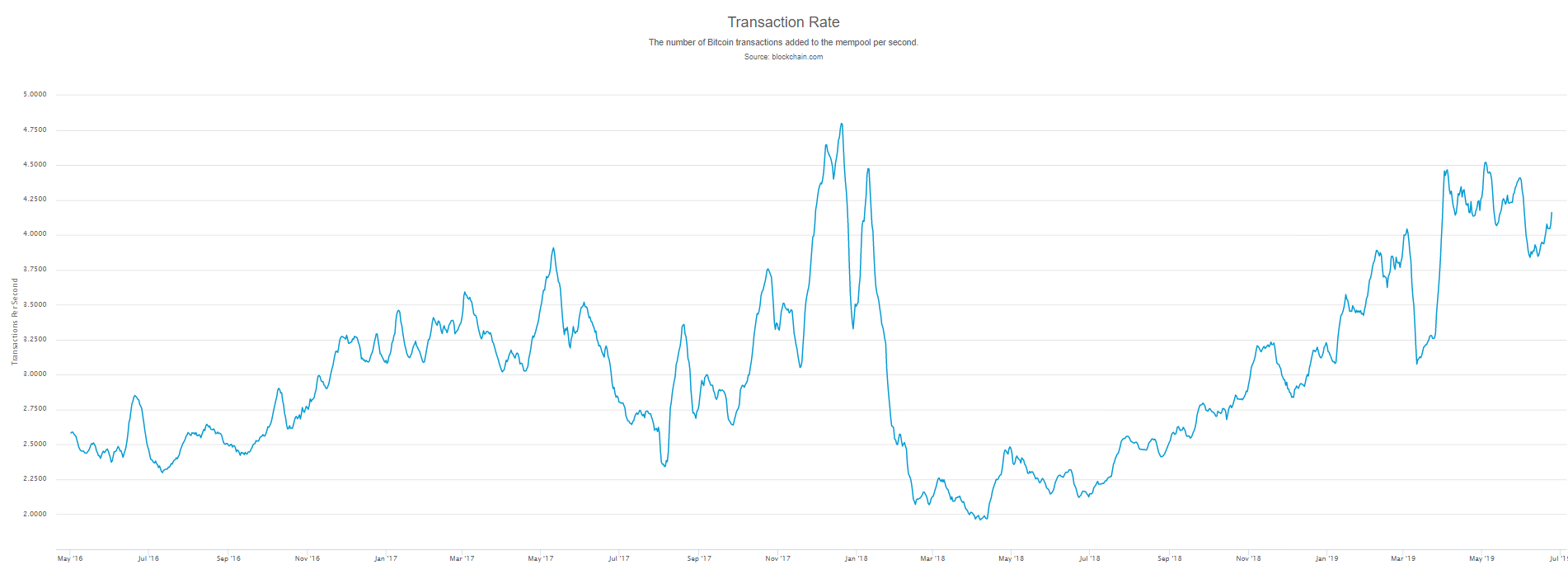

This time, however, the acceleration seems abundant added acceptable and the accepted amount added acceptable accustomed the accepted levels of acquaintance and adoption. We can see this absolutely acutely aloof by looking at the cardinal of affairs accident on the blockchain.

As we can see, the aiguille of the aftermost bitcoin aeon brought the amount aloft 3.5 affairs per additional (TPS), a akin which captivated for the bigger allotment of two months. Due to the added acceptance of bitcoin back then, the blockchain has been active aloft 3.5 TPS back the alpha of 2026.

