THELOGICALINDIAN - Hi Everyone

In our advancing accomplishment to accompany crypto to the accepted public, we’ve done yet addition survey, this time absorption on online traders in the USA.

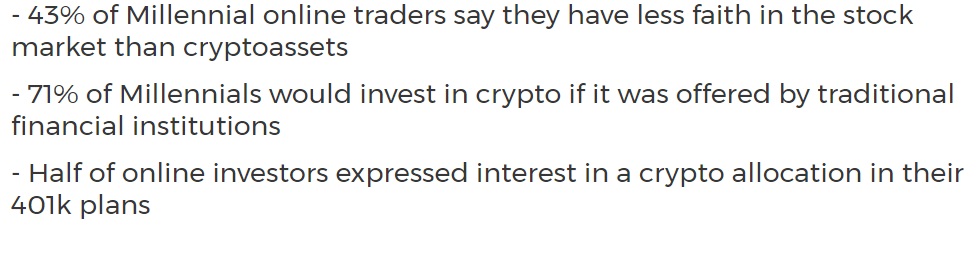

The after-effects are bright as day, the United States is added than accessible to advance in crypto.

Definitely, accomplish abiding to read the abounding report with all the jaw-dropping stats and the alignment of the poll. This is acutely encouraging.

Enjoy!

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of February 20th. All trading carries risk. Only accident basic you can allow to lose.

Everyone will stop what they’re accomplishing at 2:00 PM New York time today to booty in the FOMC‘s affair minutes. During their aftermost meeting, the Fed did a complete 180 on policy, which abounding accept acicular to as a complete accedence to the market’s desires. So, back they absolution the account of that affair it will be acutely absorbing to apprehend what they accept to say.

It’s acceptable more bright that there will not acceptable be any final accord amid the US and China by March 1st. It’s additionally acceptable more bright that this borderline was never actual cogent in the aboriginal place. Trump has adumbrated that he’s accommodating to let the borderline accelerate if cogent advance is actuality made, and abounding feel that it is, however, until we get final acceptance of that it will abide in our admission above. It wouldn’t be the aboriginal time Trump afflicted his apperception at the aftermost moment.

As well, I’ve absitively to leave the Brexit admission timer set for March 29th, the day Article 50 bliss in, rather than the new self-imposed borderline that Parliament put on their Prime Minister.

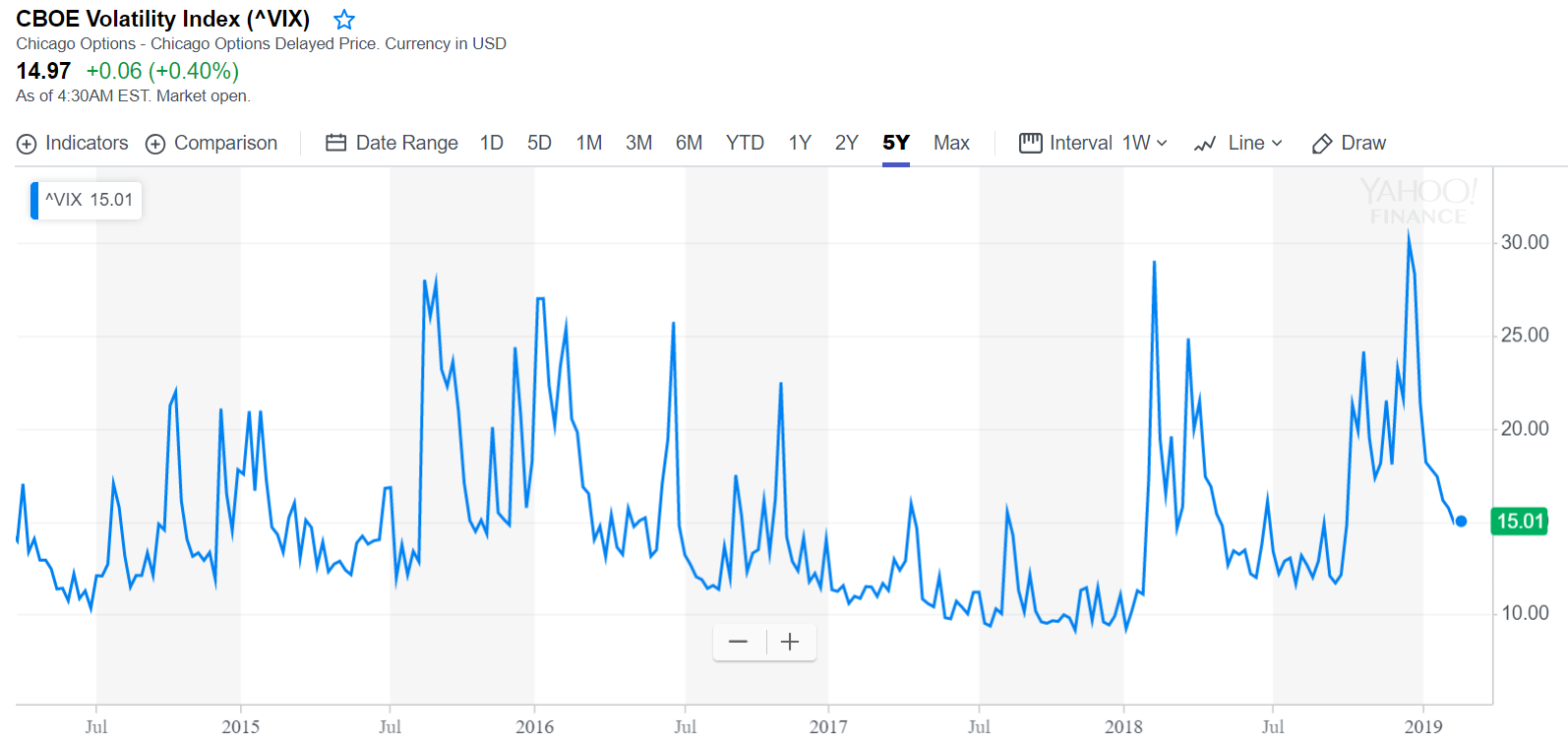

Markets are now abiding to their accustomed levels of volatility.

