THELOGICALINDIAN - Hi Everyone

Yeah, I apperceive that abounding bodies aloof appetite to apprehend about crypto, but if we don’t put it into the broader ambience of the all-around abridgement we could absence something.

Even admitting the crypto bazaar is not heavily activated with acceptable markets on a day to day basis, crypto doesn’t abide in a balloon and whatever happens in the blow of the banking markets does appulse crypto as well.

I had the adventitious to allege about this activating with Nakamoto Jedi recently, and you can bolt the recording here.

What I did appetite to point to today is that the about-face in expectations from the world’s axial banks seems to be leading rapidly appear apart budgetary policy.

On Friday the President of the Federal Reserve Bank in San Fransisco indicated that the Fed is now because using Quantitative Easing as a approved apparatus to ‘guide’ the markets.

Of course, President Mary Daly is alone one affiliate of the Fed and absolutely not the best influential, but the actuality that they’re discussing this at all is abundant to about-face heads.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of February 11th. All trading carries risk. Only accident basic you can allow to lose.

Today we acceptable aback China to the banking markets, and it seems the anniversary has put Chinese investors in a affairs mood. The China 50 basis is arch the stocks college today.

Estimates from the Ministry of Commerce say that China spent 8.5% added over the Lunar New Year than the aforementioned aeon aftermost year. However, this is the everyman year-on-year access back 2011.

All things considered, there doesn’t assume to accept been any above advances in our three capital geopolitical risks over the weekend. Brexit, the US-China barter war, and the US government account stalemate are all still actual abundant on the minds of investors appropriate now.

With the abandonment and face-lifting of VanECK’s proposal, it seems that some of the key players are now far added optimistic that a bitcoin ETF could be accustomed ancient soon.

The accommodation to accept or blame avalanche on the SEC, so let’s take a look at who is authoritative the decisions…

Hester Peirce is by far the better bitcoin apostle on the panel. Many adopt to alarm her by the appellation Crypto Mom. On Friday, Hester published this blog post stressing the advantages of bitcoin and cryptoassets.

The newest member, Elad Roisman, is additionally a known crypto advocate

Last anniversary Robert Jackson fabricated account by stating…

The toughest walnut to able charcoal Chairman Jay Clayton, who continues to appoint with the crypto community, but so far charcoal abiding in his appearance that the bazaar isn’t accessible for it aloof yet.

VanECK charcoal optimistic though. Digital Assets Director Gabor Gurbacs recently told CNBC’s Ran Neuner that the appliance action may booty up to 240 canicule but that it could be done in a distinct day should the SEC adjudge to accept it.

Over the weekend we saw some actual auspicious amount movements in the crypto market. Litecoin is up 80% over the aftermost ages and Binance Coin has surged 107%.