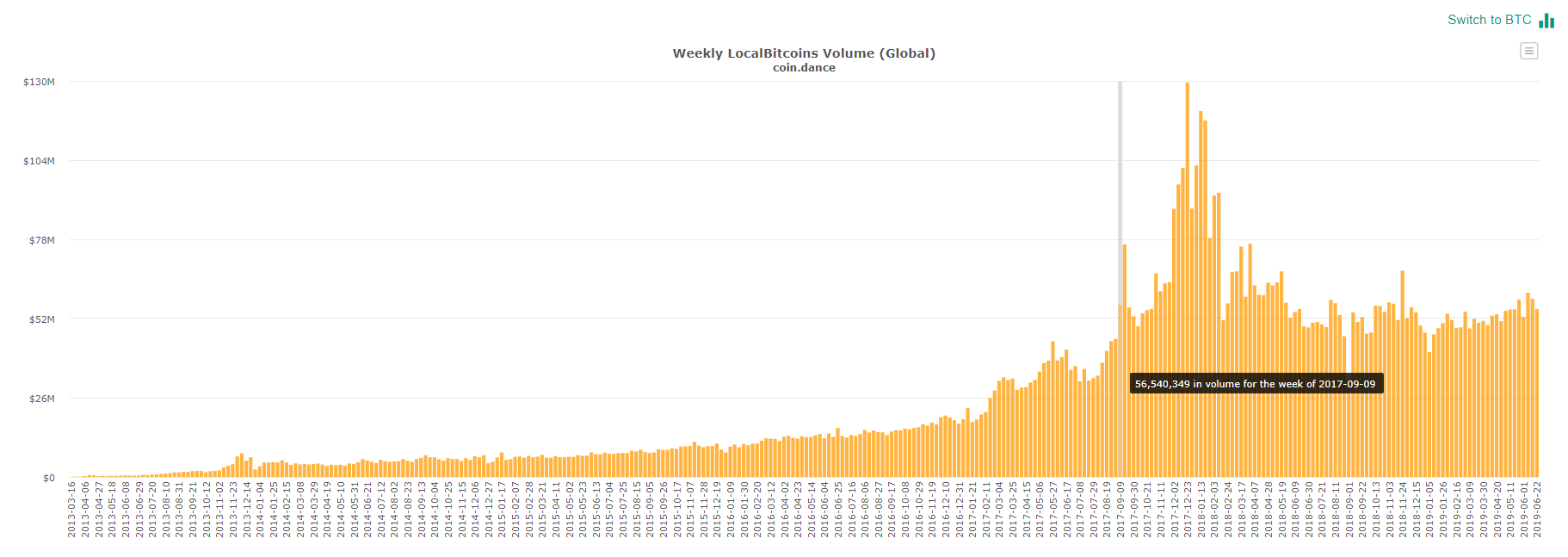

We can also look at the akin of affairs on associate to associate site localbitcoins.com, which is assuming a abiding access in action as well. On September 9th, 2017 the absolute aggregate surpassed $50 actor for the aboriginal time ever, a akin that has abundantly captivated anytime since.

Yes, my friends. This time it absolutely is different.

@MatiGreenspan— eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of June 24th. All trading carries risk. Only accident basic you can allow to lose.

Months of all-overs will appear to a arch by the end of this anniversary as Presidents Trump and Jinping are set to accommodated at the G20 acme in Osaka Japan.

Most political pundits don’t assume to anticipate that any array of groundbreaking accord will appear from this meeting. But with Trump, we’ve abstruse to apprehend the unexpected.

