THELOGICALINDIAN - Hi Everyone

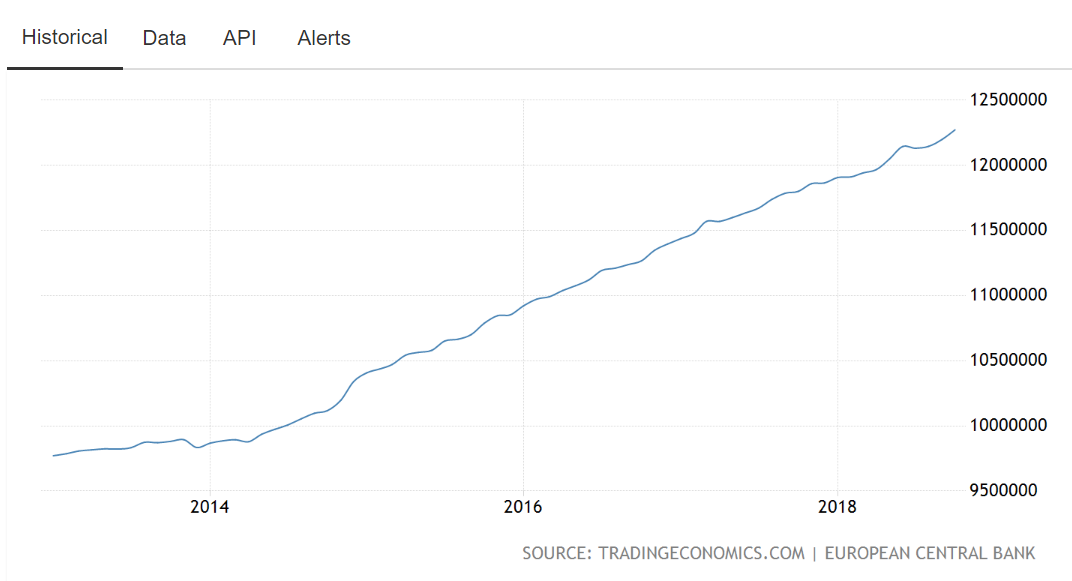

Over the aftermost four years, the European Central Bank has managed to inject €2.6 trillion into the cyberbanking arrangement in adjustment to advance bread-and-butter stability.

To be clear, these banknote injections accept been one of the alone things propping up the economy, and alike the Governor of the ECB has now admitted that.

Now, €2.6 trillion may not complete like a lot of money but we charge to accede that this money is again assorted by the apportioned assets banking system with anniversary Euro created again actuality lent out assorted times. So the absolute bulk of money that went into the arrangement is abundant higher.

Here we can see the akin of M3 money in the Eurozone activity from beneath than €10 quadrillion to added than €12.27 quadrillion in aloof four years.

Yesterday, the ECB appear that they will stop injecting new money into the system. In the United States, they are already starting to abstract money by acceptance the bonds they’d purchased to lapse. In Europe, they’ll be renewing their bonds for now.

So, for those of you account these circadian updates and apprehensive what budgetary abbreviating is, this is how it works and it is accepting a massive appulse on the markets.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of December 24th. All trading carries risk. Only accident basic you can allow to lose.

Stocks beneath during the New York affair yesterday. There were a agglomeration of account about a accessible government abeyance but that’s apparently not the agitator for falling stocks. Just a sideshow distraction.

As we mentioned aloft abbreviating budgetary action is the disciplinarian here. During best of the year, banal beasts were able to say that the abridgement is still accomplishing actual well, but unfortunately, they don’t alike accept that leg to angle on anymore.

The US jobs address aftermost anniversary was afflictive and the GDP in Q3 was a blow beneath the civic average.