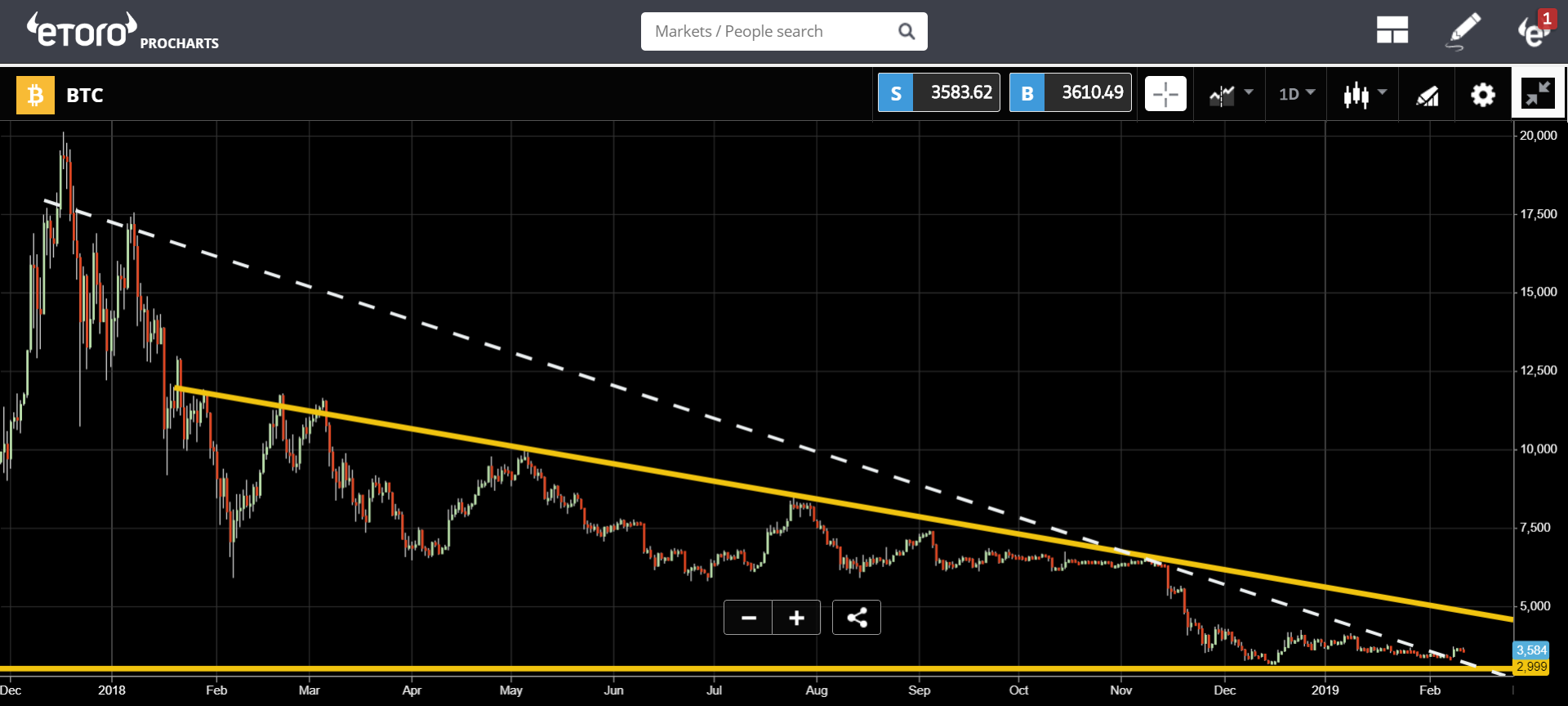

Still, admitting it pains me to say it, we haven’t apparent any absolute signs that the buck bazaar is over. Another auspicious assurance is that the attrition akin that we’ve been tracking for bitcoin (dotted white line) seems to accept been broken.

Of course, anniversary abstruse analyst will draw their curve a bit differently. So now that one attrition has been burst we charge to draw a beneath advancing line. The high chicken band in the blueprint aloft is about as bourgeois a band as we can possibly draw.

Therefore, in adjustment to say definitively that the buck bazaar is over, we would charge a able breach aloft the key cerebral barrier of $5,000.