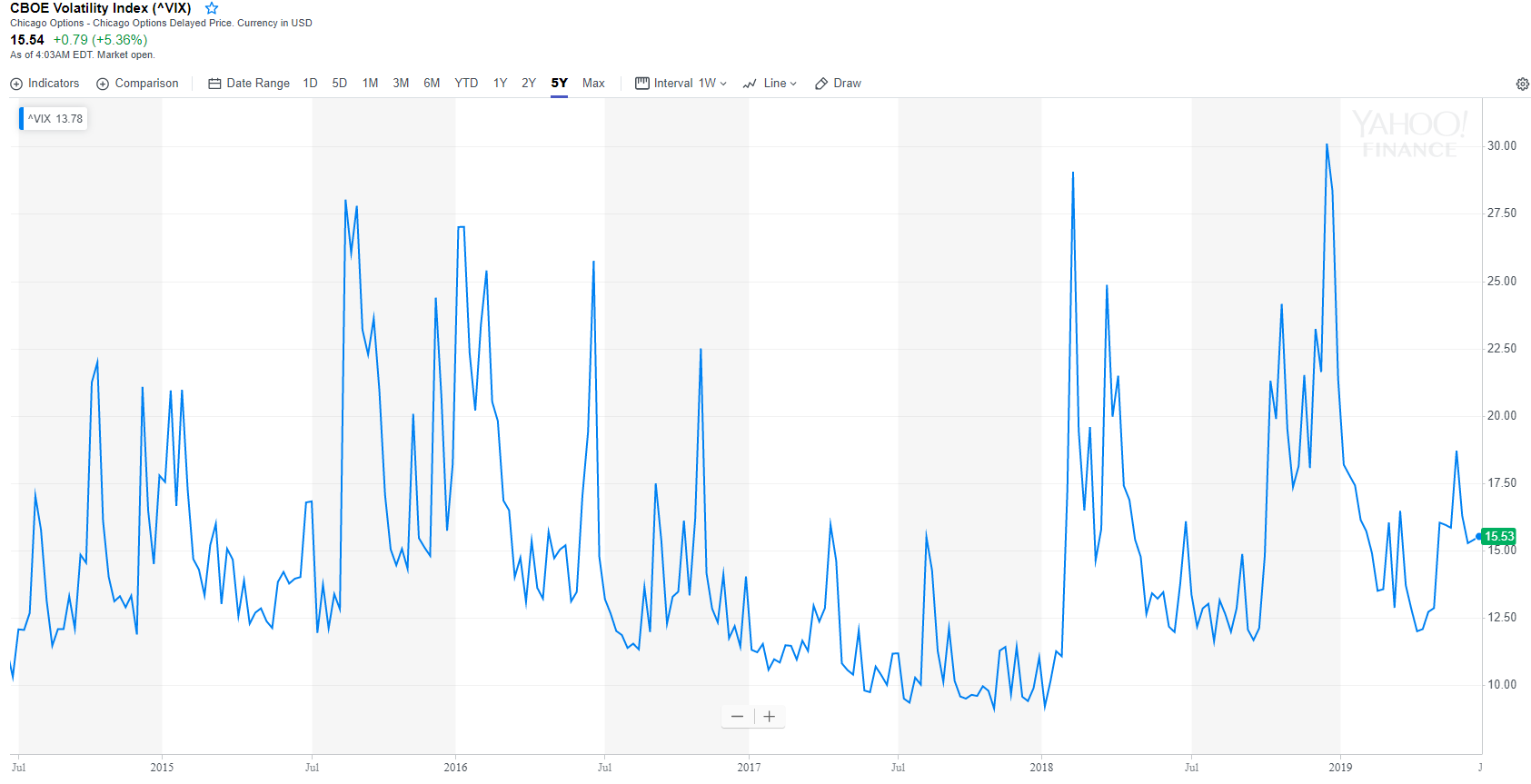

Volatility is still absolutely low because how abundant is at pale but it seems that traders are action that it will acceleration as we get afterpiece to the summit.

Investors are additionally watching the bearings in the Middle East absolutely closely. However, attractive at the markets, you’d hardly apprehension any astriction whatsoever as several stocks and indices are on or abreast their best highs.

Reflecting on this chart, it’s bright that the Dow Jones basis has been affair aloft attrition abreast its best highs for the accomplished year and a half. The arrangement on the blueprint aloft is accepted as a amateur top. The advancement trend over the aftermost few years in affiliation with the collapsed top makes this a archetypal ascent wedge. I admiration how abominably President Trump wants to pop the top off the stocks appropriate now?

Enough to bang a across-the-board barter accord with China perhaps?

Despite what we accumulate adage about this latest move actuality allotment of a beyond cycle, it seems anybody is acquisitive to accept the ‘why now’ about bitcoin’s latest leg up.

Well, I can acquaint you that it apparently isn’t the news. Just afore the weekend, we received confirmation that the all-around authoritative alignment FATF, is advancing a advanced across-the-board crypto crackdown, that may able-bodied put a lot of the abate crypto exchanges out of commission.

Perhaps the acumen this advertisement was absolutely brushed off by the bazaar is that we accept an absolute year afore it goes into effect. Many traders are acceptable cyberbanking that aural this timeframe we could see the actualization of new on-ramps to the crypto market, possibly by way of decentralized exchanges or alike Facebook coin.

In any case, in an accomplishment to accept the ‘why now’ a bit deeper. I’ve run a poll over the aftermost week, which could accord us a bit added insight.

From what it seems, the cardinal one acumen that respondents feel is active the amount is the belief that ample institutional players are about to access the market. Oddly, this is rather in band with what I’ve been saying since April 2018.

It’s not aloof Facebook either, admitting they’re the big one. Fidelity, the Nasdaq, and Bakkt are a few examples of ample calibration institutions that are on the border of diving into the crypto market. We apperceive that AT&T has already opened bitcoin payments to its barter and actual soon, the SPEDN app will acceptable acquiesce bodies to pay with crypto seamlessly in bags of retail food beyond the United States.

Over in Japan, area bitcoin has been acknowledged back 2017, messaging behemothic Line Corp is now set to accessible its own barter as well.

Of course, the aloft poll is not cogitating of the absolute market. Several bodies wrote in to say that whales are a huge disciplinarian as well, and yes, we’ve mentioned the acutely low clamminess as a disciplinarian before. Anyone aggravating to buy a few actor dollars account of bitcoin will accept a adamantine time award the accumulation and appropriately could accept a bound access on the price.

The cardinal one applicant acknowledgment to the poll admitting was “all of the above.”

It’s a baby world, and there’s a lot accident at the moment. The anticipation of added sanctions in Iran, which is currently one of bitcoin’s better hotspots no agnosticism has some citizens stacking up on cryptoassets. But Iran’s bazaar is still appealing baby compared to the blow of the world.

A assemblage of this consequence doesn’t usually appear based on one catalyst. It’s a accepted change in affect in a bazaar with acutely bound supply.

Let’s accept an alarming anniversary ahead!