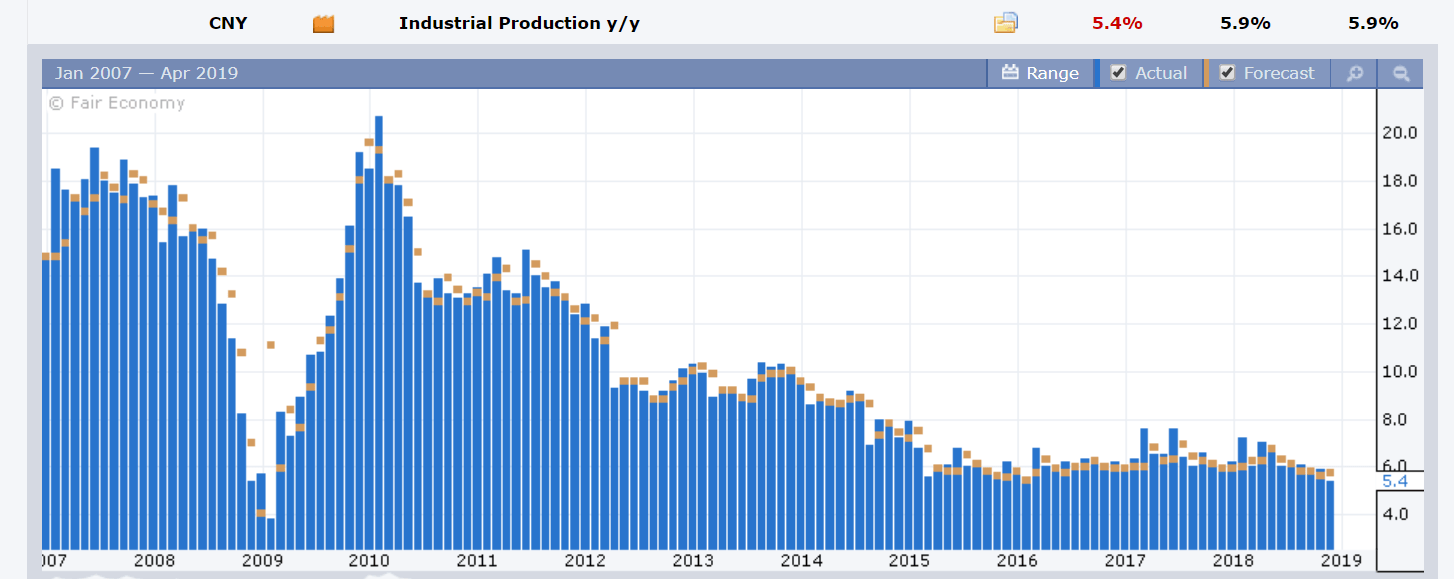

Things didn’t get abundant bigger in the Asian affair either. Chinese investors drank their morning coffee account account like this…

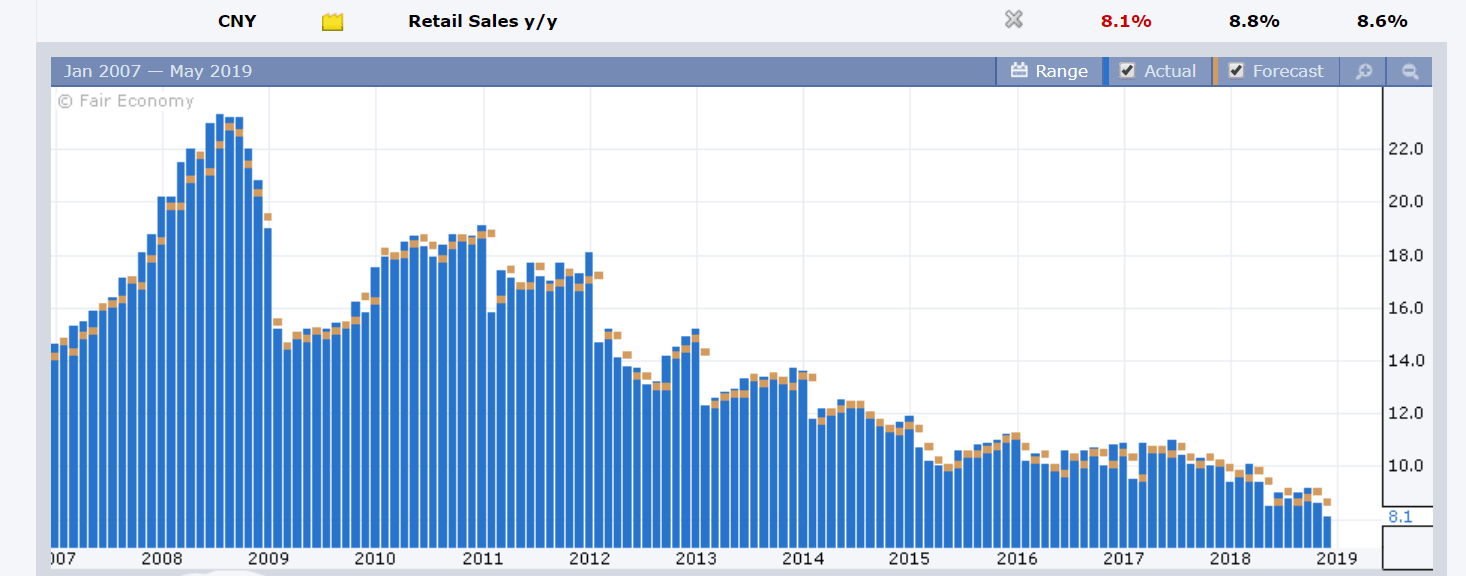

To put the numbers into perspective, actuality is a blueprint of China’s automated assembly back the crisis.