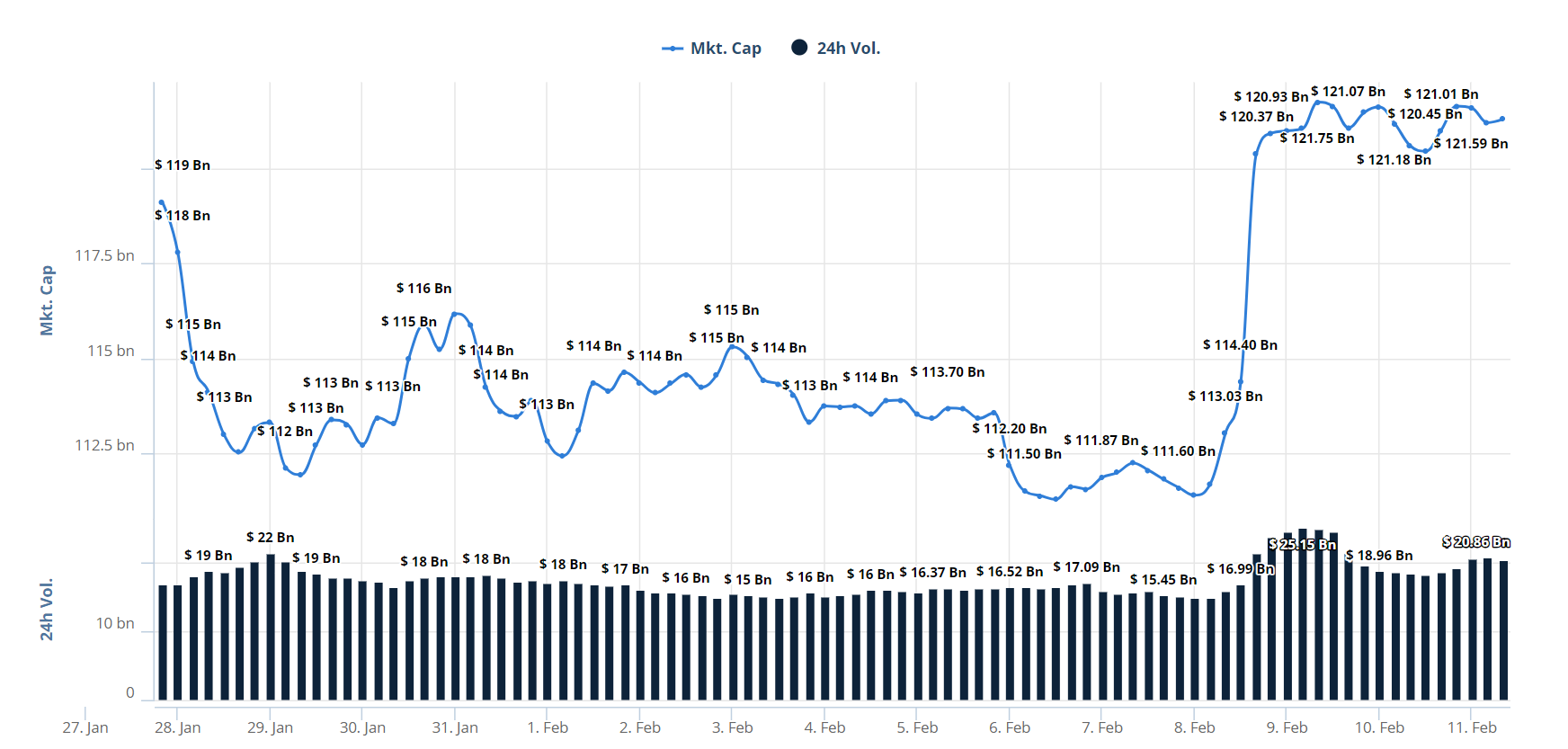

In any case, alike admitting the abstruse indicators abide bearish, the fundamentals abide to abound stronger. Volume beyond crypto exchanges over the aftermost 24 hours have reached a beginning aerial of $25 billion on Friday and accept abiding able-bodied aloft the baseline of $15 billion since.

