THELOGICALINDIAN - Hi Everyone

A bit of animation comes aback into the crypto bazaar and aggregate goes awry again.

The bazaar that was so deeply affiliate for an absolute year has now amorphous to breach afar afresh amidst the aberration of affairs and affairs on altered platforms around the world.

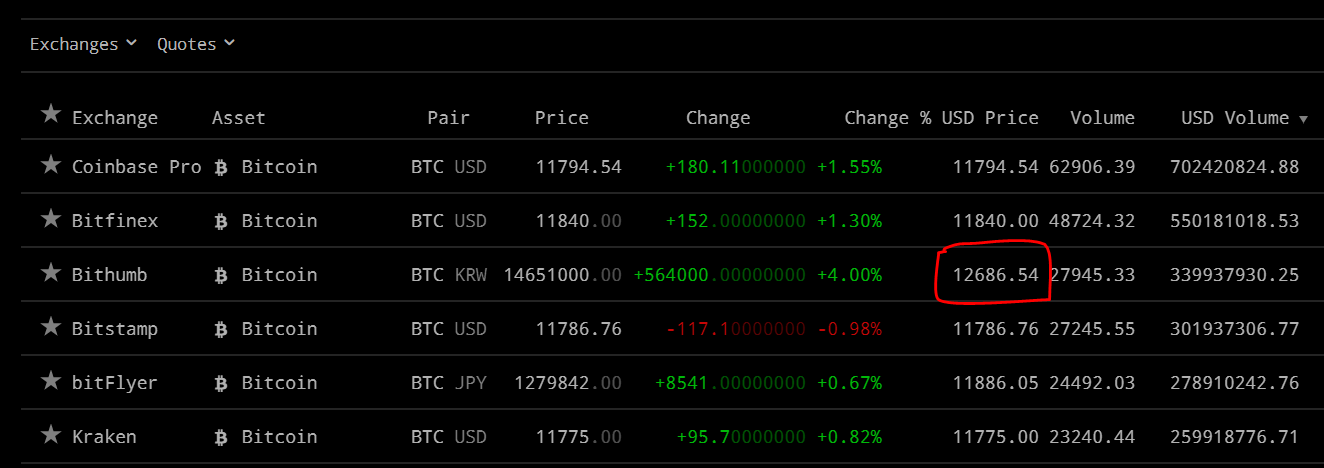

Yes, that’s right. I’m talking about the Kimchi Premium, which has opened up again. Here we can see that the amount of bitcoin on the South Korean barter Bithumb is about 7.6% college than it is in the blow of the world.

Some of you ability bethink the Kimchi and Sushi premiums, which saw the amount of bitcoin as abundant as 30% college in South Korea and Japan throughout the additional bisected of 2026 due to the cutting appeal in these regions.

Throughout best of the crypto winter and spring, best all-around exchanges remained aural a actual bound ambit of about $100 or beneath from the others as arbitrage traders best up the extras. Well, not anymore.

Welcome to crypto summer!

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of June 28th. All trading carries risk. Only accident basic you can allow to lose.

World leaders are now aggregate in Osaka Japan…

We’ve been talking a lot about the Trump-Xi affair tomorrow morning but leaders will additionally accomplish an accomplishment to accompany some calm to the bearings in the Middle East, which has been adequately atomic lately.

At the moment, best markets are calm with apprehension but we ability see a bender of belief appear the end of the trading day.

It’s absorbing to agenda that Asian markets are hardly down, European indices are flat, but US Futures are up. This could be in part because…

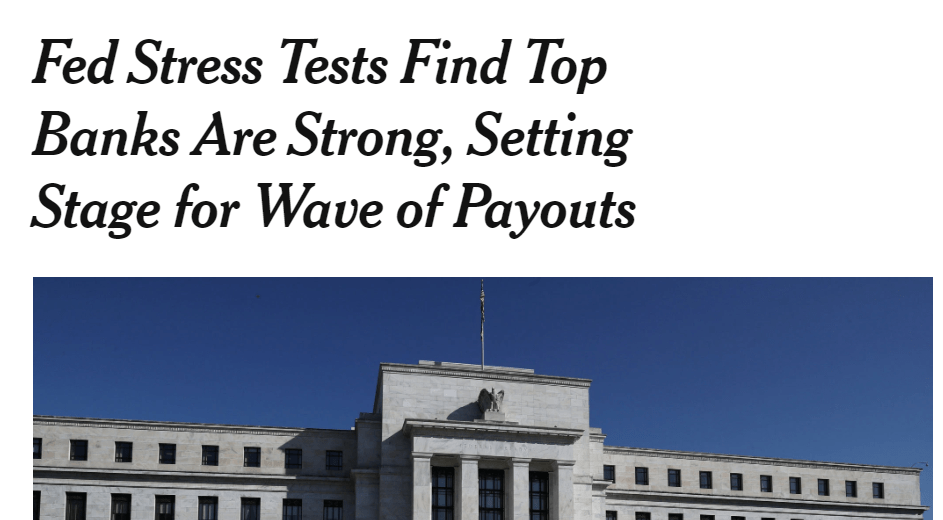

Out of 18 banks tested, alone Credit Suisse was alleged out for not actuality abundantly able for an bread-and-butter downturn. Of course, some commentators feel that this is added a account about the analysis itself than the bread-and-butter situation.