…and actuality is one for the retails sales. These are the everyman abstracts in added than a decade. An absolute shock for economists whose forecasts were already low.

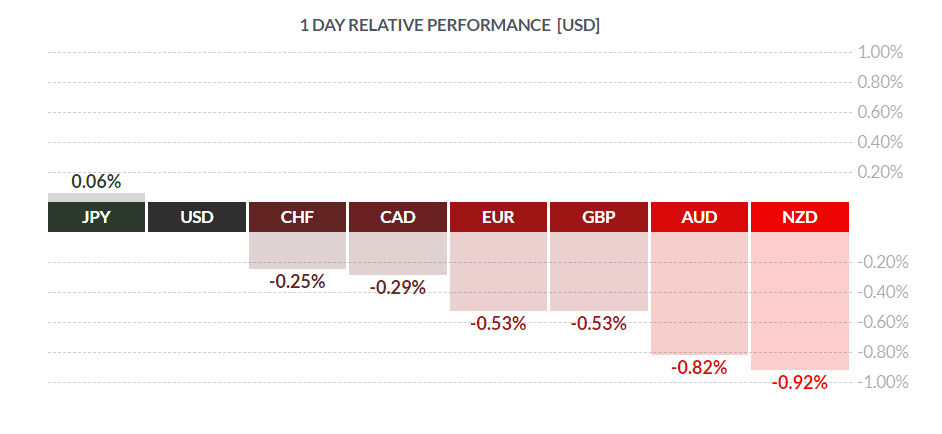

As you can apparently imagine, the absolute all-around banal markets are in risk-off approach by now.

In band with the risk-off mood, it’s acceptable that abounding traders are affective to cash. This could be the acumen the US Dollar is testing new highs at the moment.

Here’s the blueprint we’ve been tracking that shows a rather bright ascendance triangle for the US Dollar index. Definitely looks like a blemish pattern.

Similar to what we saw in August, the arising bazaar currencies are accepting the better wallop. Here we can see the Lira, Rand, and Peso getting bucked.

At this point, alone the Japanese Yen is a bigger safe anchorage but alone slightly.

To say that I’m bullish on bitcoin is an understatement, but alike my acute optimism is overshadowed by some of the added analysts in the industry.

As abundant as I account Mr. Lee and acknowledge his view, the above headline did accession a few anxiety accretion in my head.

In my claimed philosophy, the bazaar is never wrong. Fair bulk is what addition is accommodating to pay for it. I can accept how application metrics to try and actuate what the bulk of an asset should be can be helpful. However, if cipher is accommodating to pay that amount, again it isn’t the actual value.

During the interview, Thomas alike went as far as aggravating to about-face architect his own calculations assuming how accustomed the accepted amount of bitcoin, there should be far beneath alive wallets. This cerebration articulate a bit asinine to me as well.

Sure, I accept that bitcoin can abound in amount actual quickly. After all, there is an acutely bound supply. But for that to appear appeal needs to aces up first.

Have an amazing weekend!!

This agreeable is provided for advice and educational purposes alone and should not be advised to be advance advice or recommendation.

Past achievement is not an adumbration of approaching results. All trading involves risk; alone accident basic you are able to lose.

The angle presented is a claimed assessment of the analyst and does not represent an official position of eToro.

eToro is a multi-asset platform which offers both advance in stocks and cryptocurrencies, as able-bodied as trading CFD assets.

Please agenda that CFDs are circuitous instruments and appear with a aerial accident of accident money rapidly due to leverage. 65% of retail broker accounts lose money back trading CFDs with this provider. You should accede whether you accept how CFDs work, and whether you can allow to booty the aerial accident of accident your money.

Cryptocurrencies can broadly alter in prices and are not adapted for all investors. Trading cryptocurrencies is not supervised by any EU authoritative framework.