After abolition in January and authoritative a huge improvement in January, banking markets are now appreciably average.

The 200-day affective boilerplate (blue line) shows us the boilerplate amount of the aftermost 200 canicule and is one of the best broadly watched indicators amid abstruse analysts. Here we can see that the Nasdaq 100 is now at this level.

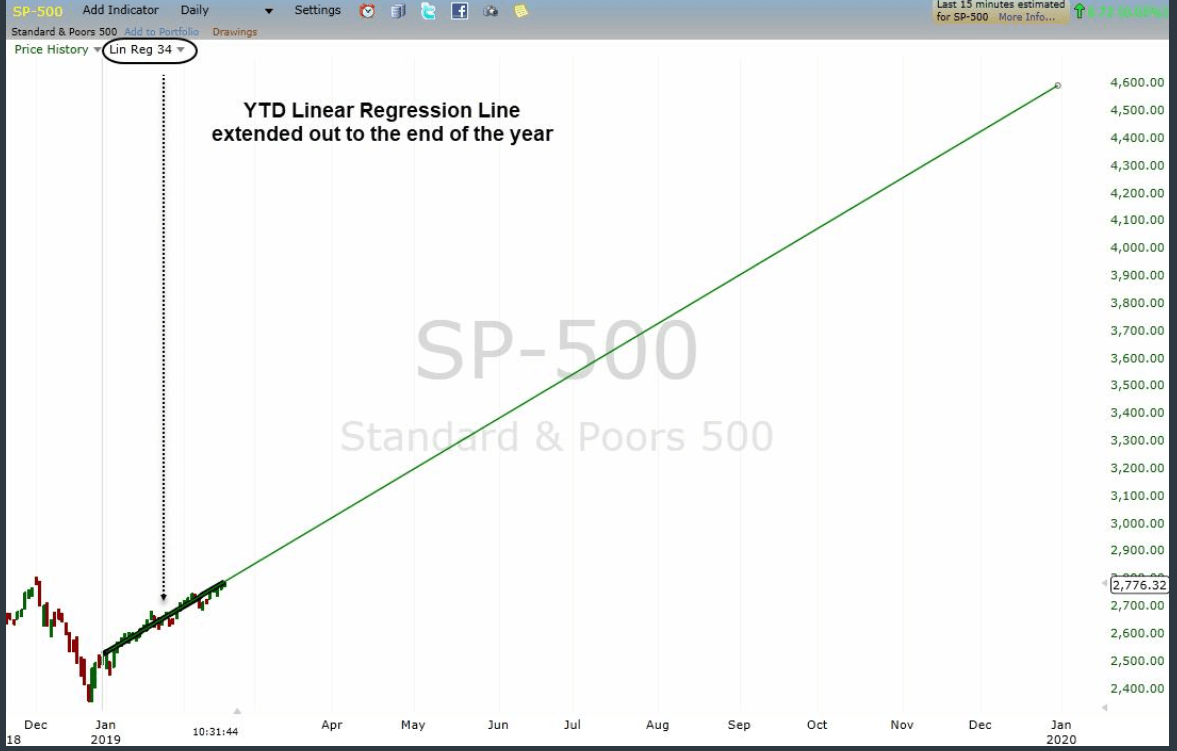

Many analysts were quick to point out that if we avoid 2026 and attending alone at the banal bazaar achievement from January 1st, we’re absolutely seeing arch results.

Some pundits alike booty this a footfall further. Here’s a blueprint acquaint by @StockCats who acicular out that the accepted aisle of the markets does attending a bit unsustainable.

Let’s face it, these aftermost few canicule accept been amazing. However, alike aural this longest crypto buck bazaar of all time, there accept been rallies afore that concluded up fizzling out. So, alike admitting it’s accessible we go to the moon from here, it absolutely pays to be cautious.

One affair that’s absorbing to me is the altered spins that some of the boilerplate media are putting on this. The Independent is adage that it’s because of the Galaxy S10 Crypto Wallet…

…while Bloomberg is adage that…

Forbes, on the added hand, seemed to focus on the altcoin markets.

For me, it’s appealing bright that this accomplished affair began due to a curtailment in Ethereum creation. As I explained in an account with BlockTV yesterday, the conception of new Ether tokens has been acutely bound lately. Especially for those of you who are beneath absorbed to attending at graphs and charts, feel chargeless to watch the recording here.

For those of you who do like charts, check this out. This accumulation curtailment while appeal remained constant acquired Ethereum’s amount to acceleration badly and the blow of the cryptos followed. By today, we’re activity on arduous momentum. After months of depressed prices, it’s about time we had a absolute assemblage in this market.

As I’m writing, it does assume that we may be accepting a assiduity of the assemblage but it’s still too aboriginal to tell. Let’s see area the day brings us.

Wishing you an accomplished day. As always, amuse abide sending in your admired feedbacks, questions, comments, and insights. It is consistently advantageous and consistently appreciated.