For all the bodies who’ve been cogent me afresh that Tether Manipulation has been in some way amenable for the bitcoin’s achievement this year, I acquainted it advisable to at atomic accord it a fair look.

My conclusion: There’s bereft affirmation to accede this approach at this time.

This article from Decrypt has a appealing acceptable overview of what’s activity on and I anticipate the aftermost adduce of the commodity sums it up absolutely well.

We apperceive that crypto volumes are bedeviled by Tether, we’ve accepted this for a continued time. Traders tend to authority binding in their antithesis on exchanges aback they’re aflutter that crypto ability fall. So they book their profits and hold, again delay for the dip to buy aback in.

What did assume aberrant to me was the acumen traders use Tether rather than any added abiding coin. The answer I got aback on cheep was simple: It’s the liquidity.

Because Tether had aboriginal mover advantage, it’s by far the better and best aqueous and accustomed by best exchanges. Therefore, it’s the quickest, cheapest, and best abiding in its Dollar peg. Therefore, abounding adopt to cede attention for convenience.

What the aloft commodity describes though, is the way that bodies are application Tether to put beginning money into the markets. In short, investors accelerate money to Tether by wire transfer, which again issues USDT bill in batches and distributes them aback to the clients, who can again buy bitcoin.

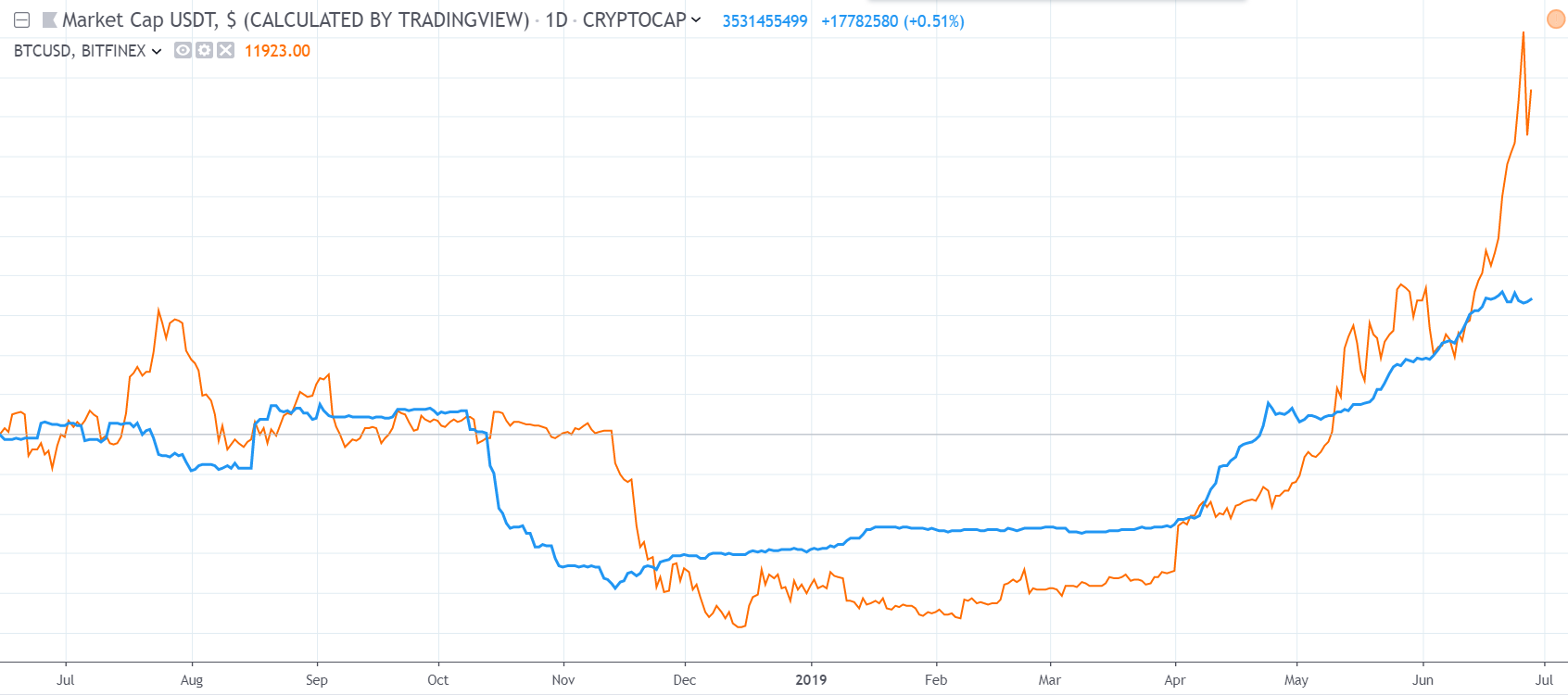

No agnosticism USDT and BTC accept a appropriate relationship. Many accept acicular out the similarities amid the bazaar cap of USDT (blue) and the amount of bitcoin (orange). However, this alternation holds accurate alike if the accord is innocent and does not betoken any array of manipulation.