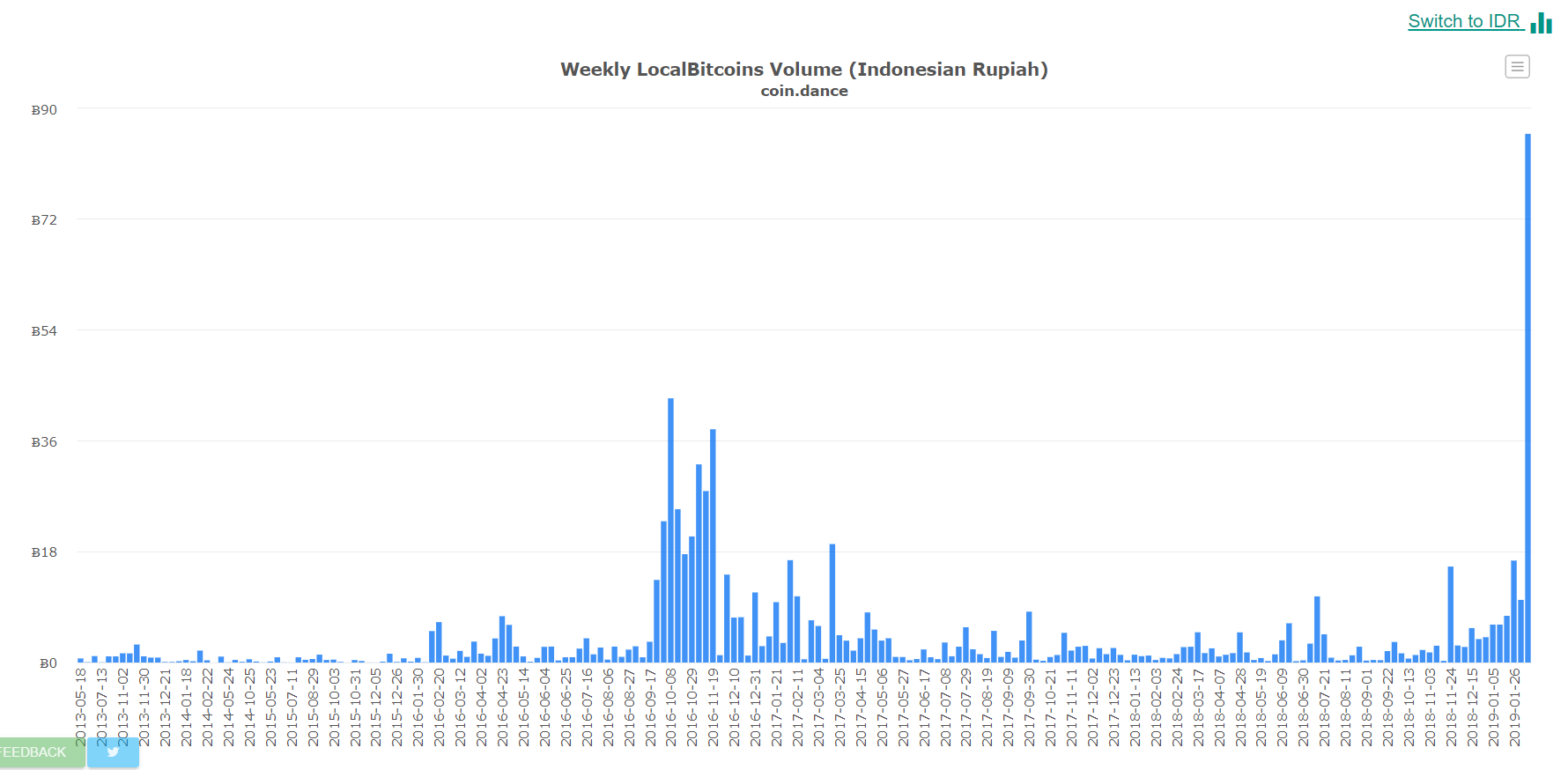

Also, we’ve been tracking ascent volumes in key regions on associate to associate barter armpit Local Bitcoins lately. One affair that jumped out at me this morning was Indonesia. I mean, volumes there accept been architecture afresh but assume to accept exploded this aftermost week.

Sure, 86 BTC in a anniversary ability not assume like abundant for a country with a citizenry of 264 actor people, but as this is a key arena area bodies tend to accelerate remittances, it’s absolutely accessible that the bodies accept woken up to a new acquittal adjustment to facilitate these transfers. We’ll charge to accumulate an eye on it.

Have a admirable anniversary ahead!