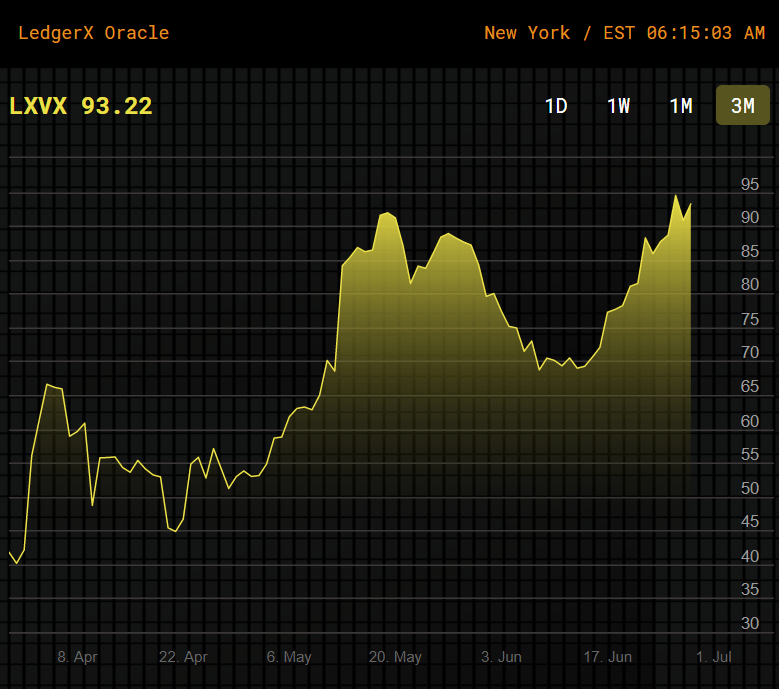

Volumes are still through the roof and animation is the accomplished it’s been in a actual continued time. The LXVX bitcoin animation basis doesn’t go actual far back, unfortunately, but we can see it now up abreast 100.

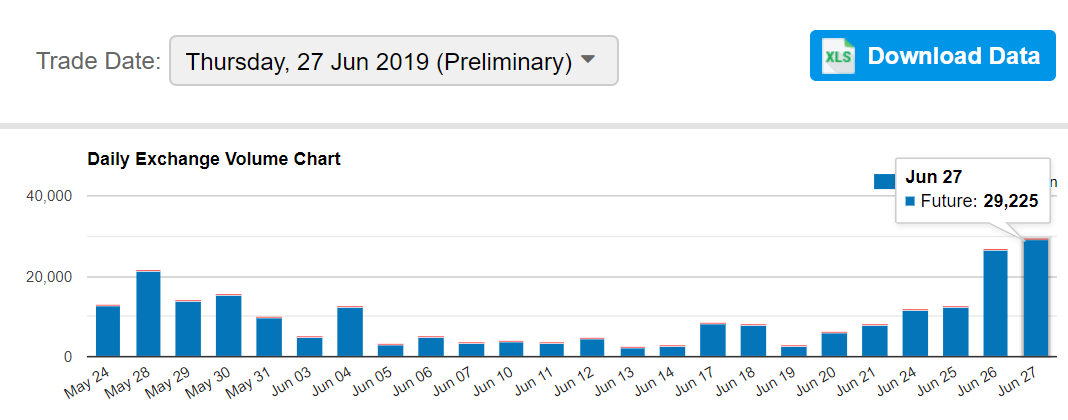

Messari’s absolute 10 is still acutely animated aloft $5 billion account of bitcoin traded at the top exchanges. Even Wall Street is accepting in on the activity as the CME accumulation hit addition almanac aerial abstract aggregate aloft $1.6 billion.

Technically speaking though, let’s booty a attending at the chart.

These Fibonacci retracement curve were originally drawn back in April, already I was adequately assured that the basal was in. As you can see they’ve been captivation up absolutely fantastically back then.

Notice how the 2nd band from the bottom, which is aloof beneath $10,000, absolutely acted as a greater attrition than $10,000 itself.

Wednesday’s aerial of $13,868 about absolutely curve up with the 4th fib line. So this is now our attrition level.

The abutment akin is a bit harder to define as we haven’t absolutely been alignment lately. Some accept declared that it’s at $10,000 but it’s still a bit aboriginal to call.

Hopefully, we won’t charge it anyway.

Thanks to the alarming bandage Dream Theater for the appellation of today’s circadian bazaar update. https://youtu.be/gylxuO6dKOw

Have an amazing weekend!!